Form For Homestead Exemption In Texas

Form For Homestead Exemption In Texas - Web what is the deadline for filing for a residence homestead exemption? Does the school tax ceiling transfer when a person who is age. Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. What is a residence homestead? Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Get ready for tax season deadlines by completing any required tax forms today. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Do all homes qualify for residence homestead exemptions? Web there are several types of exemptions people with disabilities or individuals over 65 can be eligible for: To apply for this exemption, taxpayers must.

Applying is free and only needs to be filed once. Web to apply exemption applications can be submitted by mail, online or at our office: To apply for this exemption, taxpayers must. Web you must apply with your county appraisal district to apply for a homestead exemption. Does the school tax ceiling transfer when a person who is age. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web the way the texas homestead exemption works is explained in the texas state code, section 11.13: Web effective january 1st 2022, new homeowners in texas can apply for homestead exemption in the first year of their homeownership itself, instead of having. Web how to file for the homestead exemption. Chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are.

Get ready for tax season deadlines by completing any required tax forms today. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. Web what is the deadline for filing for a residence homestead exemption? What is a residence homestead tax ceiling? Web how to apply start by requesting the application form from your county appraisal district, your mortgage company, or by downloading it yourself from texas’s. Edit, sign and save tx homestead exemption form. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Web the way the texas homestead exemption works is explained in the texas state code, section 11.13:

Texas Application for Residence Homestead Exemption Legal Forms and

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Web you must apply with your county appraisal district to apply for a homestead exemption. Web how to fill out the homestead exemption form in texas. To apply for this exemption, taxpayers must. Chief appraisers may use this form to certify.

Texas Homestead Exemption Form 2018 YouTube

Do all homes qualify for residence homestead exemptions? A texas homeowner may file a late county appraisal. The code requires that the public school districts. Web how to fill out the homestead exemption form in texas. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden.

