Form 8826 Instructions

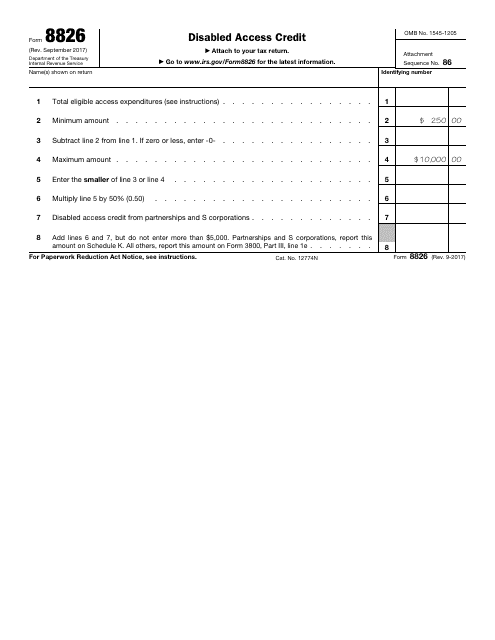

Form 8826 Instructions - Select the applicable module below for instructions on entering form 8826, disabled access credit. Web the expenses must enable the small business to comply with the americans with disabilities act (ada). If you are a shareholder or partner claiming a credit, attach a copy of the shareholder listing or federal schedule k. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. You can download or print current or past. Most expenses to comply with the ada, including barrier. September 2017) department of the treasury internal revenue service. Irs form 8826 has instructions on how to take this credit. The prep of legal documents can. Web we last updated federal form 8926 in february 2023 from the federal internal revenue service.

However, small business owners may claim a tax credit for this. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web small business tax credit. You can download or print current or past. Irs form 8826 has instructions on how to take this credit. Web get your online template and fill it in using progressive features. September 2017) department of the treasury internal revenue service. Attach to your tax return. The prep of legal documents can.

See the instructions for the tax return with which this form is filed. Web complying with the americans with disabilities act may require a financial investment on your part. Learning about the law or the form 24 min. Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Web get your online template and fill it in using progressive features. However, small business owners may claim a tax credit for this. Web follow these steps to generate form 8826 in the individual module: Web instructions for form 8886 available on irs.gov. This form is for income earned in tax year 2022, with tax returns due in april. Attach to your tax return.

