Form 8990 Explained

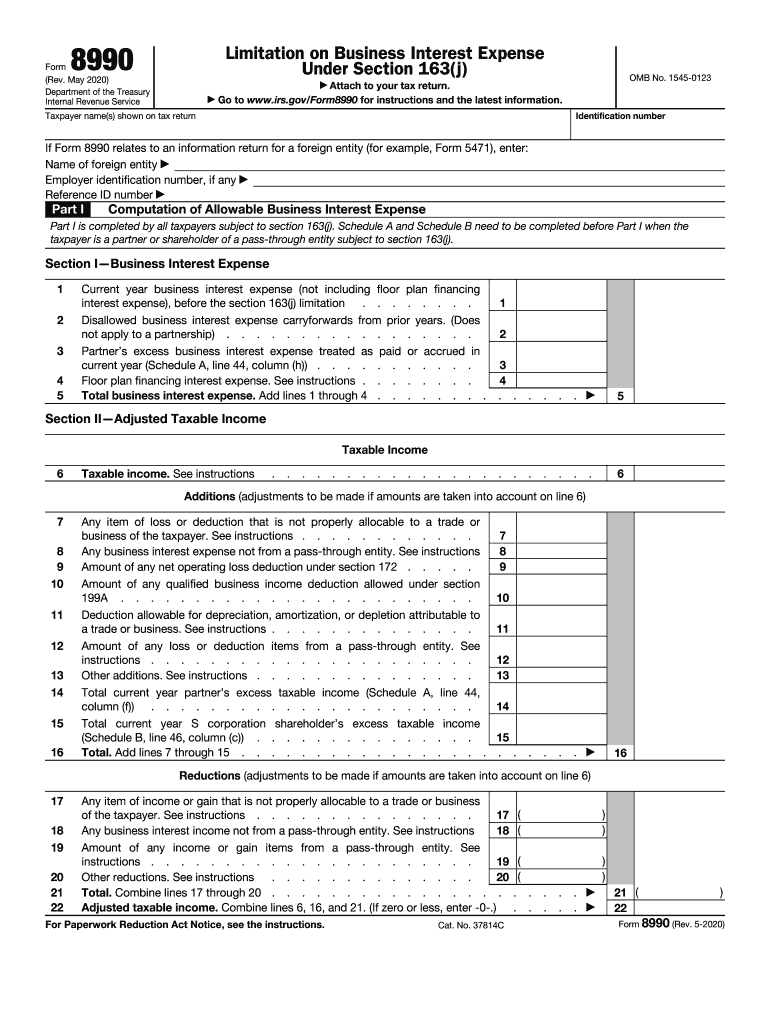

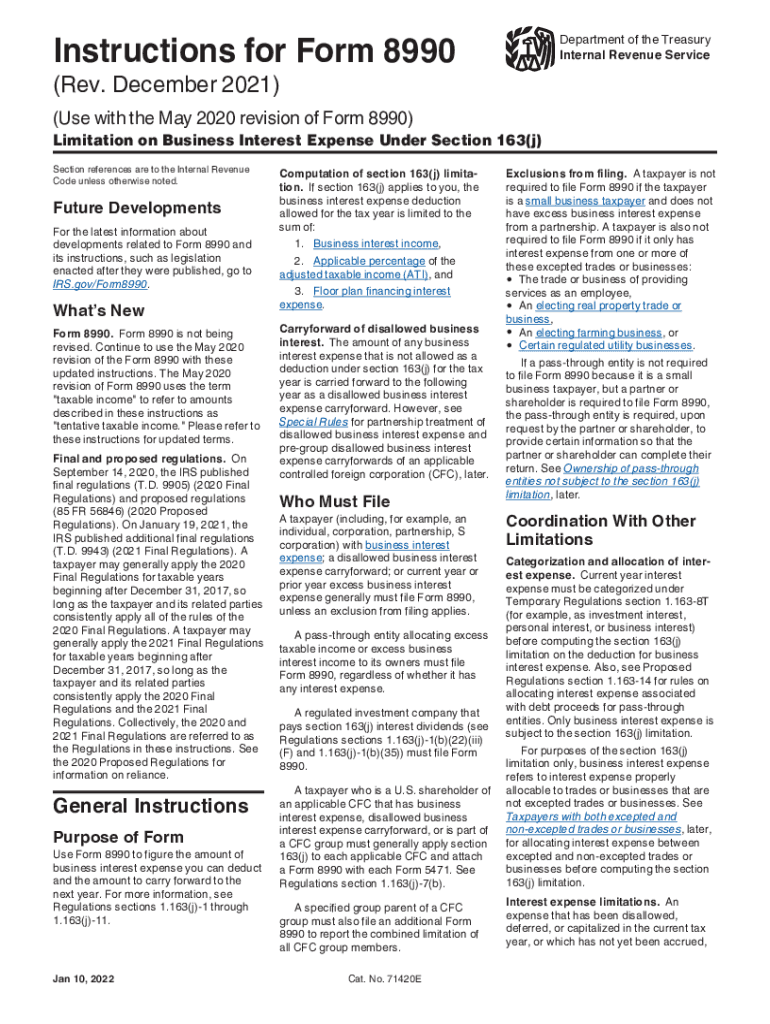

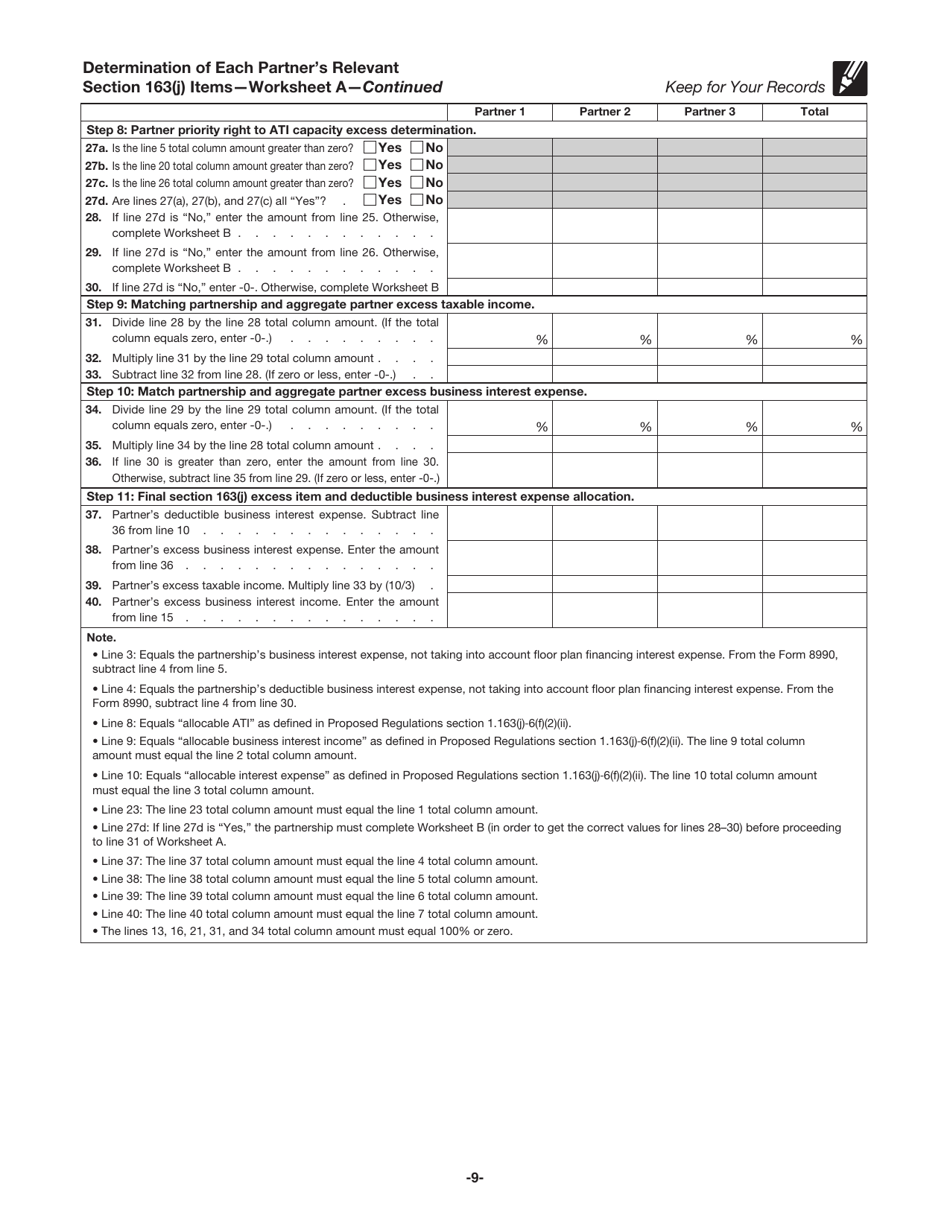

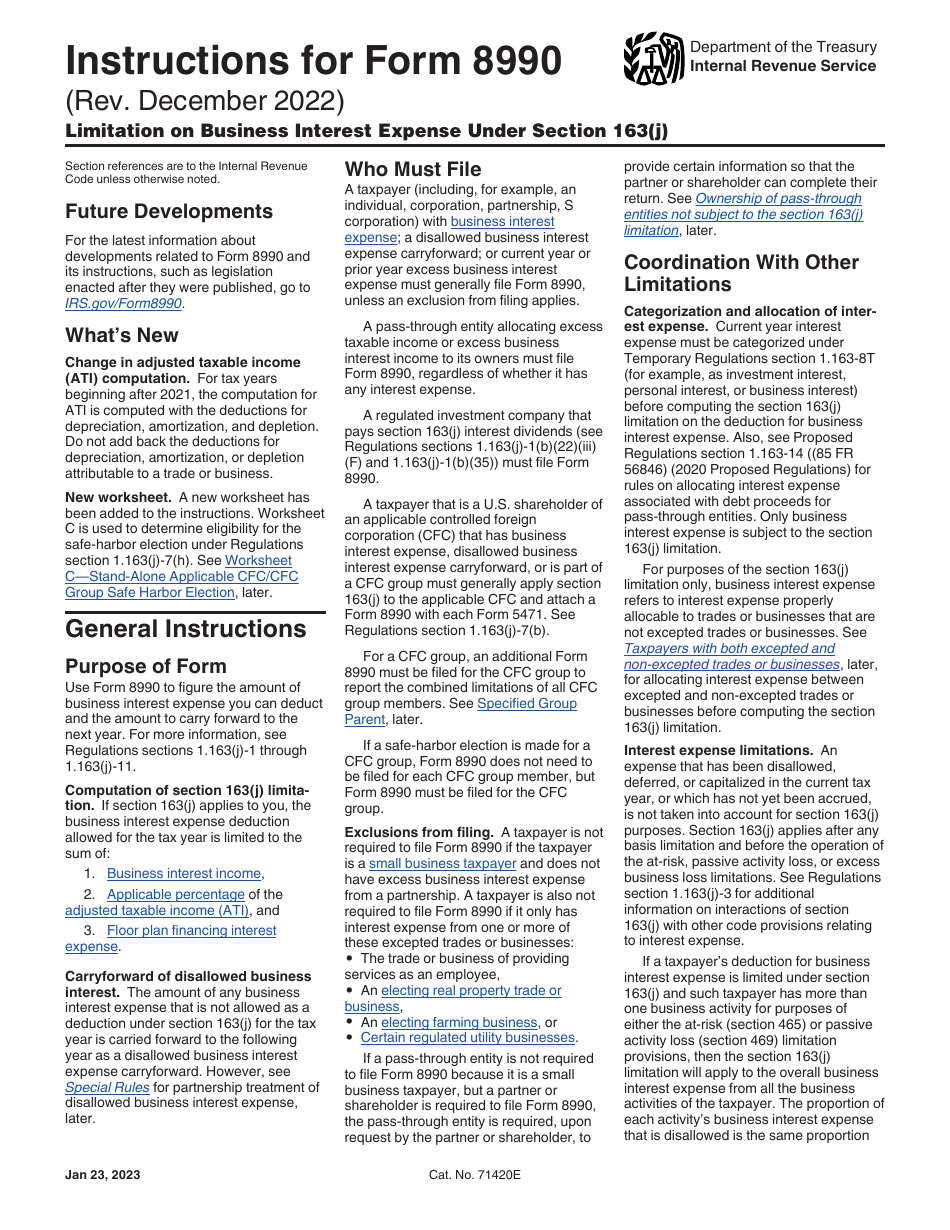

Form 8990 Explained - December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return. Web ( what's this?) form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Name of foreign entity employer identification number, if any reference id number. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web understanding the irs form 990. Web in the tables excerpts from form 1120 and excerpts from form 8990, the columns labeled practical expedient show the results of making the choice to ignore. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined. Per the instructions to form 8990: Less than $25 million in average.

