Form 926 Instructions 2022

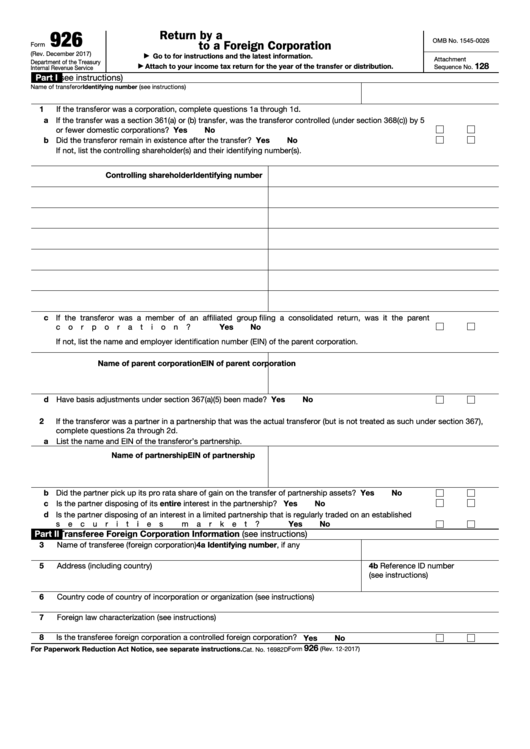

Form 926 Instructions 2022 - The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. The experts at h&r block have your expat tax needs covered return by a u.s. 9 by the internal revenue service. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Web 01/03/2022 inst 926: Form 926 is used to report certain transfers of property to a foreign corporation. Web yesno form 926 (rev. Instructions for form 941 (03/2023) instructions for form 941.

9 by the internal revenue service. Web 01/03/2022 inst 926: Web this publication will help you decide whether you have a household employee and, if you do, whether you need to pay federal employment taxes (social security tax, medicare tax, futa tax, and federal income tax withholding). The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. The experts at h&r block have your expat tax needs covered return by a u.s. Instructions for form 926, return by a u.s. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Web october 25, 2022 resource center forms form 926 for u.s. Web information about form 926, return by a u.s.

Form 926 is used to report certain transfers of property to a foreign corporation. Instructions for form 926, return by a u.s. Web october 25, 2022 resource center forms form 926 for u.s. Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 Instructions for form 941 (03/2023) instructions for form 941. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e). Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf:

IRS Form 926 Everything You Need To Know

Web october 25, 2022 resource center forms form 926 for u.s. Instructions for form 926, return by a u.s. The experts at h&r block have your expat tax needs covered return by a u.s. Web the finalized publication 926, household employer’s tax guide, was released feb. Form 926 is used to report certain transfers of property to a foreign corporation.

3911 Form 2022 2023 IRS Forms TaxUni

Web this publication will help you decide whether you have a household employee and, if you do, whether you need to pay federal employment taxes (social security tax, medicare tax, futa tax, and federal income tax withholding). Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: The experts at h&r block have your expat tax needs covered.

Form 926 Return by a U.S. Transferor of Property to a Foreign

The credits may only be claimed for wages paid for leave taken after march 31,. Expats at a glance learn more about irs form 926 and if you’re required to file for exchanging property to a foreign company. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Transferor of property to.