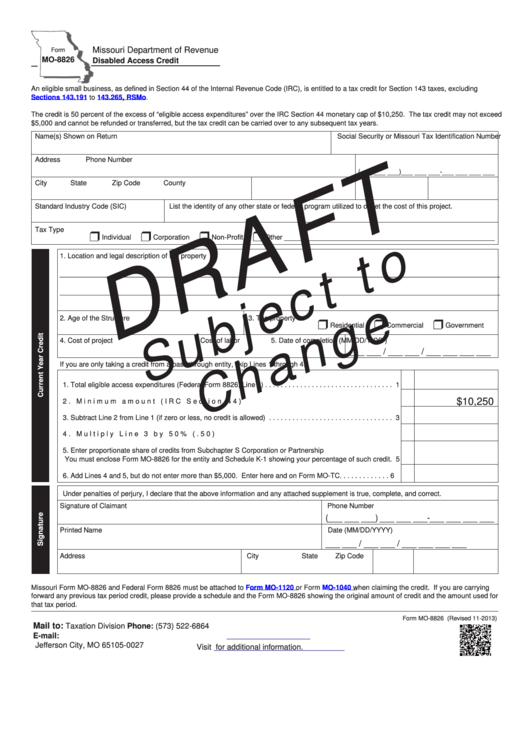

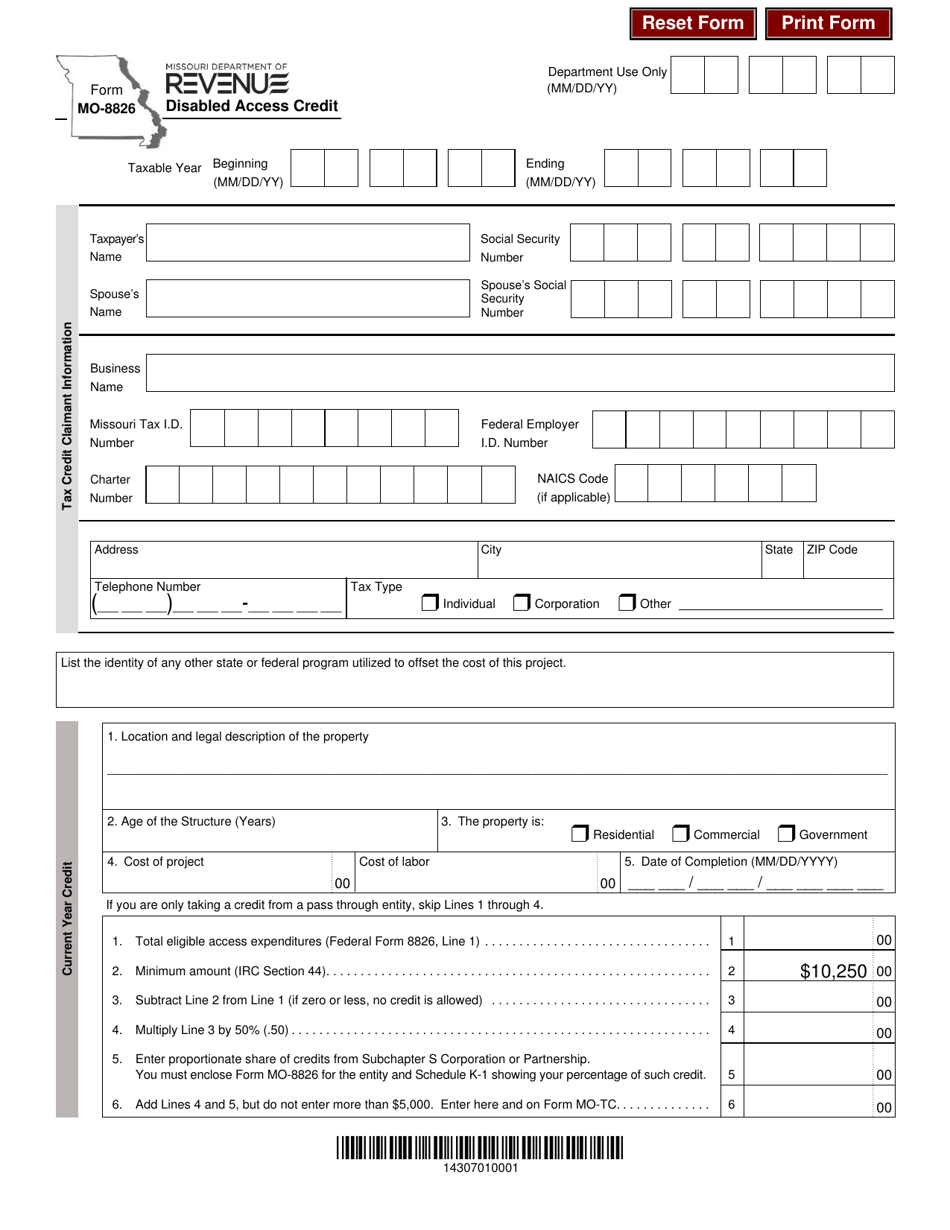

Form Mo8826 Disabled Access Credit 2013 printable pdf download

Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. June 6, 2019 11:17 am. Irs form 8826 has instructions on how to take this credit. The prep of legal documents can. Disqualified corporate interest expense disallowed under section 163(j) and.

Tax Forms Teach Me! Personal Finance

You can download or print current or past. Follow the simple instructions below: Section references are to the internal revenue code unless otherwise noted. Web i need to fill out form 8826. June 6, 2019 11:17 am.

