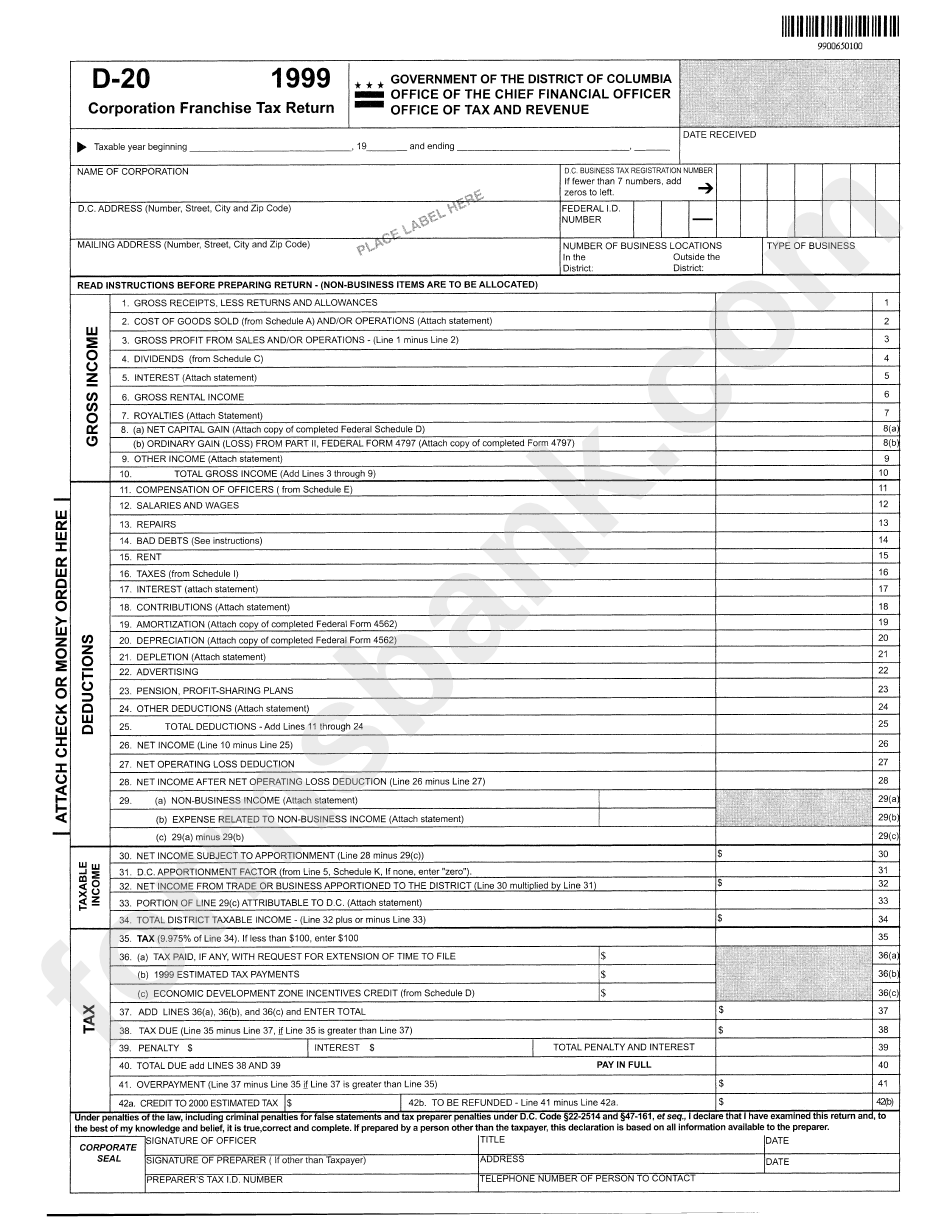

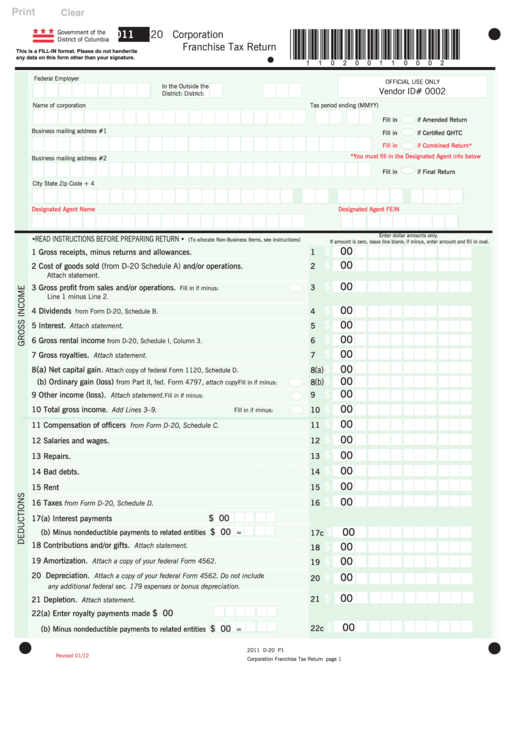

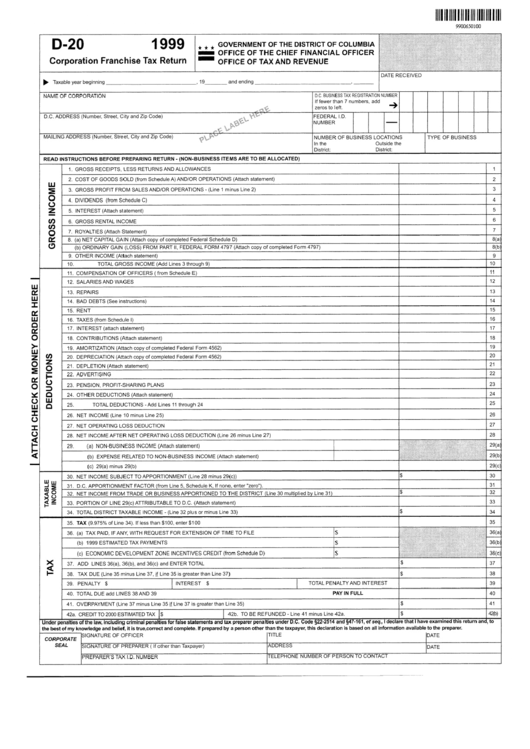

Form D 20

Form D 20 - Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Or otherwise receive income from sources within d.c. Please attach this form to your d. The corporation franchise tax rate is 9.975%. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web 1 day agomogu inc. Pursuant to 20 cfr 655.19(a),. Schedule sr must be filed with either the corporate business franchise. This form is for income earned in tax year 2022,. 10 other income (loss) (attach statement) fill in if minus:

Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web 1 day agomogu inc. Address line #2 city mailing address line #1 mailing address line #2 city federal employer. Regular corporation franchise tax (multiply line 1 by.09975) if less than. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. See the instructions for form 8949 for special provisions and. Please attach this form to your d. Or otherwise receive income from sources within d.c. Get ready for this year's tax season quickly and safely with pdffiller! Web form 4797, (attach copy) fill in if minus:

Web supervision and control in the performance of the services or labor to be performed other than hiring, payingand firing the workers. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. 2000 corporation franchise tax return for official use only : Web complete all applicable lines of form 8949 before completing line 1b, 2, 3, 8b, 9, or 10 of schedule d (form 1120). Address line #2 city mailing address line #1 mailing address line #2 city federal employer. Pursuant to 20 cfr 655.19(a),. Web form 4797, (attach copy) fill in if minus: Schedule sr must be filed with either the corporate business franchise. Regular corporation franchise tax (multiply line 1 by.09975) if less than. Or otherwise receive income from sources within d.c.

Form D20 Corporation Franchise Tax Return 1999 printable pdf download

Web form 4797, (attach copy) fill in if minus: Pursuant to 20 cfr 655.19(a),. Regular corporation franchise tax (multiply line 1 by.09975) if less than. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Address line #2 city mailing address line #1 mailing address line #2 city federal employer.

