Form 8879-S 2022

Form 8879-S 2022 - All business income for kansas city residents is subject to the profits tax, regardless of where earned. The city of kansas city, missouri has requested a. Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. Name of estate or trust. Income tax return of foreign. The 2021 revision is the last revision of the form. Ad get ready for tax season deadlines by completing any required tax forms today. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. I tax return information (whole dollars. Do not use form ftb.

The city of kansas city, missouri has requested a. Income tax return of foreign. The 2021 revision is the last revision of the form. Ad get ready for tax season deadlines by completing any required tax forms today. This form is used to. I tax return information (whole dollars. The signing of this form binds the applicant to the terms of this permit. All business income for kansas city residents is subject to the profits tax, regardless of where earned. If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Web irs form 8879 printable for 2022 filing taxes can be a daunting task, especially when it comes to dealing with various tax forms like irs form 8879.

All business income for kansas city residents is subject to the profits tax, regardless of where earned. The city of kansas city, missouri has requested a. Ad get ready for tax season deadlines by completing any required tax forms today. Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. Web by brian bingaman. Fein name and title of fiduciary. Web irs form 8879 printable for 2022 filing taxes can be a daunting task, especially when it comes to dealing with various tax forms like irs form 8879. The 2021 revision is the last revision of the form. Do not use form ftb. I tax return information (whole dollars.

form 8879c 2022 Fill Online, Printable, Fillable Blank

This form is used to. Ad get ready for tax season deadlines by completing any required tax forms today. Web by brian bingaman. All business income for kansas city residents is subject to the profits tax, regardless of where earned. Name of estate or trust.

Form 8879S IRS efile Signature Authorization for Form 1120S (2014

Web by brian bingaman. Ad get ready for tax season deadlines by completing any required tax forms today. If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Income tax return of foreign. Name of estate or trust.

2020 Form IRS 8879S Fill Online, Printable, Fillable, Blank pdfFiller

Ad get ready for tax season deadlines by completing any required tax forms today. I tax return information (whole dollars. Income tax return of foreign. Complete, edit or print tax forms instantly. The city of kansas city, missouri has requested a.