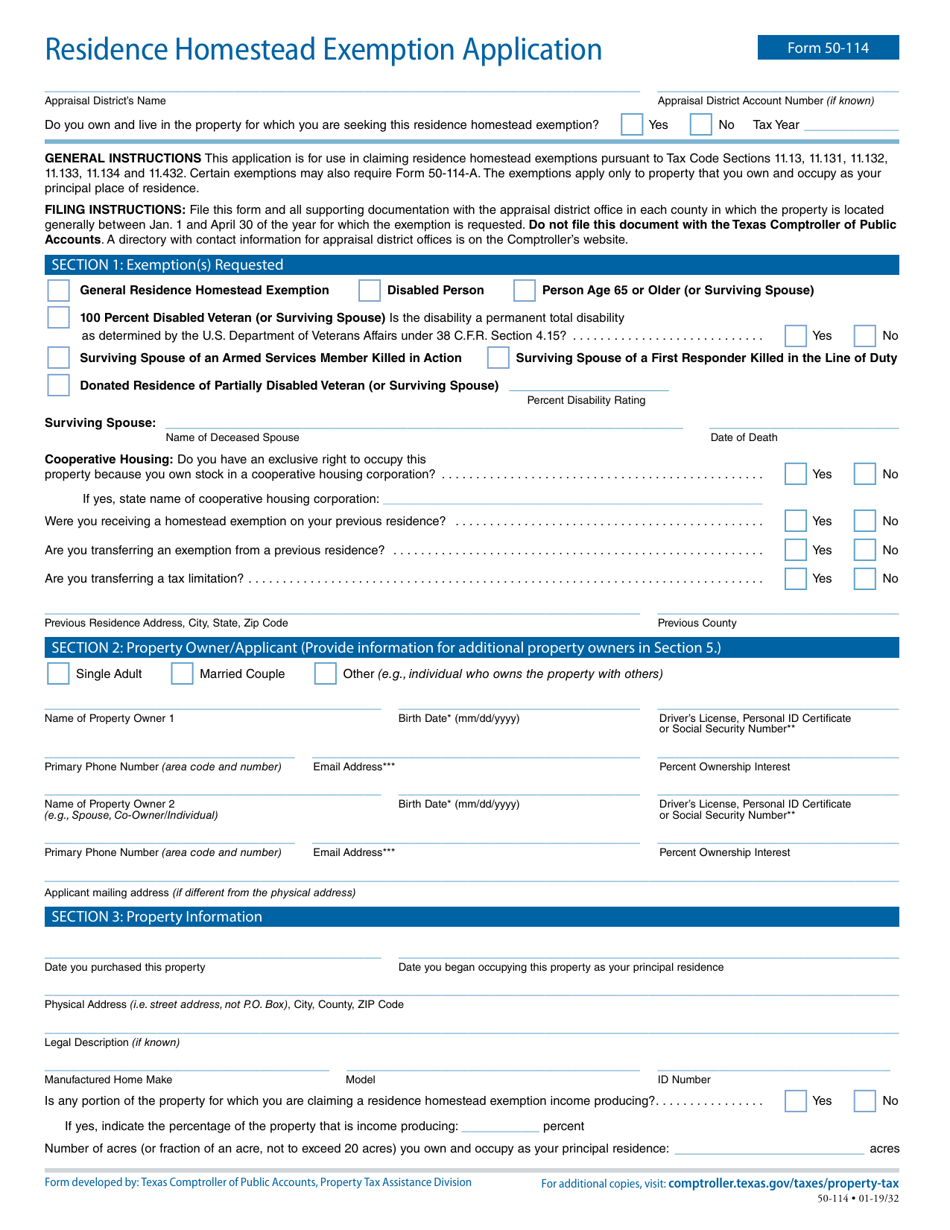

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

What is a residence homestead tax ceiling? A texas homeowner may file a late county appraisal. What is a residence homestead? Chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are. Uslegalforms allows users to edit, sign, fill and share all type of documents online.

Designation Of Homestead Request Form Texas Awesome Home

Web applying for a homestead exemption. Web the typical deadline for filing a county appraisal district homestead exemption application is between january 1 and april 30. Web you must apply with your county appraisal district to apply for a homestead exemption. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from.

Deadline to file homestead exemption in Texas is April 30

What is a residence homestead tax ceiling? Does the school tax ceiling transfer when a person who is age. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation, so their tax burden is lower. A texas homeowner may file a late county appraisal. Web applying for a homestead exemption.

Harris Co TX Homestead Exemption

Get ready for tax season deadlines by completing any required tax forms today. All residence homestead owners are allowed a. Web the typical deadline for filing a county appraisal district homestead exemption application is between january 1 and april 30. Web the homestead exemption allows homeowners to exempt a portion of the appraised value of their primary residence from taxation,.