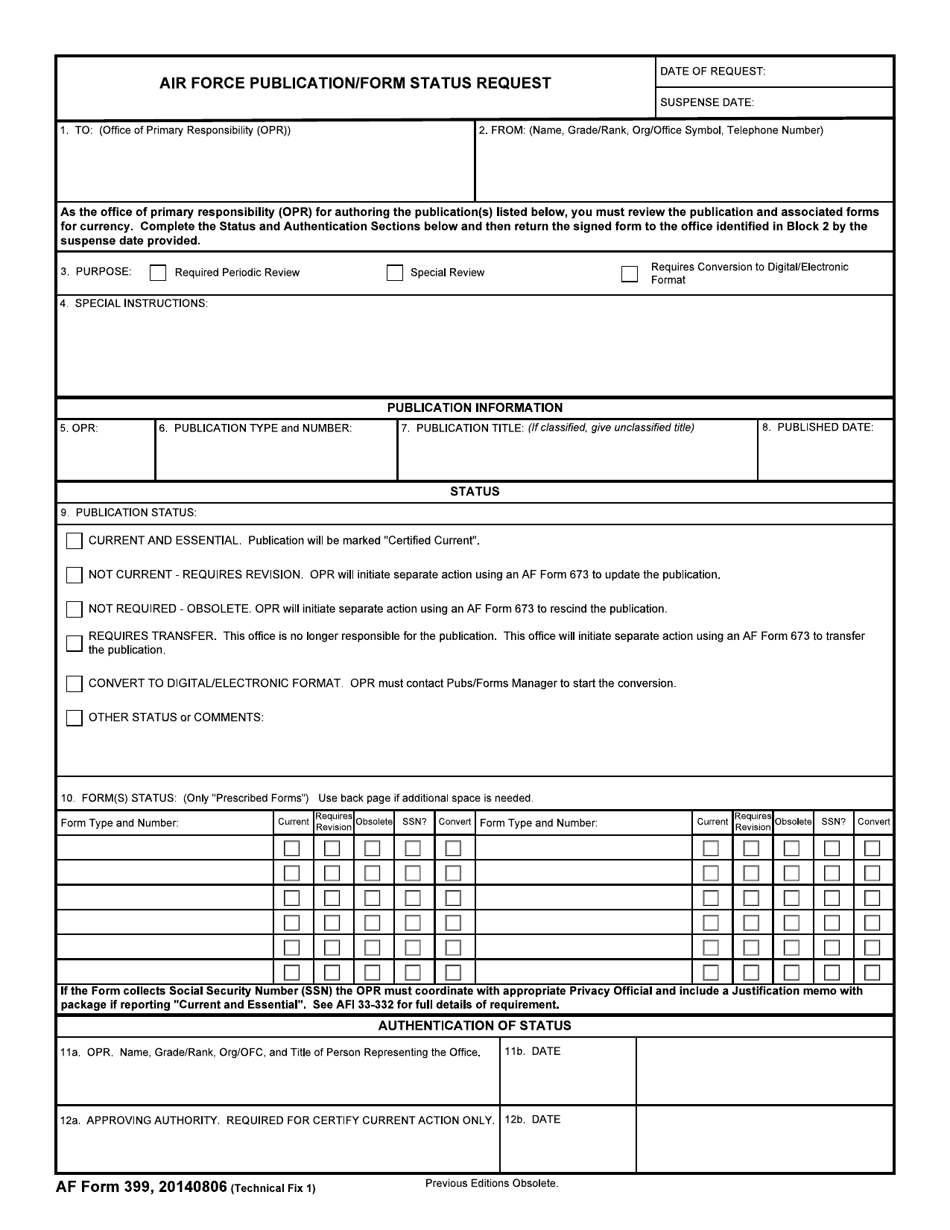

AF Form 399 Fill Out, Sign Online and Download Fillable PDF

Instructions for form 941 (03/2023) instructions for form 941. Instructions for form 926, return by a u.s. Instructions for form 926, return by a u.s. Web information about form 926, return by a u.s. Citizen or resident, a domestic corporation, or a domestic estate or trust.

Instructions Draft For Form 926 Return By A U.s. Transferor Of

Web information about form 926, return by a u.s. The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022. Web 01/03/2022 inst 926: Transferor of property to a foreign corporation Instructions for form 926, return by a u.s.

