Form 4563 Irs

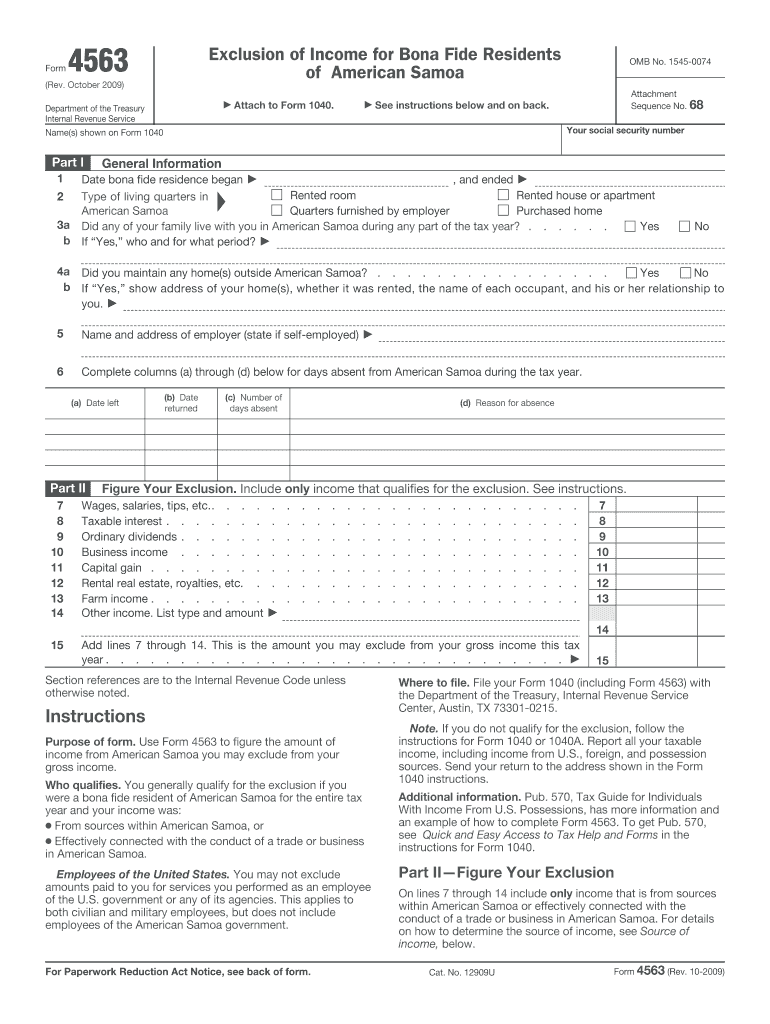

Form 4563 Irs - A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. Request for taxpayer identification number (tin) and certification. • form 8396, mortgage interest credit; • form 8839, qualified adoption expenses; Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. Web federal forms with your federal income tax return: Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s. Individual tax return form 1040 instructions; You generally qualify for the.

Who qualifies you qualify for the exclusion if you were a bona fide. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. Form 4562 is used to. • form 8859, carryforward of the. Exclusion of income for bona fide residents of american samoa keywords: Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web get 📝 printable irs form 4563 exclusion of income for bona fide residents of american samoa for 2020 ☑️ all blank template samples in pdf, doc, rtf and jpg ☑️. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Web irs form 4562 is used to claim depreciation and amortization deductions. • form 8839, qualified adoption expenses;

• form 8859, carryforward of the. Web irs form 4562 is used to claim depreciation and amortization deductions. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Web federal forms with your federal income tax return: A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes. • form 8396, mortgage interest credit; Income you must report on form 1040. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040.

