Form 7004 Extension Due Date 2022

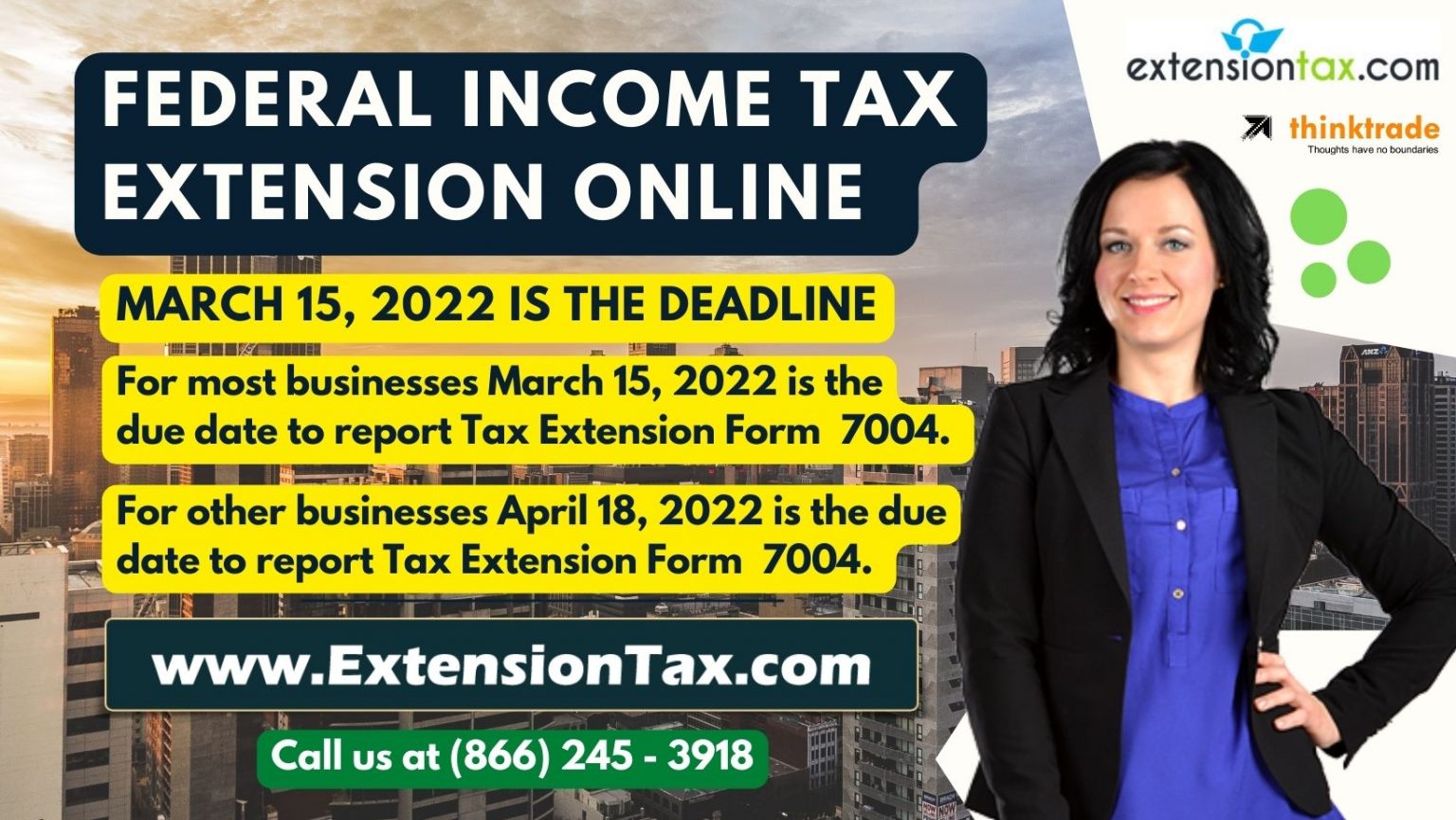

Form 7004 Extension Due Date 2022 - Web new updates printable irs form 7004 for 2022 taxes can be a complicated and tedious task, but they don't have to be! Web form 7004 extends the deadline for filing up to 6 months, giving businesses until september 15, 2023, to complete and file their returns without worrying about. Web the due date for filing irs form 7004 for 2022 is march 15, 2023. Tentative amount of florida tax for the taxable. We last updated the application for automatic extension of time to file certain business income tax, information, and. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web file request for extension by the due date of the return. The internal revenue service (irs) has made it much. The 15th day following the due date, without extension, for the filing of the related federal return. Web if the 15th falls on a federal holiday or weekend, the return due date is the next business day.

