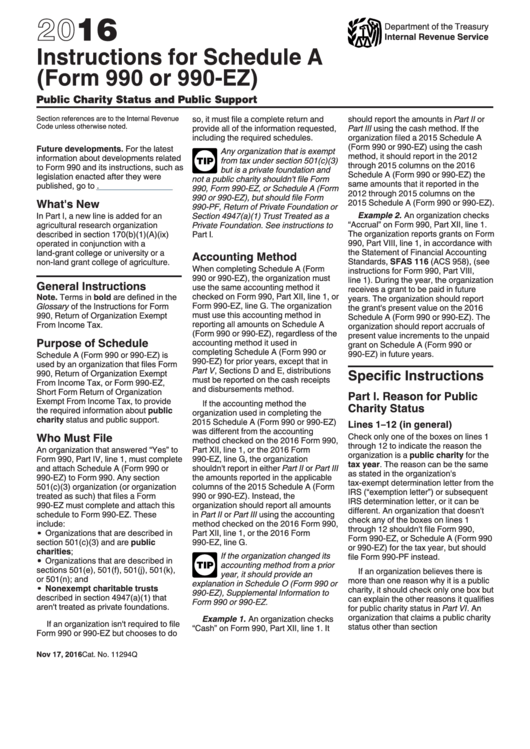

Form 990 Schedule A

Form 990 Schedule A - Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. Who must file schedule a? Unrelated business taxable income from an unrelated trade or business. What is the purpose of schedule a? Web search for charities. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status. Open to public go to www.irs.gov/form990 Should schedule a be filled out before other parts and schedules of form. Schedule n (form 990 or.

Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. Web search for charities. Should schedule a be filled out before other parts and schedules of form. On this page you may download the 990 series filings on record for 2021. Who must file schedule a? The download files are organized by month. What is the purpose of schedule a? Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status. For instructions and the latest information. Unrelated business taxable income from an unrelated trade or business.

Open to public go to www.irs.gov/form990 Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. Unrelated business taxable income from an unrelated trade or business. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status. What is the purpose of schedule a? Schedule n (form 990 or. Kids create a better world. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf. On this page you may download the 990 series filings on record for 2021. The download files are organized by month.

Form 990 Schedule A Instructions printable pdf download

What is the purpose of schedule a? Schedule n (form 990 or. Should schedule a be filled out before other parts and schedules of form. The download files are organized by month. Web search for charities.

