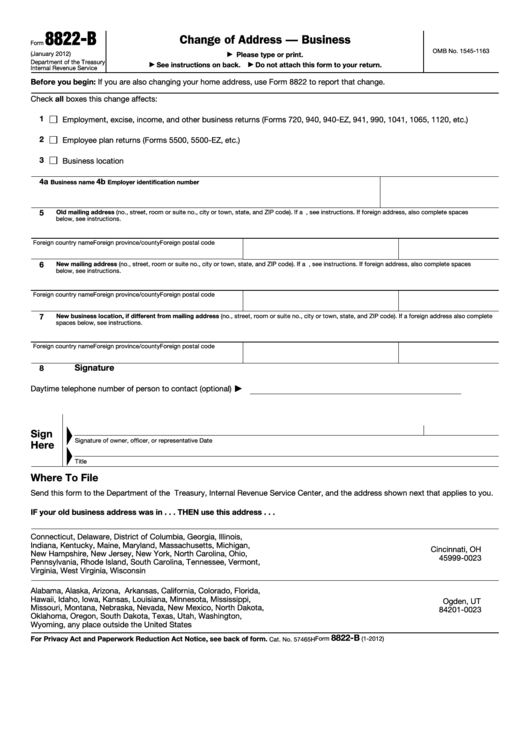

Form 8822-B-Change Of Address

Form 8822-B-Change Of Address - Filling out form 8822 form 8822 requires only basic information,. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Check all boxes this change affects: If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process your change of address. Web report error it appears you don't have a pdf plugin for this browser. Identity of your responsible party. Web separate form 8822 for each child. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.

Changes in responsible parties must be reported to the irs within 60 days. Web report error it appears you don't have a pdf plugin for this browser. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Generally, it takes 4 to 6 weeks to process a change of address. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Changing both home and business addresses? Check all boxes this change affects: Web separate form 8822 for each child. Identity of your responsible party.

If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Identity of your responsible party. Check all boxes this change affects: Changes in responsible parties must be reported to the irs within 60 days. Generally, it takes 4 to 6 weeks to process your change of address. Web separate form 8822 for each child. Generally, it takes 4 to 6 weeks to process a change of address. Filling out form 8822 form 8822 requires only basic information,. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Web form 8822 is used to report changes to your home address to the irs when you’ve moved.

