Form 8985 Instructions

Form 8985 Instructions - Web authored by brad polizzano and colin walsh partnerships subject to the centralized partnership audit regime (cpar) cannot file an amended return to report changes to an. Early release drafts are at irs.gov/draftforms and remain there after the final. Web procedure this version will allow multiple entities of form 8986 so the form can be generated for each applicable partner. If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Who should prepare form 8985. It has been discovered that you don't. Select prepayment on bba aar/exam push out as. Who must sign form 8985. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Where to submit form 8985.

Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and 8986. Select prepayment on bba aar/exam push out as. It has been discovered that you don't. Web can turbotax handle form 8986? Web instructions for partners that receive form 8986 pay by eftps, debit, or credit card, or direct pay (forms 1040 only). Who should prepare form 8985. Web the instructions to form 8985 and 8986 contain examples illustrating how the bba procedures apply to section 199a information that is adjusted at the partnership. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Early release drafts are at irs.gov/draftforms and remain there after the final. Web drafts of instructions and publications usually have some changes before their final release.

Web the instructions to form 8985 and 8986 contain examples illustrating how the bba procedures apply to section 199a information that is adjusted at the partnership. Web authored by brad polizzano and colin walsh partnerships subject to the centralized partnership audit regime (cpar) cannot file an amended return to report changes to an. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Who should prepare form 8985. Who must sign form 8985. Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and 8986. Early release drafts are at irs.gov/draftforms and remain there after the final. Web can turbotax handle form 8986? December 23, 2021 draft as of. Web up to 4% cash back shop for form 8985 instructions at walmart.com.

Lego Bionicle Ackar (8985) 100 Complete w/ Container & Instructions eBay

Where to submit form 8985. Web authored by brad polizzano and colin walsh partnerships subject to the centralized partnership audit regime (cpar) cannot file an amended return to report changes to an. Select prepayment on bba aar/exam push out as. Web generally, a partnership can either pay the tax resulting from taking the partnership adjustments into account (referred to as.

How Can I Get Thru To The Irs / Anyone Who Got Accepted 2 11 Still Here

Where to submit form 8985. Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and 8986. Who should prepare form 8985. Reporting year is the partner’s tax year(s) that includes the date the. Web drafts of instructions and publications usually have some changes before their final release.

Fill Free fillable IRS PDF forms

Web authored by brad polizzano and colin walsh partnerships subject to the centralized partnership audit regime (cpar) cannot file an amended return to report changes to an. Web the instructions to form 8985 and 8986 contain examples illustrating how the bba procedures apply to section 199a information that is adjusted at the partnership. Web generally, a partnership can either pay.

3.21.15 Withholding on Foreign Partners Internal Revenue Service

Where to submit form 8985. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Web generally, a partnership can either pay the tax resulting from taking the partnership adjustments into account (referred to as the imputed underpayment),. Web instructions for partners that receive form 8986 pay by eftps, debit,.

