Form 5227 Extension

Form 5227 Extension - Used to report information on. Web tax exempt bonds. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. Web go to www.irs.gov/form5227 for instructions and the latest information. Charitable lead trusts will usually not generate. Extension form 8868 for form 5227 can be electronically filed. Web screen 48.1, form 5227; Select the pin authorization indicator, and then. Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts.

Income tax return for estates and trusts; 5227 (2022) form 5227 (2022) page. Web go to www.irs.gov/form5227 for instructions and the latest information. Select the pin authorization indicator, and then. Web tax exempt bonds. Web common questions about form 5227 in lacerte. Used to report information on. Information return trust accumulation of charitable amounts. Select the links below to see solutions for frequently asked questions concerning form 5227. Web is there an extension?

5227 (2022) form 5227 (2022) page. Web common questions about form 5227 in lacerte. Web screen 48.1, form 5227; 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. These types of trusts file. Form 5227 faqs the following includes answers to. Extension form 8868 for form 5227 can be electronically filed. Web is there an extension? Used to report information on.

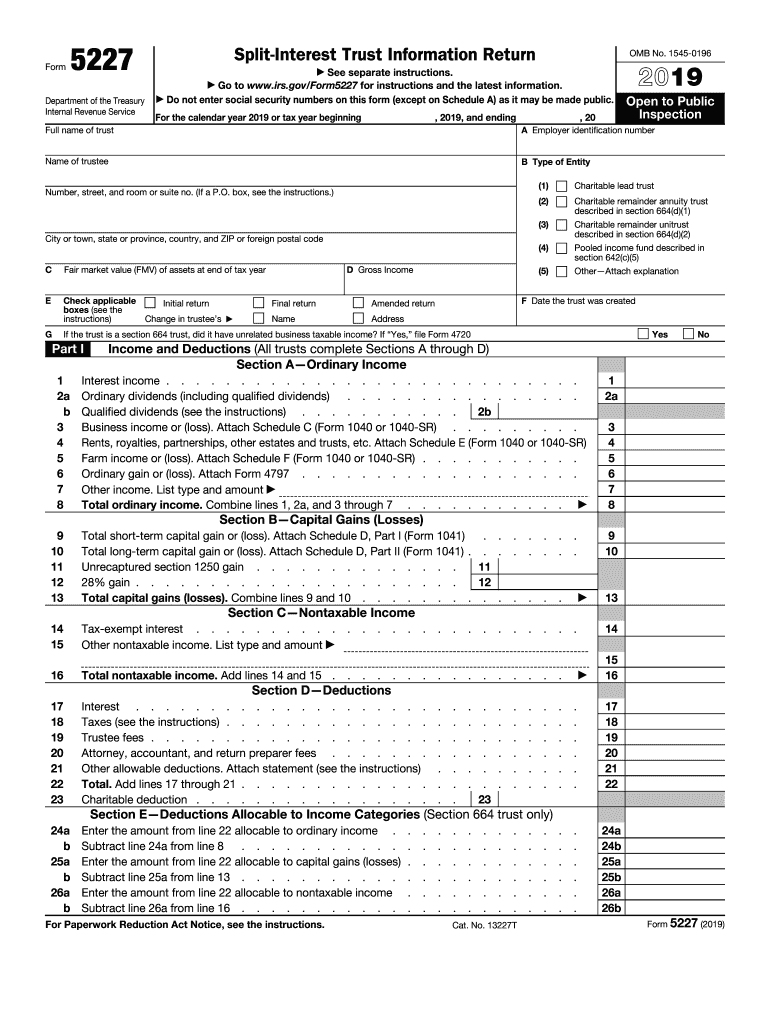

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Information return trust accumulation of charitable amounts. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Extension form 8868 for form 5227 can be electronically filed. Used to report information on. Select the pin authorization indicator, and then.