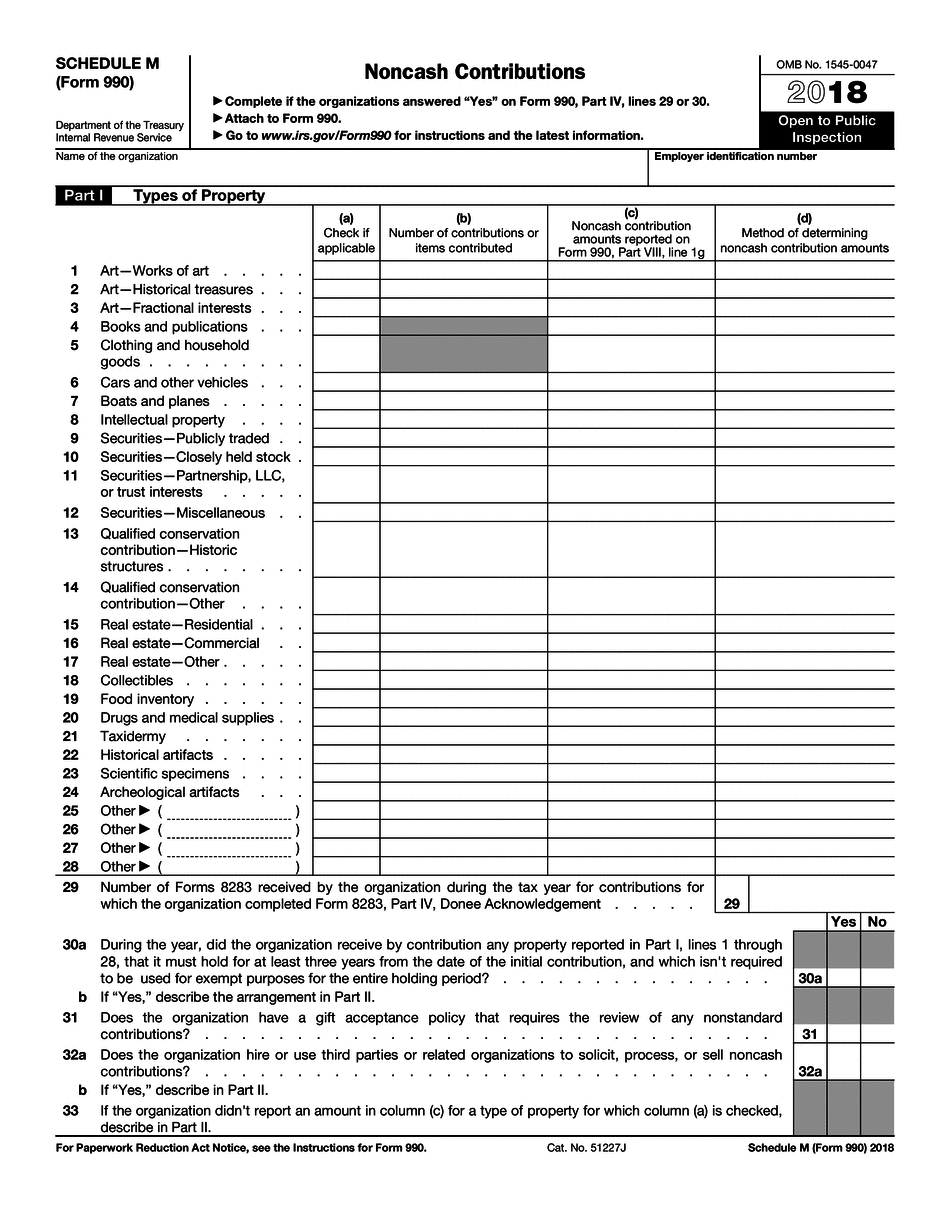

IRS Form 990 (Schedule M) 2018 2019 Fillable and Editable PDF Template

What is the purpose of schedule a? For instructions and the latest information. Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf. Although there.

Form 990 Schedule A Edit, Fill, Sign Online Handypdf

Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Who must file schedule a? What is the purpose of schedule a? Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt.

Fillable IRS Form 990 Schedule A 2019 2020 Online PDF Template

Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). Schedule a is required for section 501(c)3 organizations.

