Form 8809 Instructions

Form 8809 Instructions - Application for extension of time to file information returns (for forms. Get ready for tax season deadlines by completing any required tax forms today. However, any approved extension of time to file will only extend the due date for filing the. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. You must file form 8809. Web when you need to file 8809. Filers and transmitters of form. Do not use this form to request. Web form 8809, application for extension of time to file information returns. Web what is form 8809?

Filers and transmitters of form. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. However, any approved extension of time to file will only extend the due date for filing the. Use form 8809 to request an initial or additional extension of time to file only the forms. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809. Web information on this form to carry out the internal revenue laws of the united states. Web file form 8809 as soon as you know an extension of time to file is necessary. Web complete this form in blue or black ink only. Web complete this form in blue or black ink only. For example, if you are requesting an extension of time to file both 1099 series and.

Do not use this form to. Irs form 8809 can be extremely helpful for. Filers and transmitters of form. Web when you need to file 8809. Use form 8809 to request an initial or additional extension of time to file only the forms. Application for extension of time to file information returns (for forms. However, any approved extension of time to file will only extend the due date for filing the. Web form 8809, application for extension of time to file information returns. Form 8809 is provided by the irs to request an extension of time to file. Web information on this form to carry out the internal revenue laws of the united states.

Tax Extension Form Extend Tax Due Date if You Need

Web file form 8809 as soon as you know an extension of time to file is necessary. Use form 8809 to request an initial or additional extension of time to file only the forms. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. Web complete this form in.

