Form 8849 Schedule 3

Form 8849 Schedule 3 - Web what are the different schedules of form 8849? • enter amounts for alternative fuels on line 3, as appropriate. Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. Web fill out 8849 schedule 3 in a couple of clicks by simply following the instructions below: Web more about the federal 8849 (schedule 3) corporate income tax ty 2022. For amending sales by registered. We last updated the certain fuel mixtures and the alternative fuel credit in december 2022, so. The credits for alcohol fuel mixtures, biodiesel mixtures, renewable diesel mixtures,. Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the. Find the template you will need in the library of legal forms.

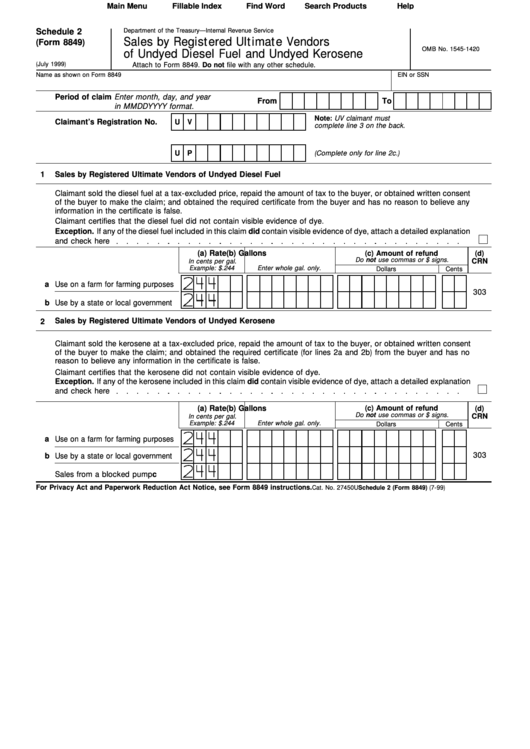

• submit a single form for all three quarter’s retroactive 2022 alternative fuels credit. For amending sales by registered. Claims are made using form 8849 (claim for refund of excise taxes). We last updated the certain fuel mixtures and the alternative fuel credit in december 2022, so. Web schedule 3 (form 8849). Sales by registered ultimate vendors. Other claims including the credit claim from form 2290. Web schedule 2 (form 8849) (rev. Web schedule 3 (form 8849) (rev. Irs schedule 3 (form 8849), tax payers can claim a tax credit for any biodiesel or any other alternative fuels they produce or use in the year.

Web schedule 3 (form 8849). Section 4081 (e) claims schedule 6: Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the. To claim refunds on nontaxable use of fuels. Sales by registered ultimate vendors. Web more about the federal 8849 (schedule 3) corporate income tax ty 2022. Web through this form, i.e. Use this form to claim a. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Irs schedule 3 (form 8849), tax payers can claim a tax credit for any biodiesel or any other alternative fuels they produce or use in the year.

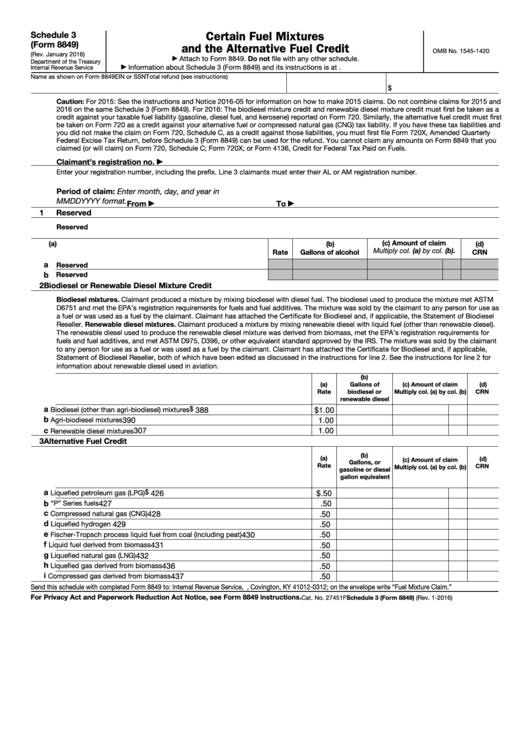

Fillable Schedule 3 (Form 8849) Certain Fuel Mixtures And The

Web form schedule 1 form 8849 schedule 2 schedule 3 schedule 4 schedule 5 schedule 6 11 hr., 57 min. Web what are the different schedules of form 8849? Web claimants must submit claims on form 8849, “claims for refund of excise taxes,” and include schedule 3, “certain fuel mixtures and the alternative fuel credit.”. Use this form to claim.

