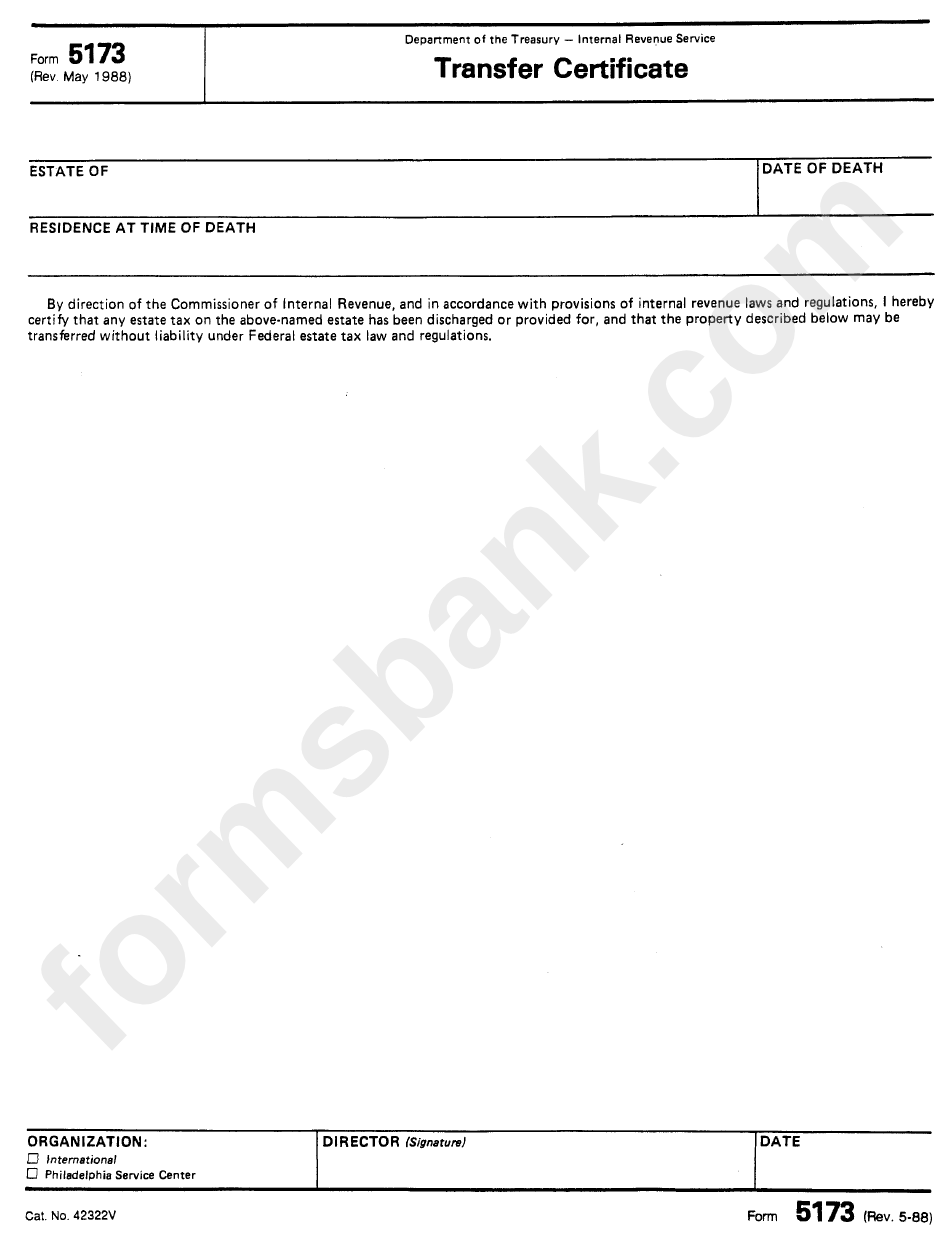

Form 5173 Irs

Form 5173 Irs - Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Introduction to irs transfer certificate and form 706 na Web income tax return, each member of the controlled group must file form 5713 separately. Persons having operations in or related to countries that require participation in or. Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. Web form 5173 is required when a deceased nonresident has u.s. Web read your notice carefully. A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web read your notice carefully. Web form 5173 is required when a deceased nonresident has u.s. It will explain how much you owe and how to pay it. Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Web to request a transfer certificate for an estate of a nonresident citizen of the united states. Form 5713 is used by u.s. A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states.

