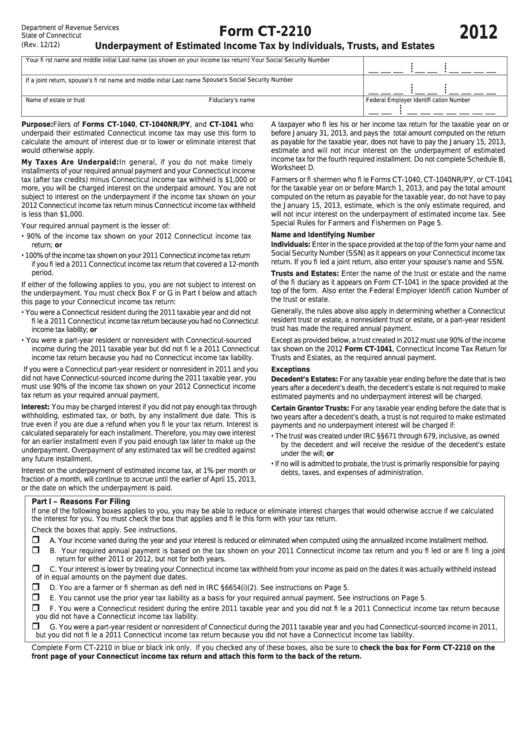

Form Ct 2210

Form Ct 2210 - Web connecticut individual forms availability. The irs will generally figure your penalty for you and you should not file form 2210. This will begin an appeal process that may result in the dcf’s finding being. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Filers of forms ct‑1040connecticut resident income , tax returnct‑1040nr/py, , connecticut. Web please complete this form and submit this request to: Simple, secure, and can be completed from the comfort of your home. The irs will generally figure your penalty for you and you should not file form 2210. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the.

Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Web file your 2022 connecticut income tax return online! Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not file form 2210. Enter the total amount of connecticut income tax. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web connecticut individual forms availability. Web file your 2022 connecticut income tax return online! Enter the total amount of connecticut income tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Simple, secure, and can be completed from the comfort of your home. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web if you are attaching a completed: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.

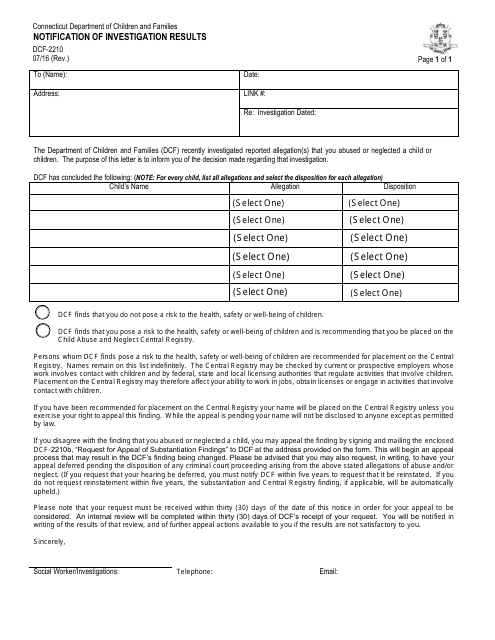

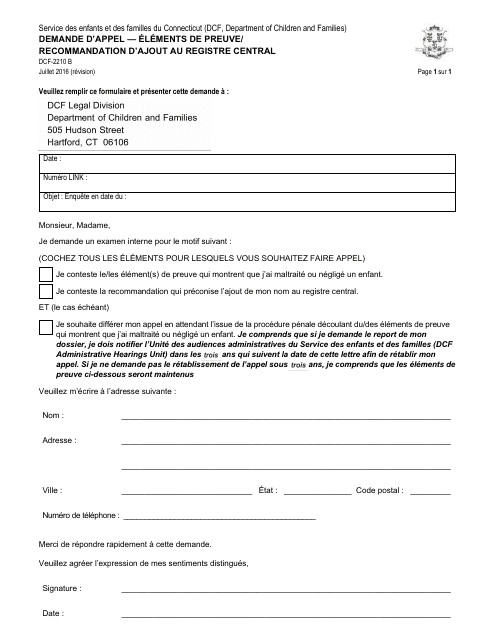

Form DCF2210 Download Fillable PDF or Fill Online Notification of

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. This will begin an appeal process that may result in the dcf’s finding being. Benefits to electronic filing include: Web file your 2022 connecticut income tax return online! Web purpose of form use form 2210.

