Form 941 And 940

Form 941 And 940 - Section 3504 agents who elect to file an aggregate. Edit, sign and print irs 941 tax form on any device with dochub. Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other. Form 940 is the form an employer must file for reporting purposes when remitting payment of the futa tax to the irs. This form reports the business’s federal. How to file the form if you own or manage a. Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. Web learn more about the irs forms 940 and 941. Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Form 941 asks for the total amount of.

However, some small employers (those whose annual liability for social security, medicare, and. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering. Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other. Web what are irs forms 940 and 941 share irs form 940 is an annual form that needs to be filed by any business that has employees. Ad get ready for tax season deadlines by completing any required tax forms today. Form 940 is the form an employer must file for reporting purposes when remitting payment of the futa tax to the irs. Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. We need it to figure and collect the right amount of tax. Web form 940 vs. Web generally, employers are required to file forms 941 quarterly.

In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering. Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. Gather information needed to complete form 941. The filings true up what you’ve already remitted to the irs with. Form 941 is a quarterly report for employers. Ad get ready for tax season deadlines by completing any required tax forms today. We need it to figure and collect the right amount of tax. However, form 940 is filed annually and it only reports an employer’s futa taxes. Web learn more about the irs forms 940 and 941. If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four.

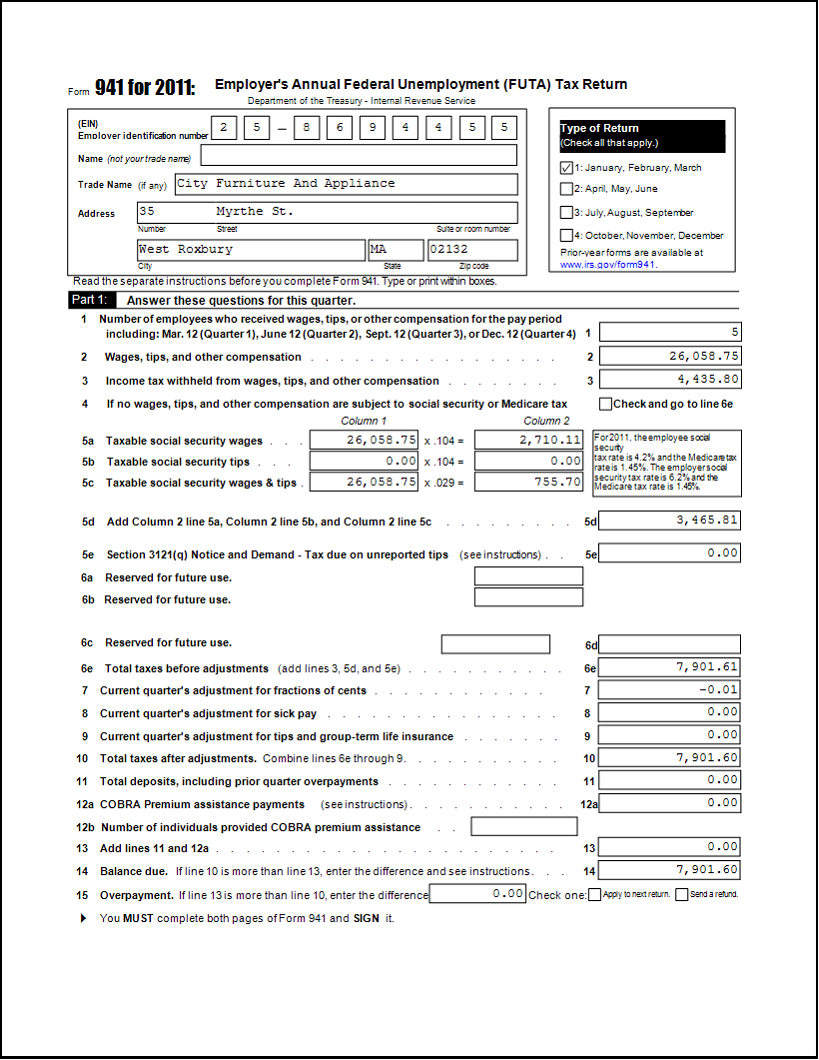

Sample 11 Form Completed 11 Common Misconceptions About Sample 11 Form

Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web generally, employers are required to.