A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply. Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. (form 706na and form 5173) watch on in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web information about form 5713, international boycott report, including recent updates, related forms and instructions on how to file. Web read your notice carefully. Persons having operations in or related to countries that require participation in or. The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a

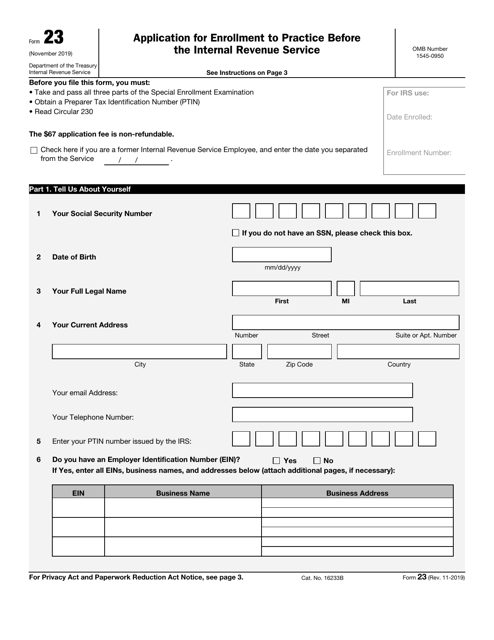

IRS Form 23 Download Fillable PDF or Fill Online Application for

Introduction to irs transfer certificate and form 706 na Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Get everything done in minutes. Web form 5173 is required when a deceased nonresident has u.s. (form 706na and form 5173) watch on in this article, we’ll explore obtaining the.

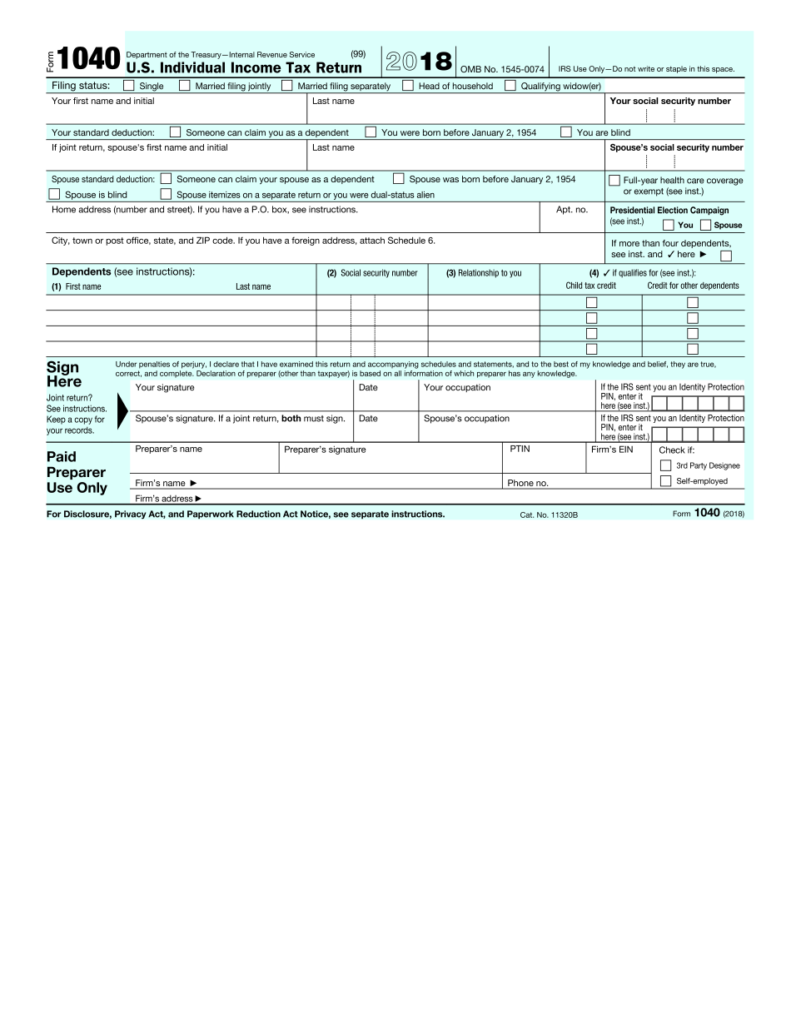

IRS 1040 Form Fillable Printable In PDF 2021 Tax Forms 1040 Printable

Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to request a transfer certificate for an estate of.

