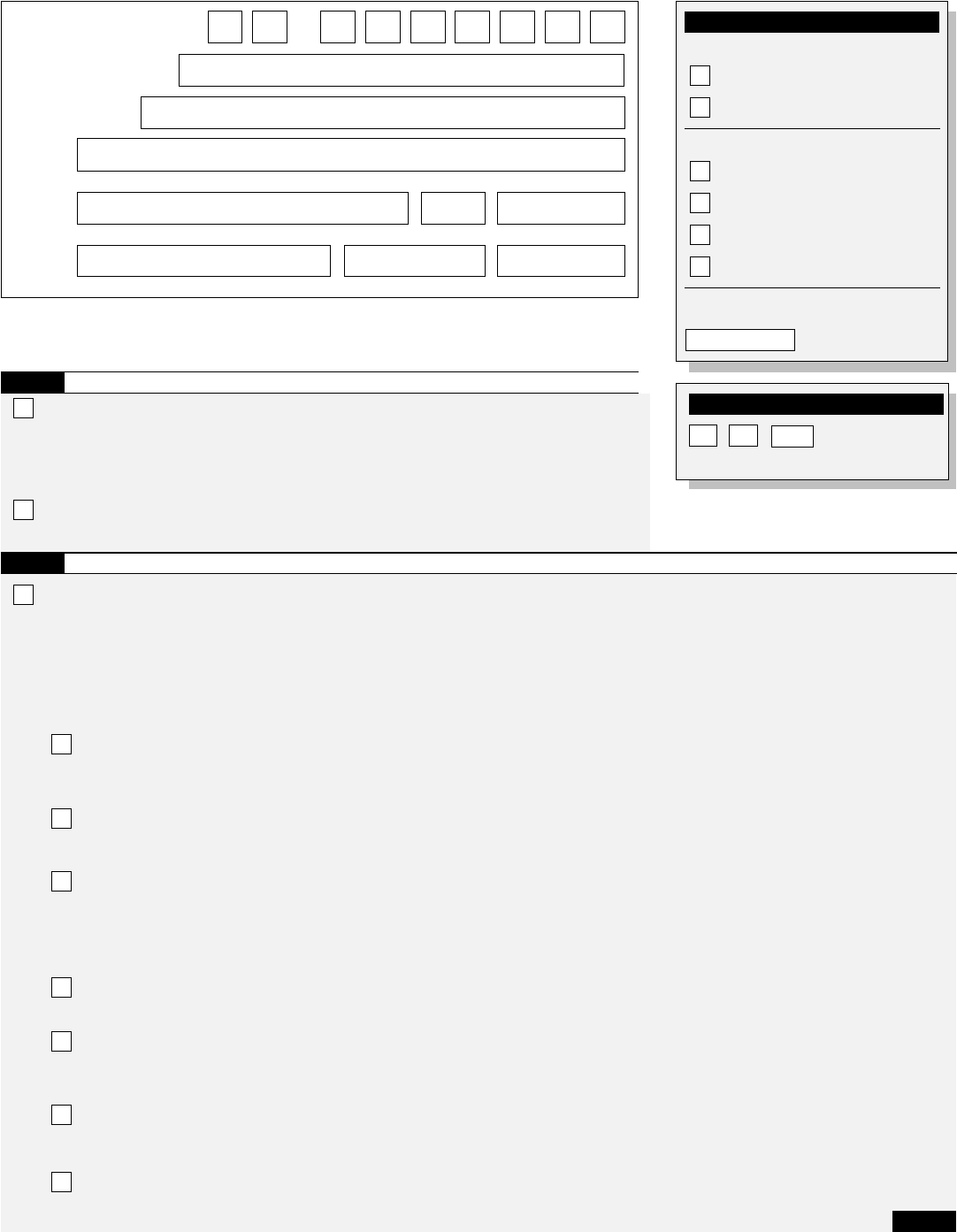

Form 941 Rev April 2020

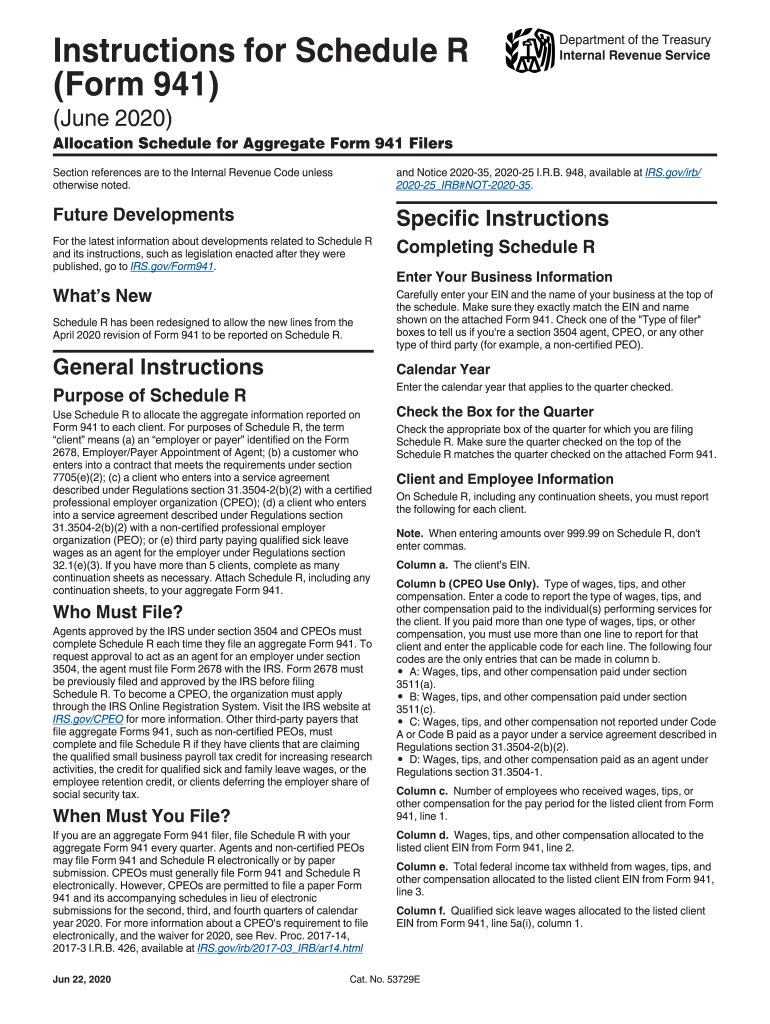

Form 941 Rev April 2020 - General instructions purpose of schedule r use schedule r to allocate the aggregate information reported on form 941 to each client. Enter the calendar year of the quarter you’re correcting. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Web there is a draft version of the irs form 941x (rev. April, may, june read the separate instructions before completing this form. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Specific instructions box 1—employer identification number (ein). Employer s quarterly federal tax return keywords: July 2020) adjusted employer’s quarterly federal tax return or claim for refund. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

The social security wage base limit is $160,200. Web instructions for form 941(rev. April 2020) department of the treasury — internal revenue service. Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of social security tax; Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. It specifically has to be the april 2020 revision, not the current revision. January, february, march name (not your trade name) 2: Web form 941 (2021) employer's quarterly federal tax return for 2021. You may use these instructions and the april 2022 revision of form 941. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b).

See deposit penalties in section 11 of pub. Web form 941 (2021) employer's quarterly federal tax return for 2021. This revision incorporates the additional elements related to the changes implemented on the form 941 (rev. July 2020) employer’s quarterly federal tax return 950120 omb no. American samoa, guam, the commonwealth of the northern mariana islands, and the u.s. Web there is a draft version of the irs form 941x (rev. 30 by the internal revenue service. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Those returns are processed in the order received. Web answer (1 of 3):

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

(yyyy) enter the date you discovered errors. The following significant changes have been made to form 941 to allow for the reporting of new employment tax credits and other tax. Type or print within the boxes. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. 30 by the internal.

941 form 2018 Fill out & sign online DocHub

July 2020) adjusted employer’s quarterly federal tax return or claim for refund. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Instructions for form 941 (rev. For purposes of schedule r, the term “client” means (a) an “employer or payer” identified on the form Web april 2020 revision of form 941 to.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

If you don’t have an ein, you may apply for one online by April, may, june read the separate instructions before completing this form. The final version is expected to be available by the end of september 2020. Web instructions for form 941 (rev. Specific instructions box 1—employer identification number (ein).

