Form 668 Z

Form 668 Z - Partial certificate of release of federal tax lien: Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice withdrawal. Press done after you finish the form. Two additional withdrawal options resulted from the commissioner’s 2011 fresh start initiative. You will receive a copy along with notice 48, instructions for the certificate of release of federal tax lien, once your nftl has been released after full payment. Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. At a minimum, search your records using the taxpayer’s name, address, and identifying number(s) shown on this form. Utilize the sign tool to add and create your electronic signature to signnow the form 668z. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Make a reasonable effort to identify all property and rights to property belonging to this person.

You will receive a copy along with notice 48, instructions for the certificate of release of federal tax lien, once your nftl has been released after full payment. Make a reasonable effort to identify all property and rights to property belonging to this person. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Press done after you finish the form. At a minimum, search your records using the taxpayer’s name, address, and identifying number(s) shown on this form. Partial certificate of release of federal tax lien: Certificate of release of federal estate tax lien under. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice withdrawal. Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. Now you'll be able to print, save, or share the document.

Web double check all the fillable fields to ensure full accuracy. Make a reasonable effort to identify all property and rights to property belonging to this person. Two additional withdrawal options resulted from the commissioner’s 2011 fresh start initiative. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice withdrawal. Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. Web the irs will record form 668 (z), certificate of release of federal tax lien, as public record. Now you'll be able to print, save, or share the document. Partial certificate of release of federal tax lien: Certificate of release of federal estate tax lien under. Press done after you finish the form.

IRS Notice Federal Tax Lien Colonial Tax Consultants

Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. You will receive a copy along with notice 48, instructions for the certificate of release of federal tax lien, once your nftl has been released after full payment. Web double check all the fillable fields to ensure full accuracy. Two additional.

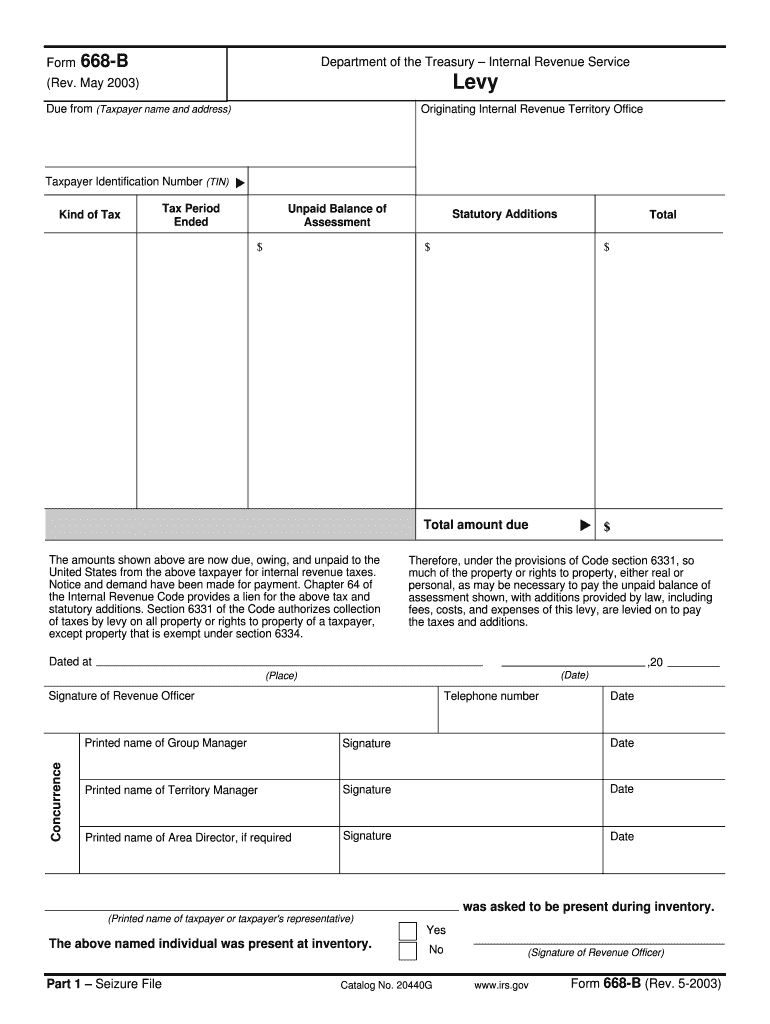

IRS Notices and Letter Form 668A(c) Understanding IRS Notice 668A(c

Partial certificate of release of federal tax lien: Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. Press done after you finish the form. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Make a reasonable effort to identify.