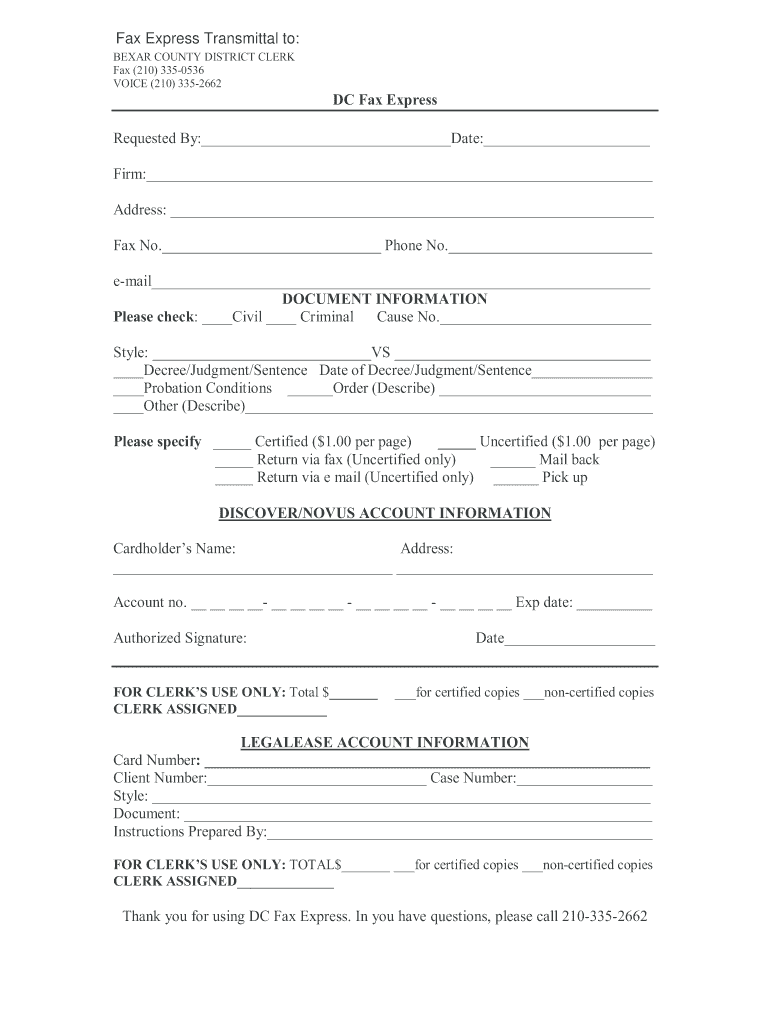

The Process of Obtaining a Federal Transfer Certificate from the IRS

Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Web to request a transfer certificate for an estate of a nonresident citizen of the united states. What is a form 5173? Web form 5173 is required when a.

Form 5173 PDF Fill Out and Sign Printable PDF Template signNow

Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. If you receive income unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Web typically after 9 months you can request an estate tax closing letter, an account.