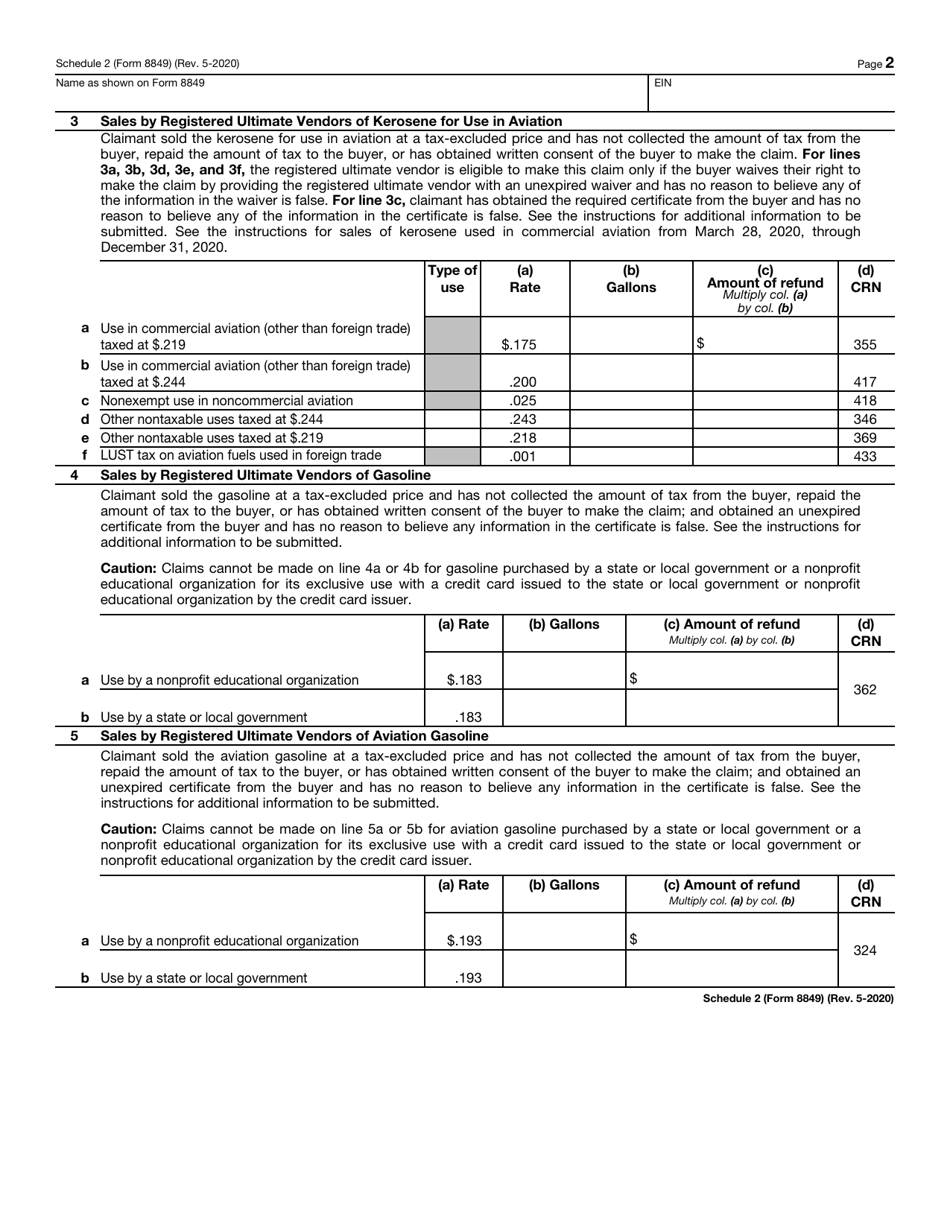

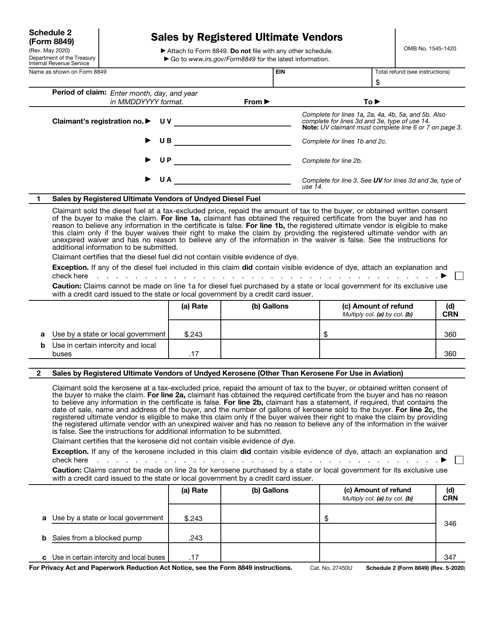

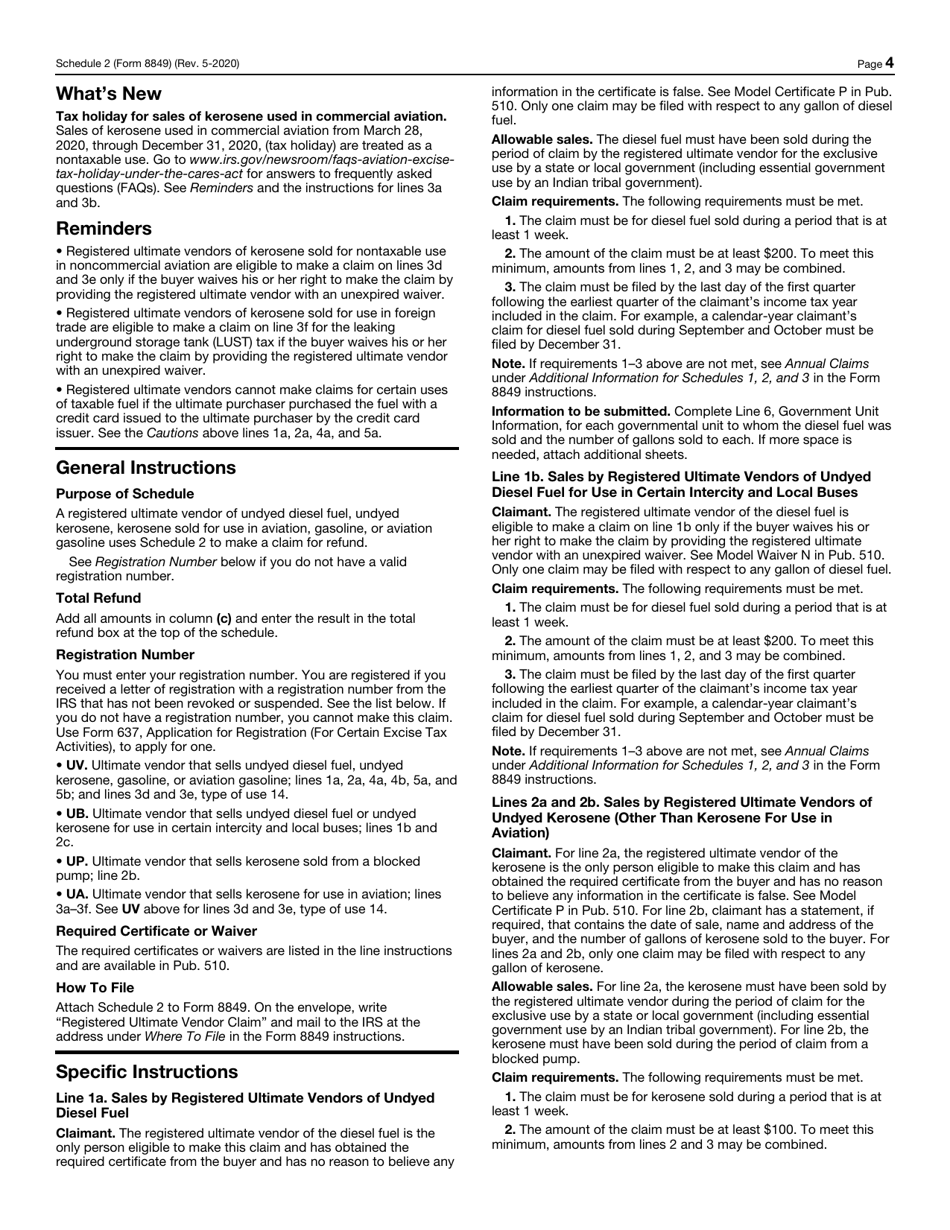

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Web form schedule 1 form 8849 schedule 2 schedule 3 schedule 4 schedule 5 schedule 6 11 hr., 57 min. Irs schedule 3 (form 8849), tax payers can claim a tax credit for any biodiesel or any other alternative fuels