Form 8995 Instructions 2022

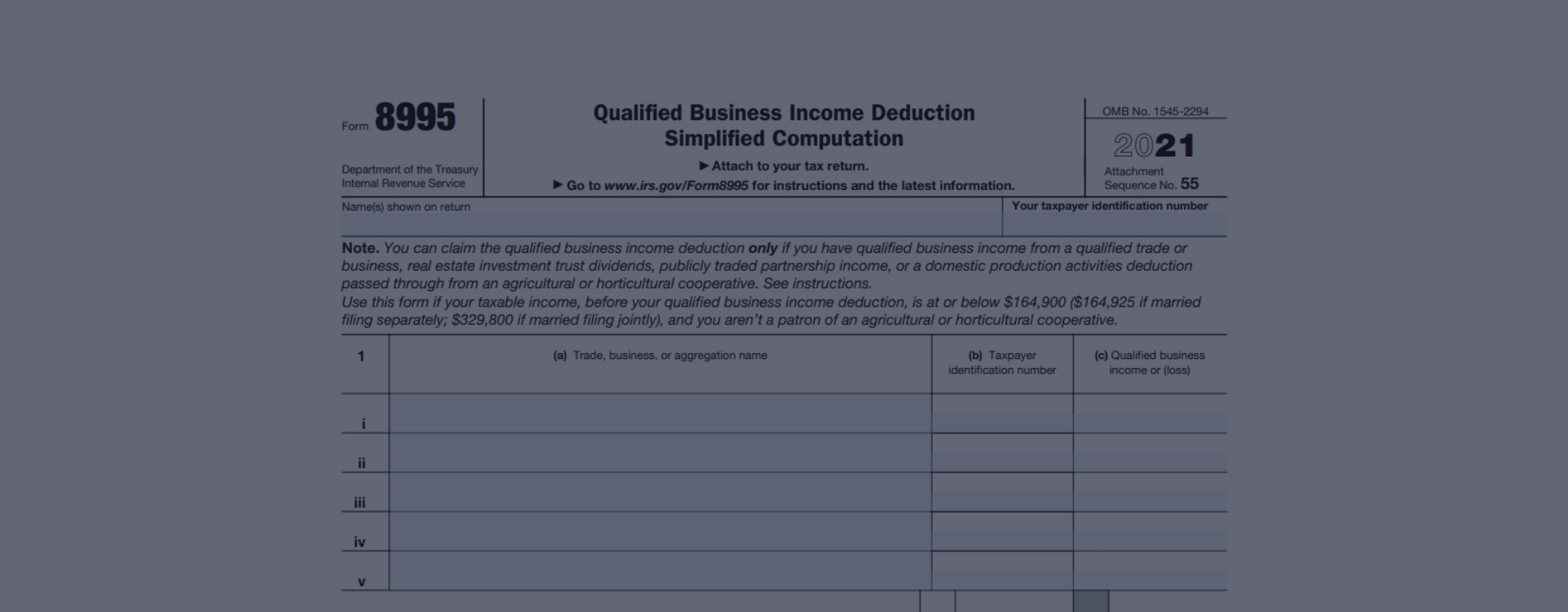

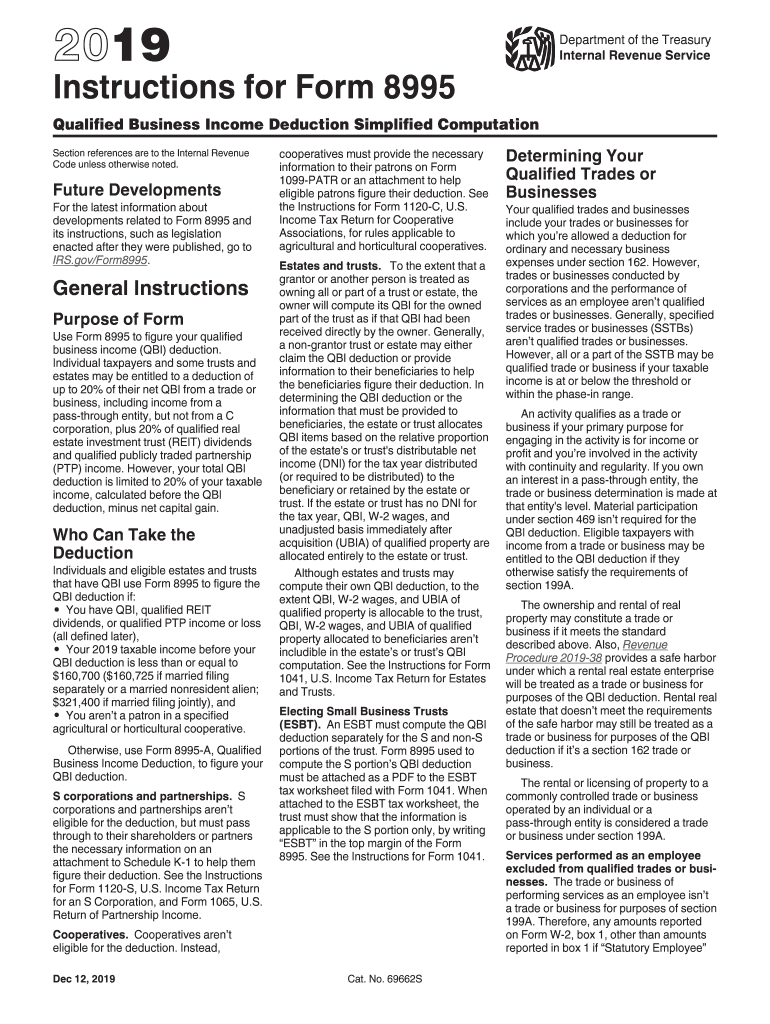

Form 8995 Instructions 2022 - Fear not, for i am here to guide you through the labyrinth of taxation! This was corrected in the 2022 instructions for form 8995 posted on irs.gov on march 10, 2023. Taxable income limitations are adjusted for inflation and. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea of forms and instructions. Web purpose of form. Web taxable income limitation adjustments. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Today, let's dive into the world of tax form 8995 instructions and unravel the mysteries of this vital document. Don’t worry about which form your return needs to use.

Web purpose of form. Web taxable income limitation adjustments. Go to www.irs.gov/form8995 for instructions and the latest information. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Fear not, for i am here to guide you through the labyrinth of taxation! Taxable income limitations are adjusted for inflation and. Web if you downloaded or printed the 2022 instructions for form 8995 between january 12 and march 10, 2023, please note that under the heading who can take the deduction, the end of the second bullet point should read and not or. There are two ways to calculate the qbi deduction: Don’t worry about which form your return needs to use. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return.