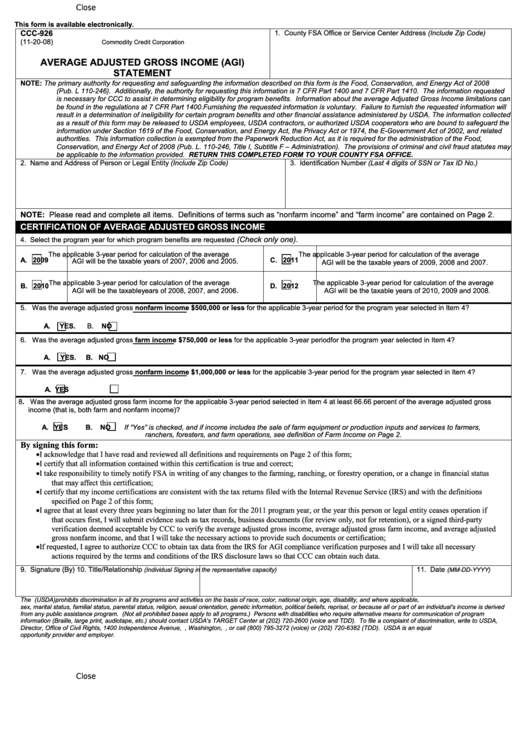

Fillable Form Ccc926 Average Adjusted Gross (Agi) Statement

Transferor of property to a foreign corporation Web the finalized publication 926, household employer’s tax guide, was released feb. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 The experts at h&r block have your expat tax needs covered return by a u.s.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Instructions for form 941 (03/2023) instructions for form 941. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Web october 25, 2022 resource center forms form 926 for.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

Web 01/03/2022 inst 926: Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 Citizens.

926 instructions Fill out & sign online DocHub

Instructions for form 926, return by a u.s. Instructions for form 941 (03/2023) instructions for form 941. The experts at h&r block have your expat tax needs covered return by a u.s. It explains how to figure, pay, and report these taxes for your household employee. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf:

Instructions For Form 926 2022 2023

The experts at h&r block have your expat tax needs covered return by a u.s. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Web this publication will help you decide whether you have a household employee and, if you do, whether you need to pay federal employment taxes (social security tax, medicare tax, futa tax, and federal.

Web This Publication Will Help You Decide Whether You Have A Household Employee And, If You Do, Whether You Need To Pay Federal Employment Taxes (Social Security Tax, Medicare Tax, Futa Tax, And Federal Income Tax Withholding).

Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 (pr) instructions for form 940 (pr), employer's annual federal unemployment (futa) tax return (puerto rico version) 2021 12/14/2021 inst 940 Transferor of property to a foreign corporation 1118 12/04/2018 inst 940 9 by the internal revenue service. The publication was updated to remind employers that the credits for qualified paid sick and family leave wages still are available in 2022.

Web October 25, 2022 Resource Center Forms Form 926 For U.s.

Instructions for form 926, return by a u.s. Instructions for form 940 (2022) instructions for form 940 (2022) i940.pdf: Web the finalized publication 926, household employer’s tax guide, was released feb. Web information about form 926, return by a u.s.

Expats At A Glance Learn More About Irs Form 926 And If You’re Required To File For Exchanging Property To A Foreign Company.

Web 01/03/2022 inst 926: The experts at h&r block have your expat tax needs covered return by a u.s. Transferor of property to a foreign corporation, to report any exchanges or transfers of tangible or intangible property that are described in section 6038b(a)(1)(a) of the internal revenue code to a foreign corporation. Form 926 is used to report certain transfers of property to a foreign corporation.

Web Yesno Form 926 (Rev.

The credits may only be claimed for wages paid for leave taken after march 31,. Web instructions for form 926 (11/2018) instructions for form 926 (11/2018) i926.pdf: Transferor of property to a foreign corporation Citizen or resident, a domestic corporation, or a domestic estate or trust must complete and file form 926 to report certain transfers of property to a foreign corporation that are described in section 6038b (a) (1) (a), 367 (d), or 367 (e).