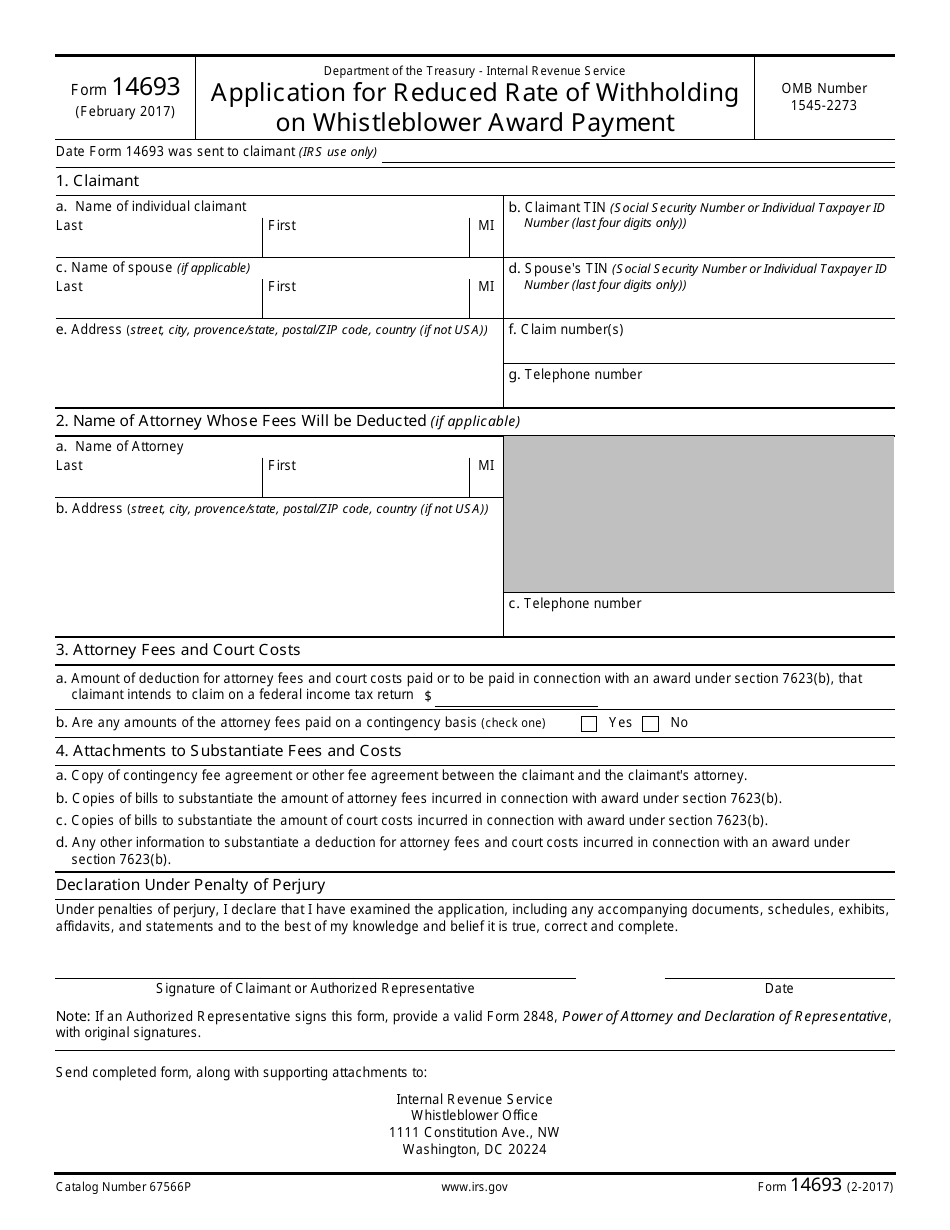

IRS Form 14693 Download Fillable PDF or Fill Online Application for

Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. (form 706na and form 5173) watch on in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. A member of a controlled group (as defined.

Form 5173 Transfer Certificate Form Inernal Revenue Service

A member of a controlled group (as defined in section 993(a)(3)) is not required to file form 5713 if all of the following conditions apply. Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. Get everything done in minutes. Web form 5173 is required when a.

EDGAR Filing Documents for 000119312516456864

Web income tax return, each member of the controlled group must file form 5713 separately. Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. Persons having operations in or related to countries that require participation in or. If you receive income unevenly during the year, you may be able to.

form 5173 Fill Online, Printable, Fillable Blank form706

The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a Custodian in order for them to release the. Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Use form 2220, underpayment of estimated tax by..

LOGO

Form 5713 is used by u.s. Web income tax return, each member of the controlled group must file form 5713 separately. Persons having operations in or related to countries that require participation in or. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided.

