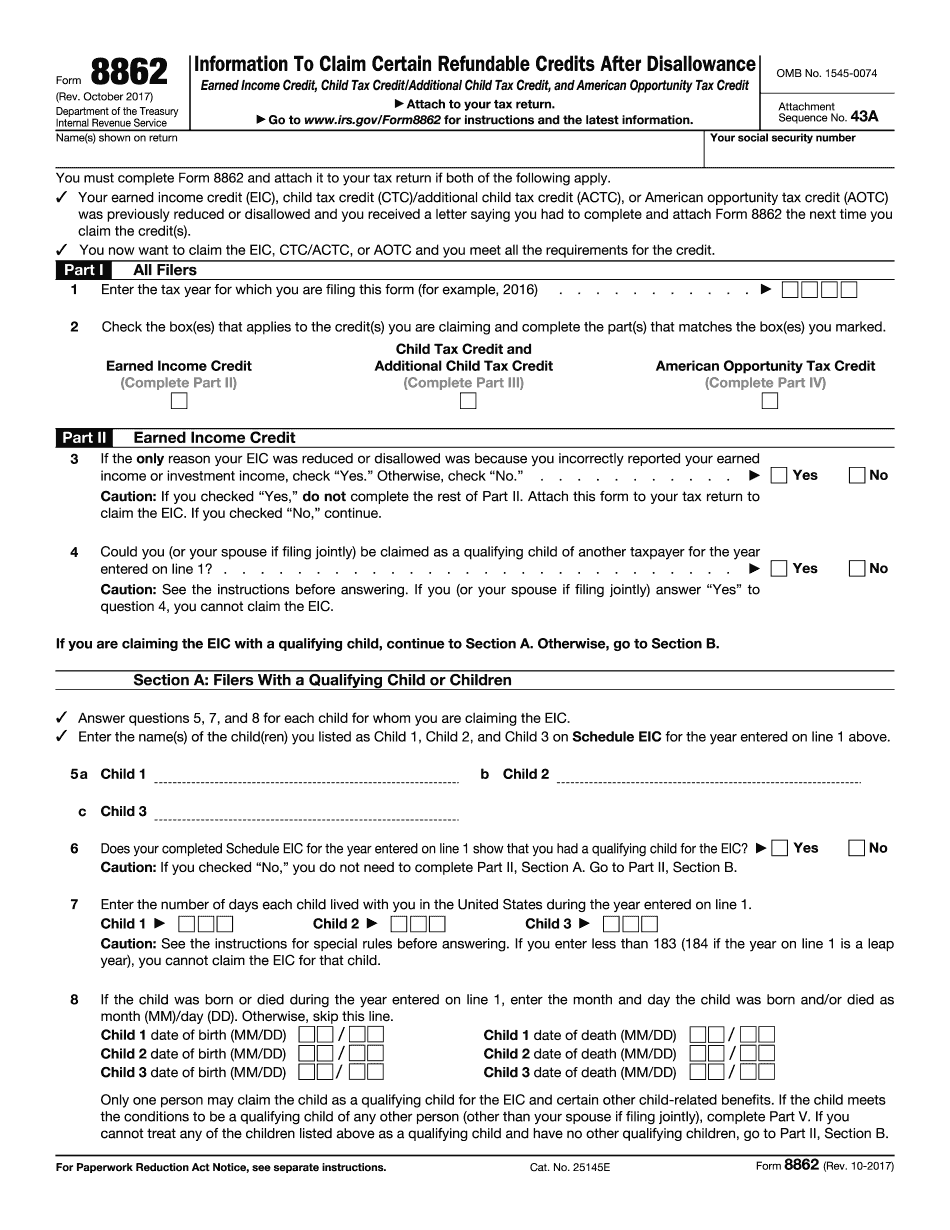

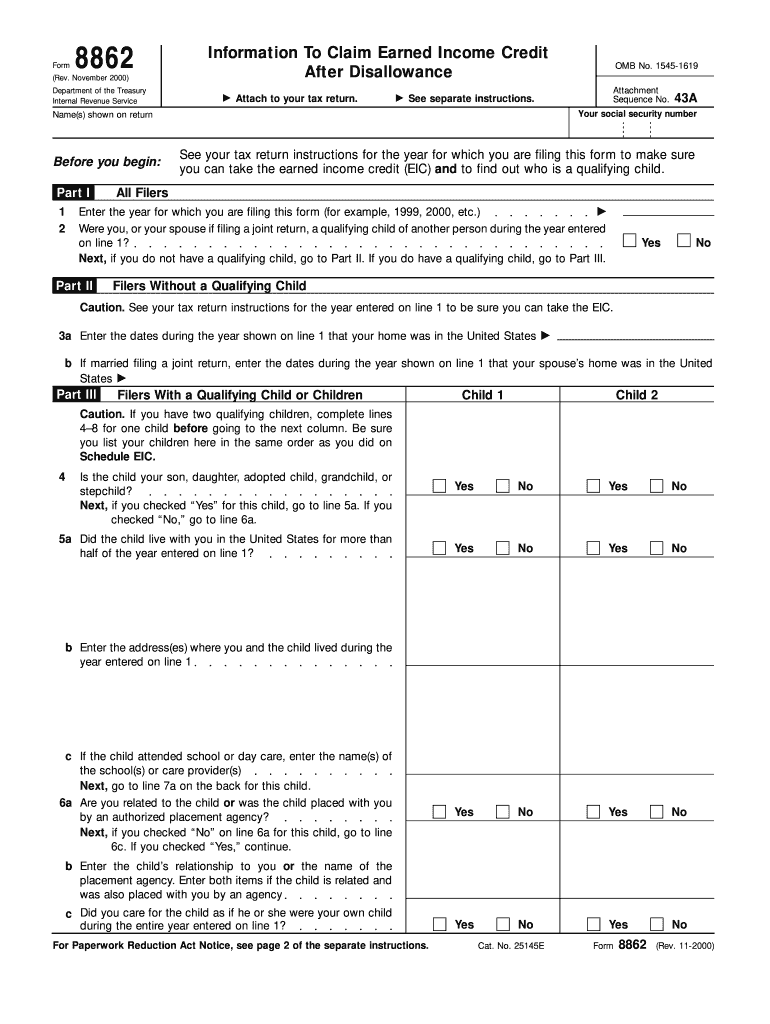

Form 8862 Required

Form 8862 Required - Web how do i enter form 8862? Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any. Complete, edit or print tax forms instantly. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. The irs — not efile.com — has rejected your return, as form 8862 is required. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Web the taxpayer may be required to include form 8862 information to claim earned income credit after disallowance on the next tax return in order to qualify for eic when the irs. Web follow the simple instructions below:

Put your name and social security number on the statement and attach it at. Web instructions for form 8862 (rev. Number each entry on the statement to correspond with the line number on form 8862. Irs form 8862 where do i enter my estimated tax payments?. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. The irs — not efile.com — has rejected your return, as form 8862 is required. Please sign in to your. If you wish to take the credit in a. Get your online template and fill it in using. This form is for income earned in tax year 2022, with tax returns due in april.

If you wish to take the credit in a. Web follow the simple instructions below: Get your online template and fill it in using. Web if the irs rejected one or more of these credits: Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web how do i enter form 8862? Complete, edit or print tax forms instantly. Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Watch this turbotax guide to learn more.turbotax home:. The irs — not efile.com — has rejected your return, as form 8862 is required.

IRS 8867 2020 Fill out Tax Template Online US Legal Forms

Complete, edit or print tax forms instantly. The irs — not efile.com — has rejected your return, as form 8862 is required. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Ad download or email irs 8862 & more fillable forms, try for free now! Irs form 8862 where do i enter my estimated tax payments?.

IRS Form 8862 Diagram Quizlet

Ad download or email irs 8862 & more fillable forms, try for free now! Web if the irs rejected one or more of these credits: Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Complete, edit or print tax forms instantly. Are you still seeking a fast.

