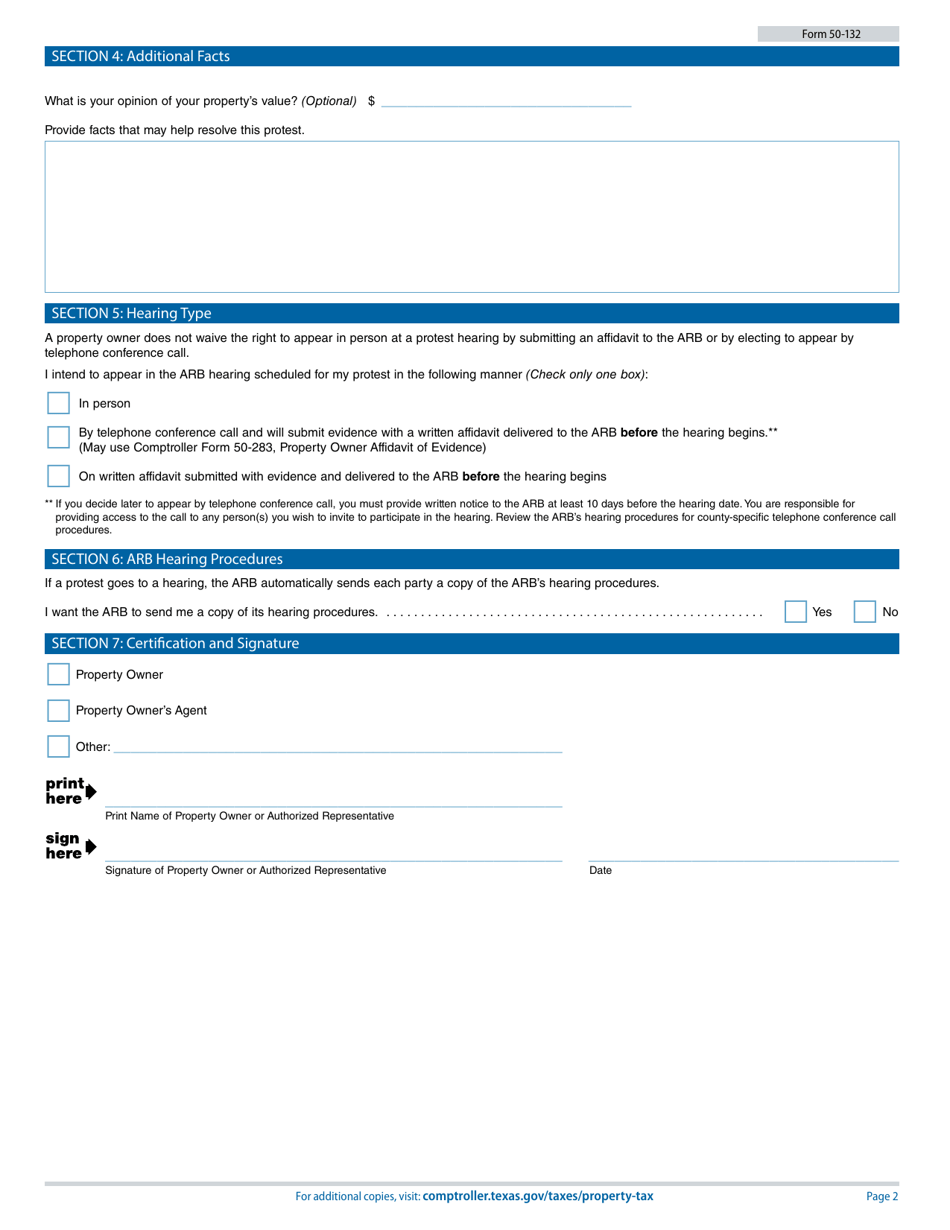

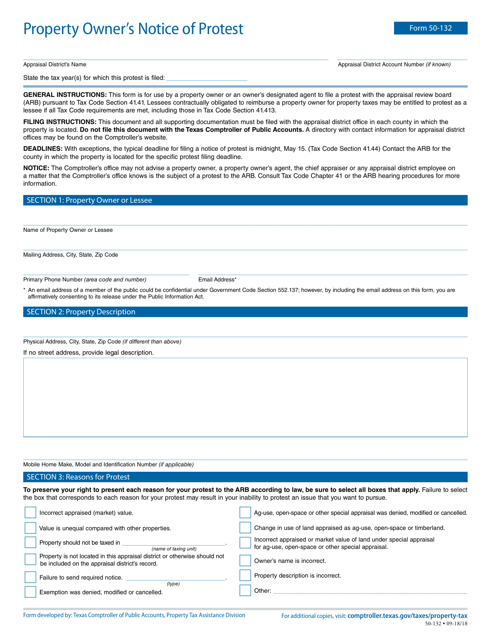

Form 50 132

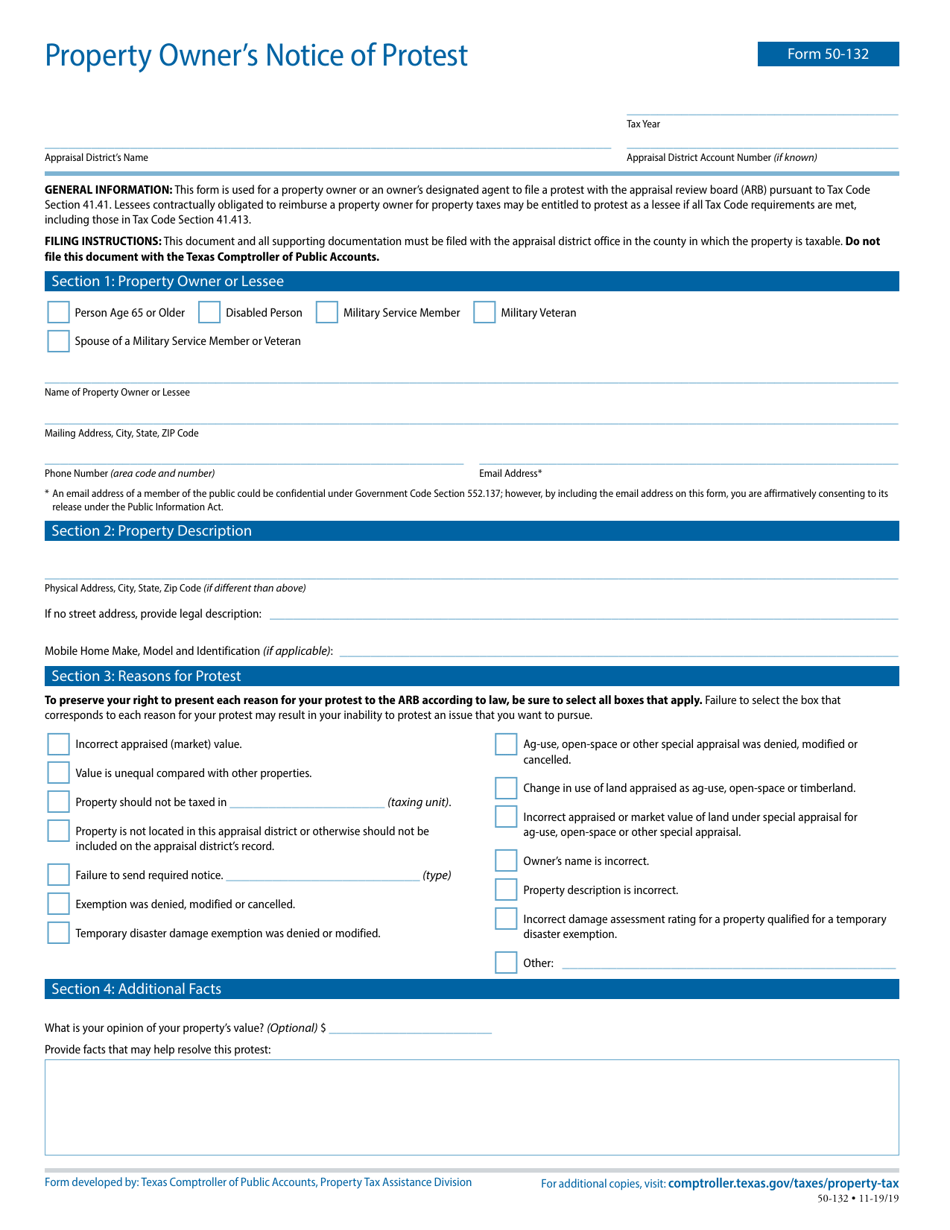

Form 50 132 - A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. Web property tax protest and appeal procedures. (1) was not intentional or the result of conscious indifference; • the appraised (market) value of your property; A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. You may follow these appeal procedures if you have a concern about: A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. Property owners have the right to protest actions concerning their property tax appraisals. Property tax protest and appeal procedures. And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.”