Name of foreign entity employer identification number, if any reference id number. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. General instructions purpose of form. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. December 2019) department of the treasury internal revenue service. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web in the tables excerpts from form 1120 and excerpts from form 8990, the columns labeled practical expedient show the results of making the choice to ignore. The form calculates the section 163 (j).

Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined. December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return. Limitation on business interest expense under section 163(j). Web ( what's this?) form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Attach to your tax return. Web there are exemptions from filing form 8990 for sec. Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: See the instructions for form 8990 for additional. Web understanding the irs form 990. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990.

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

December 2019) department of the treasury internal revenue service. Attach to your tax return. Note that passthrough entities not subject to the 163. Limitation on business interest expense under section 163(j). Per the instructions to form 8990:

Irs Business 163 J Form Fill Out and Sign Printable PDF Template

The form calculates the section. Web a if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web section 199a is a qualified business income (qbi) deduction. Note that passthrough entities not subject to the 163. Web form 8990 is dedicated to reporting information as it applies to section 163(j).

Section 163j Photos Free & RoyaltyFree Stock Photos from Dreamstime

Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web in the tables excerpts from form 1120 and excerpts from form 8990, the columns labeled practical expedient show the results of making the choice to ignore. Web developments related to form 8990 and its instructions, such.

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

December 2019) department of the treasury internal revenue service. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web there are exemptions from filing form 8990 for sec. Web form 8990 is dedicated to reporting information as it applies to section 163(j). Limitation on business interest expense under section 163(j).

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. The form calculates the section 163 (j). Note that passthrough entities not subject to the 163. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how.

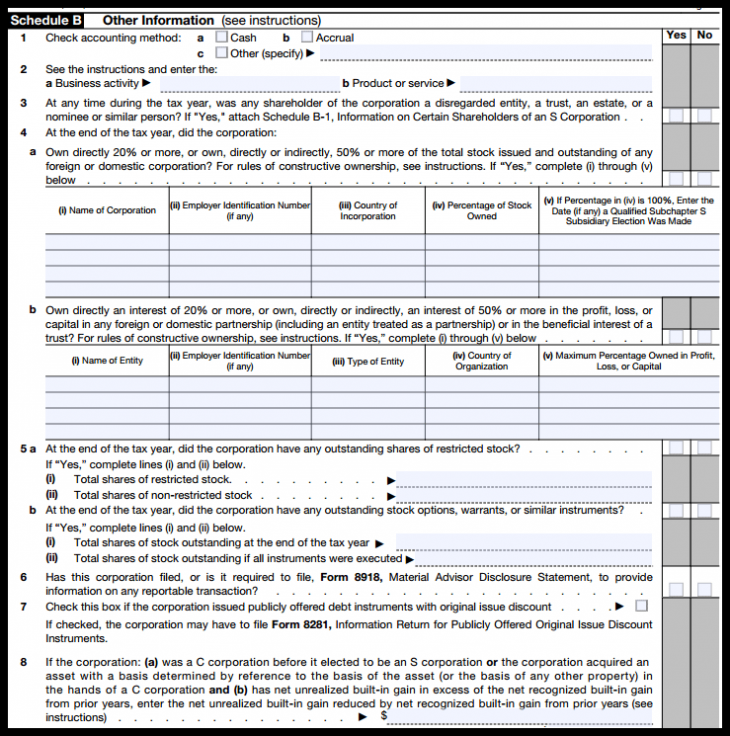

IRS Form 1120S Definition, Download, & 1120S Instructions

Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined. Per the instructions to form 8990: Web form 8990 is dedicated to reporting information as it applies to section 163(j). The form calculates the section 163 (j). Limitation on business interest expense under section 163(j).

