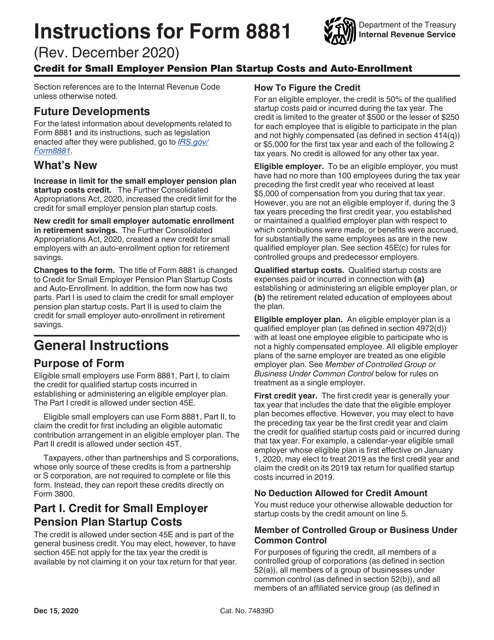

Form 8881 Instructions

Form 8881 Instructions - Follow the steps below for the applicable. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Instructions for form 8881, credit for small employer pension plan startup. Eligible employers you qualify to claim this. The form really isn’t that challenging, but there are a few tips and tricks. Web information about form 8281 and its instructions is at. An update to information on the form. It can be written as 0.196131 in decimal form (rounded to 6 decimal places). Web the irs provides additional details about the startup and auto deferral credits here.

Instructions for form 8881, credit for small employer pension plan startup. The form really isn’t that challenging, but there are a few tips and tricks. It can be written as 0.196131 in decimal form (rounded to 6 decimal places). Web information about form 8281 and its instructions is at. Web obtain a completed and signed form 3681 for: Retain form 3681 and attachments in accordance with. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Web 1683 / 8581 is already in the simplest form.

However, taxpayers whose only source of this credit is from a partnership. Read the instructions for where. Follow the steps below for the applicable. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Instructions for form 8881, credit for small employer pension plan startup. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: Web the irs provides additional details about the startup and auto deferral credits here. Make sure to read if you even need to use form 8881, or perhaps only form 3800. The estimated burden for individual taxpayers filing this form is approved. Web information about form 8281 and its instructions is at.

W8EXP Form Instructions

Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web 1683 / 8581 is already in the simplest form. However, taxpayers whose only source of this credit is from a partnership. Read the instructions for where. Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881:

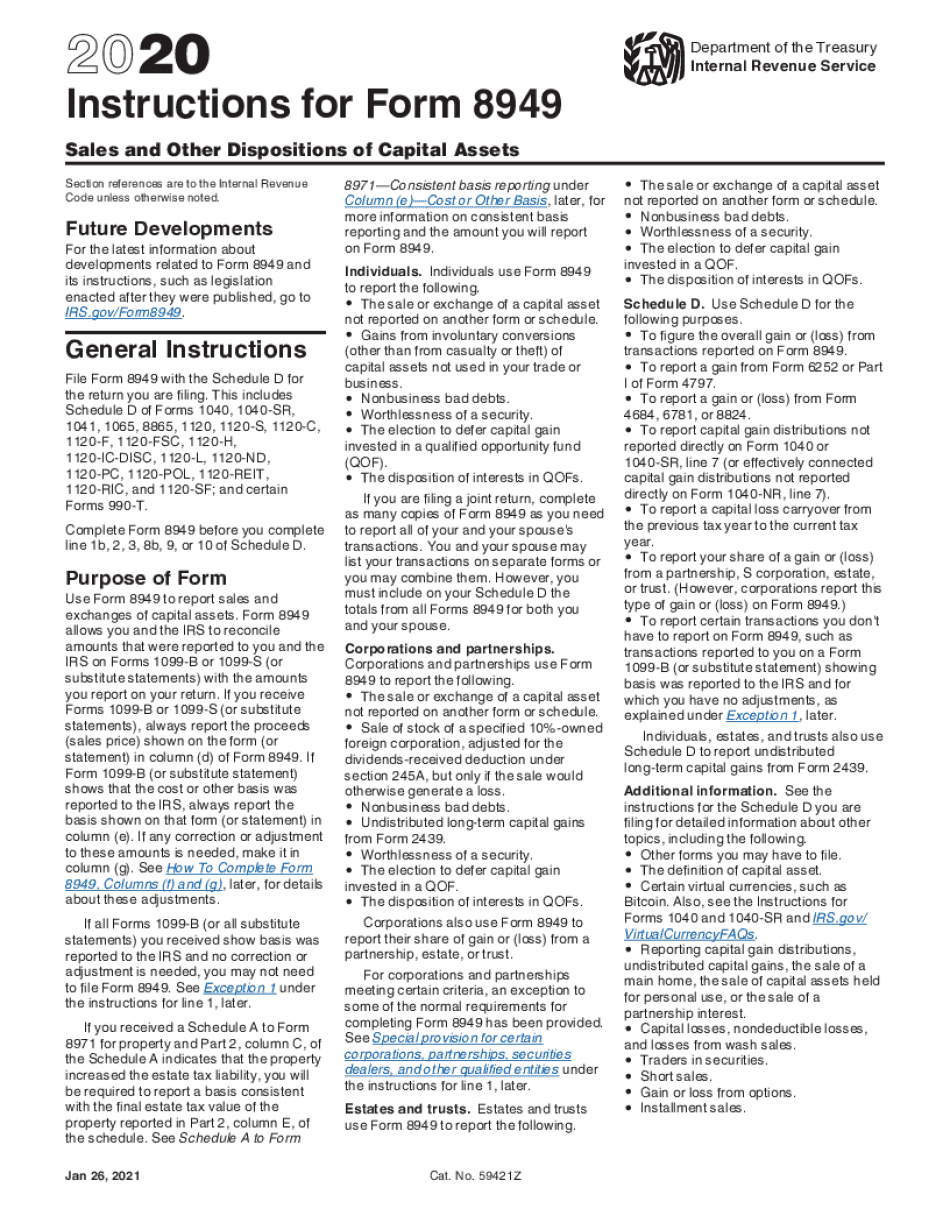

Form 8949 Instructions 2020 2021 Fillable and Editable PDF Template

An update to information on the form. Eligible employers you qualify to claim this. Eligible businesses may claim the credit using form 8881, credit for small. However, taxpayers whose only source of this credit is from a partnership. The estimated burden for individual taxpayers filing this form is approved.

File IRS 2290 Form Online for 20222023 Tax Period

Web information about form 8281 and its instructions is at. Web 1683 / 8581 is already in the simplest form. Follow the steps below for the applicable. Make sure to read if you even need to use form 8881, or perhaps only form 3800. Read the instructions for where.

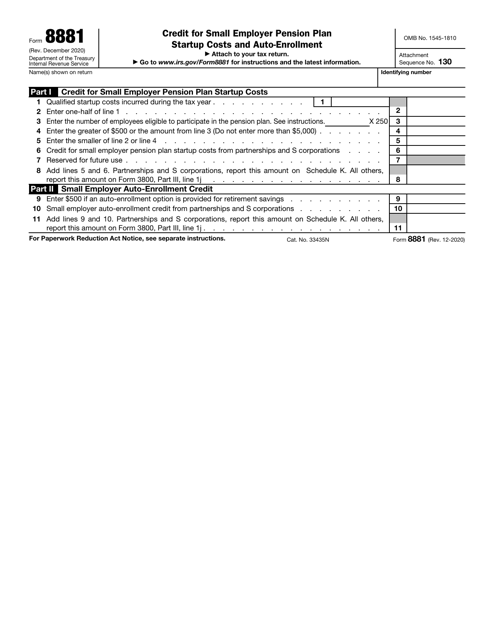

IRS Form 8881 Download Fillable PDF or Fill Online Credit for Small

Make sure to read if you even need to use form 8881, or perhaps only form 3800. Web obtain a completed and signed form 3681 for: Instructions for form 8881, credit for small employer pension plan startup. Eligible businesses may claim the credit using form 8881, credit for small. Credit for small employer pension plan startup costs 1220 12/17/2020 inst.