And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.” This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district responsible for appraising the owner’s property and have the appraisal review board (arb) hear and decide the matter. (1) was not intentional or the result of conscious indifference; Property owners have the right to protest actions concerning their property tax appraisals. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. You may follow these appeal procedures if you have a concern about: • the appraised (market) value of your property; Property tax protest and appeal procedures. Web property tax protest and appeal procedures.

In most cases, you have until may 15 or 30 days from the date the appraisal district notice is delivered — whichever date is later. And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.” • the appraised (market) value of your property; A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district responsible for appraising the owner’s property and have the appraisal review board (arb) hear and decide the matter. Property owners have the right to protest actions concerning their property tax appraisals. Web property tax protest and appeal procedures. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. You may follow these appeal procedures if you have a concern about:

Form 50132 Download Fillable PDF or Fill Online Property Owner's

• the appraised (market) value of your property; This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district responsible for appraising the owner’s property and have the appraisal review board (arb) hear and decide the matter. You may follow these appeal procedures if you have.

Form 50132 Download Fillable PDF or Fill Online Property Owner's

A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.” A property owner or an owner’s designated agent can use this form.

Form 50 114 20202021 Fill and Sign Printable Template Online US

• the appraised (market) value of your property; (1) was not intentional or the result of conscious indifference; Property tax protest and appeal procedures. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated agent can use.

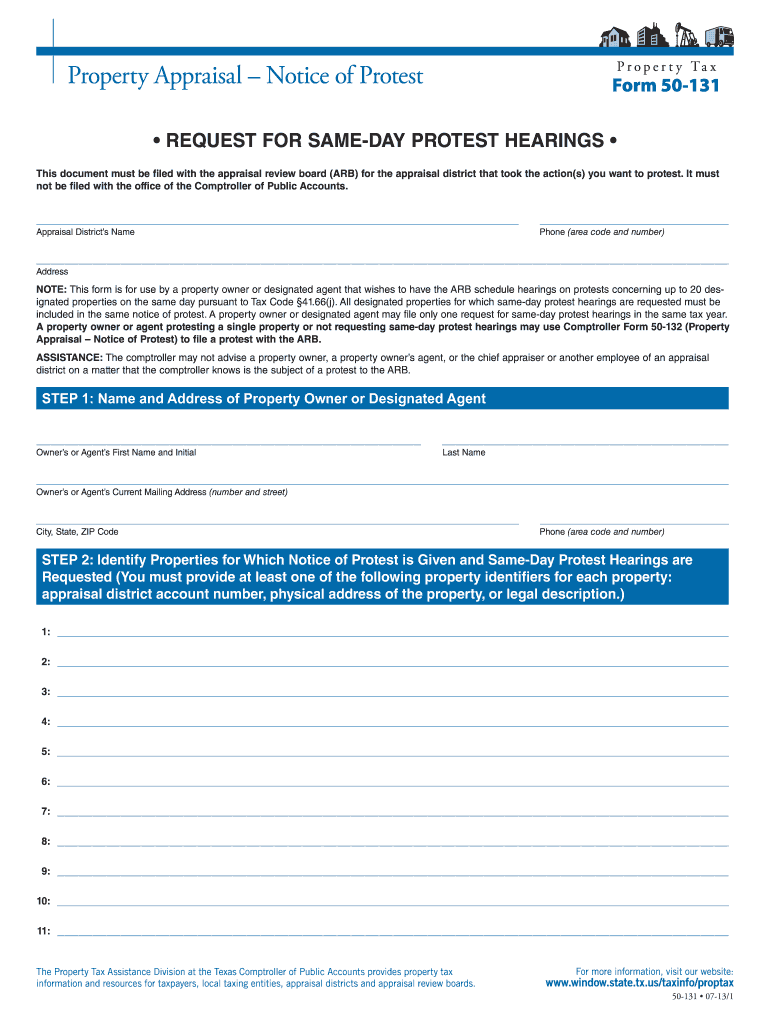

Comptroller Texas Gov Forms 50 131 Pdf Fill Out and Sign Printable

• the appraised (market) value of your property; (1) was not intentional or the result of conscious indifference; A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. This form is for use by a property owner or the owner’s designated agent to file.

Contrato de asociación en participación Texas comptroller log in

You may follow these appeal procedures if you have a concern about: A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb).