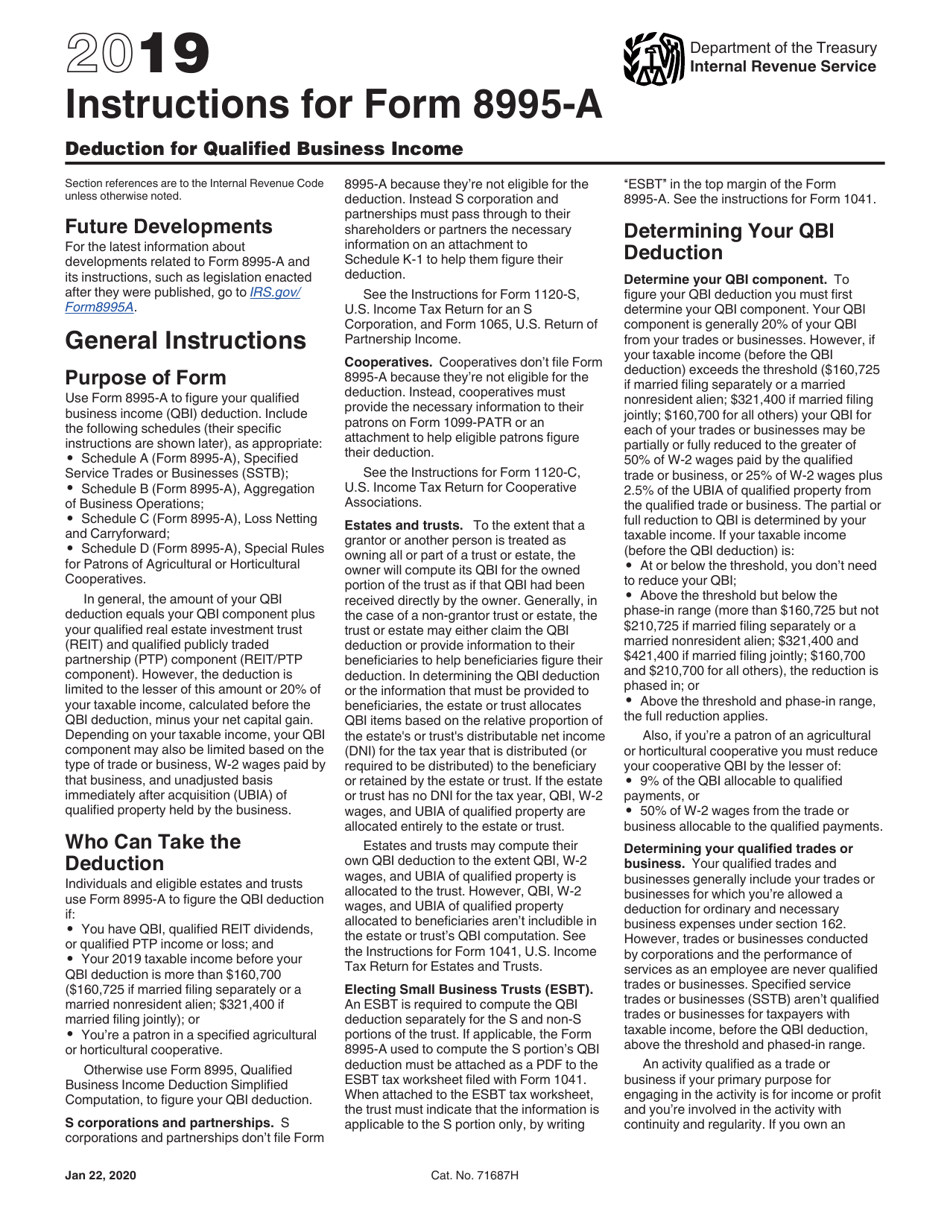

Fear not, for i am here to guide you through the labyrinth of taxation! Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Go to www.irs.gov/form8995 for instructions and the latest information. Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web purpose of form. After you complete the required steps. There are two ways to calculate the qbi deduction: Use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing. Don’t worry about which form your return needs to use.

Form 8995 Basics & Beyond

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Don’t worry about which form your return needs to use. Use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing. Web the qualified business income deduction (qbi) is intended.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Web purpose of form. Today, let's dive into the world of tax form 8995 instructions and unravel the mysteries of this vital document. Taxable income limitations are adjusted for inflation and. Don’t worry about which form your return needs to use. Fear not, for i am here to guide you through the labyrinth of taxation!

IRS Form 8995 Instructions Your Simplified QBI Deduction

This was corrected in the 2022 instructions for form 8995 posted on irs.gov on march 10, 2023. Don’t worry about which form your return needs to use. Web taxable income limitation adjustments. There are two ways to calculate the qbi deduction: Web purpose of form.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

This was corrected in the 2022 instructions for form 8995 posted on irs.gov on march 10, 2023. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web purpose of form. Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only.

8995 Fill out & sign online DocHub

Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing. Today, let's dive into the world of tax.