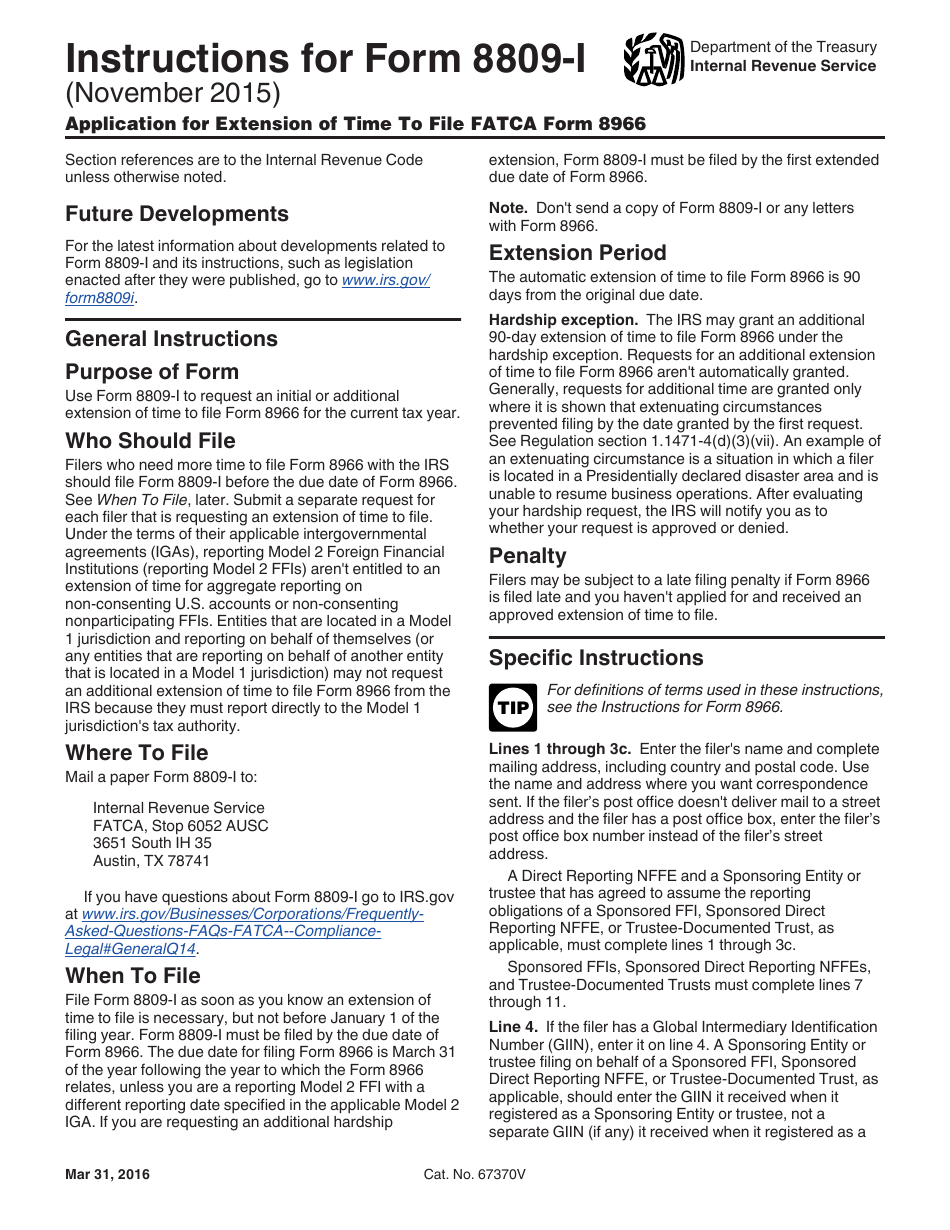

Download Instructions for IRS Form 8809I Application for Extension of

Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Web complete this form in blue or black ink only. September 2017) department of the treasury internal revenue service. You must file form 8809. Get ready for tax season deadlines by completing any required tax forms today.

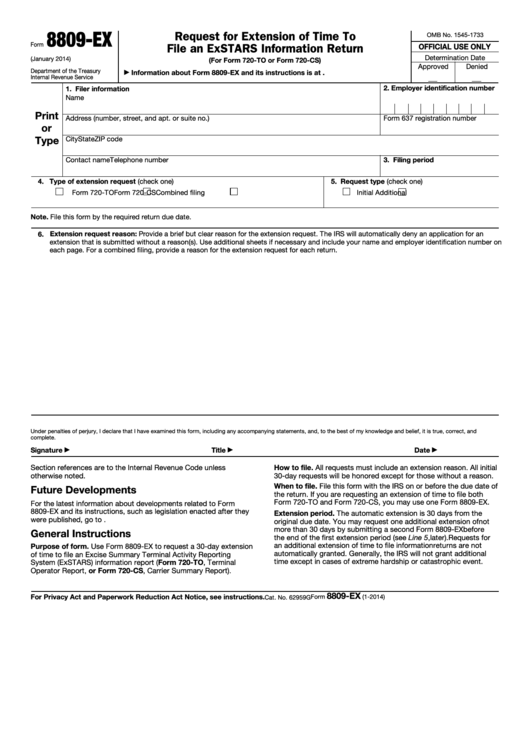

Fillable Form 8809Ex Request For Extension Of Time To File An

Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Irs form 8809 can be extremely helpful for. Web complete this form in blue or black ink only. Web complete this form in blue or black ink only. Use form 8809 to request an initial or additional extension of time.

