Form 8801 Instructions 2022

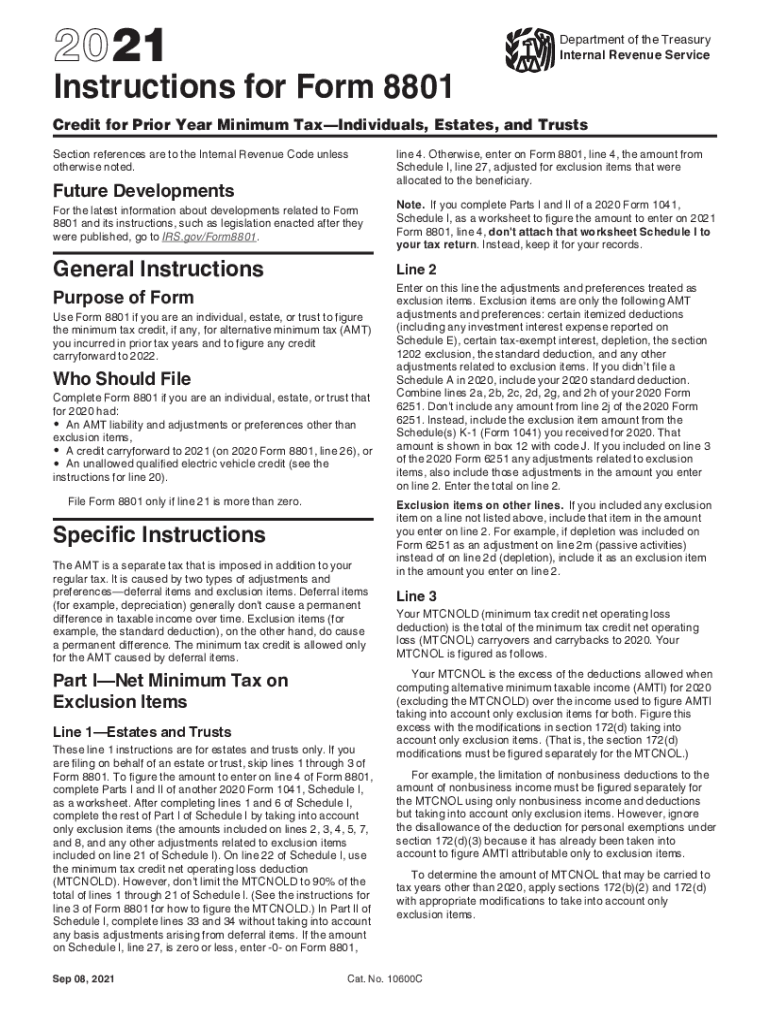

Form 8801 Instructions 2022 - The days of terrifying complex tax and legal forms are over. Edit, sign and print tax forms on any device with uslegalforms. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Enjoy smart fillable fields and interactivity. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions to 2022 form 6251; Get your online template and fill it in using progressive features. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Web click on the following links to go the forms and their instructions. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of.

Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. The days of terrifying complex tax and legal forms are over. Instructions to 2022 form 6251; Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Instructions to 2022 form 8801;. Web 30 votes how to fill out and sign irs form 8801 online? Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to.

Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Get your online template and fill it in using progressive features. Web click on the following links to go the forms and their instructions. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Enjoy smart fillable fields and interactivity. Instructions to 2022 form 8801;. The days of terrifying complex tax and legal forms are over. Web 30 votes how to fill out and sign irs form 8801 online?

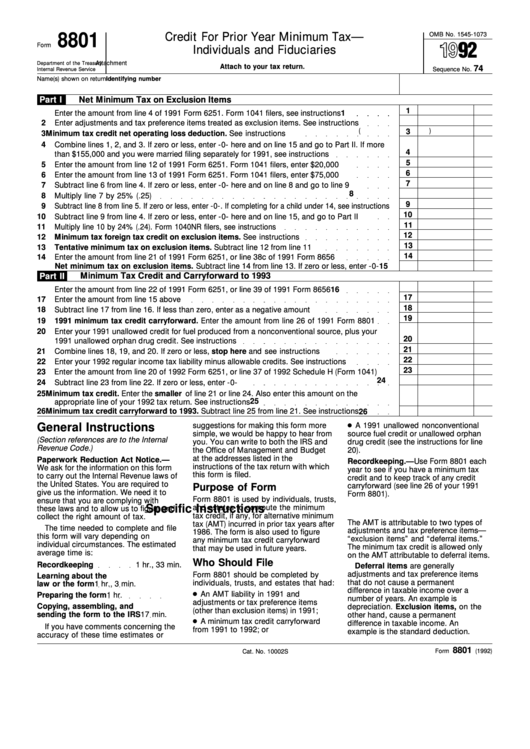

Form 8801 Credit for Prior Year Minimum Tax Individuals, Estates

Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to. Get your online template and fill it in using progressive features. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. Department of the.