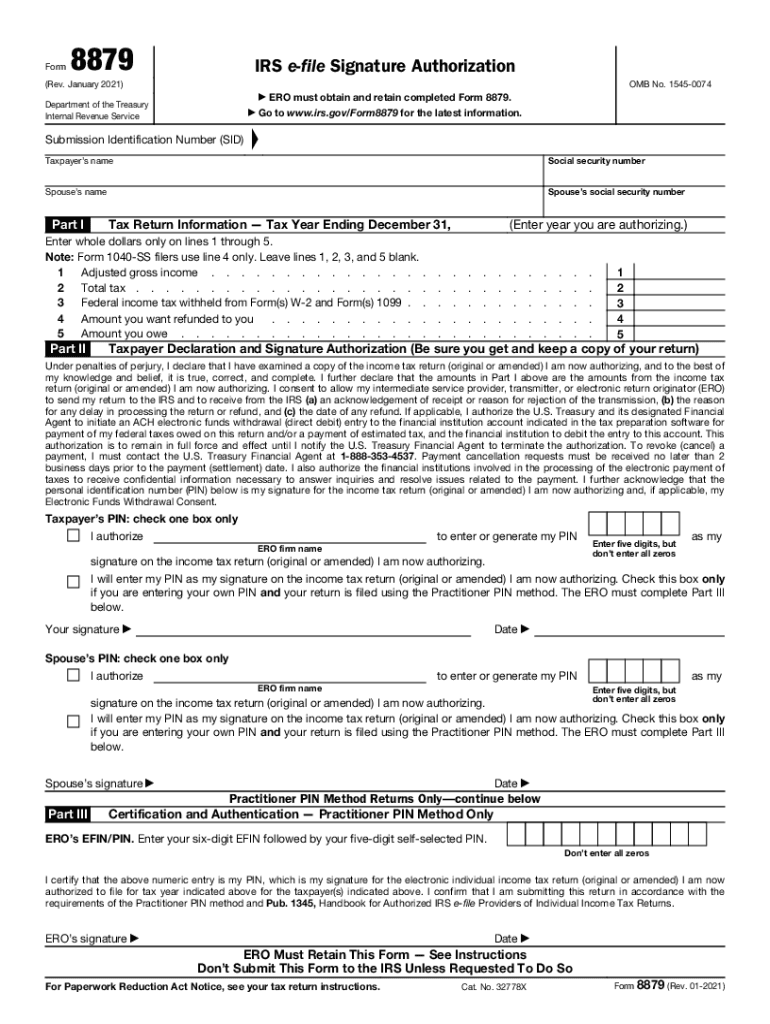

Form 8879 Fill Out and Sign Printable PDF Template signNow

Web instructions for partners that receive form 8986 pay by eftps, debit, or credit card, or direct pay (forms 1040 only). We are currently looking into the possibility of having to amend a few partnership returns for 2020. Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and.