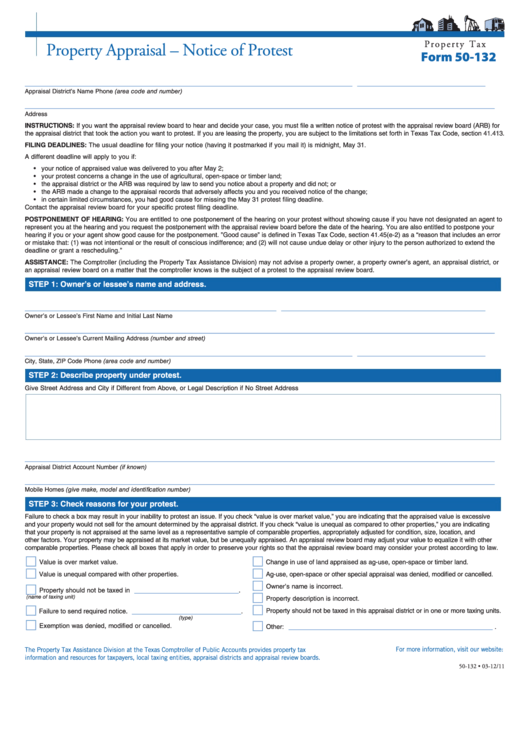

Fillable Form 50132 Property Appraisal Notice Of Protest printable

You may follow these appeal procedures if you have a concern about: Property owners have the right to protest actions concerning their property tax appraisals. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. In most cases, you have until may 15 or.

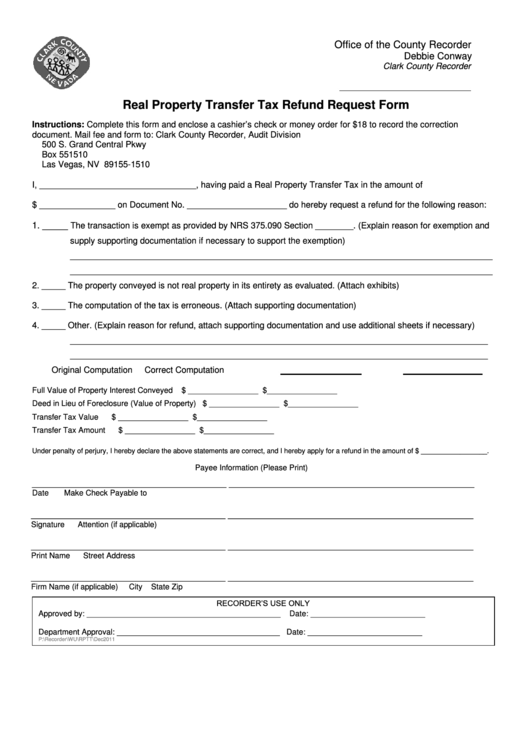

Top 12 Property Tax Refund Form Templates free to download in PDF format

You may follow these appeal procedures if you have a concern about: • the appraised (market) value of your property; This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district responsible for appraising the owner’s property and have the appraisal review board (arb) hear and.