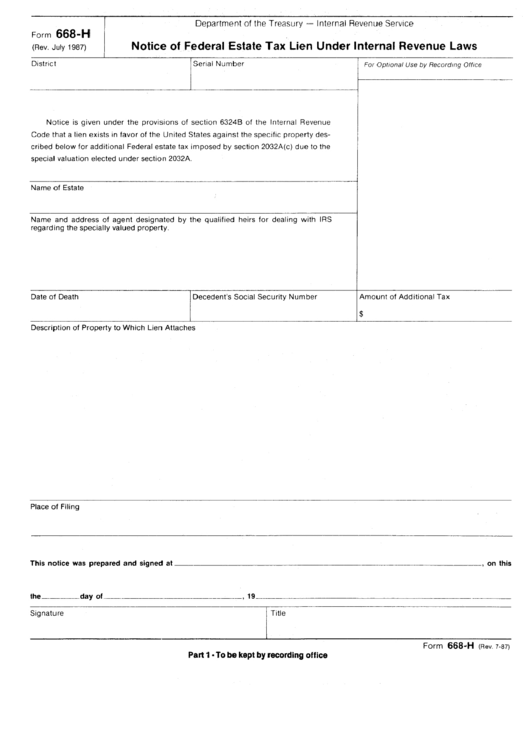

Form 668H Notice Of Federal Estate Tax Lien Under Internal Revenue

Make a reasonable effort to identify all property and rights to property belonging to this person. Utilize the sign tool to add and create your electronic signature to signnow the form 668z. When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Partial certificate of release of federal tax lien:.

Release Of Levy Form 668 D Fill Out and Sign Printable PDF Template

Make a reasonable effort to identify all property and rights to property belonging to this person. Partial certificate of release of federal tax lien: When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Web double check all the fillable fields to ensure full accuracy. Web for eligibility, refer to.

How do I remove an IRS tax lien? YouTube

When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Press done after you finish the form. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice.