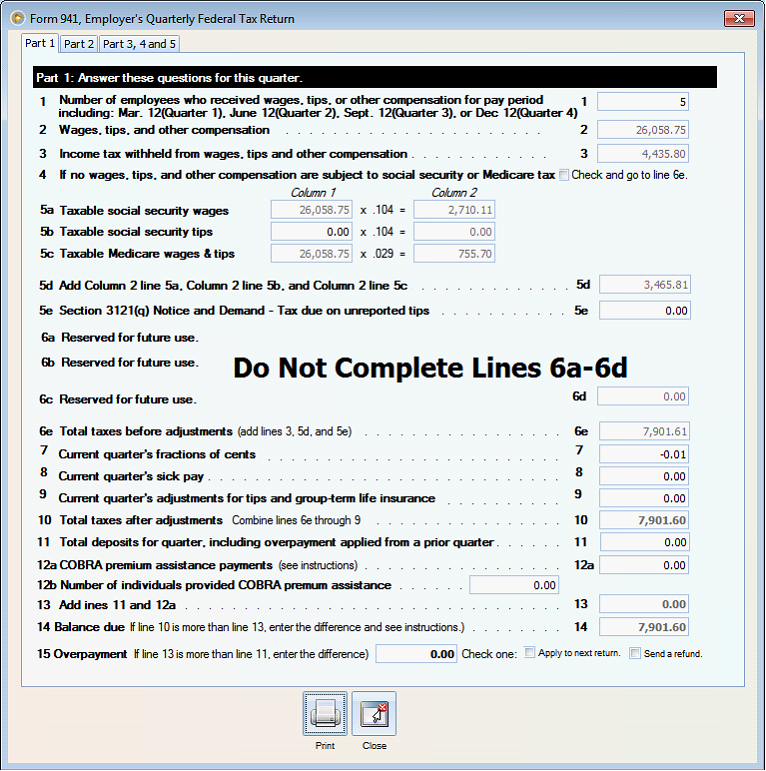

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Web what is the difference between a 940 and a 941 form? The filings true up what you’ve already remitted to the irs with. Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other. Connecticut, delaware, district of columbia, georgia,. Form 941 asks for the total amount of.