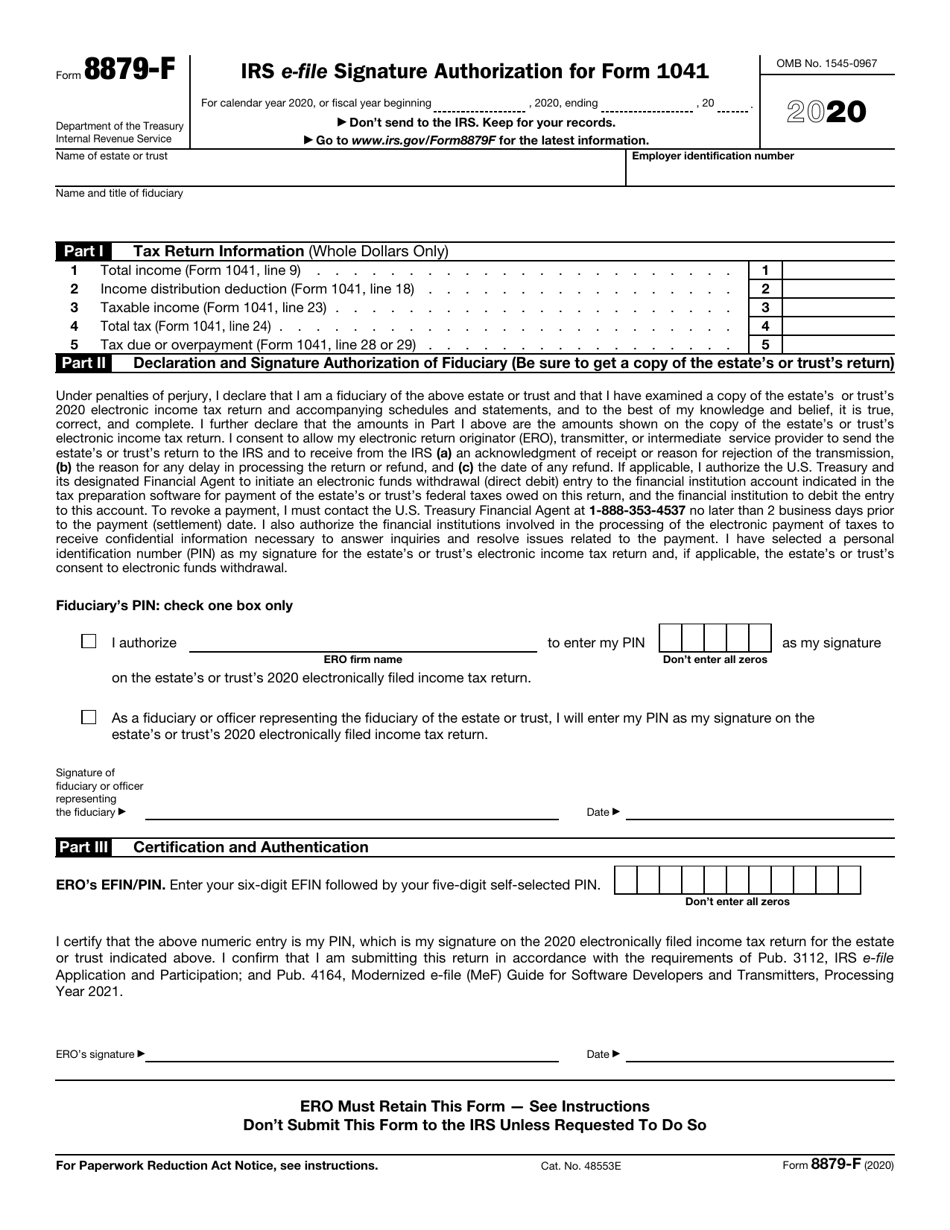

IRS Form 8879F Download Fillable PDF or Fill Online IRS EFile

Complete, edit or print tax forms instantly. The 2021 revision is the last revision of the form. Name of estate or trust. Do not use form ftb. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023.

form 8879 vs 1040 Fill Online, Printable, Fillable Blank

Do not use form ftb. Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. The 2021 revision is the last revision of the form. Fein name and title of fiduciary. Name of estate or trust.