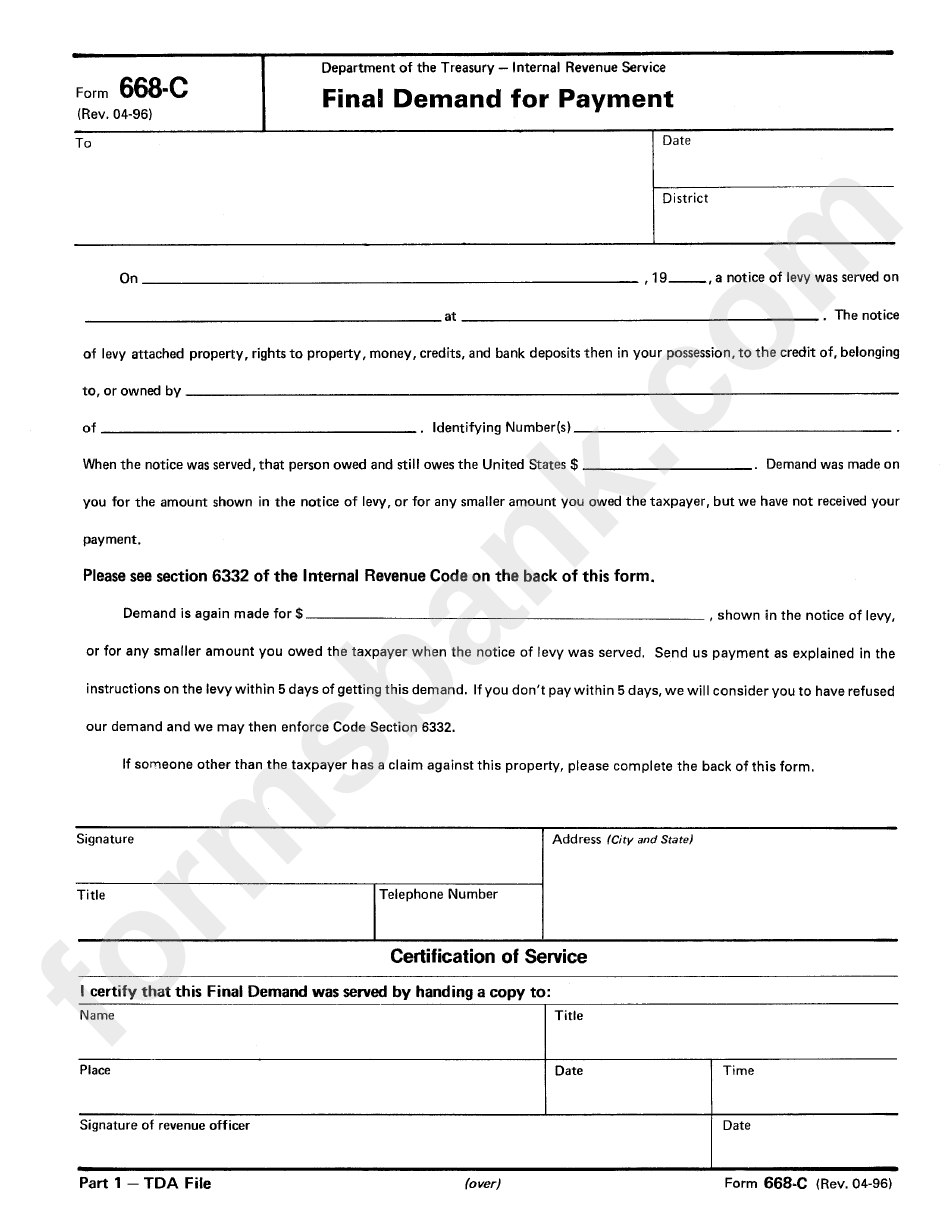

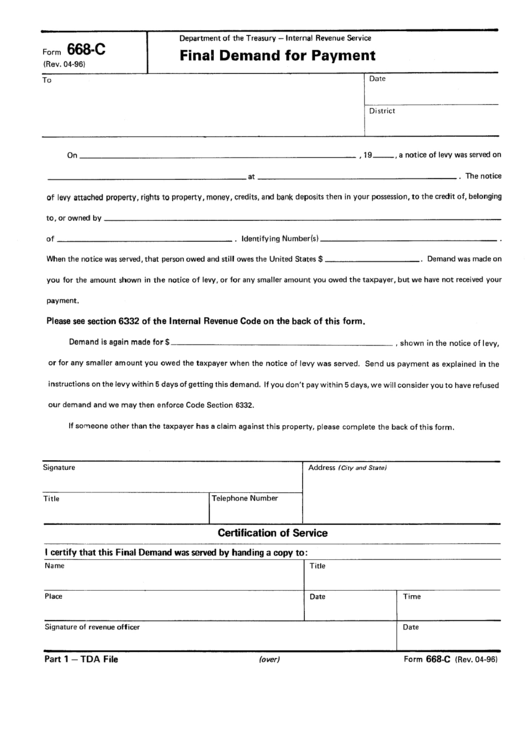

Form 668C Final Demand For Payment printable pdf download

Make a reasonable effort to identify all property and rights to property belonging to this person. Web double check all the fillable fields to ensure full accuracy. Utilize the sign tool to add and create your electronic signature to signnow the form 668z. Partial certificate of release of federal tax lien: Web the document used to release a lien is.

Francis K. Fong Letters Blogs, Settling the Calvin Cycle Question

Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice withdrawal. At a minimum, search your records using.

5.12.3 Lien Release and Related Topics Internal Revenue Service

Utilize the sign tool to add and create your electronic signature to signnow the form 668z. Web double check all the fillable fields to ensure full accuracy. You will receive a copy along with notice 48, instructions for the certificate of release of federal tax lien, once your nftl has been released after full payment. Web the document used to.

Form 668C Final Demand For Payment Department Of The Treasury

When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Press done after you finish the form. Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien. Two additional withdrawal options resulted from the commissioner’s 2011 fresh start initiative. You will.

What is IRS Form 668 Z? Global Gate IRS Tax Relief

Partial certificate of release of federal tax lien: Web double check all the fillable fields to ensure full accuracy. This can be a very difficult to language translator }appointment pay by credit card pay by ach, e check or bank draft the rescue squad for troubled and overtaxed taxpayers ph: Web the irs will record form 668 (z), certificate of.

Utilize The Sign Tool To Add And Create Your Electronic Signature To Signnow The Form 668Z.

Certificate of release of federal estate tax lien under. Two additional withdrawal options resulted from the commissioner’s 2011 fresh start initiative. Partial certificate of release of federal tax lien: At a minimum, search your records using the taxpayer’s name, address, and identifying number(s) shown on this form.

Press Done After You Finish The Form.

Web the irs will record form 668 (z), certificate of release of federal tax lien, as public record. You will receive a copy along with notice 48, instructions for the certificate of release of federal tax lien, once your nftl has been released after full payment. Now you'll be able to print, save, or share the document. Web the document used to release a lien is form 668 (z), certificate of release of federal tax lien.

This Can Be A Very Difficult To Language Translator }Appointment Pay By Credit Card Pay By Ach, E Check Or Bank Draft The Rescue Squad For Troubled And Overtaxed Taxpayers Ph:

When a lien is satisfied or otherwise discharged, the taxpayer receives form 668z, certificate of release of federal tax lien. Web double check all the fillable fields to ensure full accuracy. Make a reasonable effort to identify all property and rights to property belonging to this person. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf and the video lien notice withdrawal.