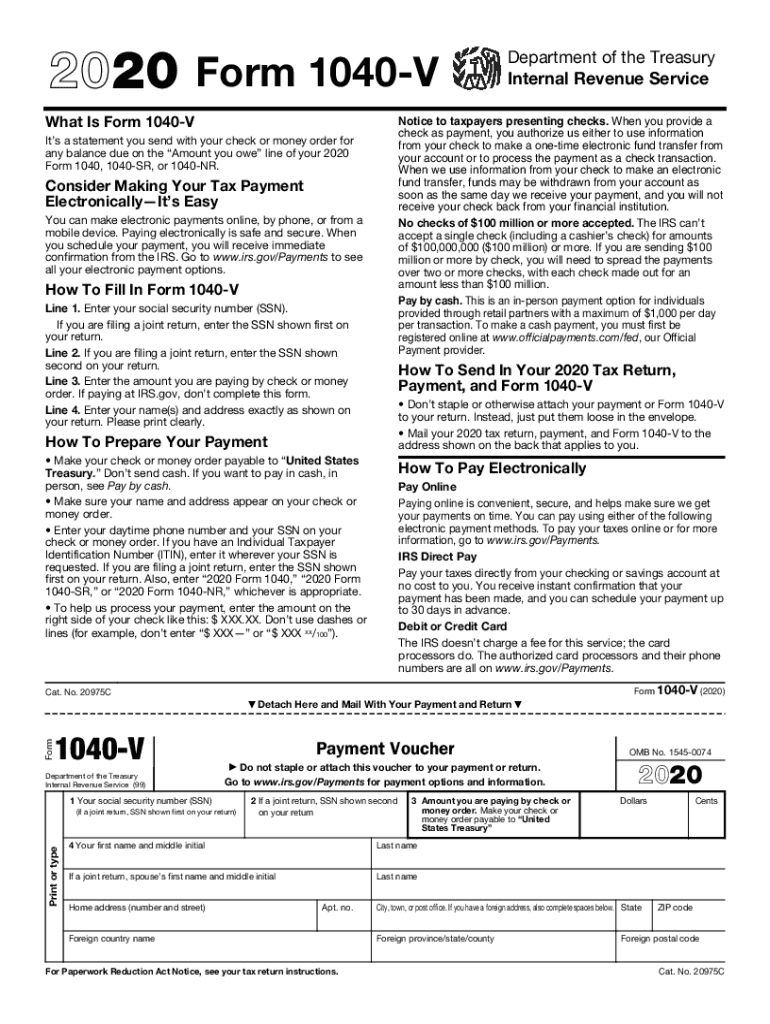

Irs Payment Voucher Fill Out and Sign Printable PDF Template signNow

Exclusion of income for bona fide residents of american samoa keywords: Form 4562 is used to. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Income you must report on form 1040. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of.

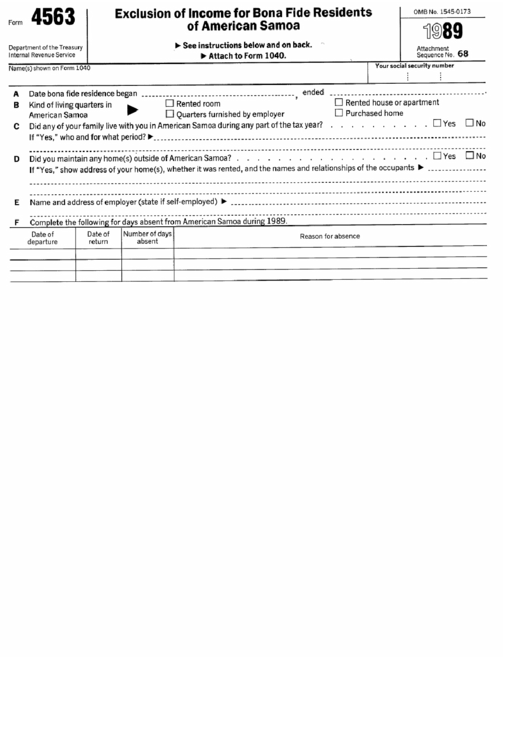

Form 4563 (1989) Exclusion Of For Bona Fide Residents Of

One is eligible to file this. Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. Form 4562 is also used when you elect to expense certain property under section 179 or. • form 8839, qualified adoption expenses; Exclusion of income for bona fide residents of american samoa.