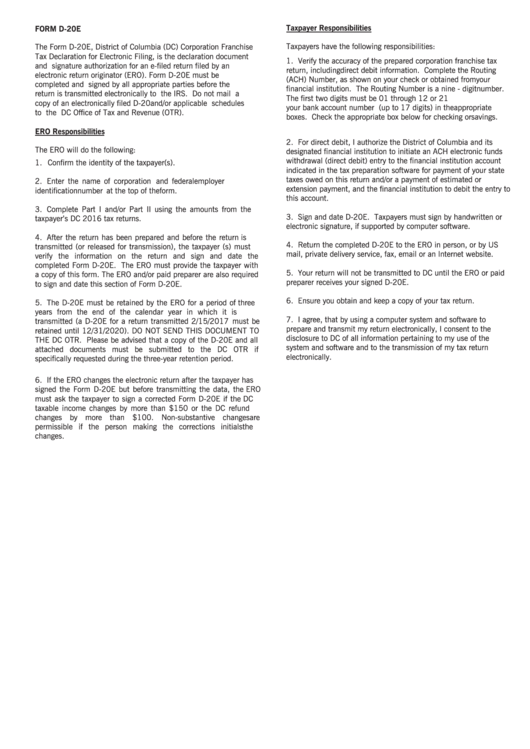

The Form D20e District Of Columbia (Dc) Corporation Franchise Tax

Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web complete all applicable lines of form 8949 before completing line 1b, 2, 3, 8b, 9, or 10 of schedule d (form 1120). Address line #2 city mailing address line #1 mailing address line #2 city federal employer. 10 other income.

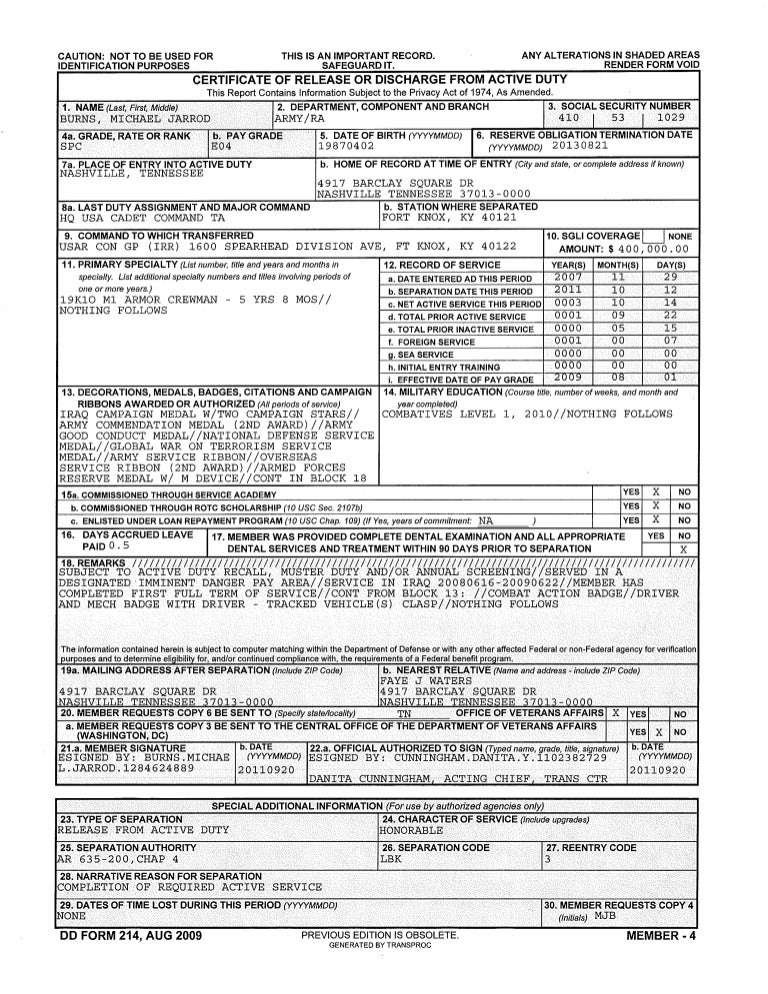

form214

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. This form is for income earned in tax year 2022,. See the instructions for form 8949 for special provisions and. Please attach this form to your d. Regular corporation franchise tax (multiply line 1 by.09975).

