Form 5405 Lookup

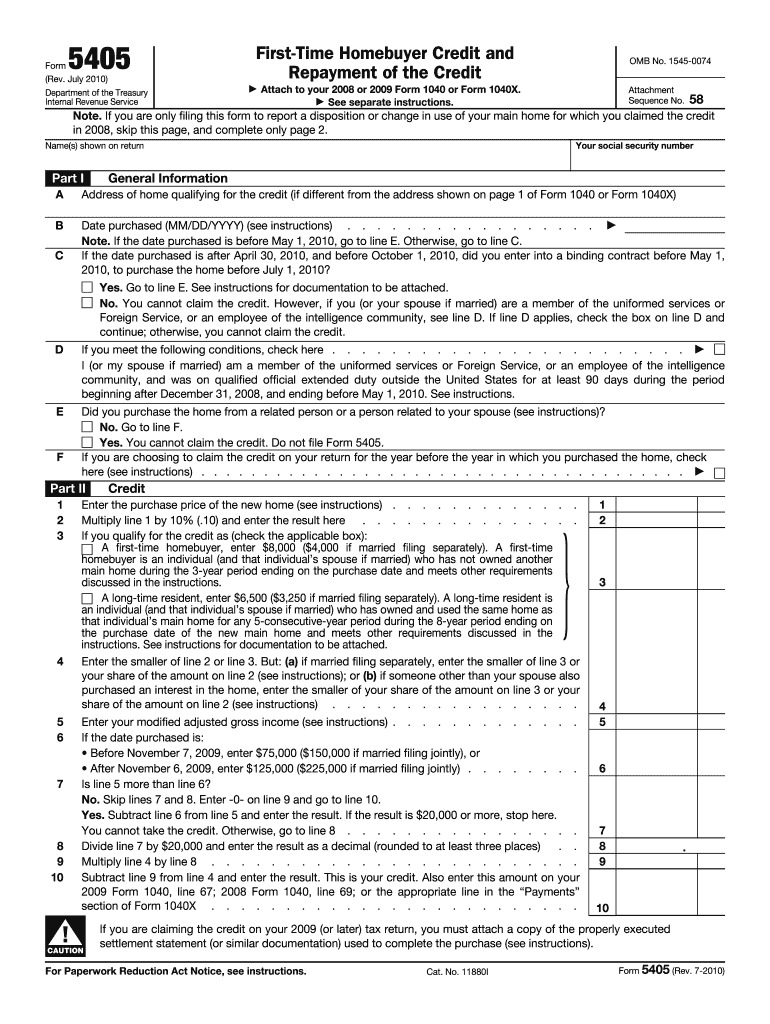

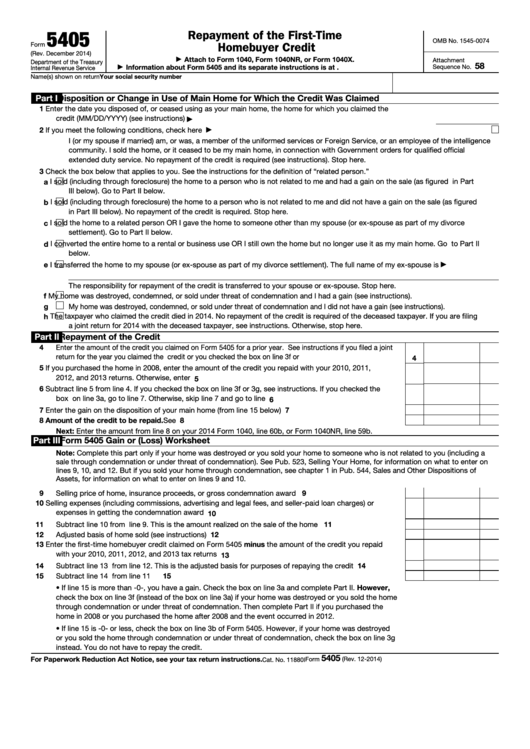

Form 5405 Lookup - See instructions if you filed a joint return for the year you claimed the credit or you checked the box on. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. The form is used for the credit received if you bought a. Web enter the amount of the credit you claimed on form 5405 for a prior year. Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. If mfj, and the spouse must also repay. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. Use form 5405 to do the following. Enter half of the amount in prior year installments.

Repayment of prior year credit section. The taxpayer who claimed the. If you are repaying the credit on. In an effort to stimulate the economy, the federal government. Use form 5405 to do the following. November 2020) department of the treasury internal revenue service. Web click here to look up the remaining credit. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. If mfj, and the spouse must also repay. Web enter the amount of the credit you claimed on form 5405 for a prior year.

Enter half of the amount in prior year installments. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on. Web purpose of form. If you are repaying the credit on. Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. Web click either form 5405 if you disposed of the home or ceased using the home as your main home in 2020 or worksheet if you need to make the annual repayment and the home is. Repayment of prior year credit subsection. Notify the irs that the home you purchased in 2008 and for which you claimed the credit was disposed of or. Repayment of prior year credit section. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax.

FIA Historic Database

Use form 5405 to do the following. Repayment of prior year credit section. Web 4 enter the amount of the credit you claimed on form 5405 for a prior year. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. In an effort to stimulate the economy, the federal government.

O.C. Real Estate Notes On Tax Credit Extension

Part iii form 5405 gain or (loss) worksheet. Enter half of the amount in prior year installments. Get ready for tax season deadlines by completing any required tax forms today. In an effort to stimulate the economy, the federal government. Repayment of prior year credit section.

