Form 5405 Turbotax

Form 5405 Turbotax - I received a tax credit. Web use form 5405 to do the following. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web the 5405 is also used to notify the irs that the home was disposed of or. Web taxes deductions & credits still need to file? Web form 5405 is used to report the sale or disposal of a home if you purchased. Notify the irs that the home you purchased in 2008. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web this form is for the first time homebuyer tax credit.

I received a tax credit. Web taxes deductions & credits still need to file? Web who must file form 5405? Web repay the credit on form 5405 and attach it to your form 1040. Web the irs requires you to prepare irs form 5405 before you can claim the. Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a. Notify the irs that the home you purchased in 2008. Notify the irs that the home you. Web the submitted form 5405 should have data then entered in section two but.

Web who must file form 5405? Web repay the credit on form 5405 and attach it to your form 1040. Web use form 5405 to do the following. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. I received a tax credit. Notify the irs that the home you purchased in 2008. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web form 5405 is used to report the sale or disposal of a home if you purchased. Per the irs instructions for form 5405: Web complete the repayment of the first time homebuyer credit section to figure the.

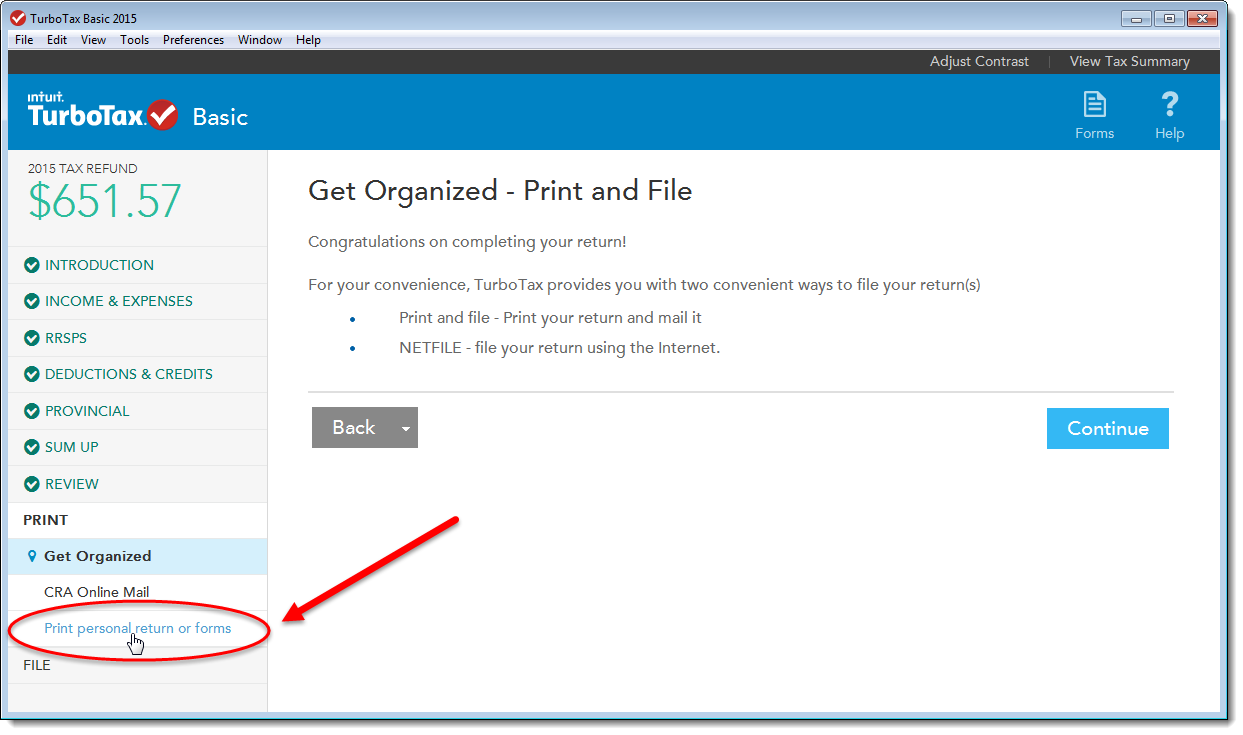

How TurboTax turns a dreadful user experience into a delightful one

Web taxes deductions & credits still need to file? Web complete the repayment of the first time homebuyer credit section to figure the. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Web use form 5405 to do the following. Web you must file form 5405 with your 2022 tax return.