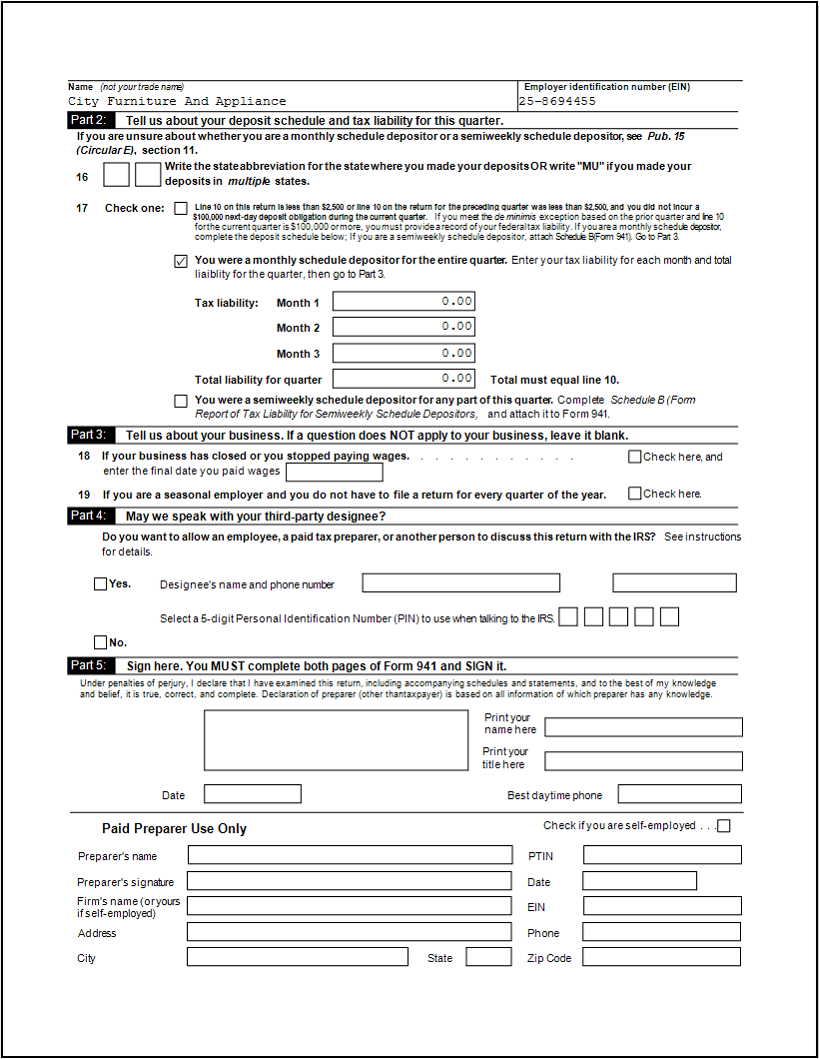

Reports > Year 2011 941 & 940 Reports

Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other. Web form 940 vs. Web generally, employers are required to file forms 941 quarterly. If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Form 941 getting help.

Reports > Year 2011 941 & 940 Reports

Web mailing addresses for forms 941. Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web what are irs forms 940 and 941 share irs form 940 is an annual form that.

Irs.gov Form 941 Amended Form Resume Examples MW9pPdM9AJ

We need it to figure and collect the right amount of tax. Some small employers are eligible to file an annual form 944 pdf. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. However, some small employers (those whose annual liability for social security, medicare, and. The filings true.

form 940 pr 2020 Fill Online, Printable, Fillable Blank

Web if you file form 941 and are a semiweekly depositor, then report your tax liability on schedule b (form 941), report of tax liability for semiweekly schedule. Web what is the difference between a 940 and a 941 form? This form reports the business’s federal. The filings true up what you’ve already remitted to the irs with. Web the.

Reports > Year 2011 941 & 940 Reports

Form 941 is a quarterly report for employers. Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Gather information needed to complete form 941. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a..

Prepare 941 and 940 form by Sandeep_kc Fiverr

Section 3504 agents who elect to file an aggregate. Web the two irs forms are similar. Connecticut, delaware, district of columbia, georgia,. We need it to figure and collect the right amount of tax. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering.

Reports > Year 2011 941 & 940 Reports

Connecticut, delaware, district of columbia, georgia,. Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other. Edit, sign and print.

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web generally, employers are required to file forms 941 quarterly. Web if you file form.

Form 941, On The Other Hand, Reports Federal Income Tax.

However, form 940 is filed annually and it only reports an employer’s futa taxes. Form 941 is a quarterly report for employers. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Web generally, employers are required to file forms 941 quarterly.

Web What Is The Difference Between A 940 And A 941 Form?

This form reports the business’s federal. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web the two irs forms are similar. Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability.

Web Mailing Addresses For Forms 941.

Web what are irs forms 940 and 941 share irs form 940 is an annual form that needs to be filed by any business that has employees. However, some small employers (those whose annual liability for social security, medicare, and. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering. We need it to figure and collect the right amount of tax.

If You Operate A Business And Have Employees Working For You, Then You Likely Need To File Irs Form 941, Employer’s Quarterly Federal Tax Return, Four.

Web learn more about the irs forms 940 and 941. Web if you file form 941 and are a semiweekly depositor, then report your tax liability on schedule b (form 941), report of tax liability for semiweekly schedule. Gather information needed to complete form 941. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1460.png)