Form 944 For 2022

Form 944 For 2022 - 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Let's get your 941 changed to 944 forms in quickbooks online. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. January 12, 2023 06:41 pm. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment. Web irs form 944 is the employer's annual federal tax return. Revised draft instructions for form 944. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web this being said, the deadline to file form 944 is jan.

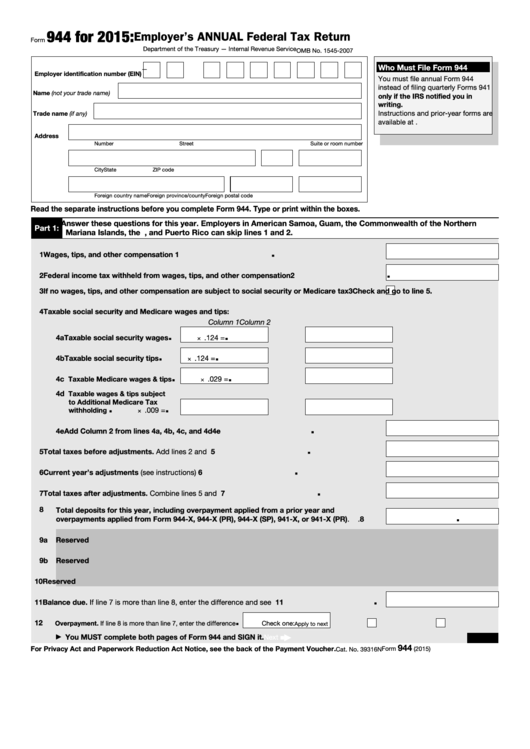

Edit, sign and save emp annual fed tax return form. Web for 2022, the due date for filing form 944 is january 31, 2023. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. The forms no longer include lines pertaining to the employee retention credit or advance payments. Web tax liability falls on the employer rather than the employee. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making. Complete, edit or print tax forms instantly. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Try it for free now! Web what is irs form 944 for 2022?

The form was introduced by the irs to give smaller employers a break in filing and paying federal. 944 (2022) this page intentionally left blank. Web tax liability falls on the employer rather than the employee. Ad upload, modify or create forms. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Let's get your 941 changed to 944 forms in quickbooks online. The forms no longer include lines pertaining to the employee retention credit or advance payments. Complete, edit or print tax forms instantly. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals.

How To Fill Out Form I944 StepByStep Instructions [2021]

Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Complete, edit or print tax forms instantly. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. However, if.