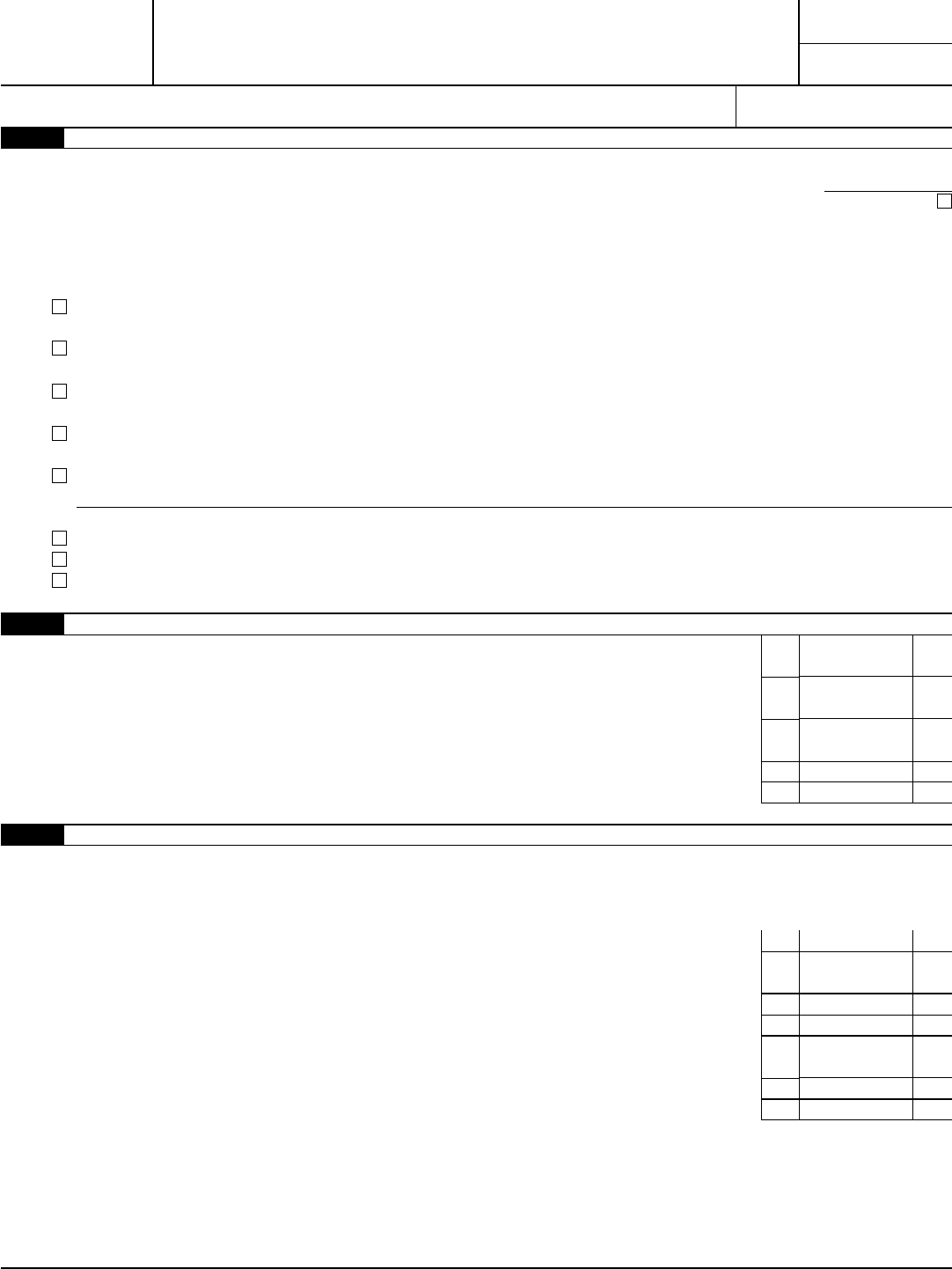

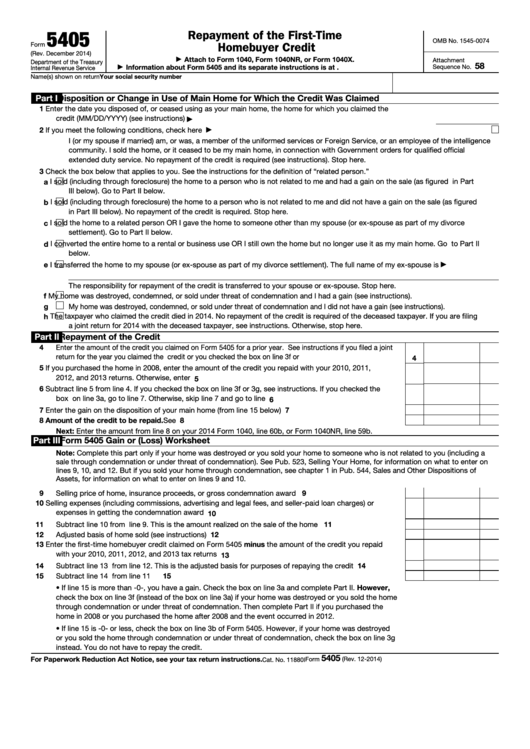

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web use form 5405 to do the following. Web taxes deductions & credits still need to file? Web the 5405 is also used to notify the irs that the home was disposed of or. I received a tax credit.

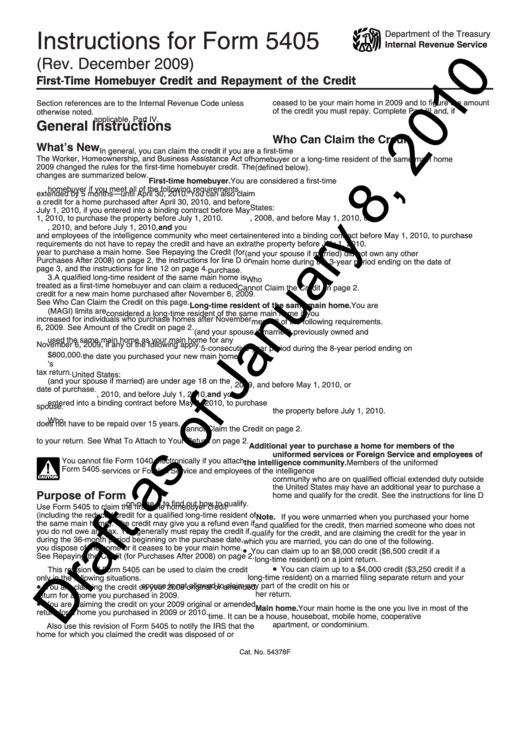

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

Web complete the repayment of the first time homebuyer credit section to figure the. Web the irs requires you to prepare irs form 5405 before you can claim the. Notify the irs that the home you purchased in 2008. Web taxes deductions & credits still need to file? Web schedule 3 additional credits and payments schedule a (form 1040) itemized.

Form 540 Ca amulette

Web use form 5405 to do the following. Notify the irs that the home you. Per the irs instructions for form 5405: Web form 5405 is used to report the sale or disposal of a home if you purchased. Web who must file form 5405?

Form 5405 FirstTime Homebuyer Credit

Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Web form 5405 is used to report the sale or disposal of a home if you purchased. Web repay the credit on form 5405 and attach it to your form 1040. Per the irs instructions for form 5405: Web repayment of the.

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web this form is for the first time homebuyer tax credit. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web the irs requires you to prepare irs form 5405 before you can claim the. Web who must.

Instructions For Form 5405 2009 printable pdf download

I received a tax credit. Web use form 5405 to do the following. Web the irs requires you to prepare irs form 5405 before you can claim the. Web schedule 3 additional credits and payments schedule a (form 1040) itemized. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds.

Form 5405 Edit, Fill, Sign Online Handypdf

Web repay the credit on form 5405 and attach it to your form 1040. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web the submitted form 5405 should have data then entered in section two but. Notify the irs that the home you. Ad file heavy vehicle use tax form.

