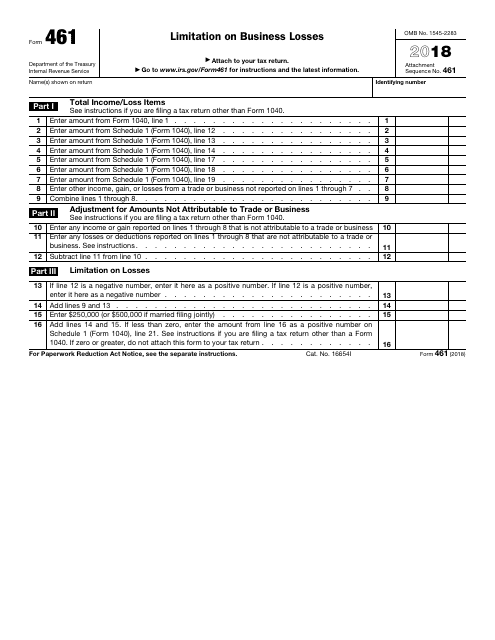

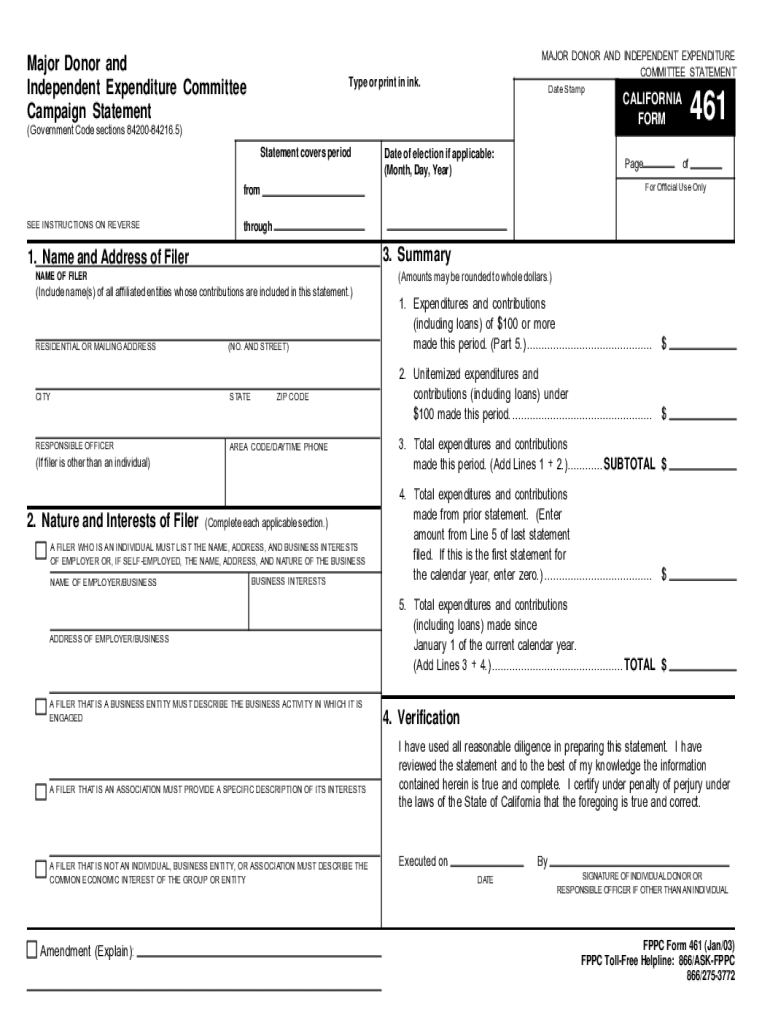

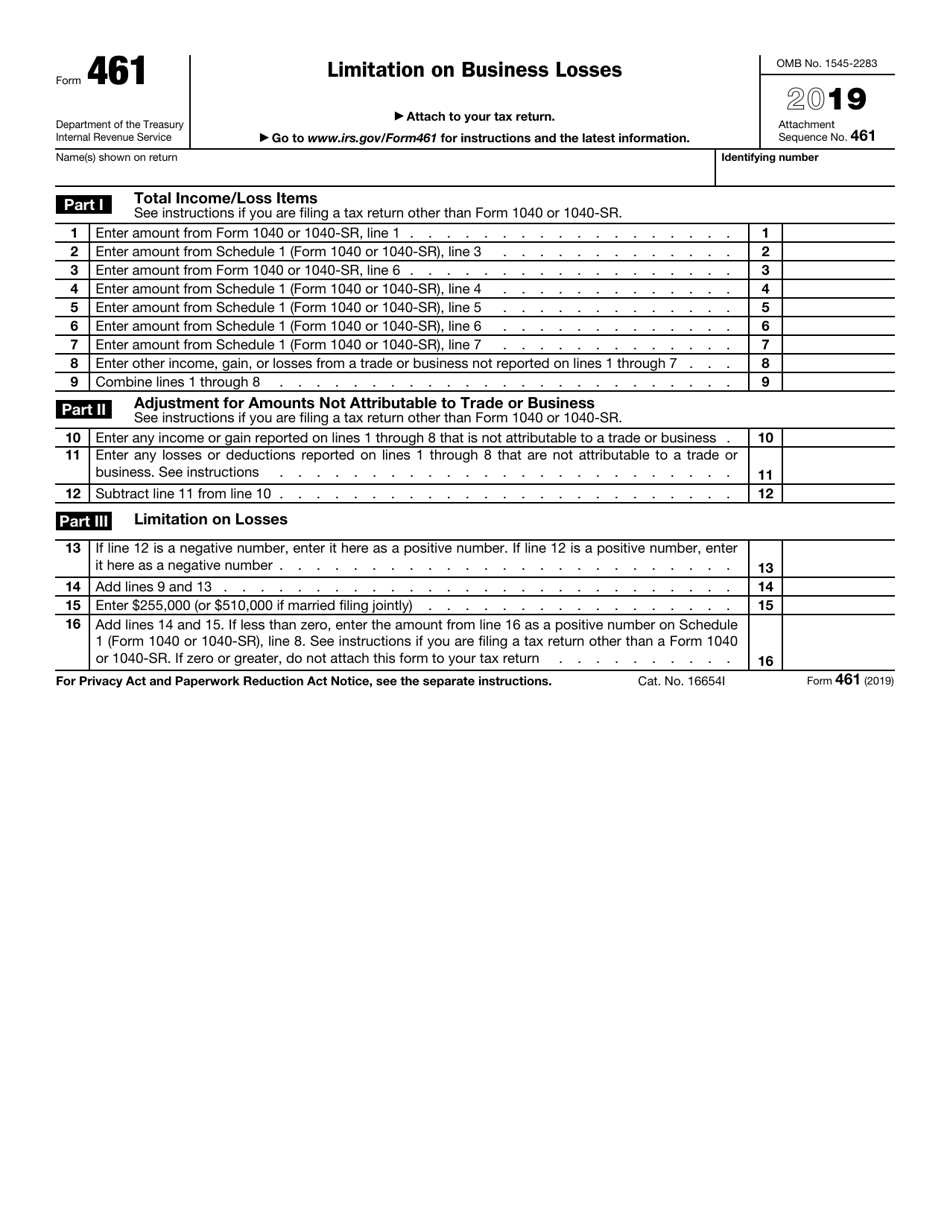

Form 461 Excess Business Loss

Form 461 Excess Business Loss - Web form 461 will be used to determine if there is an excess business loss.the taxpayers cannot deduct an excess business loss in the current year, however, according to the. However, for california purposes, the. Web the tcja amended sec. An excess business loss is the amount by which the total deductions from your trades or businesses are more than your total gross income or. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. 461 (l), should recognize that all of the taxpayer's trades or businesses (of both spouses, in the case of a joint. Part ii adjustment for amounts. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year. 461 to include a subsection (l), which disallows excess business losses of noncorporate taxpayers if the amount of the loss is in.

Web the irs and treasury, in drafting guidance for sec. 461 to include a subsection (l), which disallows excess business losses of noncorporate taxpayers if the amount of the loss is in. Web the tcja amended sec. The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. However, the excess business loss is treated as a net operating loss (nol) carryover. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades. Web about form 461, limitation on business losses. Part ii adjustment for amounts. Taxpayers can not deduct an excess business loss in the current year. Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or.