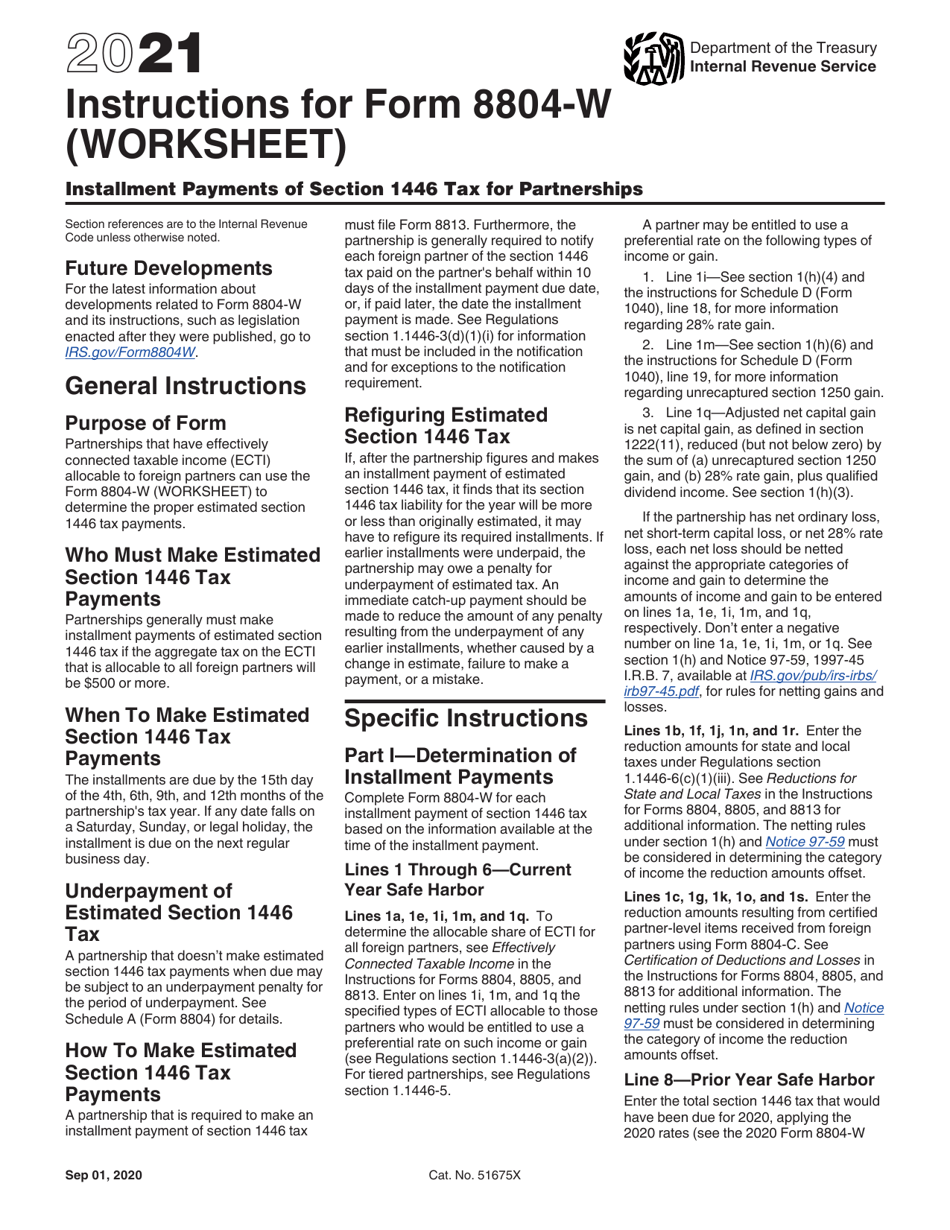

Download Instructions for IRS Form 8804W Installment Payments of

Get your online template and fill it in using progressive features. Instructions to 2022 form 8801;. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments.

Form 8801 Credit For Prior Year Minimum Tax Individuals And

Web click on the following links to go the forms and their instructions. Web (see the instructions for line 3 of form 8801 for how to figure the mtcnold.) in part ii of schedule i, complete lines 33 and 34 without taking into account any basis adjustments. Web general instructions purpose of form use form 8801 if you are an.

What Is A 8801 Form cloudshareinfo

Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Instructions to 2022 form 8801;. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Ad download or email irs 8801 & more.

Form 8802 Instructions 2021 2022 IRS Forms Zrivo

Instructions to 2022 form 6251; Enjoy smart fillable fields and interactivity. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Form 8801 is used to calculate the minimum tax credit, if any, for alternative minimum tax (amt) incurred in prior. The days of terrifying complex tax and legal forms are over.

form 8804 instructions 20192022 Fill Online, Printable, Fillable

Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web 30 votes how to fill out and sign irs form 8801 online? Edit, sign and print tax forms on any device with uslegalforms. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut.

Form 8801 Irs Memo on the Piece of Paper. Stock Image Image of form

Instructions to 2022 form 6251; Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Web 30 votes how to fill out and sign irs form 8801 online? Enjoy smart fillable fields and interactivity. Web follow the.