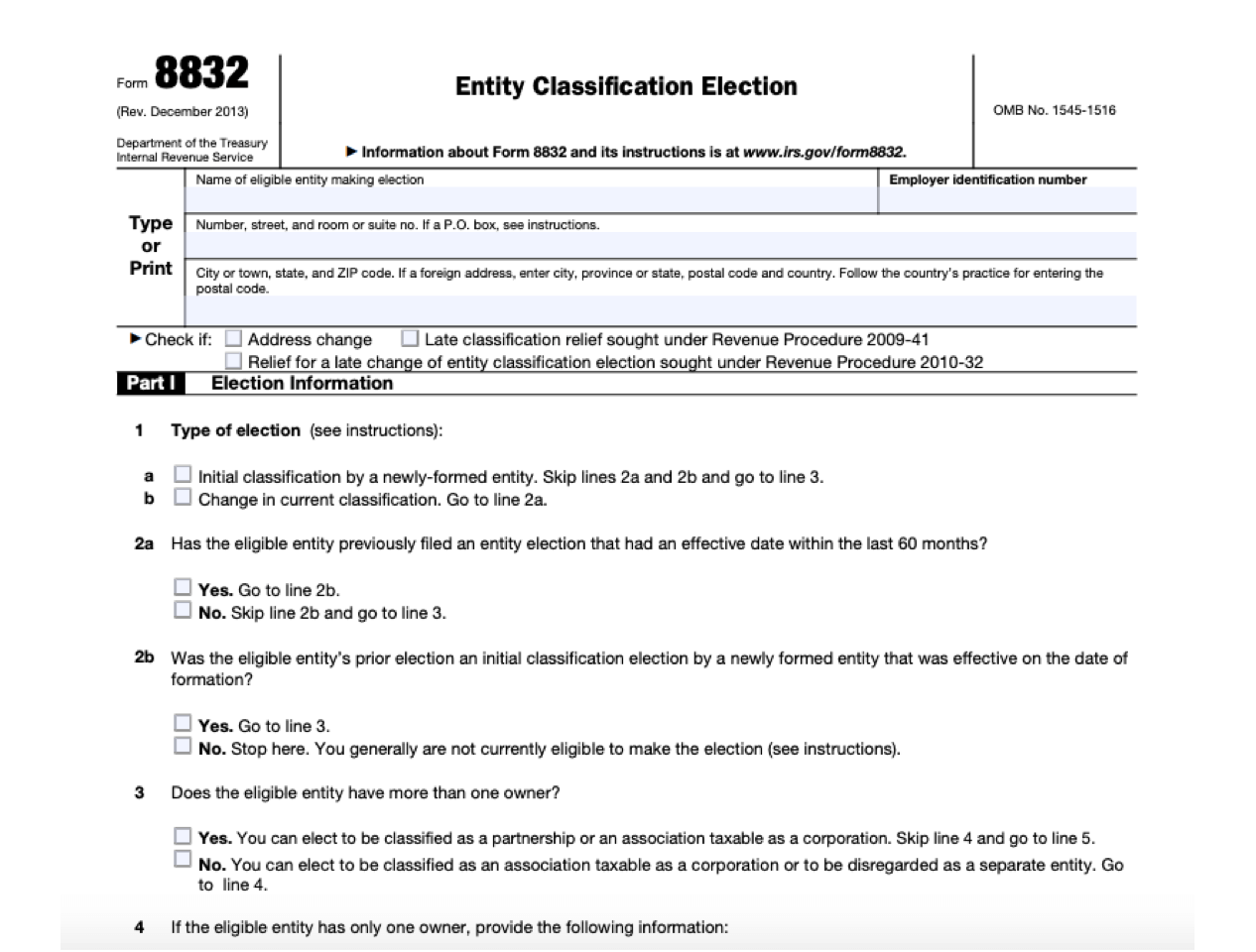

Form 8832 Instructions and Frequently Asked Questions

If this message is not eventually replaced by the proper contents of the document, your pdf viewer may not be able to display this type of document. Select prepayment on bba aar/exam push out as. Web procedure this version will allow multiple entities of form 8986 so the form can be generated for each applicable partner. Web drafts of instructions.

Bir form 2307 guidelines and instructions & Top review

It has been discovered that you don't. December 23, 2021 draft as of. Web instructions for partners that receive form 8986 pay by eftps, debit, or credit card, or direct pay (forms 1040 only). Web drafts of instructions and publications usually have some changes before their final release. If this message is not eventually replaced by the proper contents of.

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

December 23, 2021 draft as of. Who should prepare form 8985. Where to submit form 8985. Reporting year is the partner’s tax year(s) that includes the date the. Web can turbotax handle form 8986?

Dd Form 2875 Army Fillable Army Military

December 23, 2021 draft as of. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Reporting year is the partner’s tax year(s) that includes the date the. Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and.

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

Web up to 4% cash back shop for form 8985 instructions at walmart.com. Web the instructions to form 8985 and 8986 contain examples illustrating how the bba procedures apply to section 199a information that is adjusted at the partnership. Input is available on other > form 8985. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize.

Web Drafts Of Instructions And Publications Usually Have Some Changes Before Their Final Release.

December 23, 2021 draft as of. Web the bba partnership must complete form 8985, adjustment tracking report, to summarize the total adjustment reported on the aar. Input is available on other > form 8985. Who should prepare form 8985.

It Has Been Discovered That You Don't.

Web the instructions to form 8985 and 8986 contain examples illustrating how the bba procedures apply to section 199a information that is adjusted at the partnership. Where to submit form 8985. Web can turbotax handle form 8986? Web until the irs releases the final instructions, filers should rely on the draft instructions in completing and filing forms 8985 and 8986.

Who Must Sign Form 8985.

Web instructions for partners that receive form 8986 pay by eftps, debit, or credit card, or direct pay (forms 1040 only). Reporting year is the partner’s tax year(s) that includes the date the. We are currently looking into the possibility of having to amend a few partnership returns for 2020. Web up to 4% cash back shop for form 8985 instructions at walmart.com.

If This Message Is Not Eventually Replaced By The Proper Contents Of The Document, Your Pdf Viewer May Not Be Able To Display This Type Of Document.

Web procedure this version will allow multiple entities of form 8986 so the form can be generated for each applicable partner. Select prepayment on bba aar/exam push out as. Web generally, a partnership can either pay the tax resulting from taking the partnership adjustments into account (referred to as the imputed underpayment),. Early release drafts are at irs.gov/draftforms and remain there after the final.