Form 8962 Online Free

Form 8962 Online Free - Web updated 2nd bullet: The aca law includes a. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Credit for qualified retirement savings contributions. Ad free for simple tax returns only with turbotax® free edition. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Information to claim certain refundable credits. Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. Click on the button get form to open it and start editing. Ad access irs tax forms.

Ad free for simple tax returns only with turbotax® free edition. Click on the button get form to open it and start editing. If you bought your health insurance from the marketplace, you will file form 8962 with your tax return. Web you’ll need it to complete form 8962, premium tax credit. Complete, edit or print tax forms instantly. You have to include form 8962 with your tax return if: Web updated 2nd bullet: Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web a 12c letter means the irs needs more information to process your return. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year.

Form 8962 is used either (1) to reconcile a premium tax. Get ready for tax season deadlines by completing any required tax forms today. This form is for income. Web updated 2nd bullet: Web more about the federal form 8862 tax credit. Fill out all necessary fields in the selected doc making use of our powerful pdf. Web at efile.com, we cover all the healthcare tax forms in the following pages: Web a 12c letter means the irs needs more information to process your return. Filling out form 8962 online is easy, thanks to jotform. Click on the button get form to open it and start editing.

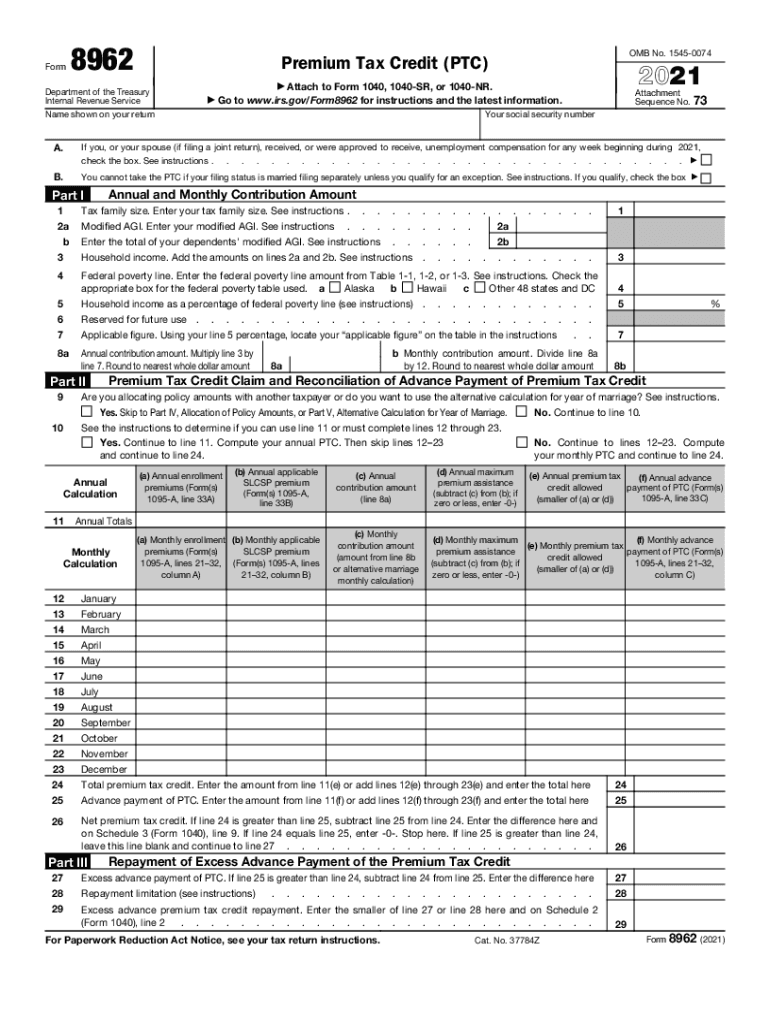

2021 Form IRS 8962 Fill Online, Printable, Fillable, Blank pdfFiller

Ad access irs tax forms. Click on the button get form to open it and start editing. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by.