Instructions for Form 8990 (12/2021) Internal Revenue Service

Web section 199a is a qualified business income (qbi) deduction. Limitation on business interest expense under section 163(j). See the instructions for form 8990 for additional. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 8990 instructions for details on the gross receipts test.

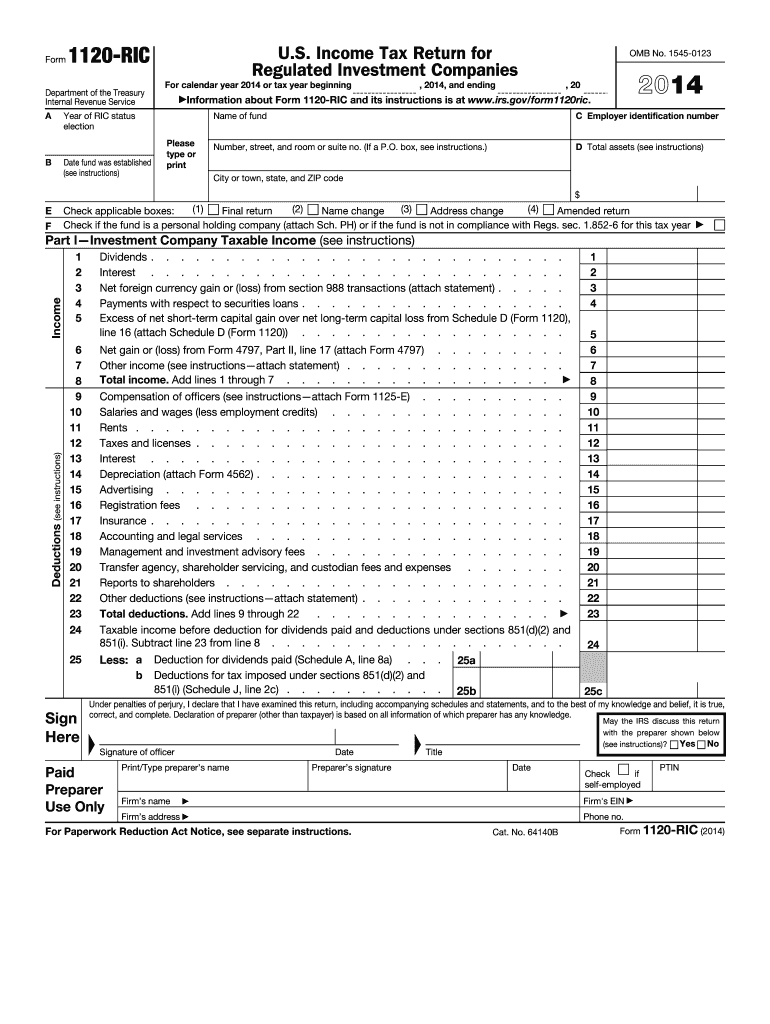

2014 Form IRS 1120RIC Fill Online, Printable, Fillable, Blank pdfFiller

Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. The form calculates the section 163 (j). Limitation on business interest expense under section 163(j). May 2020) department of the treasury internal revenue service. Per the instructions to form 8990:

Instructions for Form 8990 (12/2021) Internal Revenue Service

Name of foreign entity employer identification number, if any reference id number. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Web there are exemptions from.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web in the tables excerpts from form 1120 and excerpts from form 8990, the columns labeled practical expedient show the results of making the choice to ignore. General instructions purpose of form. May 2020) department of the treasury internal revenue service. The form calculates the section 163 (j). The form calculates the section.

Web Developments Related To Form 8990 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form8990.

The form calculates the section 163 (j). May 2020) department of the treasury internal revenue service. Limitation on business interest expense under section 163(j). Web understanding the irs form 990.

December 2019) Department Of The Treasury Internal Revenue Service.

With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. See the instructions for form 8990 for additional. Web if the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return.

Per The Instructions To Form 8990:

Web in the tables excerpts from form 1120 and excerpts from form 8990, the columns labeled practical expedient show the results of making the choice to ignore. Web ( what's this?) form 8990 the new section 163 (j) business interest expense deduction and carryover amounts are reported on form 8990. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires.

Name Of Foreign Entity Employer Identification Number, If Any Reference Id Number.

Note that passthrough entities not subject to the 163. Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined. General instructions purpose of form. Attach to your tax return.