Form 8829 Instructions 2021

Form 8829 Instructions 2021 - Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Claiming expenses for the business use of your home the home office. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Instructions for form 8829 department of the treasury internal revenue service expenses for business. Web form 8829 is only for taxpayers filing form 1040 schedule c. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Fill, sign, print and send online instantly. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: Complete, edit or print tax forms instantly.

Web method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can carry over to your 2022 form 8829. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web carry over to your 2022 form 8829. Background information on form 8829. What’s new personal protective equipment. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2022 of amounts not deductible in 2021. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: Complete, edit or print tax forms instantly. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Web use a separate form 8829 for each home you used for business during the year.

See the instructions for lines 25 and 31. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2022 of amounts not deductible in 2021. Web complete irs 8829 instructions 2021 online with us legal forms. What’s new personal protective equipment. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Get ready for tax season deadlines by completing any required tax forms today. Fill, sign, print and send online instantly. Instructions for form 8829 department of the treasury internal revenue service expenses for business. Complete, edit or print tax forms instantly. Claiming expenses for the business use of your home the home office.

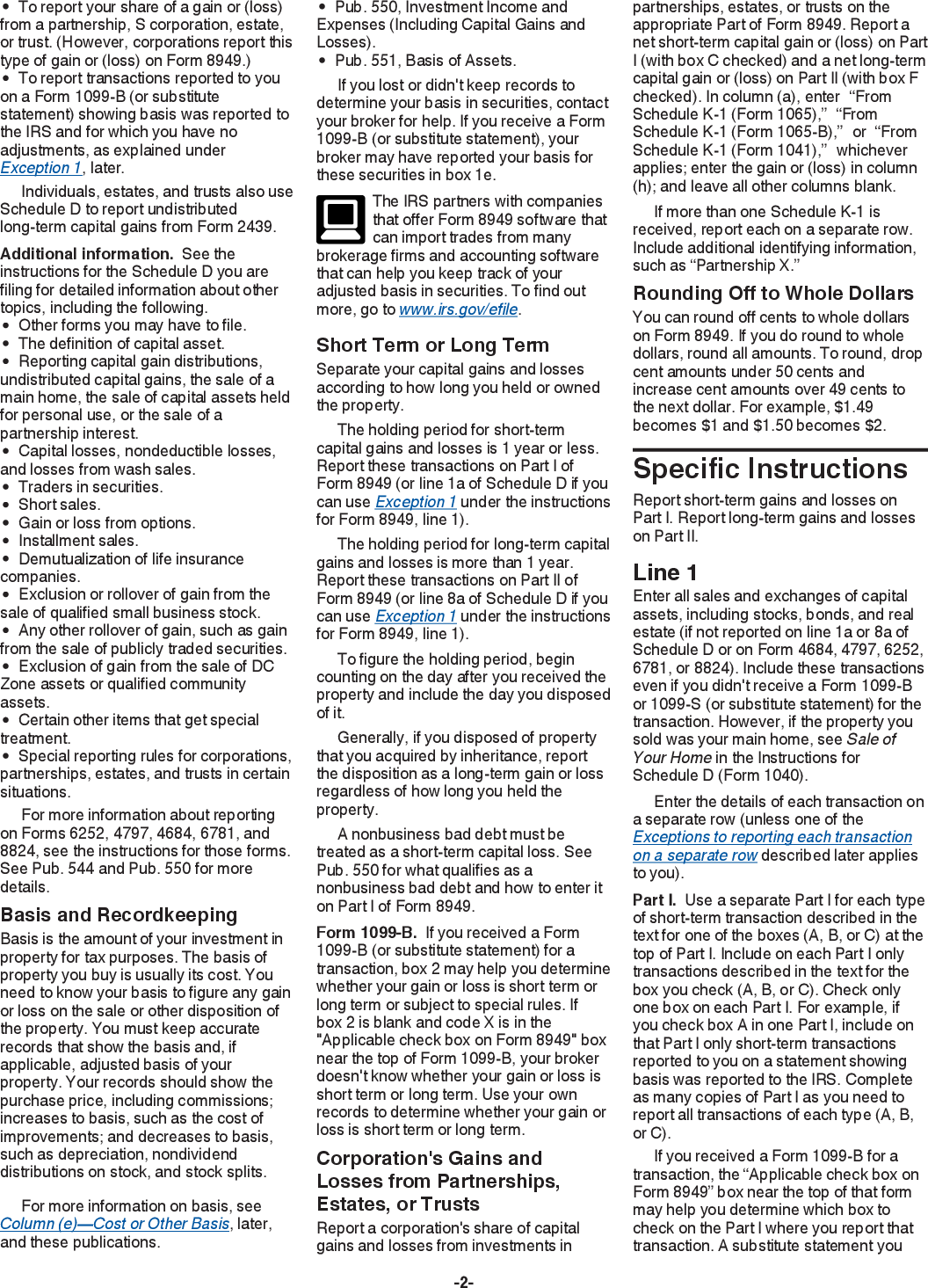

Online generation of Schedule D and Form 8949 for 10.00

Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web form 8829 is only for taxpayers filing form 1040 schedule c. Get ready for tax season deadlines by completing any required tax forms today. Web march 24, 2021 small business resource center small business tax prep.

IRS Form 8949.

Web use a separate form 8829 for each home you used for business during the year. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. What’s new personal protective equipment. Web form 8829 2021 expenses for business use of your home department of the treasury internal.

How to Claim the Home Office Deduction with Form 8829 Ask Gusto

Instructions for form 8829 department of the treasury internal revenue service expenses for business. Background information on form 8829. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

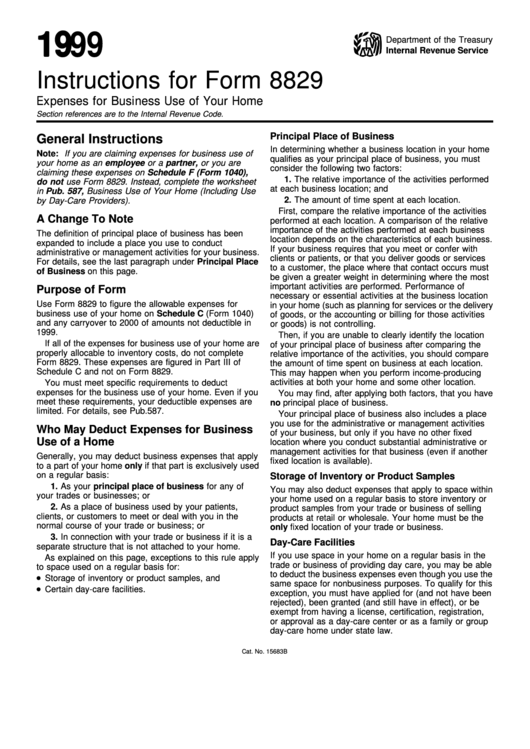

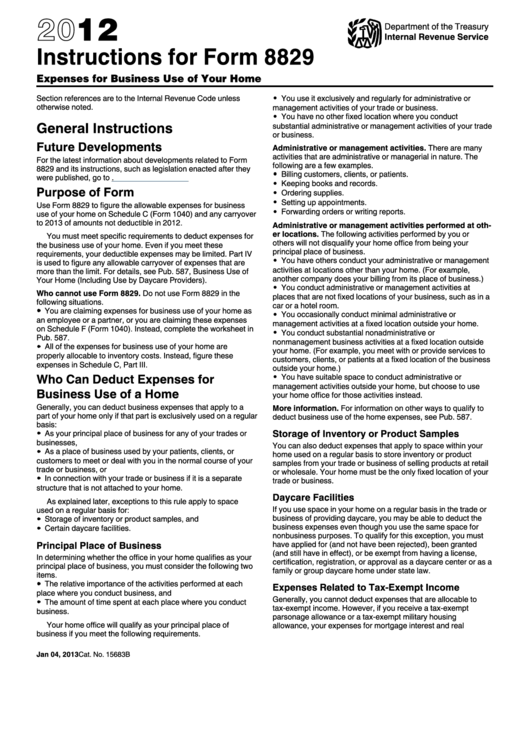

General instructions purpose of form use form 8829 to figure the allowable expenses for. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. Web in this article, we’ll walk through the basics of this tax form and the home business deduction,.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Web carry over to your 2022 form 8829. Go to www.irs.gov/form8829 for instructions and the latest information. Web there are two ways to claim the deduction: Claiming expenses for the business use of your home the home office. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to.