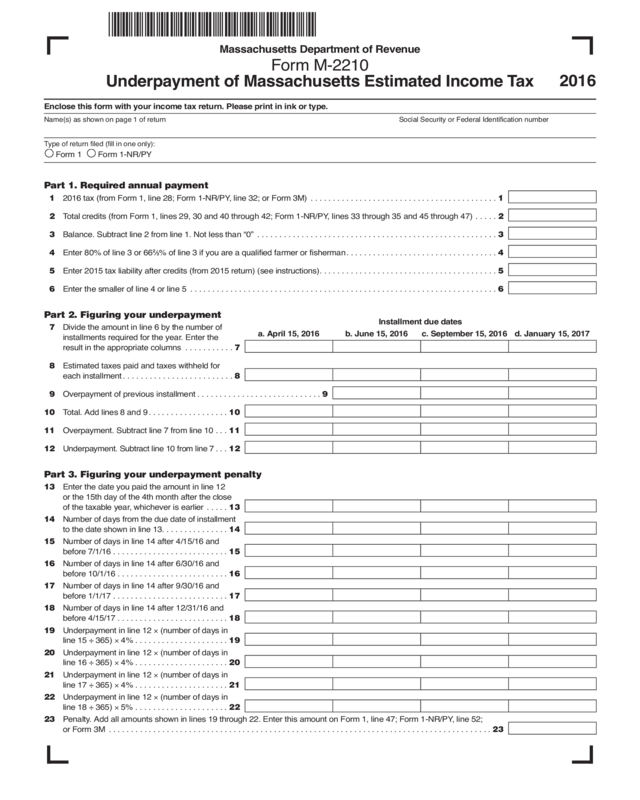

Form M2210 Edit, Fill, Sign Online Handypdf

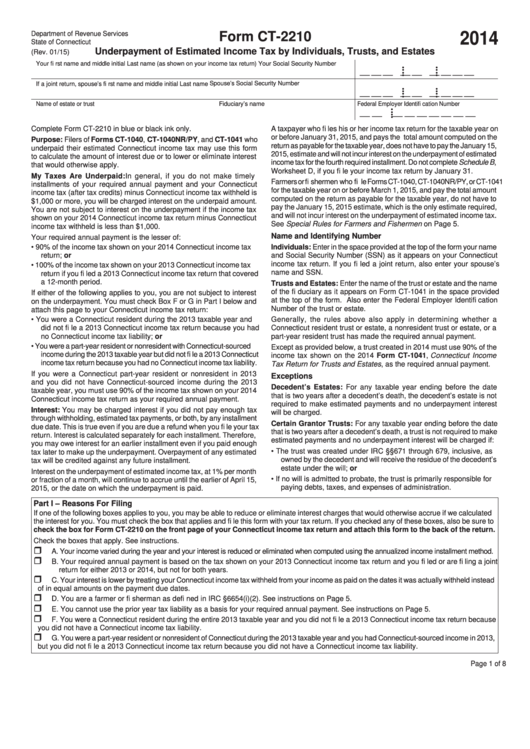

Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web if you are attaching a completed: Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose:.