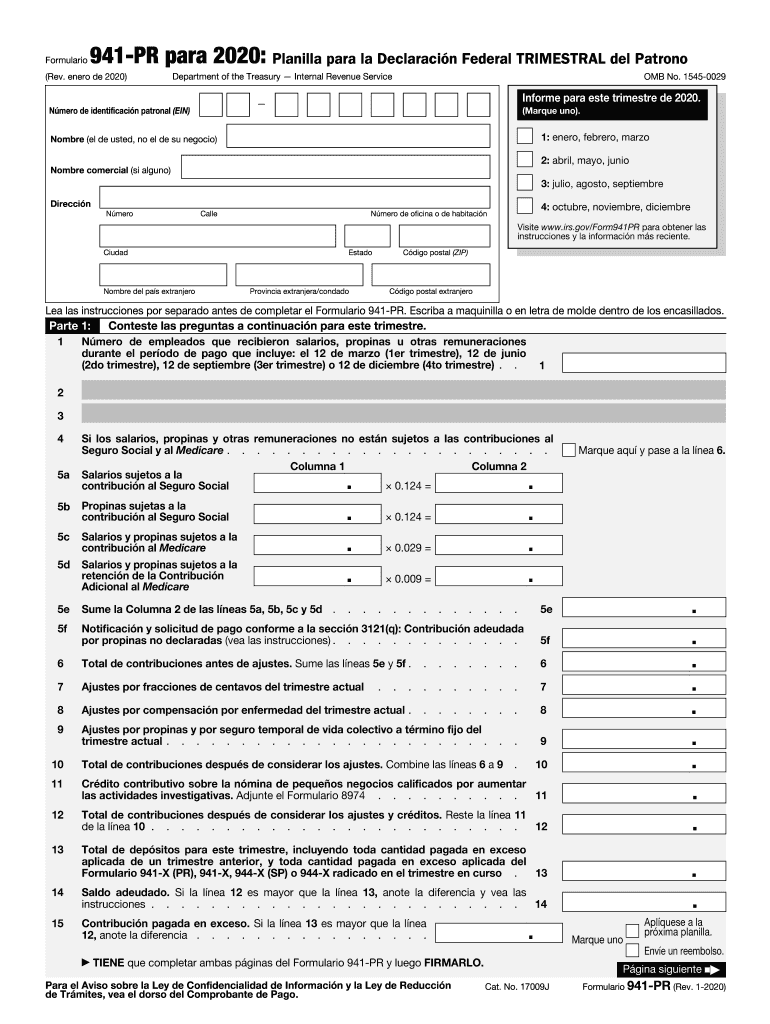

form 941 pr 2020 Fill Online, Printable, Fillable Blank

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2020, and before april 1, 2021, aren't subject to the employer share of social security.

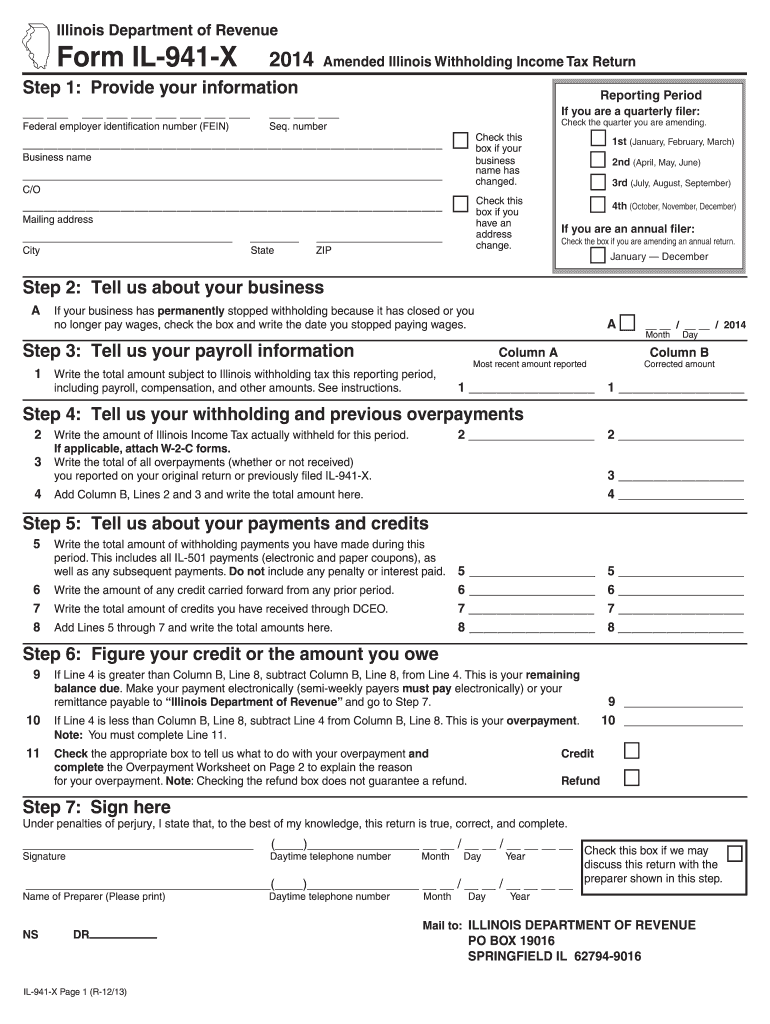

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Type or print within the boxes. July 2020) adjusted employer’s quarterly federal tax return or claim for refund. Employer’s quarterly federal tax return. Four lines—1, 13b, 24, and 25—were changed from those that were on this year’s second version of form 941, employer’s quarterly federal tax return, which was released. The following significant changes have been made to form 941.