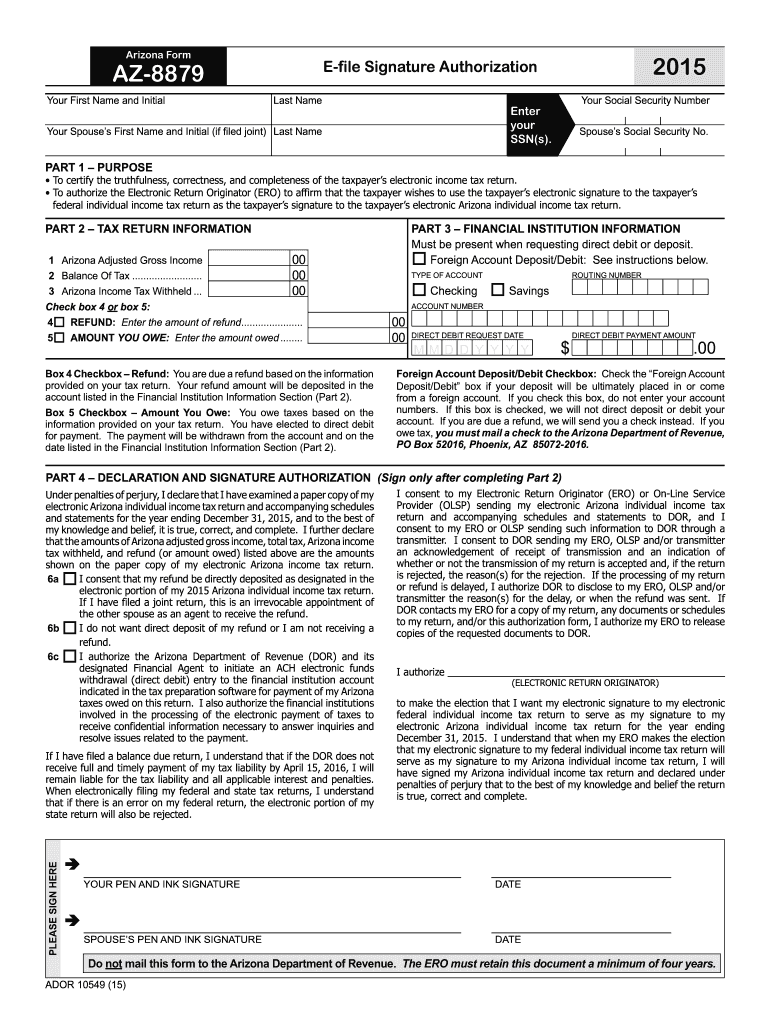

Az 8879 Fill Out and Sign Printable PDF Template signNow

Web irs form 8879 printable for 2022 filing taxes can be a daunting task, especially when it comes to dealing with various tax forms like irs form 8879. Income tax return of foreign. Ad get ready for tax season deadlines by completing any required tax forms today. The signing of this form binds the applicant to the terms of this.

Downloadable Form 8879 IRS EFile Signature Authorization 2014 Tax Year

This form is used to. Fein name and title of fiduciary. Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Web these where to file addresses are to be used only by.

Form 3832 Instructions Fill Out and Sign Printable PDF Template signNow

This form is used to. The signing of this form binds the applicant to the terms of this permit. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Name of estate or trust. If signed by applicant’s contractor or that contractor’s authorized.

Form 8879S IRS efile Signature Authorization for Form 1120S (2014

All business income for kansas city residents is subject to the profits tax, regardless of where earned. The signing of this form binds the applicant to the terms of this permit. The city of kansas city, missouri has requested a. Income tax return of foreign. Ad get ready for tax season deadlines by completing any required tax forms today.

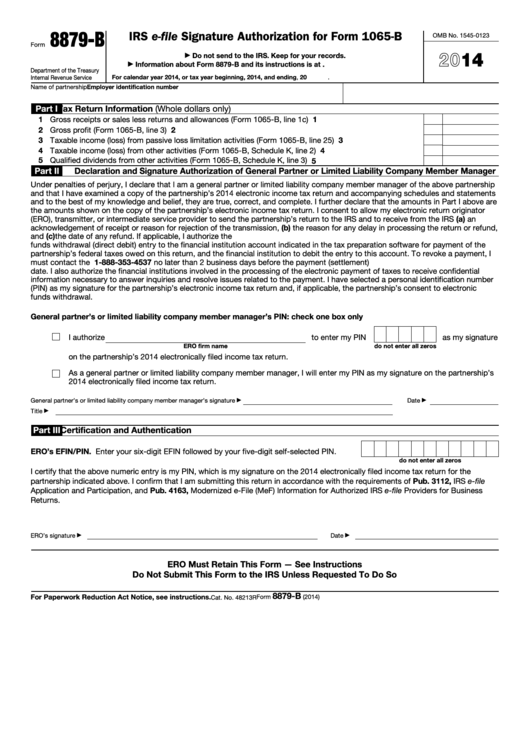

Fillable Form 8879B Irs EFile Signature Authorization For Form 1065

Do not use form ftb. All business income for kansas city residents is subject to the profits tax, regardless of where earned. Income tax return of foreign. Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. Web these where to file addresses are to be.

Income Tax Return Of Foreign.

If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023.

Name Of Estate Or Trust.

I tax return information (whole dollars. Fein name and title of fiduciary. Web irs form 8879 printable for 2022 filing taxes can be a daunting task, especially when it comes to dealing with various tax forms like irs form 8879. This form is used to.

Web By Brian Bingaman.

Web 8879 (pmt) part i extension payment information for taxable year 2022 electronic funds withdrawal (efw) amount withdrawal date (mm/dd/yyyy) part ii scheduled estimated. The city of kansas city, missouri has requested a. Do not use form ftb. The 2021 revision is the last revision of the form.

The Signing Of This Form Binds The Applicant To The Terms Of This Permit.

All business income for kansas city residents is subject to the profits tax, regardless of where earned.