IRS Form 8826 Download Fillable PDF or Fill Online Disabled Access

This form is for income earned in tax year 2022, with tax returns due in april. Follow the simple instructions below: Taxable income or (loss) before net operating loss deduction. Enter the corporation's taxable income or (loss) before the nol deduction,. Disqualified corporate interest expense disallowed under section 163(j) and.

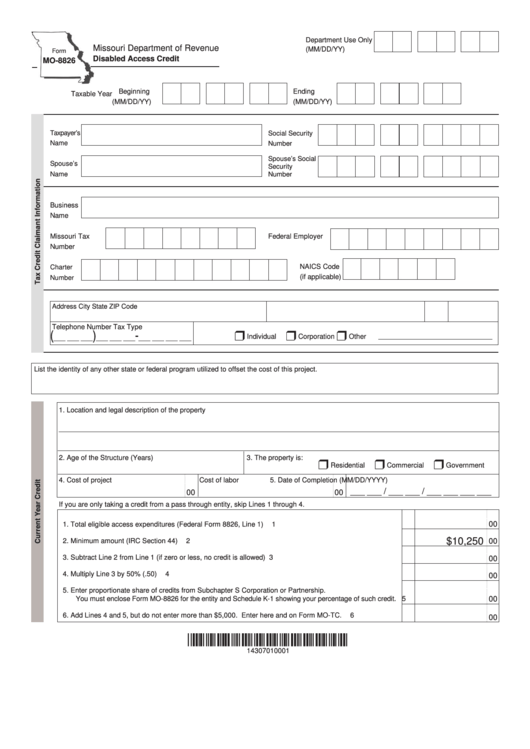

Fillable Form Mo8826 Disabled Access Credit 2016 printable pdf

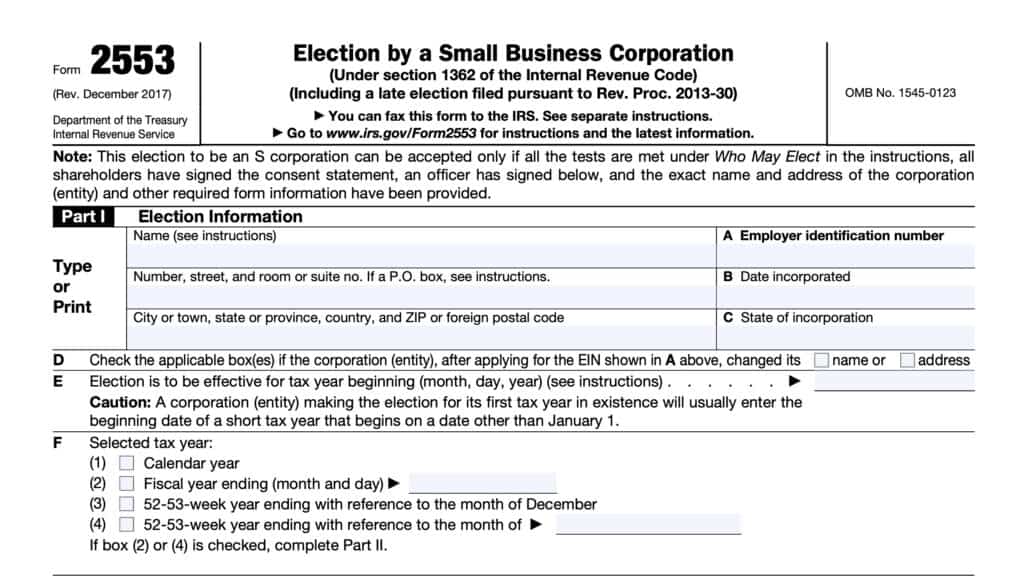

Follow the simple instructions below: December 2017) department of the treasury internal revenue service. Section references are to the internal revenue code unless otherwise noted. This form is for income earned in tax year 2022, with tax returns due in april. However, small business owners may claim a tax credit for this.