2016 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

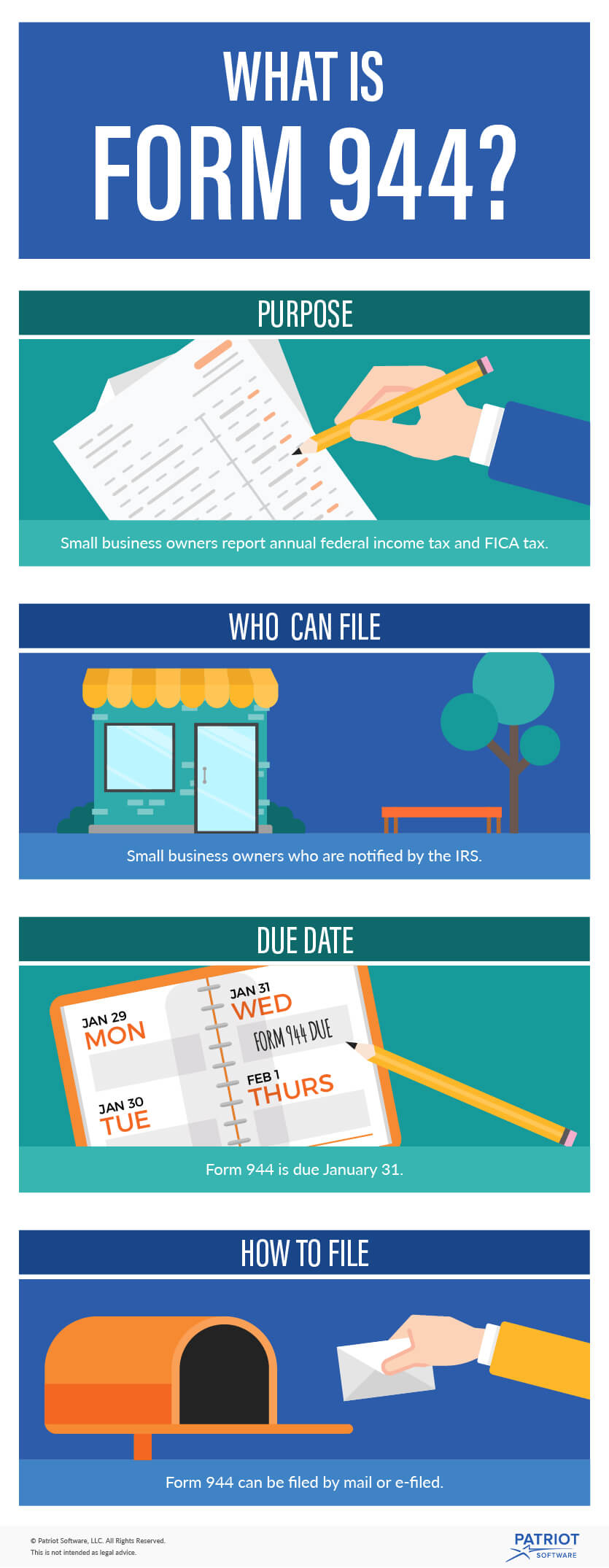

Web form 944, employer’s annual federal tax return, reports federal income and fica (social security and medicare) tax on employee wages. Complete, edit or print tax forms instantly. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Irs form 944, (employer’s annual tax return) is designed for the small employers and.

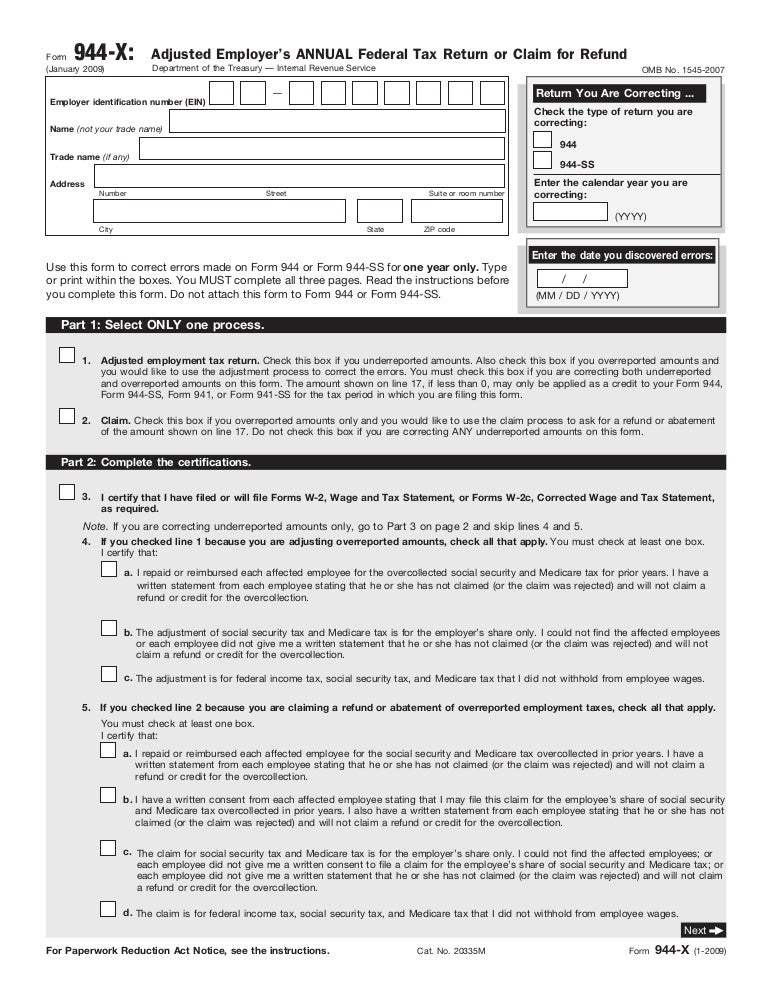

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Complete, edit or print tax forms instantly. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. January 12, 2023 06:41 pm. If you are eligible to claim a credit, you can.

What is Form 944? Reporting Federal & FICA Taxes

Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Complete, edit or print tax forms instantly. Try it for free now! Complete, edit or print tax forms instantly. Web for 2022, the due date for filing.

Form 944 2022 How To Fill it Out and What You Need To Know

Complete, edit or print tax forms instantly. Irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web irs form 944 is the employer's annual federal tax return. Web tax liability.