What Is A 8801 Form cloudshareinfo

Edit, sign and print tax forms on any device with uslegalforms. Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you.

Form 8801 Instructions Fill Out and Sign Printable PDF Template signNow

Web follow the simple instructions below: Enjoy smart fillable fields and interactivity. Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Web 30 votes how to fill out and sign irs form 8801 online? Ad download.

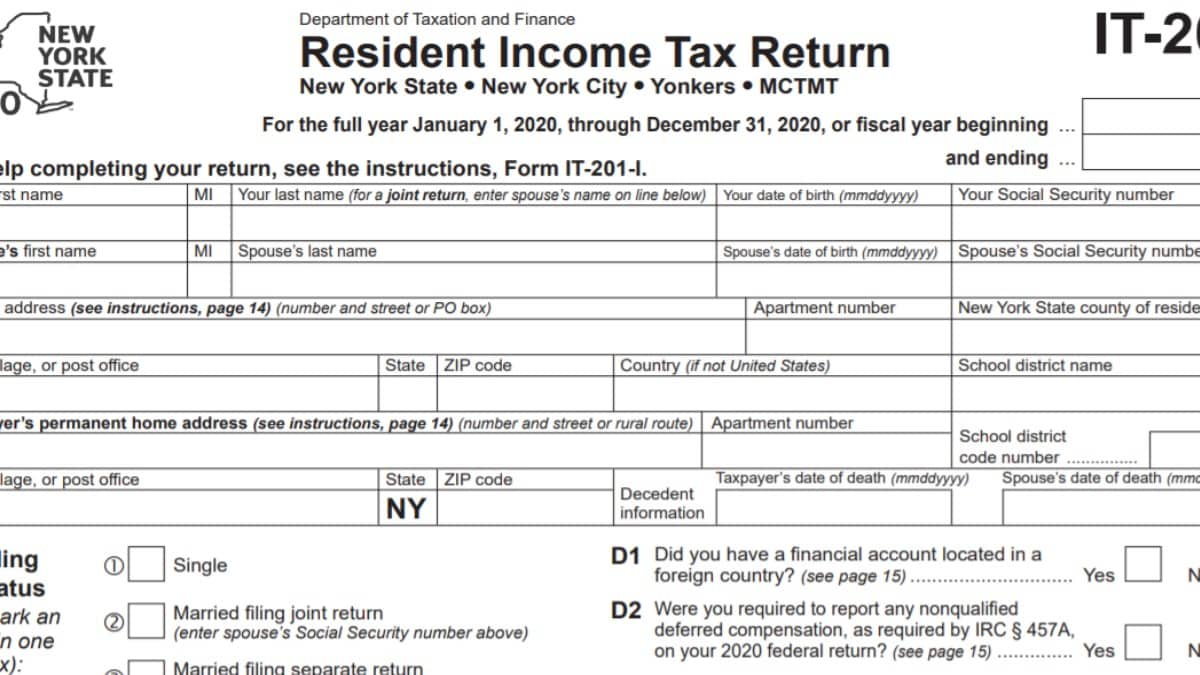

IT201 Instructions 2022 2023 State Taxes TaxUni

Enjoy smart fillable fields and interactivity. Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. Web follow the simple instructions below: Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were.

Form 8801 Is Used To Calculate The Minimum Tax Credit, If Any, For Alternative Minimum Tax (Amt) Incurred In Prior.

Instructions to 2022 form 6251; Web (see the instructions for line 3 of form 8801 for how to figure the mtcnold.) in part ii of schedule i, complete lines 33 and 34 without taking into account any basis adjustments. Web individuals, trusts, and estates should file form ct‑8801 if the individuals, trusts, or estates had a connecticut alternative minimum tax liability in 2021 and adjustments or items of. Web follow the simple instructions below:

Edit, Sign And Print Tax Forms On Any Device With Uslegalforms.

Department of the treasury internal revenue service (99) credit for prior year minimum tax— individuals, estates, and trusts. Web 30 votes how to fill out and sign irs form 8801 online? Web click on the following links to go the forms and their instructions. Enjoy smart fillable fields and interactivity.

Get Your Online Template And Fill It In Using Progressive Features.

Ad download or email irs 8801 & more fillable forms, register and subscribe now! Web department of the treasury internal revenue service credit for prior year minimum tax— individuals, estates, and trusts go to www.irs.gov/form8801 for instructions and the. The days of terrifying complex tax and legal forms are over. Web future developments for the latest information about developments related to form 8881 and its instructions, such as legislation enacted after they were published, go to.

Department Of The Treasury Internal Revenue Service (99) Credit For Prior Year Minimum Tax— Individuals, Estates, And Trusts.

Web general instructions purpose of form use form 8801 if you are an individual, estate, or trust to figure the minimum tax credit, if any, for alternative minimum tax (amt) you incurred in. Instructions to 2022 form 8801;.