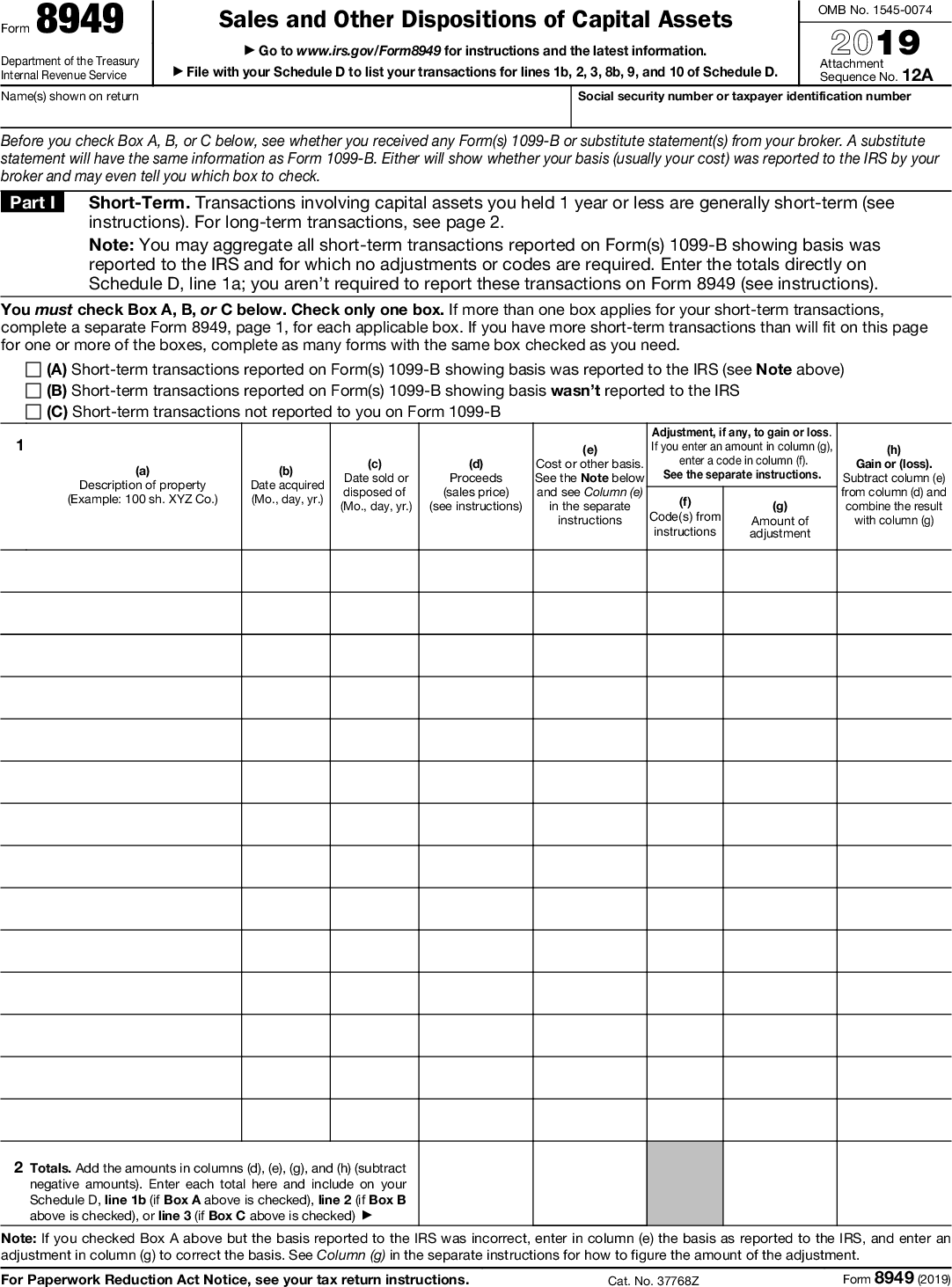

2020 Form IRS 8829 Instructions Fill Online, Printable, Fillable, Blank

Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web form 8829 is only for taxpayers filing form 1040 schedule c. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Get ready for tax season deadlines by completing any required.

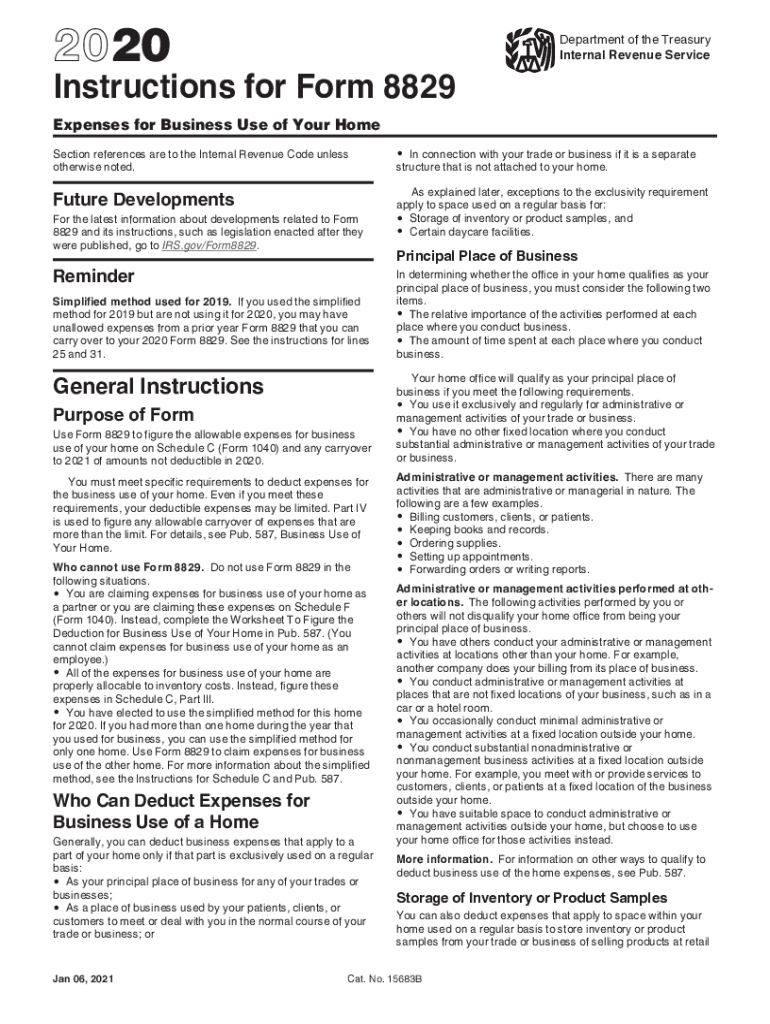

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Ad access irs tax forms. Fill, sign, print and send online instantly. Web there are two ways to claim the deduction: Web use a separate form 8829 for each home.

Instructions For Form 8829 Expenses For Business Use Of Your Home

Web complete irs 8829 instructions 2021 online with us legal forms. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) a file only with schedule c (form 1040). General instructions purpose of form use form 8829 to figure the allowable expenses for. Web method for 2021 but are not using.

Instructions For Form 8829 Expenses For Business Use Of Your Home

Ad access irs tax forms. Fill, sign, print and send online instantly. Web form 8829 is only for taxpayers filing form 1040 schedule c. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: See the instructions for lines 25 and 31.