they produce or use in the year. Web generally, you can file a claim for a refund of excise taxes.

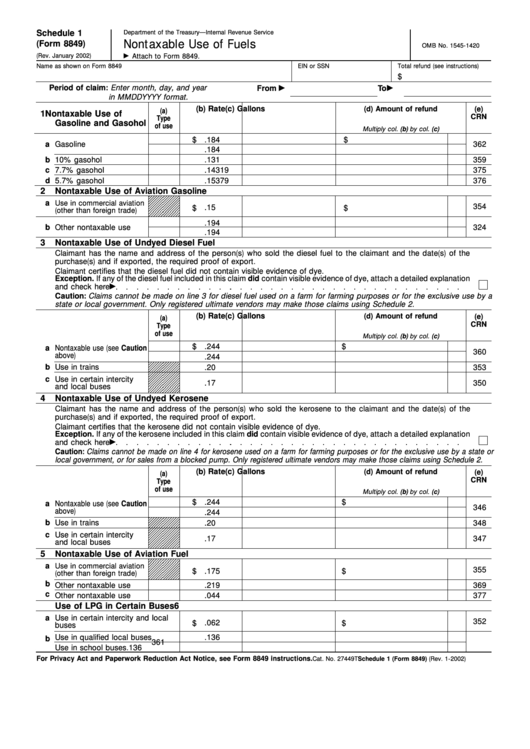

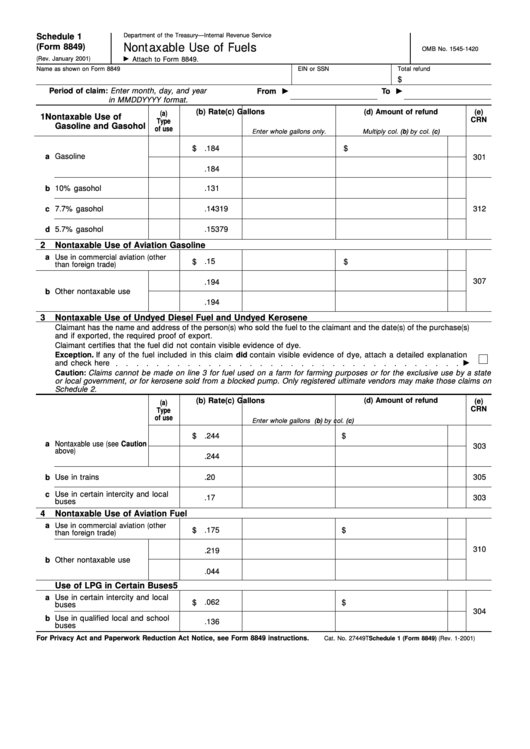

Fillable Schedule 1 (Form 8849) Nontaxable Use Of Fuels printable pdf

Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. For amending sales by registered. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Web schedule 3 (form 8849)certain fuel mixtures (rev.december 2010)and the alternative.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. Certain fuel mixtures and the alternative fuel credit schedule 5: Web schedule 3 (form 8849)certain fuel mixtures (rev.december 2010)and the alternative fuel credit omb no. Web schedule 3 (form 8849). Section 4081 (e) claims schedule 6:

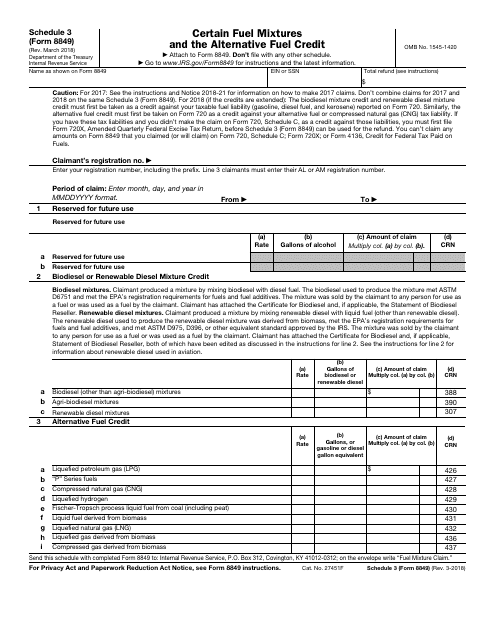

IRS Form 8849 Schedule 3 Download Fillable PDF or Fill Online Certain

December 2020) department of the treasury internal revenue service. We last updated the certain fuel mixtures and the alternative fuel credit in december 2022, so. For amending sales by registered. • enter amounts for alternative fuels on line 3, as appropriate. Web more about the federal 8849 (schedule 3) corporate income tax ty 2022.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Web schedule 2 (form 8849) (rev. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. • submit a single form for all three quarter’s retroactive 2022 alternative fuels credit. For amending sales by registered. Web form 8849 schedule 3 claims is used to claim credits that are.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Use this form to claim a. Web schedule 3 (form 8849) (rev. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Section 4081 (e) claims schedule 6: Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate.

IRS Form 8849 Schedule 2 Download Fillable PDF or Fill Online Sales by

Web fill out 8849 schedule 3 in a couple of clicks by simply following the instructions below: Web schedule 2 (form 8849) (rev. The credits for alcohol fuel mixtures, biodiesel mixtures, renewable diesel mixtures,. Claims are made using form 8849 (claim for refund of excise taxes). Section 4081 (e) claims schedule 6:

Form 8849 (Schedule 1) Nontaxable Use Of Fuels printable pdf download

Find the template you will need in the library of legal forms. To claim refunds on nontaxable use of fuels. Web schedule 3 (form 8849). Sales by registered ultimate vendors. Use this form to claim a.

Fillable Schedule 2 (Form 8849) Sales By Registered Ultimate Vendors

We last updated the certain fuel mixtures and the alternative fuel credit in december 2022, so. Web the irs has issued guidance to taxpayers regarding claiming the alternative fuel tax credits for the first three quarters of 2022. To claim refunds on nontaxable use of fuels. Web form schedule 1 form 8849 schedule 2 schedule 3 schedule 4 schedule 5.

Web Schedule 2 (Form 8849) (Rev.

To claim refunds on nontaxable use of fuels. Irs schedule 3 (form 8849), tax payers can claim a tax credit for any biodiesel or any other alternative fuels they produce or use in the year. Section 4081 (e) claims schedule 6: For amending sales by registered.

Sales By Registered Ultimate Vendors.

Other claims including the credit claim from form 2290. Web claimants must submit claims on form 8849, “claims for refund of excise taxes,” and include schedule 3, “certain fuel mixtures and the alternative fuel credit.”. • enter amounts for alternative fuels on line 3, as appropriate. Find the template you will need in the library of legal forms.

Web Schedule 3 (Form 8849) (Rev.

Web taxpayers who wish to claim the credit must file form 8849, claim for refund of excise taxes, and include schedule 3, certain fuel mixtures and the. Claims are made using form 8849 (claim for refund of excise taxes). Web generally, you can file a claim for a refund of excise taxes using form 8849 along with the appropriate schedule form. December 2020) department of the treasury internal revenue service.

The Credits For Alcohol Fuel Mixtures, Biodiesel Mixtures, Renewable Diesel Mixtures,.

Web more about the federal 8849 (schedule 3) corporate income tax ty 2022. Form 8849 has been redesigned so that it can be. Click on the get form button to. We last updated the certain fuel mixtures and the alternative fuel credit in december 2022, so.