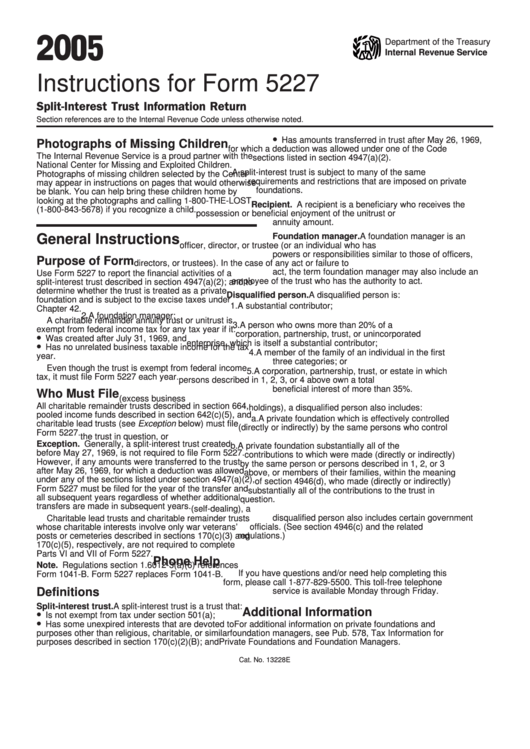

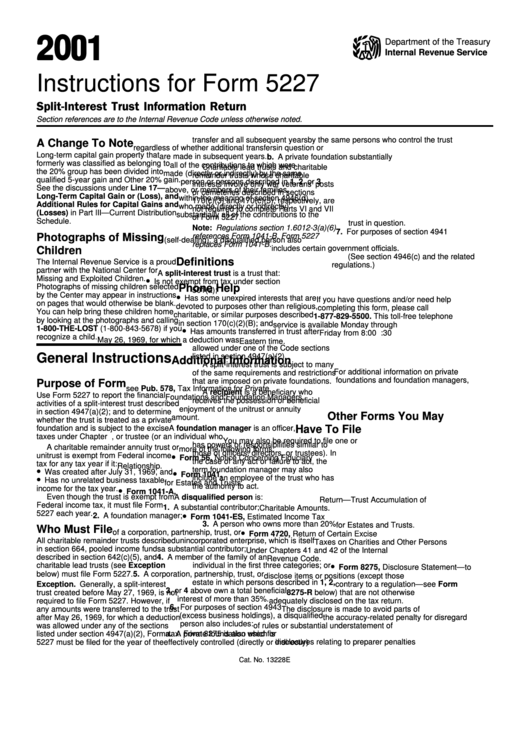

Instructions For Form 5227 printable pdf download

Web go to www.irs.gov/form5227 for instructions and the latest information. Charitable lead trusts will usually not generate. Web use form 5227 to: Form 1041 may be electronically filed, but form 5227 must be filed on paper. Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts.

Fill Free fillable F5227 2019 Form 5227 PDF form

Do not enter social security numbers on this form (except on schedule a) as it may be made public. The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. These types of trusts file. You can download or print. Code notes (a) general rule the secretary may grant a reasonable.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Form 5227 faqs the following includes answers to. Income tax return for estates and trusts; For calendar year 2022, file form 5227 by april 18, 2023. Web use form 5227 to:

Fill Free fillable F5227 2019 Form 5227 PDF form

Select the links below to see solutions for frequently asked questions concerning form 5227. You can download or print. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Extension form 8868 for form 5227 can be electronically filed. Web is there an extension?

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web screen 48.1, form 5227; There are two different scenarios that need to be reviewed: Extension form 8868 for form 5227 can be electronically filed. Form 5227 faqs the following includes answers to.

Instructions For Form 5227 printable pdf download

There are two different scenarios that need to be reviewed: Select the pin authorization indicator, and then. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts. Information return trust accumulation of charitable amounts.

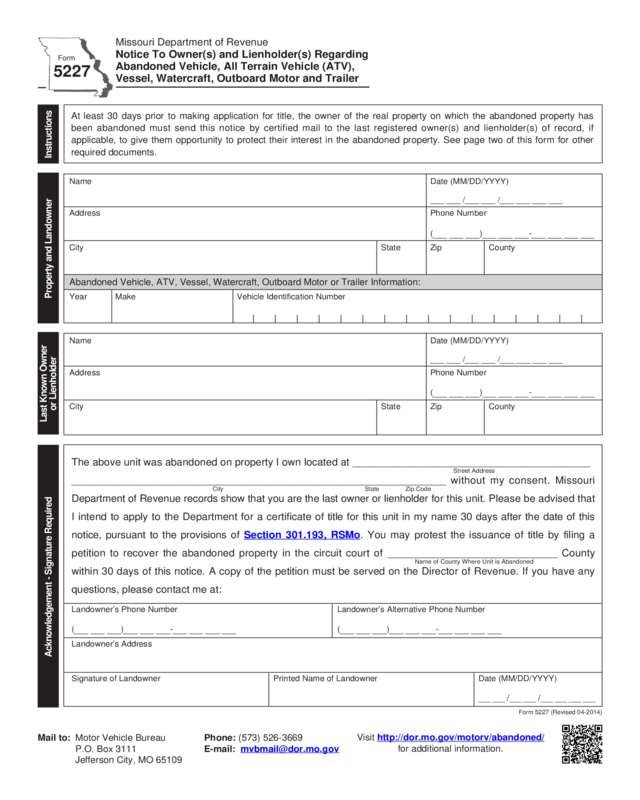

Form 5227 Missouri Department Of Revenue Edit, Fill, Sign Online

Web common questions about form 5227 in lacerte. Form 1041 may be electronically filed, but form 5227 must be filed on paper. Code notes (a) general rule the secretary may grant a reasonable extension of time for filing any return, declaration, statement, or other document required by this title or by. Web use form 5227 to: Information return trust accumulation.

Instructions For Form 5227 printable pdf download

Information return trust accumulation of charitable amounts. Web use form 5227 to: Form 5227 faqs the following includes answers to. Select the links below to see solutions for frequently asked questions concerning form 5227. There are two different scenarios that need to be reviewed:

Instructions For Form 5227 printable pdf download

2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web is there an extension? The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Information return trust accumulation of charitable amounts. Income tax return for estates and trusts;

These Types Of Trusts File.

For calendar year 2022, file form 5227 by april 18, 2023. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Do not enter social security numbers on this form (except on schedule a) as it may be made public.

Extension Form 8868 For Form 5227 Can Be Electronically Filed.

Web the program only calculates form 5227 for charitable remainder trusts and won't compute for charitable lead trusts. You can download or print. Form 5227 faqs the following includes answers to. Web is there an extension?

Web Use Form 5227 To:

The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of. Charitable lead trusts will usually not generate. There are two different scenarios that need to be reviewed: Web tax exempt bonds.

Code Notes (A) General Rule The Secretary May Grant A Reasonable Extension Of Time For Filing Any Return, Declaration, Statement, Or Other Document Required By This Title Or By.

Web screen 48.1, form 5227; Used to report information on. Information return trust accumulation of charitable amounts. Select the pin authorization indicator, and then.