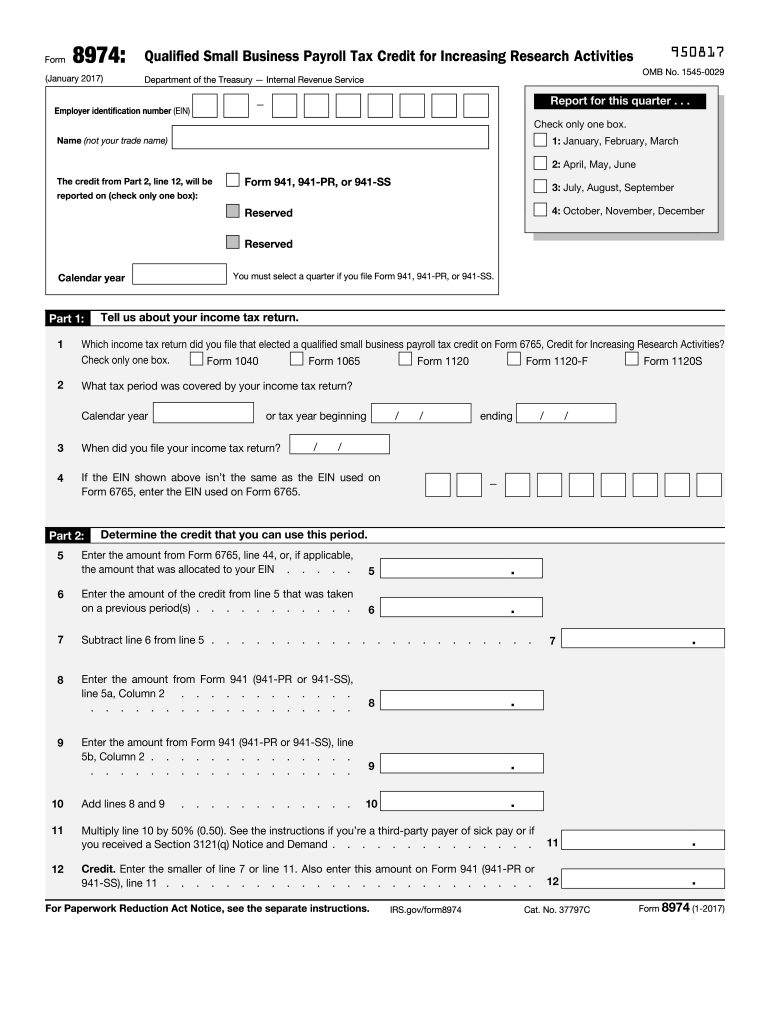

IRS 8974 2017 Fill and Sign Printable Template Online US Legal Forms

Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Web typically after 9 months you can request an estate tax closing letter, an account transcript and a transcript of the tax return. The executor of the person's estate must provide form 5173 to a u.s. Simply stated, it.

The Executor Of The Person's Estate Must Provide Form 5173 To A U.s.

The member has no operations in or related to a boycotting country (or with the government, a company, or a national of a Web to request a transfer certificate for an estate of a nonresident not a citizen of the united states. If you receive income unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Web income tax return, each member of the controlled group must file form 5713 separately.

Introduction To Irs Transfer Certificate And Form 706 Na

Custodian in order for them to release the. It will explain how much you owe and how to pay it. Get everything done in minutes. Use form 2220, underpayment of estimated tax by.

Web Information About Form 5713, International Boycott Report, Including Recent Updates, Related Forms And Instructions On How To File.

What is a form 5173? Simply stated, it is an irs issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. Pay the amount you owe by the due date on the notice. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for.

Form 5713 Is Used By U.s.

(form 706na and form 5173) watch on in this article, we’ll explore obtaining the irs transfer certificate and explain how form 706na and form 5173 apply to these cases. Web filing form 706 na to secure an irs transfer certificate form 5173 how do i get an irs transfer certificate? Web to request a transfer certificate for an estate of a nonresident citizen of the united states. A transfer certificate will be issued by the service when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for.