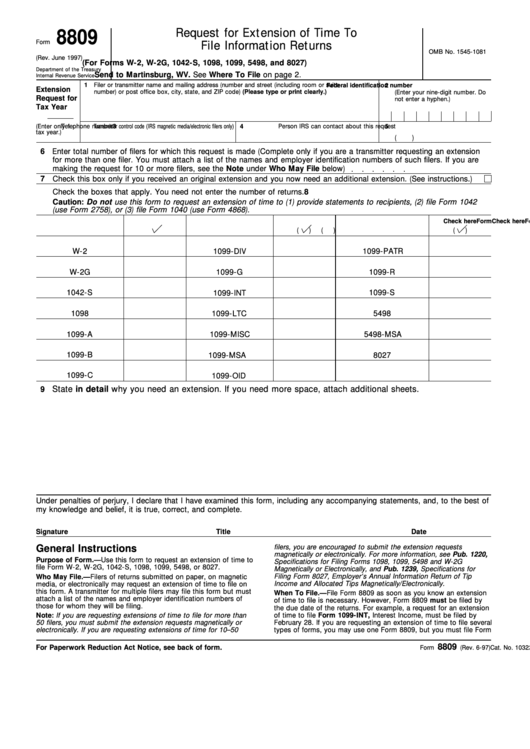

Form 8809 Request For Extension Of Time To File Information Returns

Irs form 8809 can be extremely helpful for. Web when you need to file 8809. Get ready for tax season deadlines by completing any required tax forms today. September 2017) department of the treasury internal revenue service. Web form 8809 is a federal corporate income tax form.

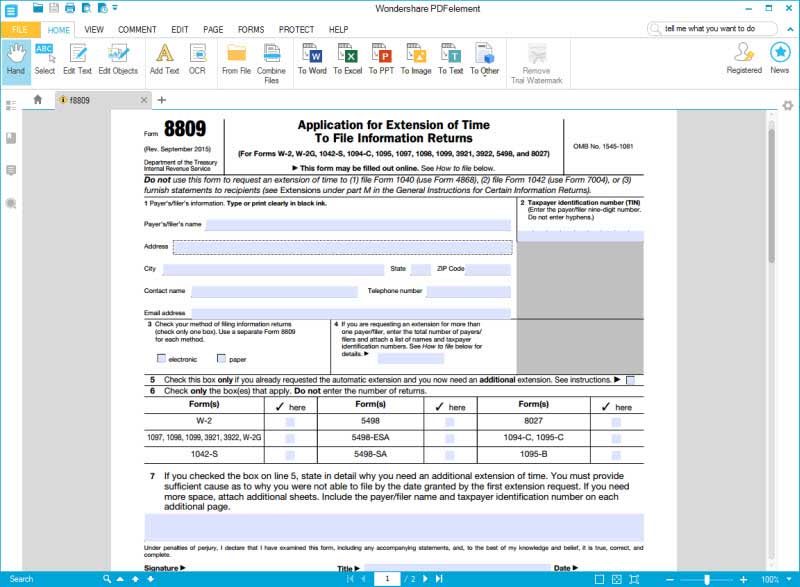

Form 8809 Application for Extension of Time to File Information

Do not use this form to request. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. Filers and transmitters of form. Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Form 8809 is provided by the irs.

Form 8809 Edit, Fill, Sign Online Handypdf

Web file form 8809 as soon as you know an extension of time to file is necessary. Web complete this form in blue or black ink only. For example, if you are requesting an extension of time to file both 1099 series and. Web form 8809 is a federal corporate income tax form. You must file form 8809.

SSA POMS RM 01105.037 Exhibit 3 Form 8809 (Request for

Use form 8809 to request an initial or additional extension of time to file only the forms. Web what is form 8809? Web file form 8809 as soon as you know an extension of time to file is necessary. Do not use this form to. Filers and transmitters of form.

Need a Filing Extension for W2s and 1099s? File Form 8809

Web when you need to file 8809. Web complete this form in blue or black ink only. Web complete this form in blue or black ink only. Do not use this form to request. Get ready for tax season deadlines by completing any required tax forms today.

Form CT8809 Download Printable PDF or Fill Online Request for

For example, if you are requesting an extension of time to file both 1099 series and. September 2017) department of the treasury internal revenue service. Do not use this form to. Use form 8809 to request an initial or additional extension of time to file only the forms. Web when you need to file 8809.

Form 8809 2022 Printable and Fillable PDF Application

Web form 8809 is a federal corporate income tax form. Irs form 8809 can be extremely helpful for. Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Do not use this form to request. However, form 8809 must be filed by the due date of the returns.

