Form 990 Instructions 2020

Form 990 Instructions 2020 - Baa for paperwork reduction act notice, see the. Tax due/overpayment no tax is due. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Schedule i (form 990) 2020: An officer must sign and date the tax return. Exempt organization business income tax return. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic changes and. Accordingly, where the form 990 references.

Sign and date your return. Baa for paperwork reduction act notice, see the. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. An officer must sign and date the tax return. Exempt organization business income tax return. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Accordingly, where the form 990 references. Schedule i (form 990) 2020:

Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Accordingly, where the form 990 references. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic changes and. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Exempt organization business income tax return. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Sign and date your return. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the.

Irs 990 Ez Instructions Tax Form Editable Online Blank in PDF

Web for paperwork reduction act notice, see the instructions for form 990. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications.

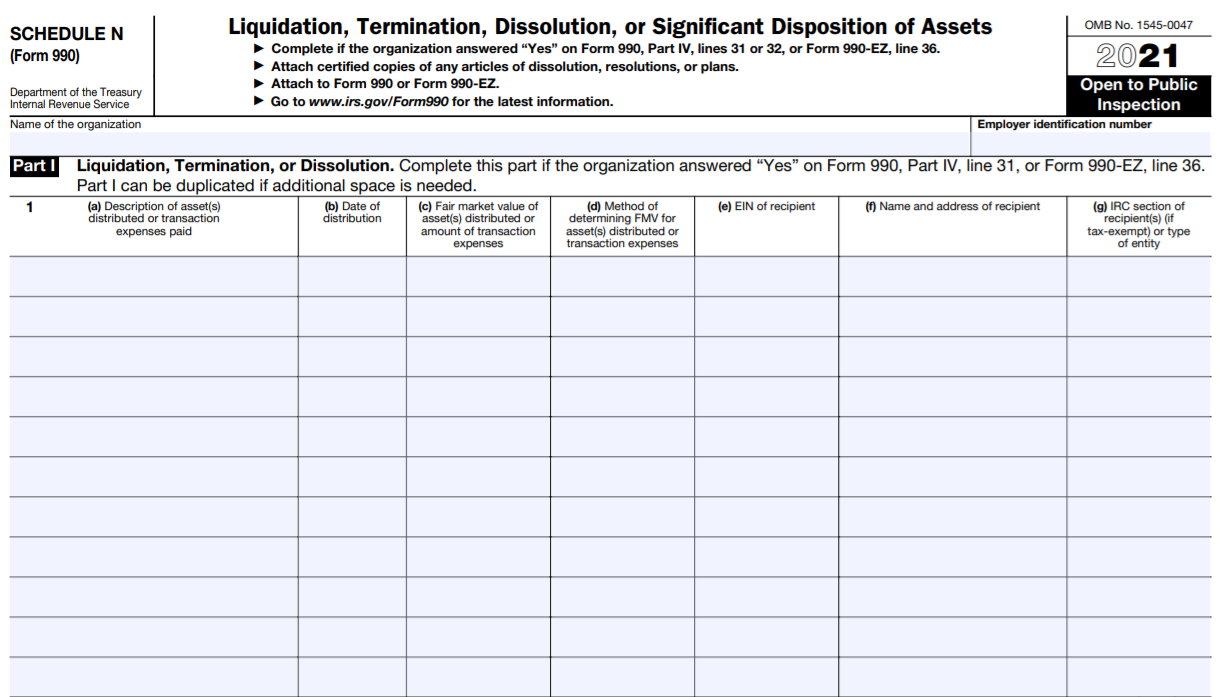

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Baa for paperwork reduction act notice, see the. Web the 2021.