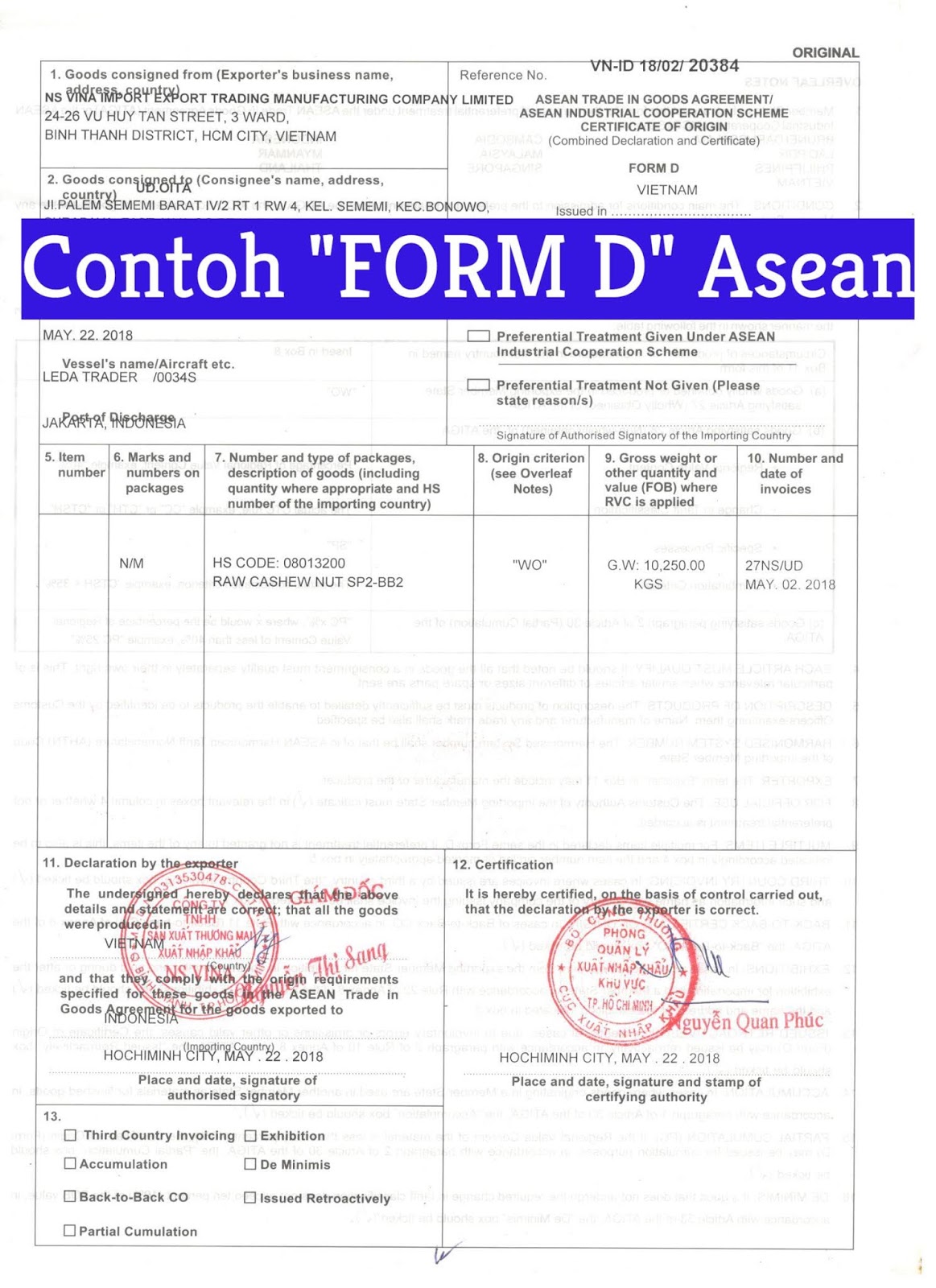

【CO form D】Quy trình cấp CO form D

Address line #2 city mailing address line #1 mailing address line #2 city federal employer. Web supervision and control in the performance of the services or labor to be performed other than hiring, payingand firing the workers. Web form 4797, (attach copy) fill in if minus: 2000 corporation franchise tax return for official use only : Web if “yes,” attach.