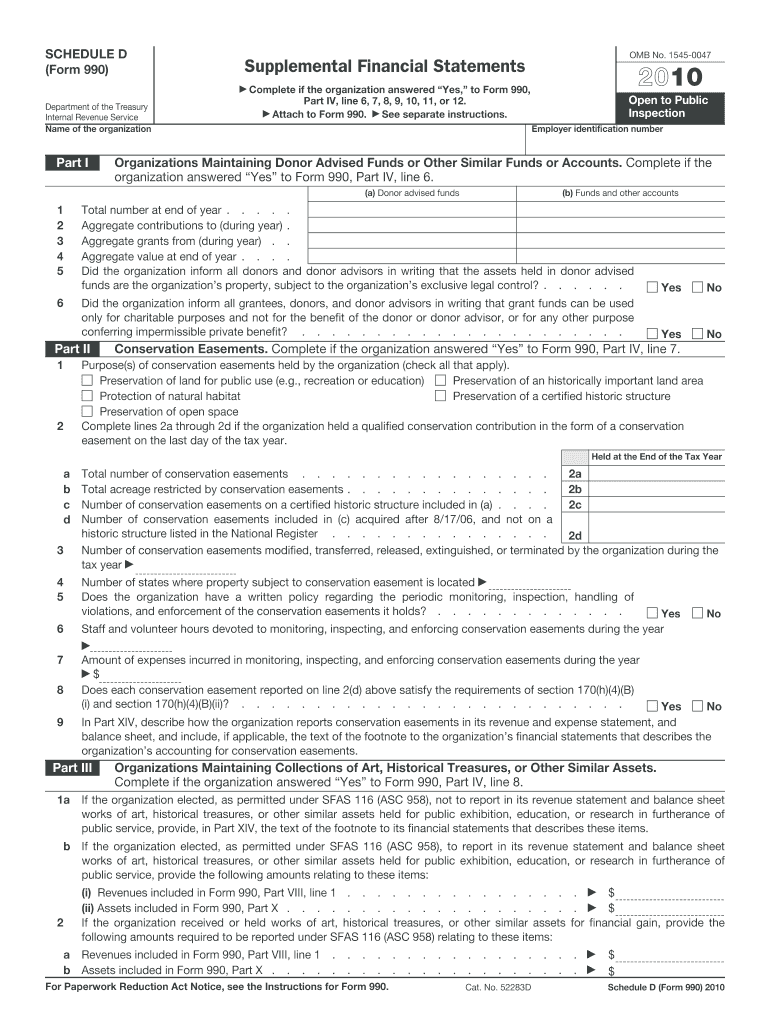

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

Kids create a better world. Should schedule a be filled out before other parts and schedules of form. Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. For instructions and the latest information. Who must file schedule a?

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Who must file schedule a? On this page you may download the 990 series filings on record for 2021. The download files are organized by month. Web search for charities. Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts.

IRS Form 990 (Schedule F) 2019 Fillable and Editable PDF Template

Who must file schedule a? Open to public go to www.irs.gov/form990 The download files are organized by month. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf. Web search for charities.

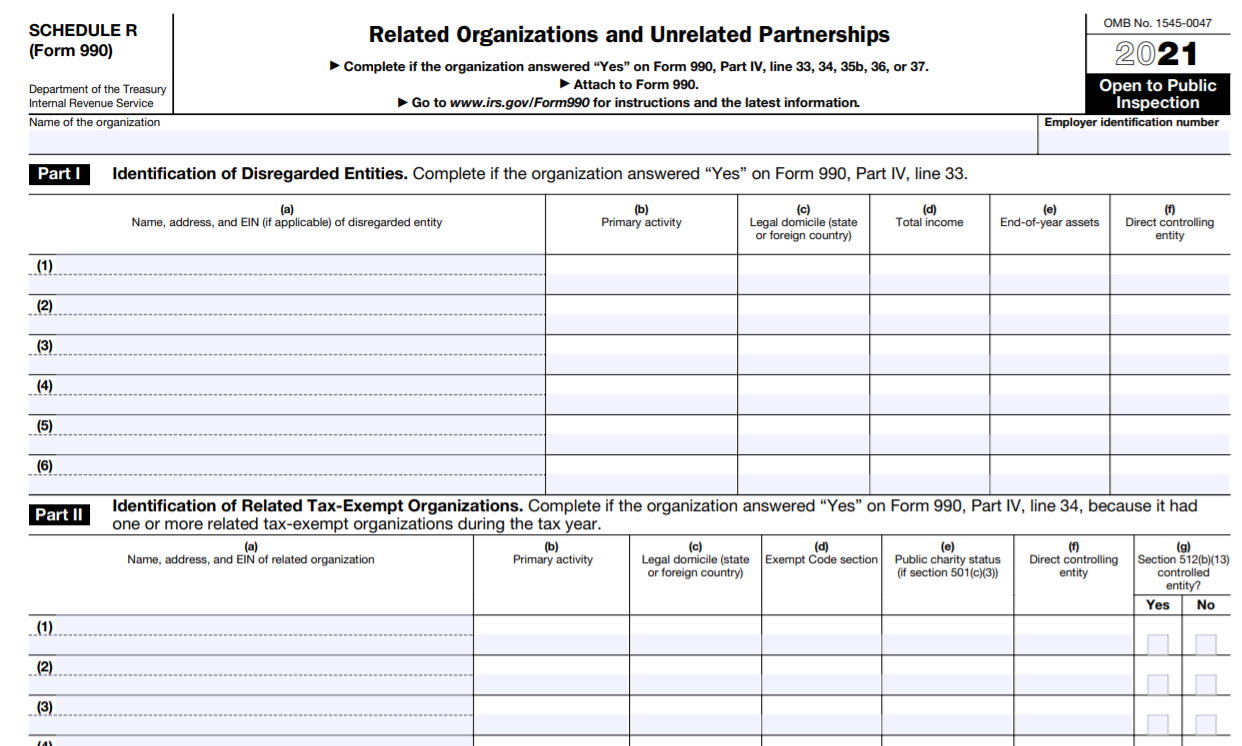

IRS Form 990 Schedule R Instructions Related Organizations and

On this page you may download the 990 series filings on record for 2021. For instructions and the latest information. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf. The download files are organized by month. Should.