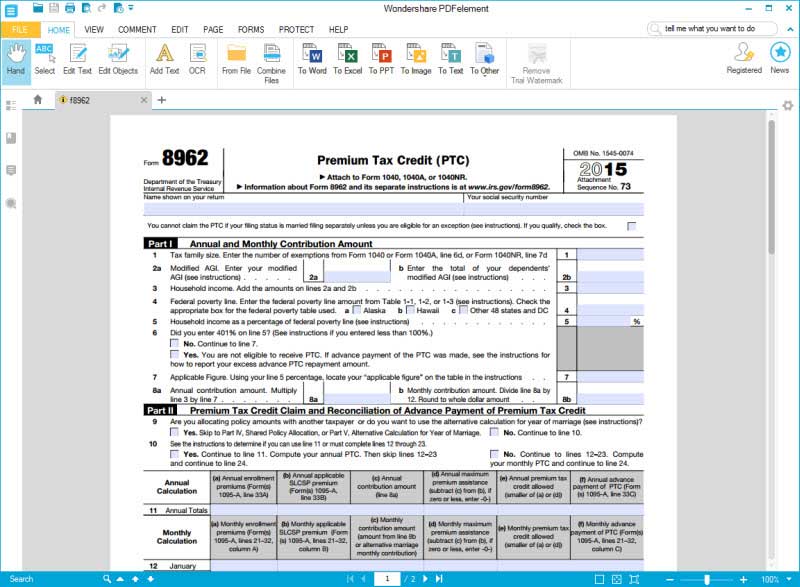

IRS Form 8962 Understanding Your Form 8962

Complete, edit or print tax forms instantly. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Click on the button get form to open it and start editing. Web starting with tax year 2021, electronically filed tax returns will be rejected if the.

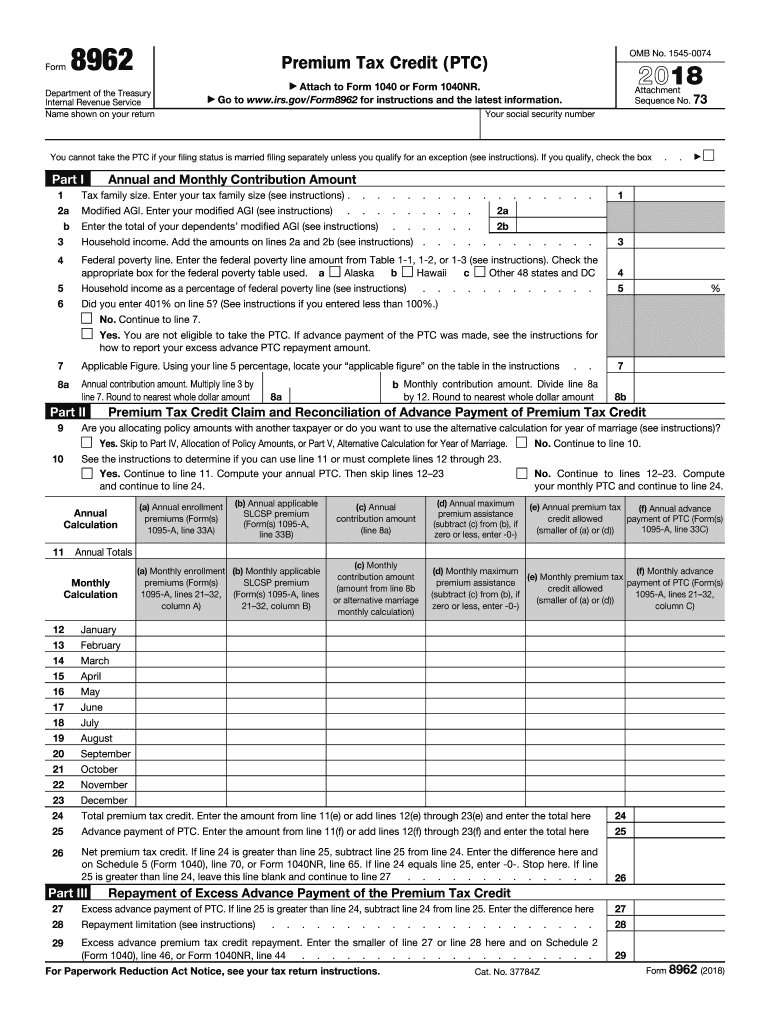

How to Fill out IRS Form 8962 Correctly?