Form 8863 Education Credits (American Opportunity and Lifetime

Income you must report on form 1040. August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service Form 4562 is used to. Web irs form 4562 is used to claim depreciation and amortization deductions. You generally qualify for the.

IRS Form 4563 Download Fillable PDF or Fill Online Exclusion of

You generally qualify for the. Web federal forms with your federal income tax return: • form 8839, qualified adoption expenses; Web irs form 4562 is used to claim depreciation and amortization deductions. Web get 📝 printable irs form 4563 exclusion of income for bona fide residents of american samoa for 2020 ☑️ all blank template samples in pdf, doc, rtf.

Form 4563 Exclusion of for Bona Fide Residents of American

One is eligible to file this. Who qualifies you qualify for the exclusion if you were a bona fide. Individual tax return form 1040 instructions; • form 8859, carryforward of the. • form 8396, mortgage interest credit;

Form 4563 Exclusion of for Bona Fide Residents of American

Web your tax for the tax year, the excess credit will be refunded without interest. Web if you qualify, use form 4563 to figure the amount of income you may exclude from your gross income. Exclusion of income for bona fide residents of american samoa keywords: Web get 📝 printable irs form 4563 exclusion of income for bona fide residents.

Form 4563 Exclusion of for Bona Fide Residents of American

Web your tax for the tax year, the excess credit will be refunded without interest. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes..

Irs Form 1090 T Universal Network

Income you must report on form 1040. Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s. Form 4562 is also used when you elect to expense certain property under section 179 or. The credit amount allowed is 33% of the portion of.

Form 4563 Fill Out and Sign Printable PDF Template signNow

Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. Form 4562 is also used when you elect to expense certain property under section 179 or. Individual tax return form 1040 instructions; Web irs form 4562 is used to claim depreciation and amortization deductions. Web federal forms with.

Fill Free fillable Exclusion of for Bona Fide Residents of

Form 4562 is used to. Request for taxpayer identification number (tin) and certification. Who qualifies the time needed to complete and file this form will vary. Use form 4563 to figure the amount of income from american samoa you may exclude from your gross income. Web your tax for the tax year, the excess credit will be refunded without interest.

Exclusion Of Income For Bona Fide Residents Of American Samoa Keywords:

• form 8396, mortgage interest credit; Income you must report on form 1040. Form 4562 is used to. Request for taxpayer identification number (tin) and certification.

Federal Individual Income Tax Returns.

August 2019) exclusion of income for bona fide residents of american samoa department of the treasury internal revenue service Web filing form 1040 to exclude your qualifying income from american samoa, complete form 4563 and attach it to your form 1040. October 2009) department of the treasury internal revenue service exclusion of income for bona fide residents of american samoa attach to form 1040. Web get 📝 printable irs form 4563 exclusion of income for bona fide residents of american samoa for 2020 ☑️ all blank template samples in pdf, doc, rtf and jpg ☑️.

• Form 8839, Qualified Adoption Expenses;

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. One is eligible to file this. Who qualifies you qualify for the exclusion if you were a bona fide. A form that one files with the irs to declare income earned in american samoa that may be excluded from one's gross income for tax purposes.

Who Qualifies The Time Needed To Complete And File This Form Will Vary.

• form 8859, carryforward of the. Web we last updated the exclusion of income for bona fide residents of american samoa in february 2023, so this is the latest version of form 4563, fully updated for tax year 2022. Web irs form 4562 is used to claim depreciation and amortization deductions. Web if you qualify for this exclusion, you may have to attach form 4563, exclusion of income for bona fide residents of american samoa, to their u.s.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at11.58.37PM-68ccc0edb6ce4cb8acf163430cfa938b.png)