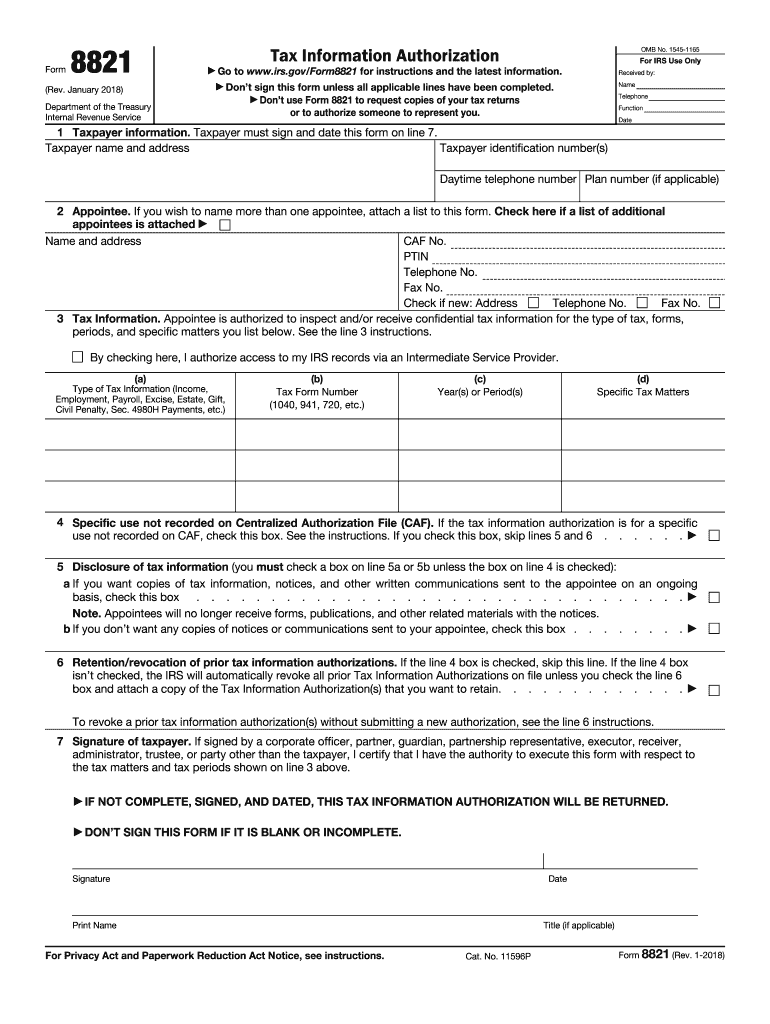

Form 8821 Fill Out and Sign Printable PDF Template signNow

General instructions purpose of form use form 8829 to figure the allowable expenses for. Claiming expenses for the business use of your home the home office. Web we last updated the expenses for business use of your home in december 2022, so this is the latest version of form 8829, fully updated for tax year 2022. Web form 8829 2021.

Ad Access Irs Tax Forms.

Complete, edit or print tax forms instantly. Fill, sign, print and send online instantly. Web march 24, 2021 small business resource center small business tax prep form 8829: Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include:

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web use a separate form 8829 for each home you used for business during the year. Background information on form 8829. Web form 8829 is only for taxpayers filing form 1040 schedule c. Go to www.irs.gov/form8829 for instructions and the latest information.

General Instructions Purpose Of Form Use Form 8829 To Figure The Allowable Expenses For.

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2022 of amounts not deductible in 2021. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2015 of amounts not deductible. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Web We Last Updated The Expenses For Business Use Of Your Home In December 2022, So This Is The Latest Version Of Form 8829, Fully Updated For Tax Year 2022.

Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web method for 2021 but are not using it for 2022, you may have unallowed expenses from a prior year form 8829 that you can carry over to your 2022 form 8829. Web complete irs 8829 instructions 2021 online with us legal forms. Web form 8829 2021 expenses for business use of your home department of the treasury internal revenue service (99) a file only with schedule c (form 1040).