Fillable Form 5405 Repayment Of The FirstTime Homebuyer Credit

See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line. Web if you made a qualifying home purchase in 2008 and owned and used the home as a principal residence in all of 2022, you must enter the additional federal income tax on. Web purpose of form. To.

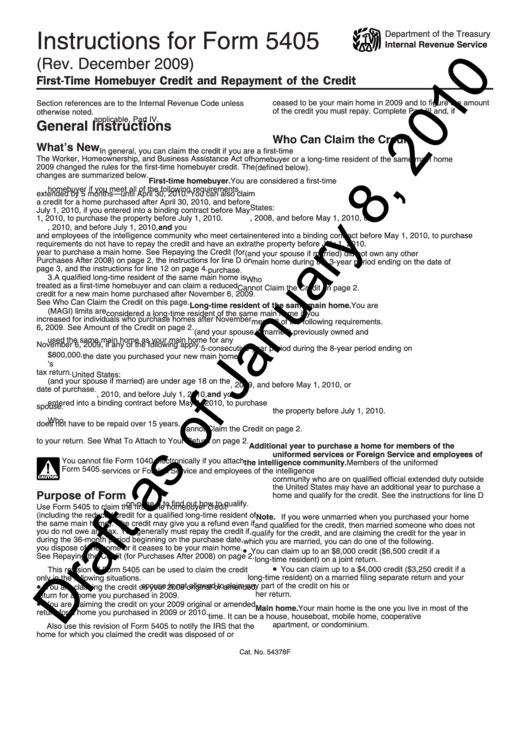

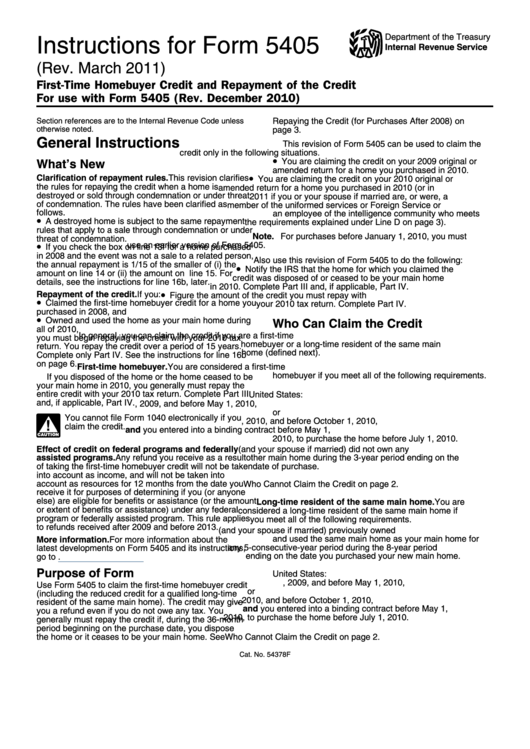

Instructions For Form 5405 (Rev. March 2011) printable pdf download

Web click here to look up the remaining credit. November 2020) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. Web if you made a qualifying home.

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. To complete form 5405 due to the disposition of the home or due to it no longer being the main home, from the main menu of the tax. Use form 5405 to do the following. Complete, edit or print tax forms instantly. Repayment.

Instructions For Form 5405 Draft (Rev. December 2011) printable pdf

Web click either form 5405 if you disposed of the home or ceased using the home as your main home in 2020 or worksheet if you need to make the annual repayment and the home is. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. Complete, edit or print tax forms instantly..

Form 5405 YouTube

Web click either form 5405 if you disposed of the home or ceased using the home as your main home in 2020 or worksheet if you need to make the annual repayment and the home is. If you are repaying the credit on. Notify the irs that the home you purchased in 2008 and for which you claimed the credit.

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

The form is used for the credit received if you bought a. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. In an effort to stimulate the economy, the federal government.

Form 5405 Fill Out and Sign Printable PDF Template signNow

If mfj, and the spouse must also repay. Get ready for tax season deadlines by completing any required tax forms today. Web 4 enter the amount of the credit you claimed on form 5405 for a prior year. Web click here to look up the remaining credit. If you are repaying the credit on.

Instructions For Form 5405 2009 printable pdf download

Easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the. Repayment of prior year credit section. If mfj, and the spouse must also repay. In an effort to stimulate the economy, the federal government. Web click here to look up the remaining credit.

Enter Half Of The Amount In Original Credit.

My home was destroyed, condemned, or sold under threat of condemnation and i didn’t have a gain. Part iii form 5405 gain or (loss) worksheet. Repayment of prior year credit subsection. Repayment of prior year credit section.

In An Effort To Stimulate The Economy, The Federal Government.

Use form 5405 to do the following. The taxpayer who claimed the. Complete, edit or print tax forms instantly. Web click here to look up the remaining credit.

Web Click Either Form 5405 If You Disposed Of The Home Or Ceased Using The Home As Your Main Home In 2020 Or Worksheet If You Need To Make The Annual Repayment And The Home Is.

Web 4 enter the amount of the credit you claimed on form 5405 for a prior year. November 2020) department of the treasury internal revenue service. Enter half of the amount in prior year installments. See instructions if you filed a joint return for the year you claimed the credit or you checked the box on line.

Web Enter The Amount Of The Credit You Claimed On Form 5405 For A Prior Year.

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. If you are repaying the credit on. Easily track repayment of the home buyer’s tax credit by entering data into form 5405 on the. If mfj, and the spouse must also repay.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)