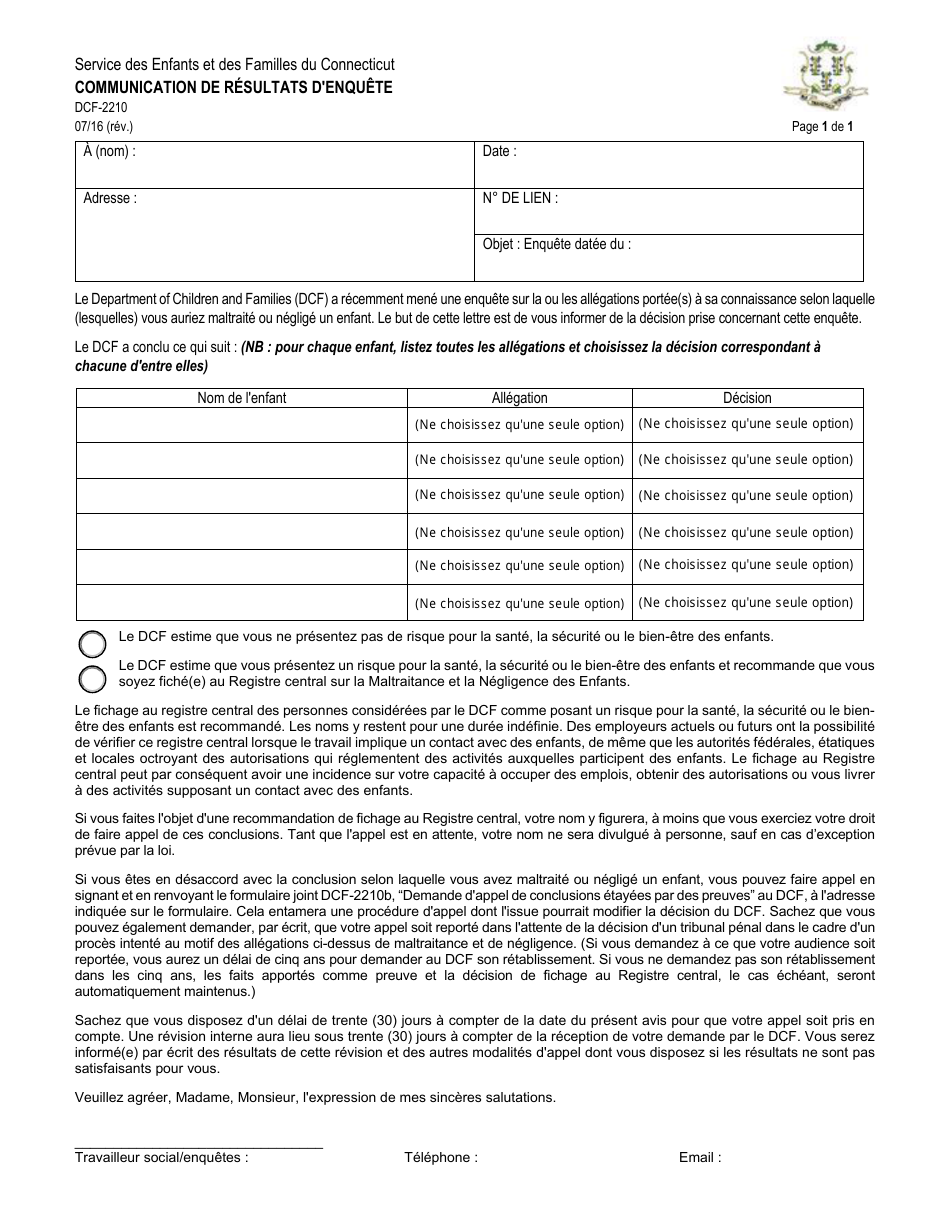

Forme DCF2210 Download Fillable PDF or Fill Online Notification of

Web connecticut individual forms availability. This will begin an appeal process that may result in the dcf’s finding being. Benefits to electronic filing include: Web if you are attaching a completed: Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy.