Fill Free fillable F941ss Accessible Form 941SS (Rev. January 2020

The final version is expected to be available by the end of september 2020. You may use these instructions and the april 2022 revision of form 941. An official website of the united states governmen. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. July 2020) adjusted.

Instructions for Schedule R Form 941 Rev June Instructions for Schedule

American samoa, guam, the commonwealth of the northern mariana islands, and the u.s. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Instructions for form 941 (rev. April 2020) department of the treasury — internal revenue service. July 2020) adjusted employer’s quarterly federal.

Form 941X Edit, Fill, Sign Online Handypdf

Web form 941 (2021) employer's quarterly federal tax return for 2021. Therefore, the tax rate on these wages is 6.2%. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. 30.

Federal 14 Form 14 Federal 14 Form Tips You Need To Learn Now AH

The final version is expected to be available by the end of september 2020. Where do i get form 941 (rev. April, may, june read the separate instructions before completing this form. Web the finalized third version of form 941 for 2020, which is to be used for the third and fourth quarters of 2020, was released sept. Web instructions.

[Solved] Form 941 for 2021 Employer's QUARTERLY Federal Tax Return

See deposit penalties in section 11 of pub. The social security wage base limit is $160,200. Web form 941 (2021) employer's quarterly federal tax return for 2021. Web instructions for form 941 (rev. April, may, june trade name (if any).

This Revision Incorporates The Additional Elements Related To The Changes Implemented On The Form 941 (Rev.

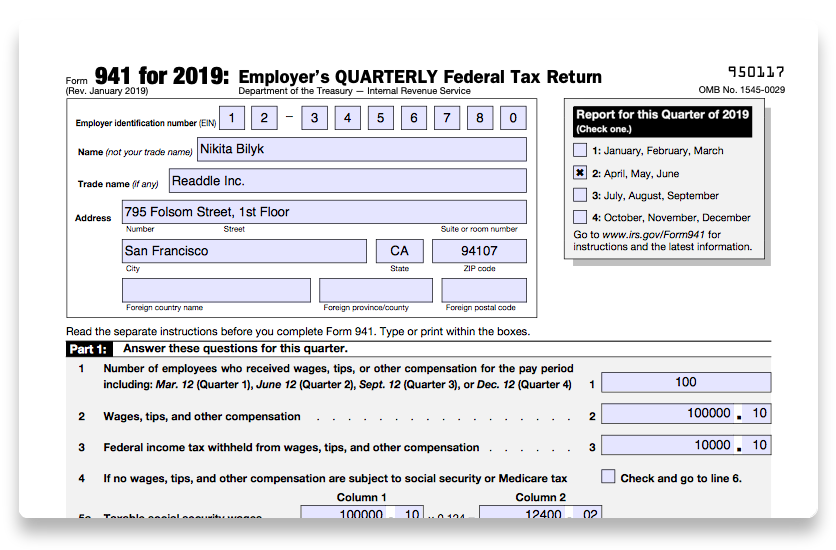

Web instructions for form 941 (rev. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. As of july 12, 2023. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no.

July 2020) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund.

For purposes of schedule r, the term “client” means (a) an “employer or payer” identified on the form Employer identification number (ein) — name (not your trade name) trade. April 2020) department of the treasury — internal revenue service. Use the april 2020 revision of form 941 to report employment taxes for the second quarter of 2020, and use the january 2020 revision of form 941 to report employment taxes for the first quarter of 2020.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

Type or print within the boxes. (yyyy) enter the date you discovered errors. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) name (not your trade name) trade name (if any) address number street — suite or room number city state zip code foreign country name foreign province/county foreign postal code 950120 Web form 941 (2021) employer's quarterly federal tax return for 2021.

The Final Version Is Expected To Be Available By The End Of September 2020.

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. April 2020), which factored in the payroll related. It specifically has to be the april 2020 revision, not the current revision. Employer’s quarterly federal tax return.