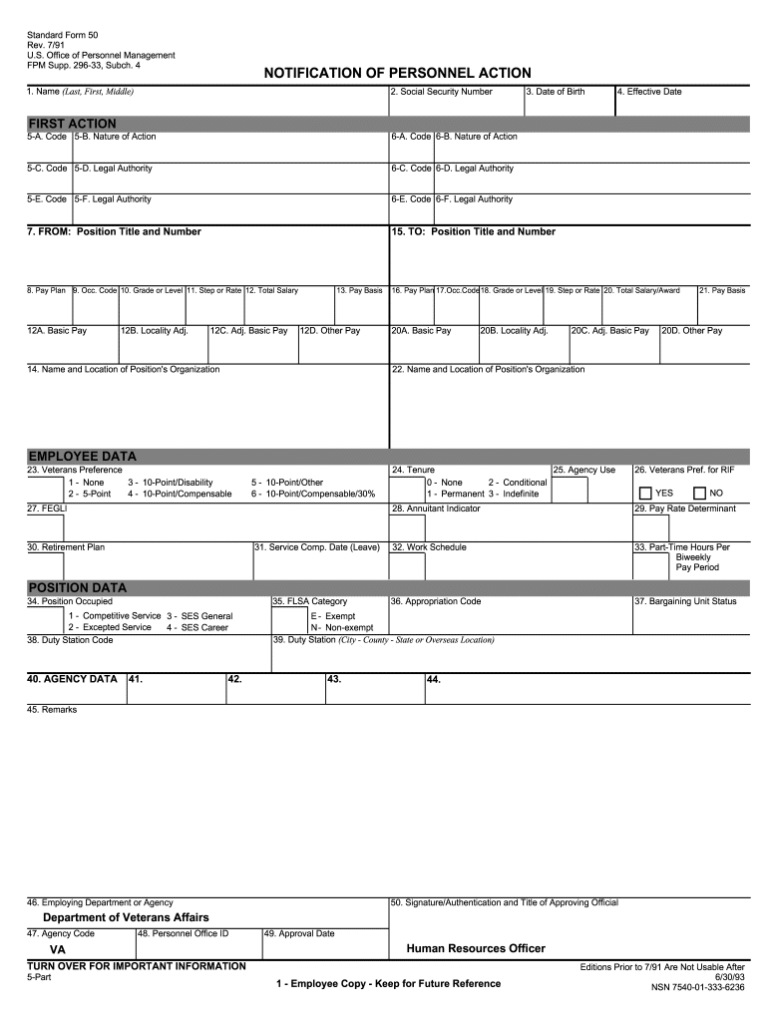

What You Need to Know About Standard Form 50 Minerva Planning Group

• the appraised (market) value of your property; (1) was not intentional or the result of conscious indifference; And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.” This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain.

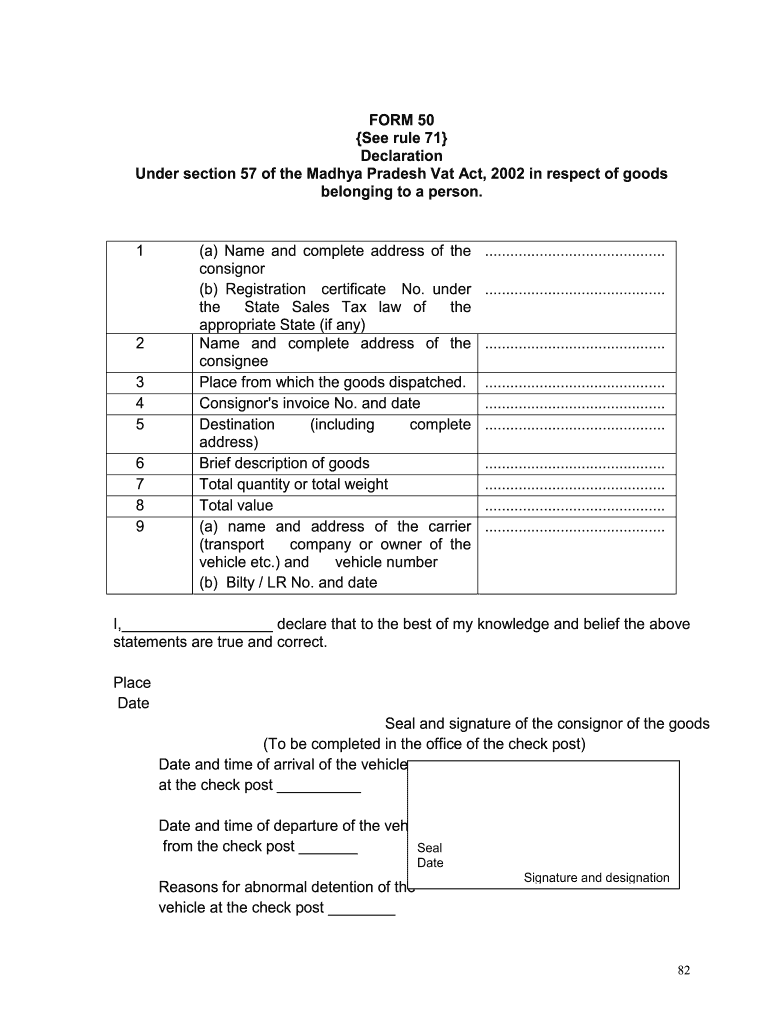

Form 50 Download Fill Online, Printable, Fillable, Blank pdfFiller

• the appraised (market) value of your property; You may follow these appeal procedures if you have a concern about: Web property tax protest and appeal procedures. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated.

Form 50132 Download Fillable PDF or Fill Online Property Owner's

A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. And (2) will not cause undue delay or.

Web Property Tax Protest And Appeal Procedures.

A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. You may follow these appeal procedures if you have a concern about: A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code. • the appraised (market) value of your property;

Property Owners Have The Right To Protest Actions Concerning Their Property Tax Appraisals.

In most cases, you have until may 15 or 30 days from the date the appraisal district notice is delivered — whichever date is later. (1) was not intentional or the result of conscious indifference; And (2) will not cause undue delay or other injury to the person authorized to extend the deadline or grant a rescheduling.” A property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code.

Property Tax Protest And Appeal Procedures.

This form is for use by a property owner or the owner’s designated agent to file a protest regarding certain actions of the appraisal district responsible for appraising the owner’s property and have the appraisal review board (arb) hear and decide the matter.