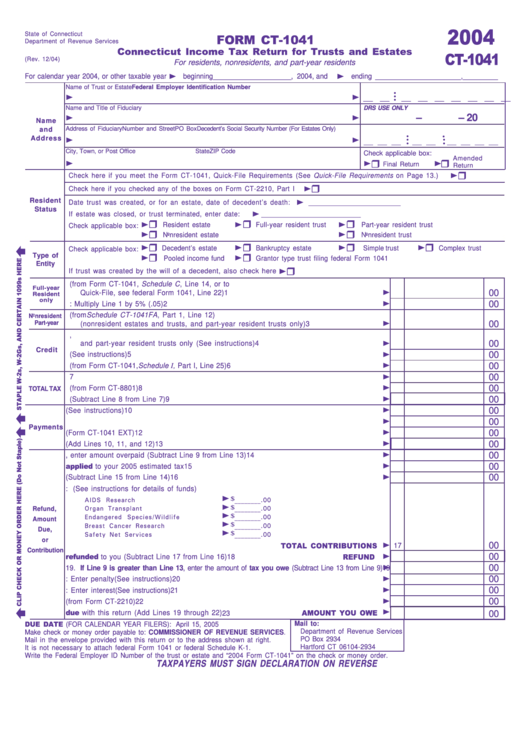

Form Ct1041 Connecticut Tax Return For Trusts And Estates

Filers of forms ct‑1040connecticut resident income , tax returnct‑1040nr/py, , connecticut. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web if you are attaching a completed: Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Estimated payment deadline extensions for tax year.

Ssurvivor Form 2210 Instructions 2018

Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Web connecticut individual forms availability. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Web please complete this form and submit this request to: Simple, secure, and can be completed from the comfort of your home.

Form DCF2210 B Download Printable PDF or Fill Online Request for

This will begin an appeal process that may result in the dcf’s finding being. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting.

Form 2210 Edit, Fill, Sign Online Handypdf

The irs will generally figure your penalty for you and you should not file form 2210. Web connecticut individual forms availability. Simple, secure, and can be completed from the comfort of your home. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. This will begin an appeal process that may result in the.

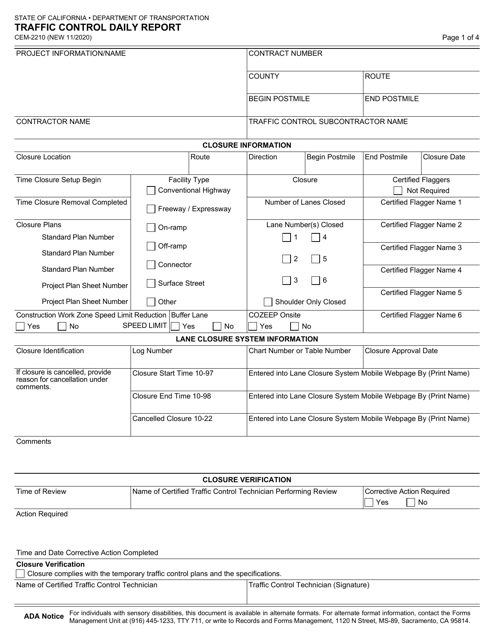

Form CEM2210 Download Fillable PDF or Fill Online Traffic Control

Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. The irs will generally figure your penalty for you and you should not file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Filers of forms ct‑1040connecticut resident income , tax returnct‑1040nr/py,.

Form Ct2210 Underpayment Of Estimated Tax By Individuals

Web file your 2022 connecticut income tax return online! Web connecticut individual forms availability. The irs will generally figure your penalty for you and you should not file form 2210. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy.

Fillable Form Ct2210 Underpayment Of Estimated Tax By

Web if you are attaching a completed: The irs will generally figure your penalty for you and you should not file form 2210. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Estimated payment deadline extensions for.

12/09) Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates Purpose:

Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Filers of forms ct‑1040connecticut resident income , tax returnct‑1040nr/py, , connecticut. Enter the total amount of connecticut income tax. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident.

Web Purpose Of Form Use Form 2210 To See If You Owe A Penalty For Underpaying Your Estimated Tax.

Simple, secure, and can be completed from the comfort of your home. Web please complete this form and submit this request to: Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Benefits to electronic filing include:

Web Use Form 2210 To Determine The Amount Of Underpaid Estimated Tax And Resulting Penalties As Well As For Requesting A Waiver Of The Penalties.

The irs will generally figure your penalty for you and you should not file form 2210. This will begin an appeal process that may result in the dcf’s finding being. Web if you are attaching a completed: Web connecticut individual forms availability.

Web File Your 2022 Connecticut Income Tax Return Online!

Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. The irs will generally figure your penalty for you and you should not file form 2210.