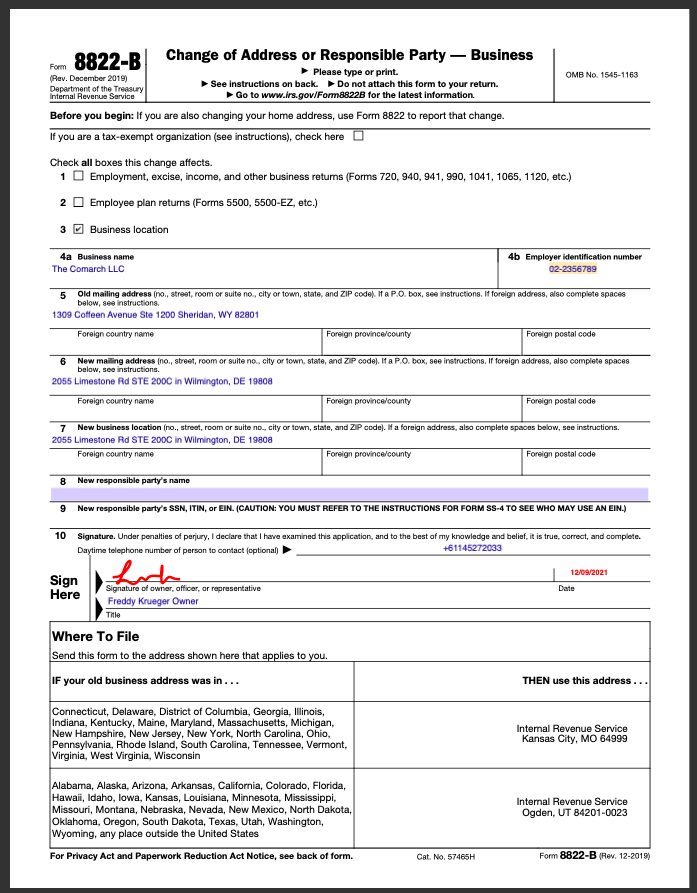

How to fill out the 8822b form Firstbase.io

Generally, it takes 4 to 6 weeks to process a change of address. Web report error it appears you don't have a pdf plugin for this browser. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web separate form 8822 for each child. Check all boxes this change affects:

Change of Address or Responsible Party Business Free Download

Web separate form 8822 for each child. Check all boxes this change affects: Generally, it takes 4 to 6 weeks to process your change of address. Changes in responsible parties must be reported to the irs within 60 days. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.

Irs Business Name Change Form 8822b Armando Friend's Template

Changing both home and business addresses? Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Check all boxes this change affects: Filling out form 8822 form 8822 requires only basic information,. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney.

Fill Free fillable Form 8822 Change of Address Part I Complete (IRS

Changes in responsible parties must be reported to the irs within 60 days. Web separate form 8822 for each child. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web form.

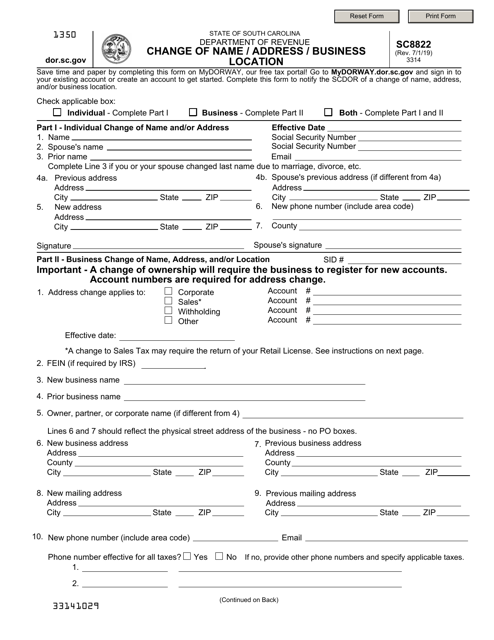

Form SC8822 Download Fillable PDF or Fill Online Change of Name

Identity of your responsible party. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Changing both home and business addresses? Web separate form 8822 for.

Form 8822 Change of Address (2014) Edit, Fill, Sign Online Handypdf

Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Web separate form 8822 for each child. Generally, it takes 4 to 6 weeks to process your change of address. Filling out form 8822 form 8822 requires only basic information,. Check all boxes this.

IRS Form 8822 Fill Out, Sign Online and Download Fillable PDF

Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Identity of your responsible party. Changes in responsible parties must be reported to the.

13 8822 Forms And Templates free to download in PDF

Check all boxes this change affects: If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Web separate form 8822 for each child. Filling out form 8822 form 8822.