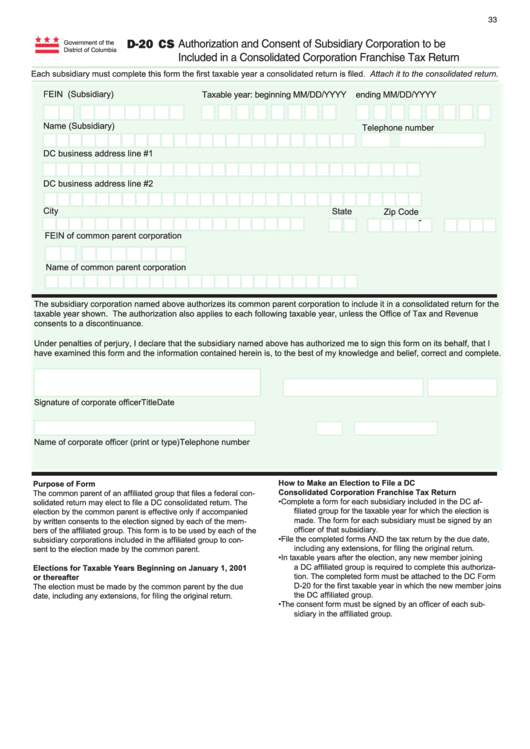

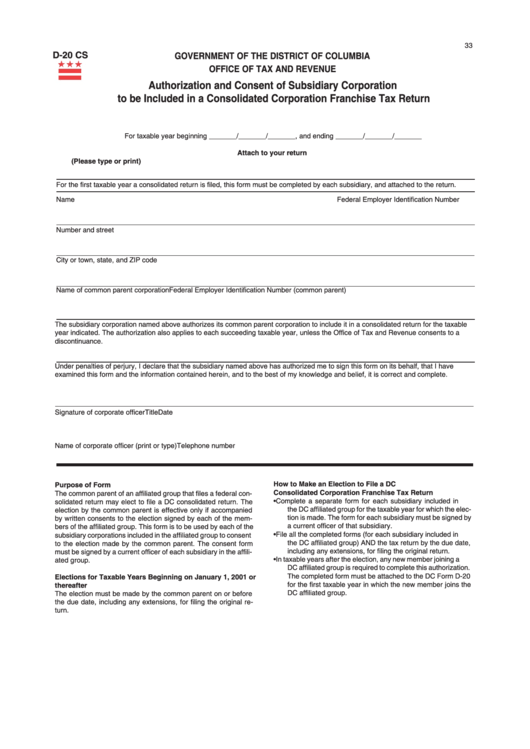

Form D20 Cs Authorization And Consent Of Subsidiary Corporation To

Web form 4797, (attach copy) fill in if minus: Web corporations that carry on or engage in a business or trade in d.c. Address line #2 city mailing address line #1 mailing address line #2 city federal employer. This form is for income earned in tax year 2022,. Web supervision and control in the performance of the services or labor.