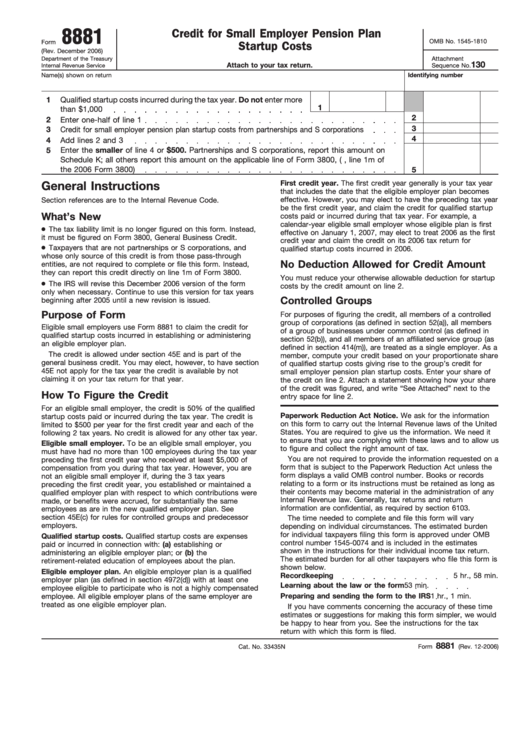

Download Instructions for IRS Form 8881 Credit for Small Employer

Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880 and when one should use this form 8880 form. Follow the steps below for the applicable. Web the time needed to complete and file this form will vary depending on individual circumstances. Instructions for form 8881,.

Form 8881 Credit for Small Employer Pension Plan Startup Costs

Web information about form 8281 and its instructions is at. Web 1683 / 8581 is already in the simplest form. However, taxpayers whose only source of this credit is from a partnership. Eligible businesses may claim the credit using form 8881, credit for small. Retain form 3681 and attachments in accordance with.

Scantron Form No 882 E Instructions Universal Network

Web obtain a completed and signed form 3681 for: Web the irs provides additional details about the startup and auto deferral credits here. Follow the steps below for the applicable. Web 1683 / 8581 is already in the simplest form. Make sure to read if you even need to use form 8881, or perhaps only form 3800.

Fillable Form 8881 Credit For Small Employer Pension Plan Startup

It can be written as 0.196131 in decimal form (rounded to 6 decimal places). Web the time needed to complete and file this form will vary depending on individual circumstances. Find the gcd (or hcf) of. Web to download the form 8880 in printable format and to know about the use of this form, who can use this form 8880.

Form 8881 Credit for Small Employer Pension Plan Startup Costs (2013

Eligible businesses may claim the credit using form 8881, credit for small. Eligible employers you qualify to claim this. Web 1683 / 8581 is already in the simplest form. Retain form 3681 and attachments in accordance with. Instructions for form 8881, credit for small employer pension plan startup.

Form 7004 Printable PDF Sample

Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Eligible employers you qualify to claim this. Web the time needed to complete and file this form will vary depending on.

Web To Download The Form 8880 In Printable Format And To Know About The Use Of This Form, Who Can Use This Form 8880 And When One Should Use This Form 8880 Form.

It can be written as 0.196131 in decimal form (rounded to 6 decimal places). Instructions for form 8881, credit for small employer pension plan startup. Eligible employers you qualify to claim this. However, taxpayers whose only source of this credit is from a partnership.

Read The Instructions For Where.

Follow the steps below for the applicable. Make sure to read if you even need to use form 8881, or perhaps only form 3800. Retain form 3681 and attachments in accordance with. Web this article will assist you with entering amounts for form 8881, credit for small employer pension plan startup costs.

Web The Time Needed To Complete And File This Form Will Vary Depending On Individual Circumstances.

Credit for small employer pension plan startup costs 1220 12/17/2020 inst 8881: An update to information on the form. The estimated burden for individual taxpayers filing this form is approved. Web information about form 8281 and its instructions is at.

Web Obtain A Completed And Signed Form 3681 For:

Find the gcd (or hcf) of. The form really isn’t that challenging, but there are a few tips and tricks. Web if you qualify, you may claim the credit using form 8881, credit for small employer pension plan startup costs pdf. Web the credit is generally claimed by filing form 8881, credit for small employer pension plan startup costs.