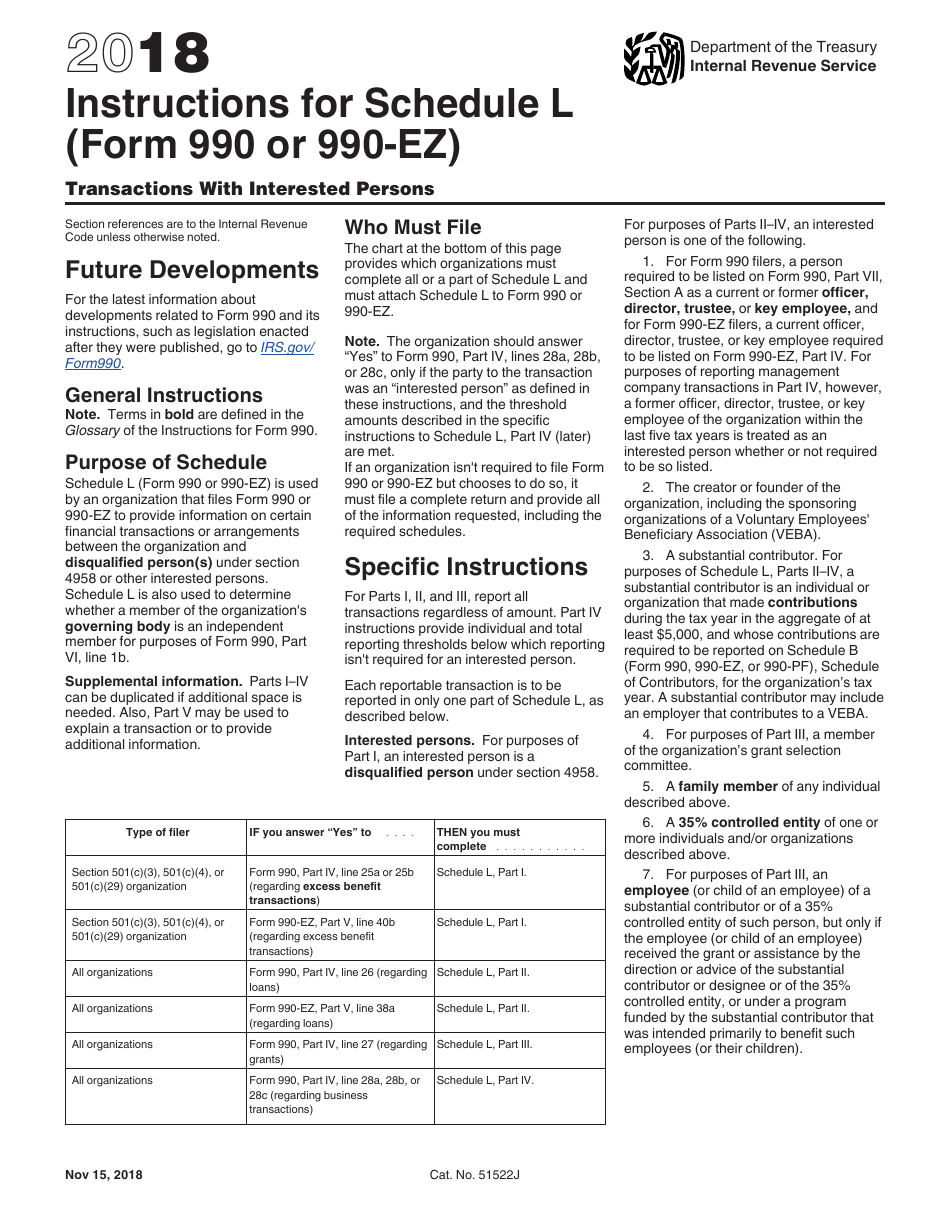

Download Instructions for IRS Form 990, 990EZ Schedule L Transactions

Schedule i (form 990) 2020: Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many. For organizations following calendar tax year..

irs form 990 instructions 2017 Fill Online, Printable, Fillable Blank

Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web for paperwork reduction act notice, see the instructions for form 990. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Web form 990 2020.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

• to figure the tax based on investment income, and • to report charitable distributions and activities. Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Web form 990 2020 return of organization exempt from.

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Baa for paperwork reduction act notice, see the. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990,.