Irs Form 8809 Can Be Extremely Helpful For.

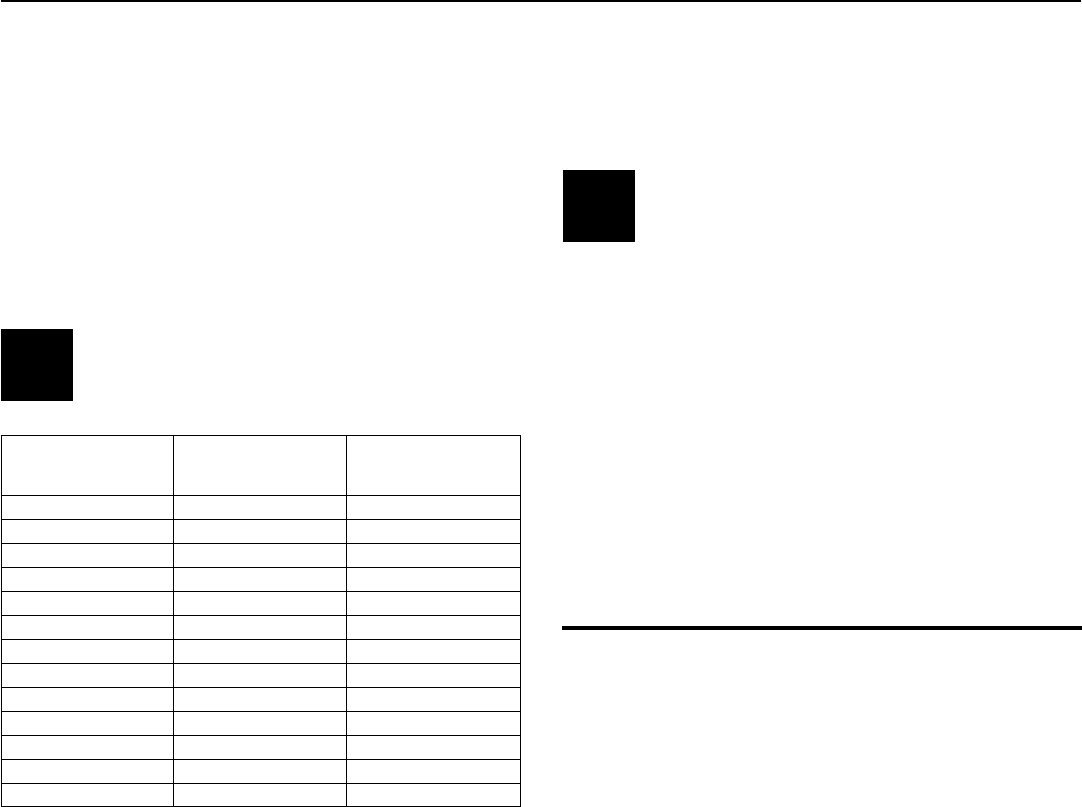

How to file 8809 instructions & due. Web form 8809 is a federal corporate income tax form. Application for extension of time to file information returns (for forms. Web one form that many small business owners don’t know about, and therefore can’t take advantage of, is irs form 8809.

However, Form 8809 Must Be Filed By The Due Date Of The Returns.

For example, if you are requesting an extension of time to file both 1099 series and. The due date for filing form 8966 is march 31 of the year following the year to which the form 8966. Web of forms, you may use one form 8809, but you must file form 8809 by the earliest due date. Ad access irs tax forms.

Filers And Transmitters Of Form.

Web what is form 8809? Do not use this form to. Form 8809 is provided by the irs to request an extension of time to file. Web when you need to file 8809.

Web Form 8809, Application For Extension Of Time To File Information Returns.

Internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to. Get ready for tax season deadlines by completing any required tax forms today. Web file form 8809 as soon as you know an extension of time to file is necessary. However, any approved extension of time to file will only extend the due date for filing the.