See if you qualify today. Web department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. Complete irs tax forms online or.

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Web form 8962 for tax credits. Try it for free now! Go to www.irs.gov/form8962 for instructions and the. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit. Web form 8962 is a form you must file with your federal income tax return.

Tax Form 8962 Printable Printable Forms Free Online

Ad access irs tax forms. Complete, edit or print tax forms instantly. With jotform smart pdf forms,. Upload, modify or create forms. The aca law includes a.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Complete irs tax forms online or print government tax documents. Web department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that.

Irs form 8962 Irs form 8962 Instruction for How to Fill It Right Irs

With jotform smart pdf forms,. See if you qualify today. Credit for qualified retirement savings contributions. Web updated 2nd bullet: Ad free for simple tax returns only with turbotax® free edition.

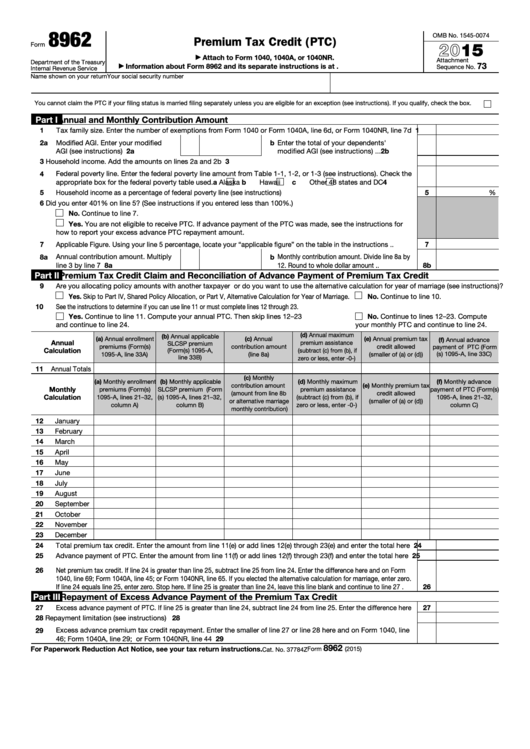

Fillable Form 8962 Premium Tax Credit (Ptc) 2015 printable pdf download

Web form 8962 for tax credits. Credit for qualified retirement savings contributions. Web a 12c letter means the irs needs more information to process your return. See if you qualify today. We last updated federal form 8862 in december 2022 from the federal internal revenue service.

IRS Form 8962 Instruction for How to Fill it Right

If you bought your health insurance from the marketplace, you will file form 8962 with your tax return. Try it for free now! Go to www.irs.gov/form8962 for instructions and the. With jotform smart pdf forms,. This form is for income.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Ad free for simple tax returns only with turbotax® free edition. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit. Fill out all necessary fields in the selected doc making use of our powerful pdf. With jotform smart pdf forms,. Upload, modify.

Upload, Modify Or Create Forms.

Web for tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the health insurance marketplace, you must complete. Form 8962 is used either (1) to reconcile a premium tax. We last updated federal form 8862 in december 2022 from the federal internal revenue service. Click on the button get form to open it and start editing.

Web Department Of The Treasury Internal Revenue Service Premium Tax Credit (Ptc) Attach To Form 1040, 1040A, Or 1040Nr.

Web updated 2nd bullet: With jotform smart pdf forms,. Web you’ll need it to complete form 8962, premium tax credit. Complete, edit or print tax forms instantly.

You Have To Include Form 8962 With Your Tax Return If:

Web form 8962 for tax credits. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Web more about the federal form 8862 tax credit.

See If You Qualify Today.

Ad free for simple tax returns only with turbotax® free edition. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit. Ad access irs tax forms. Credit for qualified retirement savings contributions.

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)