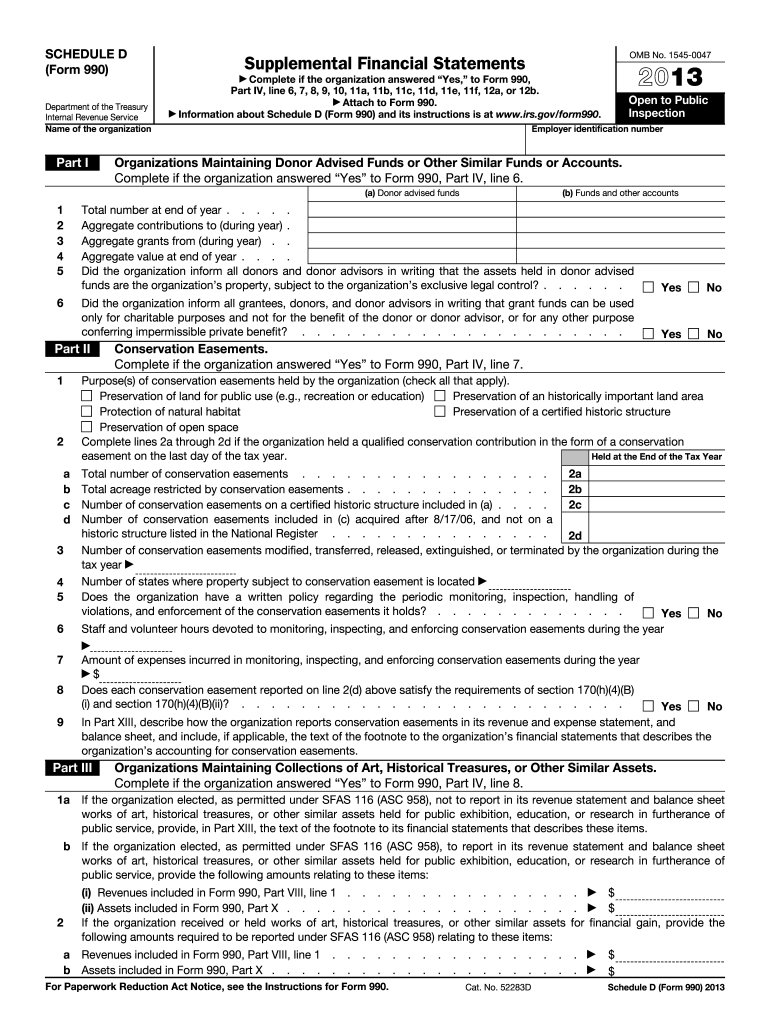

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

Baa for paperwork reduction act notice, see the. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Sign and date your return. Instructions for these schedules are. Schedule i (form 990) 2020:

2020 form 990 schedule c instructions Fill Online, Printable

Tax due/overpayment no tax is due. An officer must sign and date the tax return. Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Each unrelated trade or business of an organization.

Instructions to file your Form 990PF A Complete Guide

Schedule i (form 990) 2020: Baa for paperwork reduction act notice, see the. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many. An.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Instructions for these schedules are. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few.

Sign And Date Your Return.

Schedule i (form 990) 2020: Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Web the 2021 form 990, return of organization exempt from income tax, compared to the 2020 form 990, saw relatively few modifications other than minor stylistic changes and. Accordingly, where the form 990 references.

Web Form 990 2020 Department Of The Treasury Internal Revenue Service Return Of Organization Exempt From Income Tax Under Section 501(C), 527, Or 4947(A)(1) Of The.

Tax due/overpayment no tax is due. Web form 990 2020 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the. Exempt organization business income tax return. Instructions for these schedules are.

Web Information About Form 990, Return Of Organization Exempt From Income Tax, Including Recent Updates, Related Forms And Instructions On How To File.

For organizations following calendar tax year. • to figure the tax based on investment income, and • to report charitable distributions and activities. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Each unrelated trade or business of an organization has a separate schedule a attached to the return, with a list of how many.

Baa For Paperwork Reduction Act Notice, See The.

Web form 990 2020 return of organization exempt from income tax schedule a organization exempt under section 501(c)(3). Web filing due dates massa chusetts general laws (mgl) ch 62c, §§ 11 and 12 require c corpo rations to file their tax returns on or before the 15th day of the fourth month. Web for paperwork reduction act notice, see the instructions for form 990. An officer must sign and date the tax return.