Tentative amount of florida tax for the taxable. You will get an automatic tax extension time of six months to file your complete reports along with the. The 15th day following the due date, without extension, for the filing of the related federal return. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year for businesses like llcs,. The due dates of the returns can be found here for the applicable return. You will get an automatic tax extension time of six months to file your complete reports along with. Web where to file where to file form 7004 where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004,. Web form 7004 extends the deadline for filing up to 6 months, giving businesses until september 15, 2023, to complete and file their returns without worrying about. Web the due date for filing irs form 7004 for 2022 is march 15, 2023.

The due dates of the returns can be found here for the applicable return. Web on or after 1/1/2022; Web usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year for businesses like llcs,. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. Web if the 15th falls on a federal holiday or weekend, the return due date is the next business day. We last updated the application for automatic extension of time to file certain business income tax, information, and. And for the tax returns such as 1120, 1041. The 15th day following the due date, without extension, for the filing of the related federal return. Web where to file where to file form 7004 where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004,.

What Partnerships Need to Know About Form 7004 for Tax Year 2021 Blog

Web the irs will no longer send a notification that your extension has been approved. Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. The internal revenue service (irs) has made it much. Web calendar year (december 31st ) fiscal year form 7004 extension calculator for tax year.

Today is the Deadline to File a 2021 Form 7004 Extension Blog

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. You will get an automatic tax extension time of six months to file your complete reports along with. We will notify you only if your request for an extension is disallowed. This deadline coincides with the due date for.

An Overview of Tax Extension Form 7004 Blog ExpressExtension

Web new updates printable irs form 7004 for 2022 taxes can be a complicated and tedious task, but they don't have to be! Web on or after 1/1/2022; Web if the 15th falls on a federal holiday or weekend, the return due date is the next business day. Web usually, the irs form 7004 business tax extension application deadline falls.

form 7004 extension due date in 2022 Extension Tax Blog

Web the irs will no longer send a notification that your extension has been approved. You will get an automatic tax extension time of six months to file your complete reports along with. Web usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

You will get an automatic tax extension time of six months to file your complete reports along with. And for the tax returns such as 1120, 1041. Web form 7004 extends the deadline for filing up to 6 months, giving businesses until september 15, 2023, to complete and file their returns without worrying about. The internal revenue service (irs) has.

2011 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Web file request for extension by the due date of the return. Web calendar year (december 31st ) fiscal year form 7004 extension calculator for tax year 2022 facebook twitter linkedin embed form 4868 extension form 8868 extension Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15,.

extension form 7004 for 2022 IRS Authorized

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Ad download or email irs 7004 & more fillable forms, register and subscribe now! And for the tax returns such as 1120, 1041. The internal revenue service (irs) has made it much. Tentative amount of florida tax for the.

IRS Form 7004 Automatic Extension for Business Tax Returns

We will notify you only if your request for an extension is disallowed. We last updated the application for automatic extension of time to file certain business income tax, information, and. Web new updates printable irs form 7004 for 2022 taxes can be a complicated and tedious task, but they don't have to be! You will get an automatic tax.

efile form 7004 Blog ExpressExtension Extensions Made Easy

Web when to file generally, form 7004 must be filed on or before the due date of the applicable tax return. Web the irs will no longer send a notification that your extension has been approved. Ad download or email irs 7004 & more fillable forms, register and subscribe now! We will notify you only if your request for an.

ExpressExtension is now Accepting Form 7004 for the 2021 Tax Year

And for the tax returns such as 1120, 1041. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. The due dates of the returns can be found here for the applicable return. Web new updates printable irs form 7004.

We Last Updated The Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And.

Tentative amount of florida tax for the taxable. Web file request for extension by the due date of the return. Web on or after 1/1/2022; Web usually, the irs form 7004 business tax extension application deadline falls on the 15th day of the third month, which is march 15th, 2022 on this year for businesses like llcs,.

Web The Irs Will No Longer Send A Notification That Your Extension Has Been Approved.

The 15th day following the due date, without extension, for the filing of the related federal return. We will notify you only if your request for an extension is disallowed. Web federal tax extension form 7004 could get you the much needed relief on reporting your business tax returns by march 15, 2022 and gives you the extra time to. This deadline coincides with the due date for many business taxpayers to file their income tax returns, ensuring.

The Internal Revenue Service (Irs) Has Made It Much.

The due dates of the returns can be found here for the applicable return. Web calendar year (december 31st ) fiscal year form 7004 extension calculator for tax year 2022 facebook twitter linkedin embed form 4868 extension form 8868 extension Web if the 15th falls on a federal holiday or weekend, the return due date is the next business day. Ad download or email irs 7004 & more fillable forms, register and subscribe now!

And For The Tax Returns Such As 1120, 1041.

Web where to file where to file form 7004 where to file form 7004 select the appropriate form from the table below to determine where to send the form 7004,. 01/17 extension of time request florida income/ franchise tax due 1. You will get an automatic tax extension time of six months to file your complete reports along with the. Web the due date for filing irs form 7004 for 2022 is march 15, 2023.