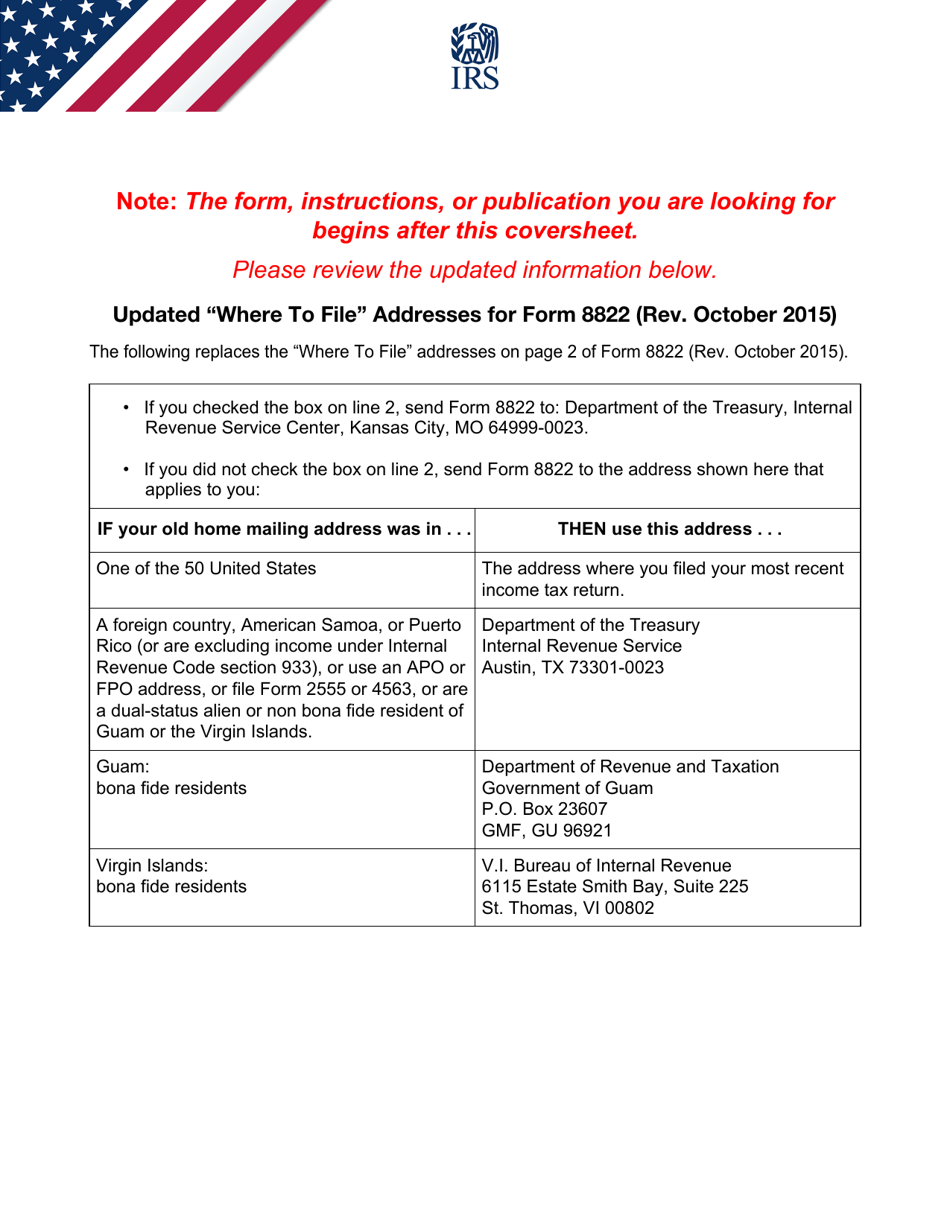

How to Change Your Address with the IRS 7 Steps (with Pictures)

Identity of your responsible party. Filling out form 8822 form 8822 requires only basic information,. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Generally, it takes 4 to 6 weeks to process your change of address. Changing both home and business addresses?

Fill Free fillable form 8822b change of address or responsible party

Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Changes in responsible parties must be reported to the irs within 60 days. Changing both home and business addresses? Web report error it appears you don't have a pdf plugin for this browser. Generally, it takes 4 to 6 weeks to process.

Identity Of Your Responsible Party.

Check all boxes this change affects: Changes in responsible parties must be reported to the irs within 60 days. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web report error it appears you don't have a pdf plugin for this browser.

Web Separate Form 8822 For Each Child.

Generally, it takes 4 to 6 weeks to process your change of address. Filling out form 8822 form 8822 requires only basic information,. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Changing both home and business addresses?

If You Are A Representative Signing For The Taxpayer, Attach To Form 8822 A Copy Of Your Power Of Attorney.

Generally, it takes 4 to 6 weeks to process a change of address. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home.