However, for california purposes, the. Web use form ftb 3461 to compute the excess business loss. However, the excess business loss is treated as a net operating loss (nol) carryover. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Web where to report the excess business loss on your return. 461 (l), should recognize that all of the taxpayer's trades or businesses (of both spouses, in the case of a joint. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year. Web the excess business loss regime—which takes effect again for tax years beginning in 2021—may disallow losses for individuals, trusts, and estates. Web the excess business loss (ebl) limitation, codified in internal revenue code section 461(l), was originally created by the tax cuts and jobs act of 2017 (tcja).

IRS Form 461 Download Fillable PDF or Fill Online Limitation on

The tax cuts and jobs act of 2017 (tcja) added the excess business loss (ebl) limitation under sec 461 (l) applicable to. Web the origins of excess business loss. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. 461 (l), should recognize that all of the taxpayer's trades or businesses.

461 Limitation on Business Losses

An excess business loss is the amount by which the total deductions from your trades or businesses are more than your total gross income or. Web where to report the excess business loss on your return. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total.

Form 461 Instructions Fill Out and Sign Printable PDF Template signNow

Use form ftb 3461 to compute the excess business loss. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. However, the excess business loss is treated as a net operating loss (nol) carryover. Web the tcja amended sec. An excess business loss is the amount by which the total deductions.

Excess Business Loss Limits Change with CARES Act Landmark

However, for california purposes, the. However, for california purposes, the. Taxpayers can not deduct an excess business loss in the current year. Web where to report the excess business loss on your return. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year.

PJI Form 461 Stamped

Web where to report the excess business loss on your return. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. However, the excess business loss is treated as a net operating loss (nol) carryover. Part ii adjustment for amounts. Taxpayers cannot deduct an excess business loss in the.

IRS Form 461 Download Fillable PDF or Fill Online Limitation on

Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Part ii adjustment for amounts. However, for california purposes, the. Web form 461 will be used to determine if there is an excess business loss.the taxpayers cannot deduct an excess business loss in the current year, however, according to the. However, for california.

Form 461 2022 2023 IRS Forms Zrivo

Taxpayers cannot deduct an excess business loss in the current year. Web form 461 will be used to determine if there is an excess business loss.the taxpayers cannot deduct an excess business loss in the current year, however, according to the. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers..

Excess business loss limitation developments Baker Tilly

10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Part ii adjustment for amounts. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades. Who must file file form.

Instructions for IRS Form 461 Limitation on Business Losses Download

Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades. Use form ftb 3461 to compute the excess business loss. Web the irs and treasury, in drafting guidance for sec. 461 (l), should recognize that all of the taxpayer's trades or.

Excess BusinessLoss Rules Suspended

However, for california purposes, the. 10 enter any income or gain reported on lines 1 through 8 that is not attributable to a trade or business. Web once gone, but now back, form 461 per irc section 461(l) disallows excess business losses for noncorporate taxpayers. Web the origins of excess business loss. However, the excess business loss is treated as.

Web For Taxable Year 2020, Complete Form Ftb 3461, California Limitation On Business Losses, If You Are A Noncorporate Taxpayer And Your Net Losses From All Of Your Trades.

Web the irs and treasury, in drafting guidance for sec. Web an excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains. Part ii adjustment for amounts. Use form ftb 3461 to compute the excess business loss.

The Tax Cuts And Jobs Act Of 2017 (Tcja) Added The Excess Business Loss (Ebl) Limitation Under Sec 461 (L) Applicable To.

Web the tcja amended sec. However, for california purposes, the. The ebl limitation under irs code section 461(l) is a fairly new concept created by the tax law commonly known as the tax cuts and jobs. Web form 461 will be used to determine if there is an excess business loss.the taxpayers cannot deduct an excess business loss in the current year, however, according to the.

Taxpayers Can Not Deduct An Excess Business Loss In The Current Year.

Who must file file form 461 if you’re a noncorporate taxpayer and your net losses from all of your trades or. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. 461 to include a subsection (l), which disallows excess business losses of noncorporate taxpayers if the amount of the loss is in. Web about form 461, limitation on business losses.

Web The Excess Business Loss (Ebl) Limitation, Codified In Internal Revenue Code Section 461(L), Was Originally Created By The Tax Cuts And Jobs Act Of 2017 (Tcja).

An excess business loss is the amount by which the total deductions from your trades or businesses are more than your total gross income or. Web taxpayers can’t deduct an excess business loss (see definitions, later) in the current year. Web where to report the excess business loss on your return. Taxpayers cannot deduct an excess business loss in the current year.