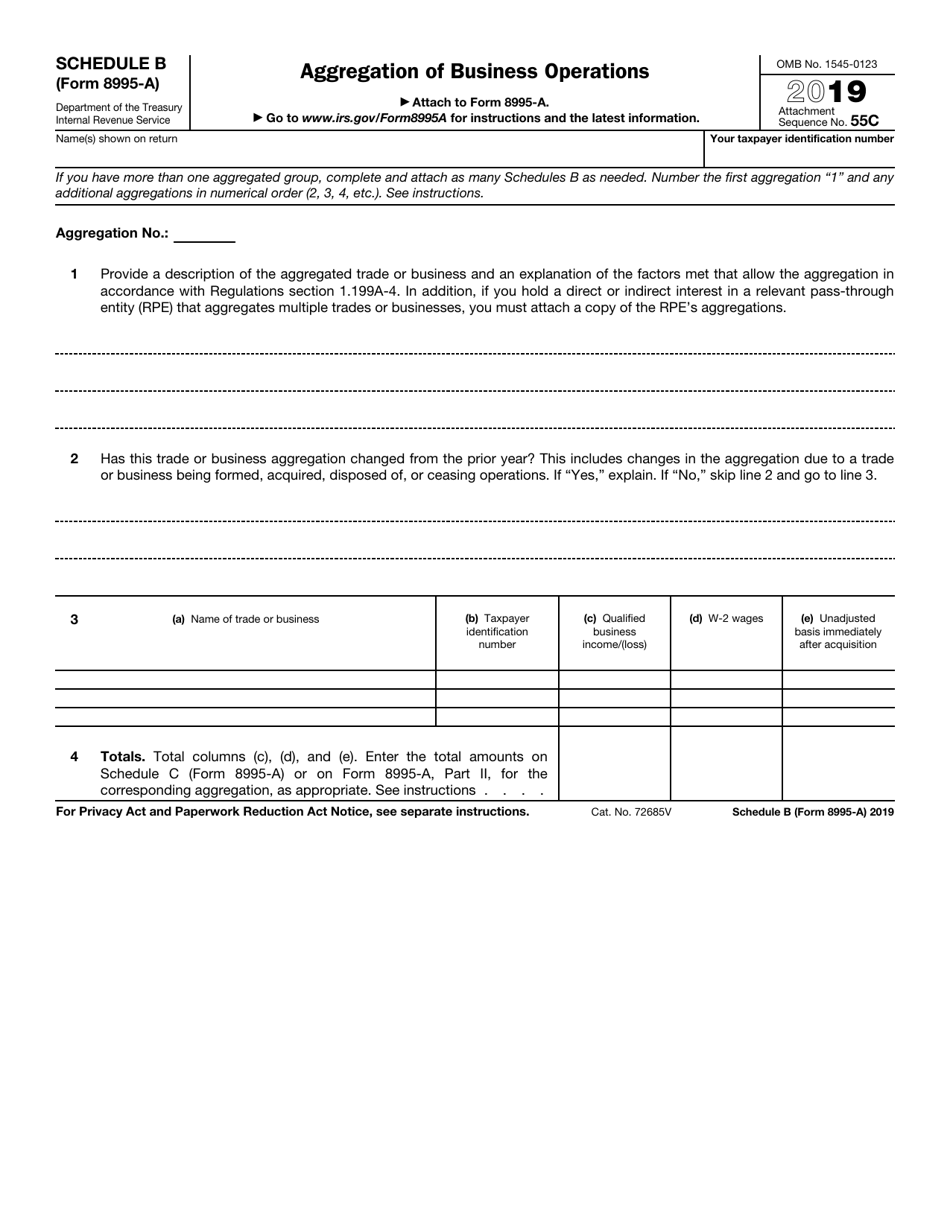

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Today, let's dive into the world of tax form 8995 instructions and unravel the mysteries of this vital document. Don’t worry about which form your return needs to use. Web if you downloaded or printed the 2022 instructions for form 8995 between january 12 and march 10, 2023, please note that under the heading who can take the deduction, the.

IRS Form 8995 Instructions for 2022 Download Form 8995 Product for Free

Taxable income limitations are adjusted for inflation and. Fear not, for i am here to guide you through the labyrinth of taxation! Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Go to www.irs.gov/form8995 for instructions and.

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

Web taxable income limitation adjustments. There are two ways to calculate the qbi deduction: Taxable income limitations are adjusted for inflation and. Go to www.irs.gov/form8995 for instructions and the latest information. Fear not, for i am here to guide you through the labyrinth of taxation!

Download Instructions for IRS Form 8995A Deduction for Qualified

This was corrected in the 2022 instructions for form 8995 posted on irs.gov on march 10, 2023. Web purpose of form. Fear not, for i am here to guide you through the labyrinth of taxation! Web 2022 irs form 8995 instructions 4 april 2023 imagine navigating through a maze of tax regulations only to find yourself lost in a sea.

8995 Instructions 2021 2022 IRS Forms Zrivo

Web purpose of form. After you complete the required steps. Today, let's dive into the world of tax form 8995 instructions and unravel the mysteries of this vital document. There are two ways to calculate the qbi deduction: Web if you downloaded or printed the 2022 instructions for form 8995 between january 12 and march 10, 2023, please note that.

There Are Two Ways To Calculate The Qbi Deduction:

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing. Click to expand the qualified business. After you complete the required steps.

This Was Corrected In The 2022 Instructions For Form 8995 Posted On Irs.gov On March 10, 2023.

Don’t worry about which form your return needs to use. Today, let's dive into the world of tax form 8995 instructions and unravel the mysteries of this vital document. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web taxable income limitation adjustments.

Web 2022 Irs Form 8995 Instructions 4 April 2023 Imagine Navigating Through A Maze Of Tax Regulations Only To Find Yourself Lost In A Sea Of Forms And Instructions.

Web updated for tax year 2022 • february 2, 2023 04:34 pm overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Fear not, for i am here to guide you through the labyrinth of taxation! Web if you downloaded or printed the 2022 instructions for form 8995 between january 12 and march 10, 2023, please note that under the heading who can take the deduction, the end of the second bullet point should read and not or. Go to www.irs.gov/form8995 for instructions and the latest information.

Taxable Income Limitations Are Adjusted For Inflation And.

Web purpose of form.