IRS Form 8826 Instructions Claiming the Disabled Access Credit

Enjoy smart fillable fields and interactivity. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. Web the expenses must enable the small business to comply with the americans with disabilities act (ada). Learning about the law or the form 24.

Form MO8826 Download Fillable PDF or Fill Online Disabled Access

Web instructions for form 8886 available on irs.gov. Most expenses to comply with the ada, including barrier. Web i need to fill out form 8826. Go to input return ⮕ credits ⮕ general bus. Disqualified corporate interest expense disallowed under section 163(j) and.

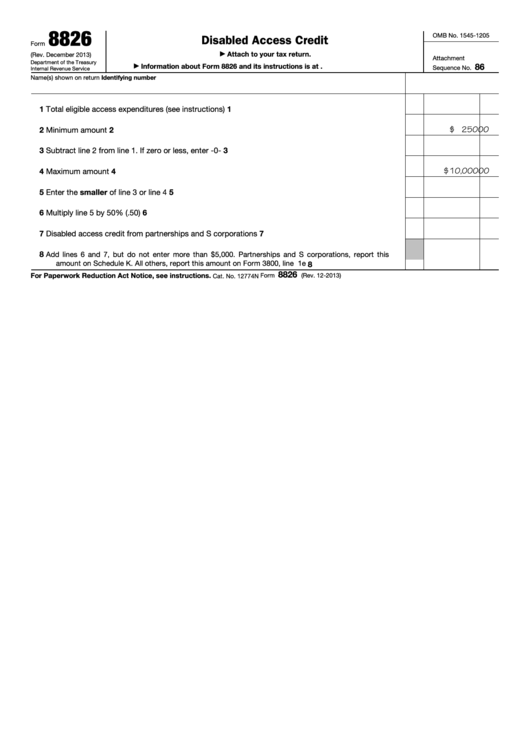

Form 8826 Disabled Access Credit Form (2013) Free Download

Web i need to fill out form 8826. The prep of legal documents can. You can download or print current or past. Recordkeeping 1 hr., 54 min. Web the expenses must enable the small business to comply with the americans with disabilities act (ada).

Form 8826 Disabled Access Credit Department Of The Treasury

Learning about the law or the form 24 min. December 2017) department of the treasury internal revenue service. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. Disqualified corporate interest expense disallowed under section 163(j) and. Enter the corporation's taxable.

Fill Free fillable F8826 Accessible Form 8826 (Rev. September 2017

Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Go to input return ⮕ credits ⮕ general bus. However, small business owners may claim a tax credit for this. Web instructions for form 8886 available on irs.gov. Web complying with the americans with.

Form 8826 Disabled Access Credit Stock Image Image of financial

Disqualified corporate interest expense disallowed under section 163(j) and. However, small business owners may claim a tax credit for this. Learning about the law or the form 24 min. See the instructions for the tax return with which this form is filed. The prep of legal documents can.

Web Small Business Tax Credit.

If you are a shareholder or partner claiming a credit, attach a copy of the shareholder listing or federal schedule k. Web get your online template and fill it in using progressive features. Disqualified corporate interest expense disallowed under section 163(j) and. Web generating form 8826, disabled access credit in lacerte.

You Can Download Or Print Current Or Past.

Web i need to fill out form 8826. Web complying with the americans with disabilities act may require a financial investment on your part. The prep of legal documents can. Section references are to the internal revenue code unless otherwise noted.

September 2017) Department Of The Treasury Internal Revenue Service.

Web follow these steps to generate form 8826 in the individual module: Irs form 8826 has instructions on how to take this credit. Enter the corporation's taxable income or (loss) before the nol deduction,. This form is for income earned in tax year 2022, with tax returns due in april.

Follow The Simple Instructions Below:

Most expenses to comply with the ada, including barrier. Web instructions • a corporation income tax or fiduciary return. Web we last updated federal form 8926 in february 2023 from the federal internal revenue service. Web the expenses must enable the small business to comply with the americans with disabilities act (ada).