2020 Form IRS 1040 Instructions Fill Online, Printable, Fillable, Blank

Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. The irs — not efile.com — has rejected your return, as form 8862 is required. Web we last updated federal form 8862 in december 2022 from.

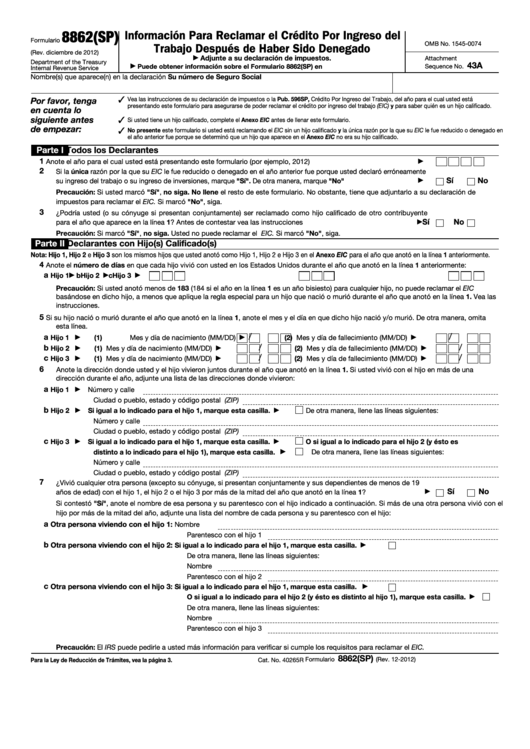

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Put your name and social security number on the statement and attach it at. Web the taxpayer may be required to include form 8862 information to claim earned income credit after disallowance on the next tax return in order to qualify for eic when the irs. Ad uslegalforms allows users to edit, sign, fill & share all type of documents.

IRS 8862 2022 Form Printable Blank PDF Online

Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web instructions for form 8862 irs.

Notice Of Disallowance Of Claim

Get your online template and fill it in using. Our service provides you with an extensive. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web if the irs rejected one or more of these credits: The irs — not efile.com — has rejected your return, as form 8862 is required.

8862 Form Fill Out and Sign Printable PDF Template signNow

Web all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you. Get your online template and fill it in using. Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Web form 8862.

Form 8862 Claim Earned Credit After Disallowance YouTube

Put your name and social security number on the statement and attach it at. Earned income credit (eic), child tax credit (ctc), refundable child tax credit. Web instructions for form 8862 (rev. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another..

Irs Form 8862 Printable Master of Documents

Get your online template and fill it in using. Number each entry on the statement to correspond with the line number on form 8862. Web if the irs rejected one or more of these credits: Put your name and social security number on the statement and attach it at. Web the taxpayer may be required to include form 8862 information.

Irs Form 8862 Printable Master of Documents

Complete, edit or print tax forms instantly. Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another. Web form 8862 irs rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 38 votes how.

Irs Form 8862 Where Do I Enter My Estimated Tax Payments?.

Web instructions for form 8862 (rev. Are you still seeking a fast and convenient tool to complete irs 8862 at an affordable price? Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits.

Eitc, Ctc, Actc Or Aotc, You May Have Received A Letter Stating That The Credit Was Disallowed.

If you wish to take the credit in a. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Get your online template and fill it in using. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

Ad Download Or Email Irs 8862 & More Fillable Forms, Try For Free Now!

Complete, edit or print tax forms instantly. Watch this turbotax guide to learn more.turbotax home:. This form is for income earned in tax year 2022, with tax returns due in april. Web form 8862 irs rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 38 votes how to fill out and sign form 8862 turbotax online?

Web The Taxpayer May Be Required To Include Form 8862 Information To Claim Earned Income Credit After Disallowance On The Next Tax Return In Order To Qualify For Eic When The Irs.

Ad uslegalforms allows users to edit, sign, fill & share all type of documents online. Edit, sign and save irs 8862 form. Web follow the simple instructions below: Web all filers enter the year for which you are filing this form (for example, 2008) if the only reason your eic was reduced or disallowed in the earlier year was because you.