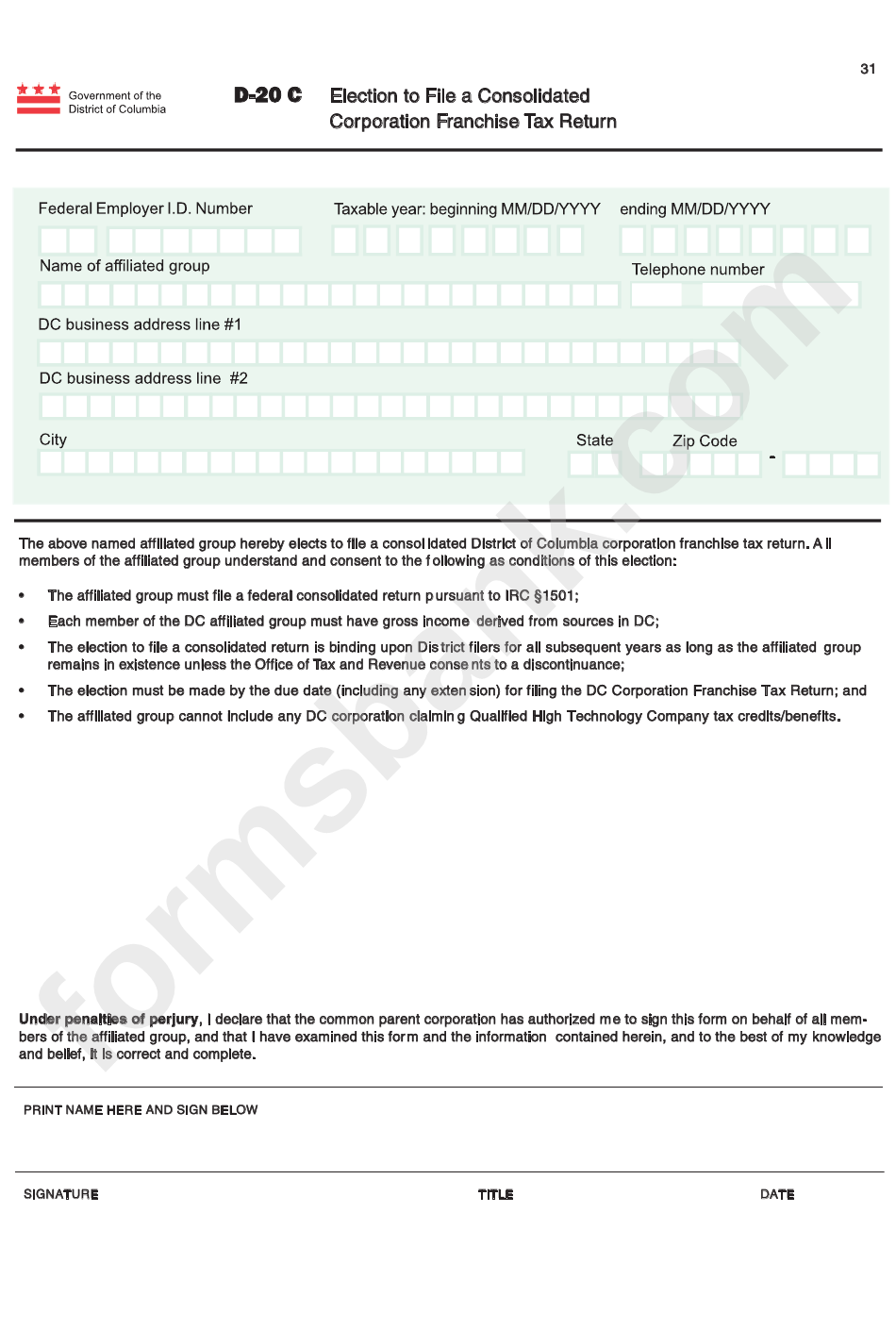

Form Dc20 C Election To File A Consolidated Corporation Franchise

Web complete all applicable lines of form 8949 before completing line 1b, 2, 3, 8b, 9, or 10 of schedule d (form 1120). Get ready for this year's tax season quickly and safely with pdffiller! This form is for income earned in tax year 2022,. Web corporations that carry on or engage in a business or trade in d.c. Pursuant.

Contoh Form DCertificate Of Origin Form D Untuk Kegiatan Ekspor dan

Regular corporation franchise tax (multiply line 1 by.09975) if less than. Get ready for this year's tax season quickly and safely with pdffiller! Web form 4797, (attach copy) fill in if minus: Pursuant to 20 cfr 655.19(a),. Or otherwise receive income from sources within d.c.

Fillable Form D20 Corporation Franchise Tax Return 2011 printable

Address line #2 city mailing address line #1 mailing address line #2 city federal employer. The corporation franchise tax rate is 9.975%. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web complete all applicable lines of form 8949 before completing line 1b, 2,.

Form D20 Cs Authorization And Consent Of Subsidiary Corporation To

2000 corporation franchise tax return for official use only : Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Schedule sr must be filed with either the corporate business franchise. Get ready for this year's tax season quickly and safely with pdffiller! Web complete all applicable lines of form 8949.

Form D20 Corporation Franchise Tax Return 1999 printable pdf download

10 other income (loss) (attach statement) fill in if minus: Please attach this form to your d. Schedule sr must be filed with either the corporate business franchise. See the instructions for form 8949 for special provisions and. Get ready for this year's tax season quickly and safely with pdffiller!

10 Other Income (Loss) (Attach Statement) Fill In If Minus:

Regular corporation franchise tax (multiply line 1 by.09975) if less than. Web form 4797, (attach copy) fill in if minus: Web supervision and control in the performance of the services or labor to be performed other than hiring, payingand firing the workers. Web 1 day agomogu inc.

Web Complete All Applicable Lines Of Form 8949 Before Completing Line 1B, 2, 3, 8B, 9, Or 10 Of Schedule D (Form 1120).

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Or otherwise receive income from sources within d.c. The corporation franchise tax rate is 9.975%. See the instructions for form 8949 for special provisions and.

Schedule Sr Must Be Filed With Either The Corporate Business Franchise.

Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Please attach this form to your d. Address line #2 city mailing address line #1 mailing address line #2 city federal employer. This form is for income earned in tax year 2022,.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

Pursuant to 20 cfr 655.19(a),. 2000 corporation franchise tax return for official use only : Web corporations that carry on or engage in a business or trade in d.c.