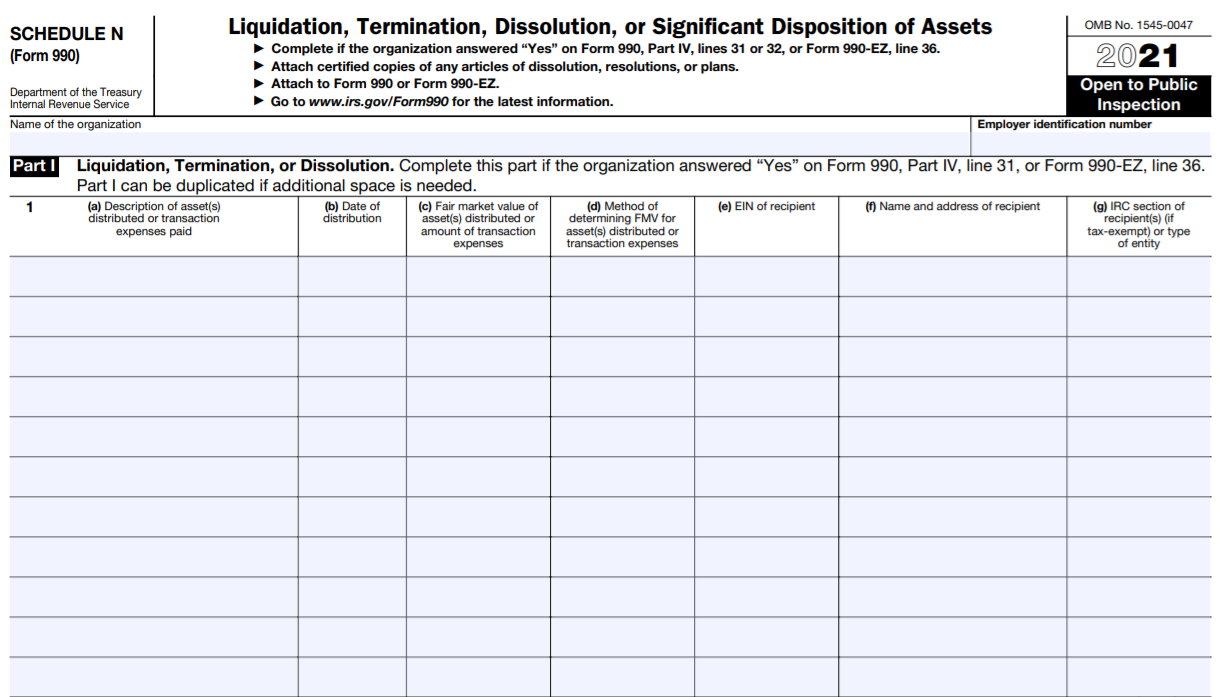

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status. Unrelated business taxable income from an unrelated trade or business. For instructions and the latest information. On this page you may download the 990 series filings on record for 2021. Web the irs has received a.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Unrelated business taxable income from an unrelated trade or business. For instructions and the latest information. Kids create a better world. What is the purpose of schedule a? Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf.

The Download Files Are Organized By Month.

On this page you may download the 990 series filings on record for 2021. Do not enter ssn numbers on this form as it may be made public if your organization is a 501(c)(3). What is the purpose of schedule a? Open to public go to www.irs.gov/form990

Who Must File Schedule A?

Schedule n (form 990 or. Should schedule a be filled out before other parts and schedules of form. Unrelated business taxable income from an unrelated trade or business. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of organization exempt from income tax pdf.

Kids Create A Better World.

For instructions and the latest information. Schedule a is required for section 501(c)3 organizations or section 4947(a)(1) charitable trusts. Web search for charities. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status.