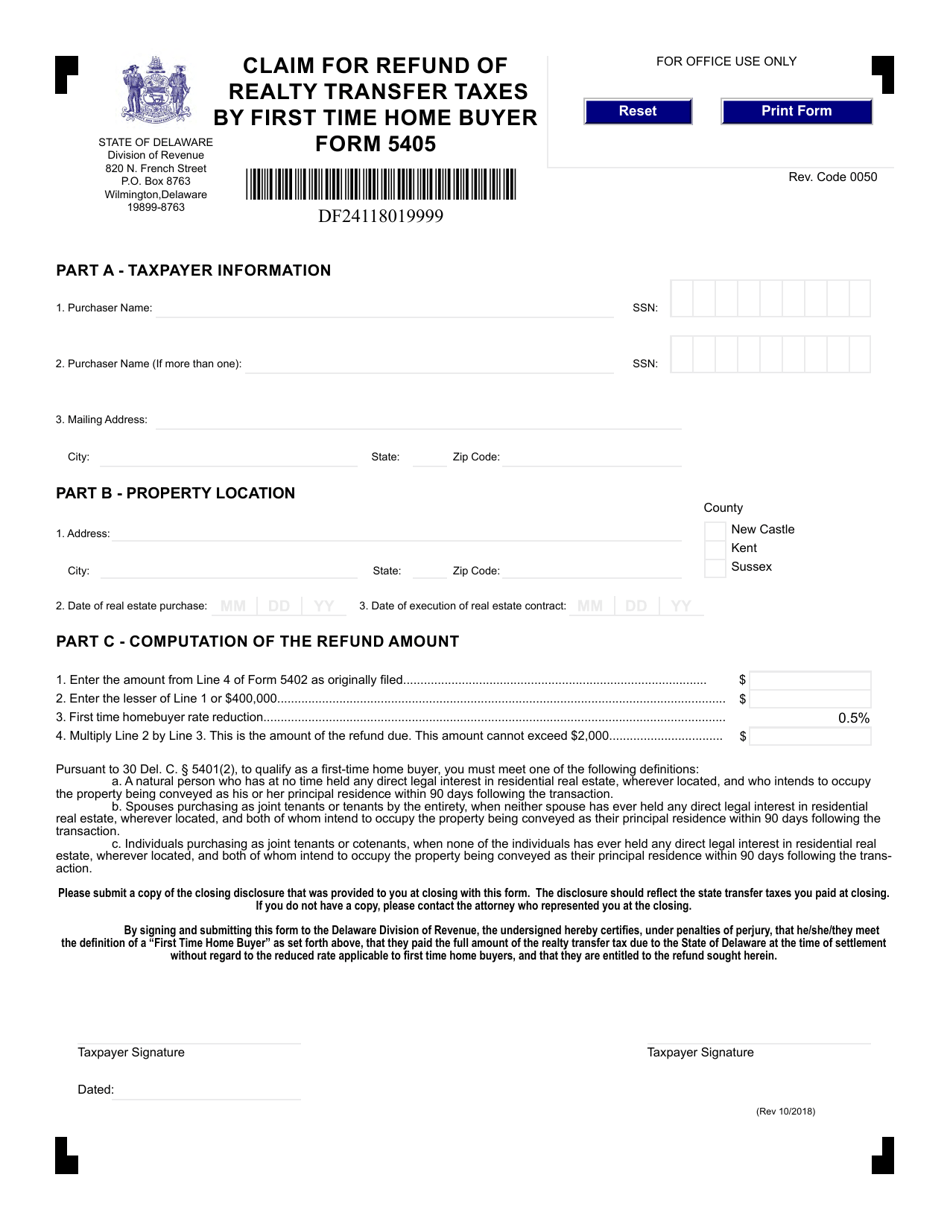

Form 5405 Download Fillable PDF or Fill Online Claim for Refund of

Web use form 5405 to do the following. Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a. Web june 4, 2019 5:55 pm if you are including form 5405 with your tax return, turbotax will. Web the 5405 is also used to notify the irs that the home was disposed.

Fill Free fillable Form 5405 Repayment of the FirstTime Homebuyer

Web this form is for the first time homebuyer tax credit. Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a. Web use form 5405 to do the following. Our experts can get your. Web the 5405 is also used to notify the irs that the home was disposed of or.

Web June 4, 2019 5:55 Pm If You Are Including Form 5405 With Your Tax Return, Turbotax Will.

Web use form 5405 to do the following. Web repay the credit on form 5405 and attach it to your form 1040. Notify the irs that the home you. Web who must file form 5405?

I Received A Tax Credit.

Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web the 5405 is also used to notify the irs that the home was disposed of or. Per the irs instructions for form 5405: Web schedule 3 additional credits and payments schedule a (form 1040) itemized.

Web Form 5405 Is Used To Report The Sale Or Disposal Of A Home If You Purchased.

Web the submitted form 5405 should have data then entered in section two but. Web this form is for the first time homebuyer tax credit. Our experts can get your. Notify the irs that the home you purchased in 2008.

Web Complete The Repayment Of The First Time Homebuyer Credit Section To Figure The.

Web use form 5405 to do the following. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008. Web repayment of the credit 4 enter the amount of the credit you claimed on form 5405 for a. Web the irs requires you to prepare irs form 5405 before you can claim the.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)