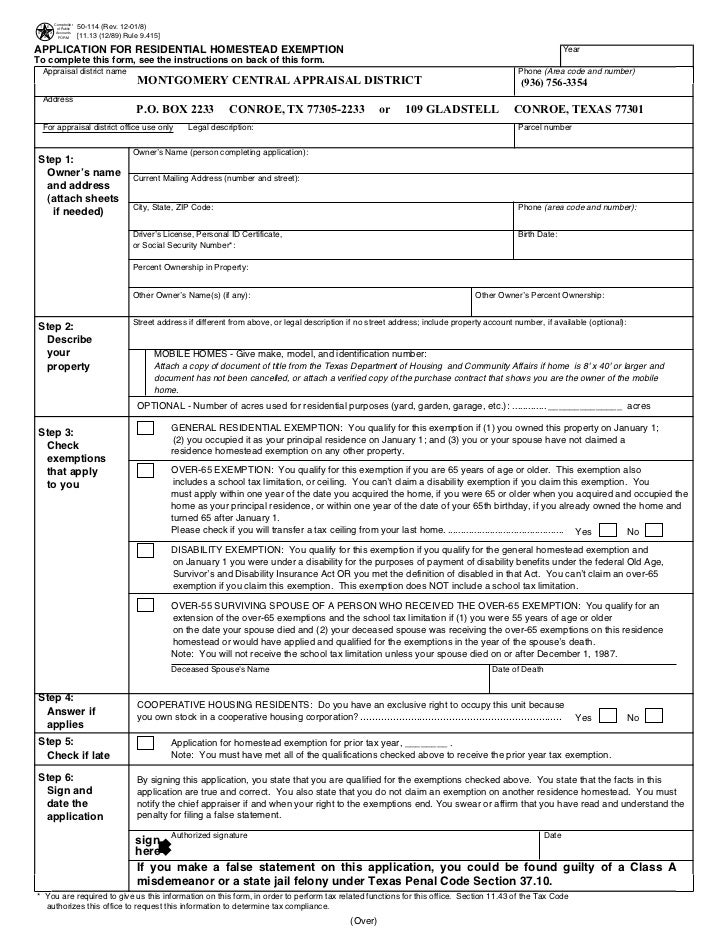

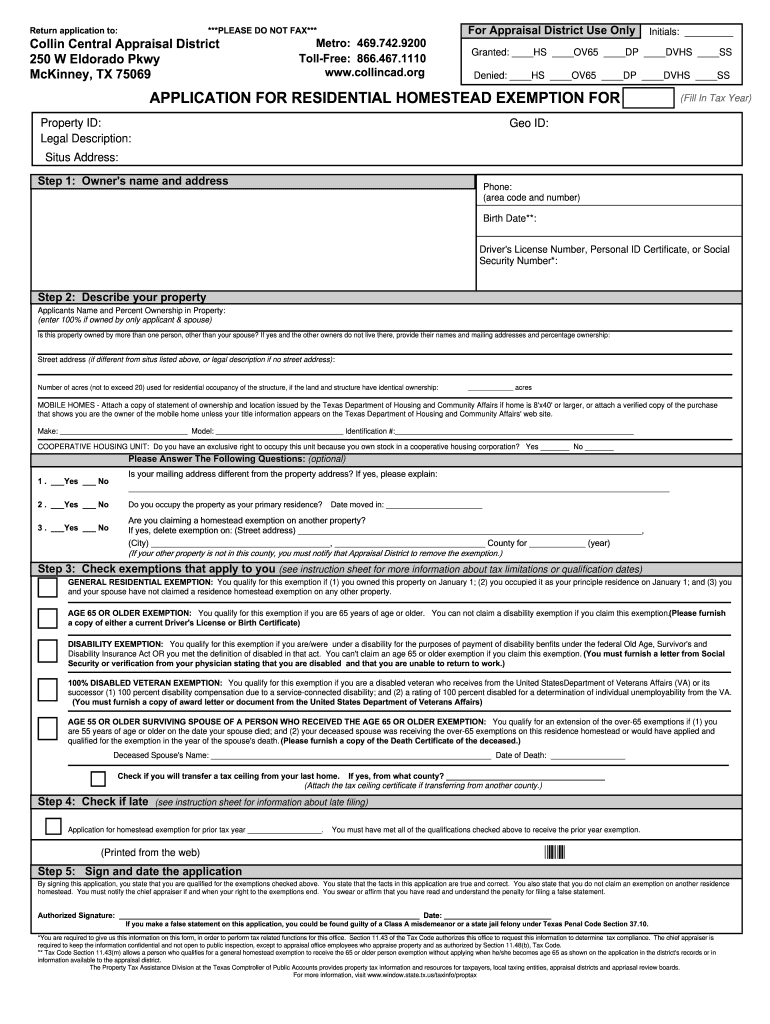

Homestead Exemption Application Montgomery County TX

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Web a general residential homestead exemption is available to taxpayers who own and reside at a property as of january 1.

TEXAS HOMESTEAD EXEMPTION What You Need to Know YouTube

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web how to file for the homestead exemption. Chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are. To apply for a homestead exemption, fill out of a copy.

Texas Homestead Tax Exemption Form

The code requires that the public school districts. To apply for this exemption, taxpayers must. Web you must apply with your county appraisal district to apply for a homestead exemption. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Web the texas homestead exemption form or tex4141 is a form.

Montgomery Co TX Homestead Exemption Form

A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below. Edit, sign and save tx homestead exemption form. All residence homestead owners are allowed a. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web the texas homestead exemption form.

A Texas Homeowner May File A Late County Appraisal.

The code requires that the public school districts. Web do i, as a homeowner, get a tax break from property taxes? Texas property owners can download and fill out the application for residence homestead exemption. To apply for this exemption, taxpayers must.

Web To Apply Exemption Applications Can Be Submitted By Mail, Online Or At Our Office:

Edit, sign and save tx homestead exemption form. Web effective january 1st 2022, new homeowners in texas can apply for homestead exemption in the first year of their homeownership itself, instead of having. Web how to fill out the homestead exemption form in texas. A qualified texas homeowner can file for the homestead exemption by filing the form that can be downloaded below.

To Apply For A Homestead Exemption, Fill Out Of A Copy Of The Homestead Exemption Application Form And Mail It, As Well As Copies Of Any.

For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in tax code §11.13(c) and (d), you. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. Web the way the texas homestead exemption works is explained in the texas state code, section 11.13: All residence homestead owners are allowed a.

Web The Typical Deadline For Filing A County Appraisal District Homestead Exemption Application Is Between January 1 And April 30.

Get ready for tax season deadlines by completing any required tax forms today. What is a residence homestead? Do all homes qualify for residence homestead exemptions? Chief appraisers may use this form to certify information necessary to determine the exemption amount to which certain surviving spouses are.