Finance Archives XperimentalHamid

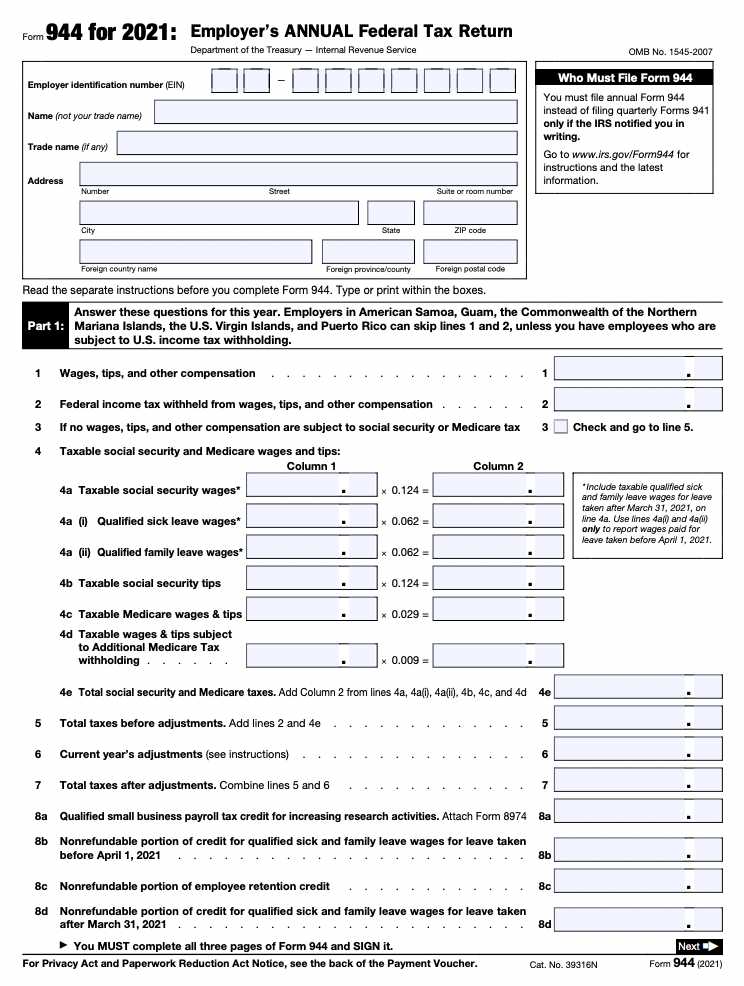

Web employer’s annual federal tax return form 944 for 2021: See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web irs form 944 is the employer's annual federal.

What is the Form I944, Declaration of SelfSufficiency? Sound

Irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Web for 2022, you have to file form 944 by january 31, 2023. 31 for the previous tax year — the return covering the 2021 year, therefore,.

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. 1 choose form and tax year 2 enter social security & medicare taxes 3 enter federal income tax. Web employer’s annual federal tax return form 944 for 2021: Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than.

Mi Certificate Ownership Fill Out and Sign Printable PDF Template

Web this being said, the deadline to file form 944 is jan. Web tax liability falls on the employer rather than the employee. Revised draft instructions for form 944. 31 for the previous tax year — the return covering the 2021 year, therefore, would be due jan. Web what is irs form 944 for 2022?

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Web irs form 944 is the employer's annual federal tax return. Web for 2022, you have to file form 944 by january 31, 2023. Irs form 944 becomes the mechanism to pay these taxes, taking the place of the irs form 941. Web what is irs form 944 for 2022? The forms no longer include lines pertaining to the employee.

Let's Get Your 941 Changed To 944 Forms In Quickbooks Online.

If you are eligible to claim a credit, you can read 2022irs instructions for form 944 page 14 to 16 to see how to complete line. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. See page 6 for additional guidance, including information on how to treat employment tax credits and social security tax deferrals. Unlike those filing a 941, small business owners have the option to pay taxes when filing, rather than making.

1 Choose Form And Tax Year 2 Enter Social Security & Medicare Taxes 3 Enter Federal Income Tax.

Web what is irs form 944 for 2022? 944 (2022) this page intentionally left blank. Web drafts of forms 943 and 944 were released. The form was introduced by the irs to give smaller employers a break in filing and paying federal.

Web However, Employers That Pay Qualified Sick And Family Leave Wages In 2022 For Leave Taken After March 31, 2020, And Before October 1, 2021, Are Eligible To Claim A Credit On Form.

Irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment. Web irs form 944 is the employer's annual federal tax return. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Through the payroll settings, we can.

Irs Form 944 Becomes The Mechanism To Pay These Taxes, Taking The Place Of The Irs Form 941.

Web tax liability falls on the employer rather than the employee. Edit, sign and save emp annual fed tax return form. If the deposits are made on time in full payment of the taxes, the return can be filed by february 10,. Web employer’s annual federal tax return form 944 for 2021:

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)