Form 4506 T

Form 4506 T - The secondary spouse on a joint return must use get. Taxpayers using a tax year. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. You can also designate (on line 5) a third party to receive the information. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. You can also designate (on line 5a) a third party to receive the information. See the product list below. You can also designate (on line 5) a third party to receive the information. Form 4506 is used by. Web covid eidl disaster request for transcript of tax return.

Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). This form gives permission for the irs to provide sba your tax return information when applying for. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. See the product list below. The secondary spouse on a joint return must use get. Taxpayers using a tax year beginning in one. Taxpayers using a tax year. See the product list below. Taxpayers using a tax year. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file.

Taxpayers using a tax year. You can also designate (on line 5) a third party to receive the information. Form 4506 is used by. Taxpayers using a tax year beginning in one. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. You can also designate (on line 5) a third party to receive the information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. 7 for situations not requiring an exact copy of. You can also designate (on line 5a) a third party to receive the information.

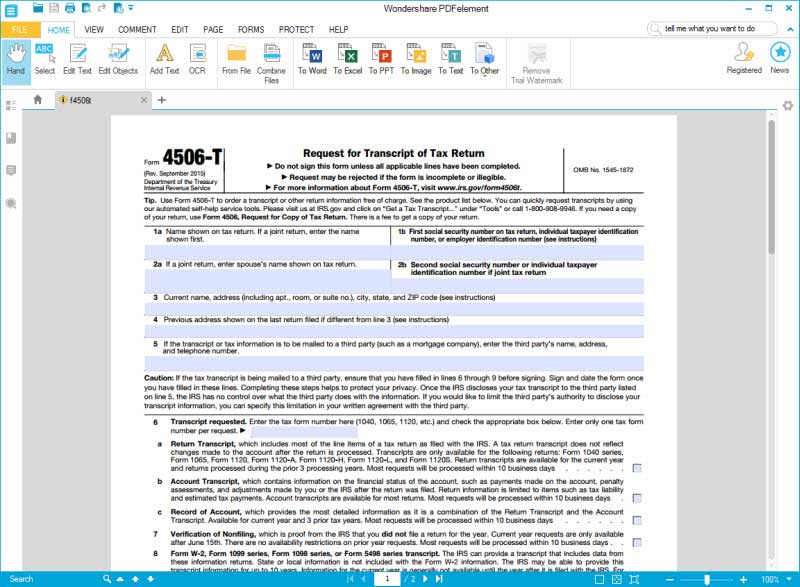

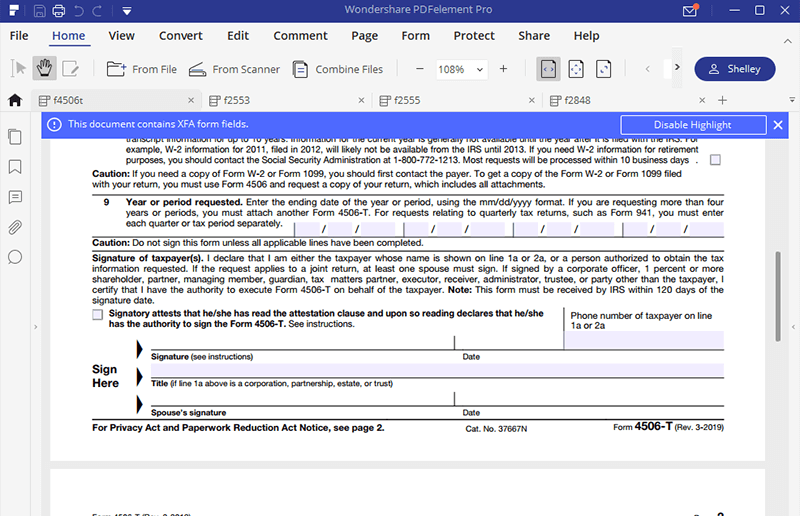

IRS Form 4506T Filling Forms Made Easy by PDFelement

You can also designate (on line 5a) a third party to receive the information. Taxpayers using a tax year beginning in one. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). 7 for situations not requiring an exact copy of. Taxpayers using a tax year.

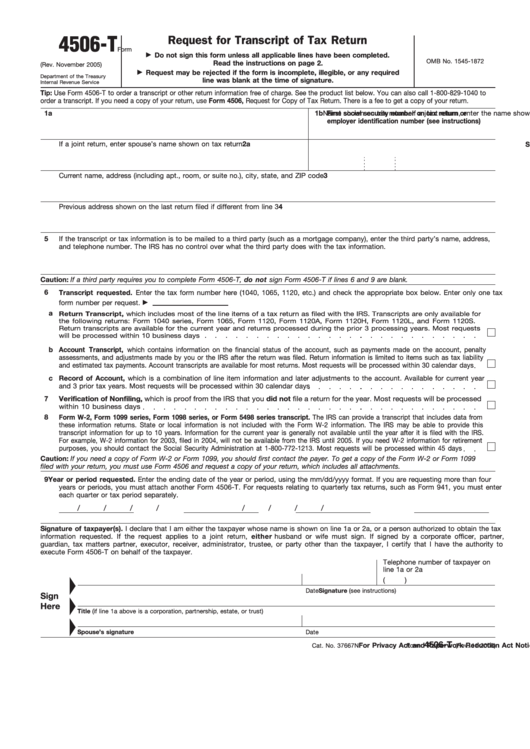

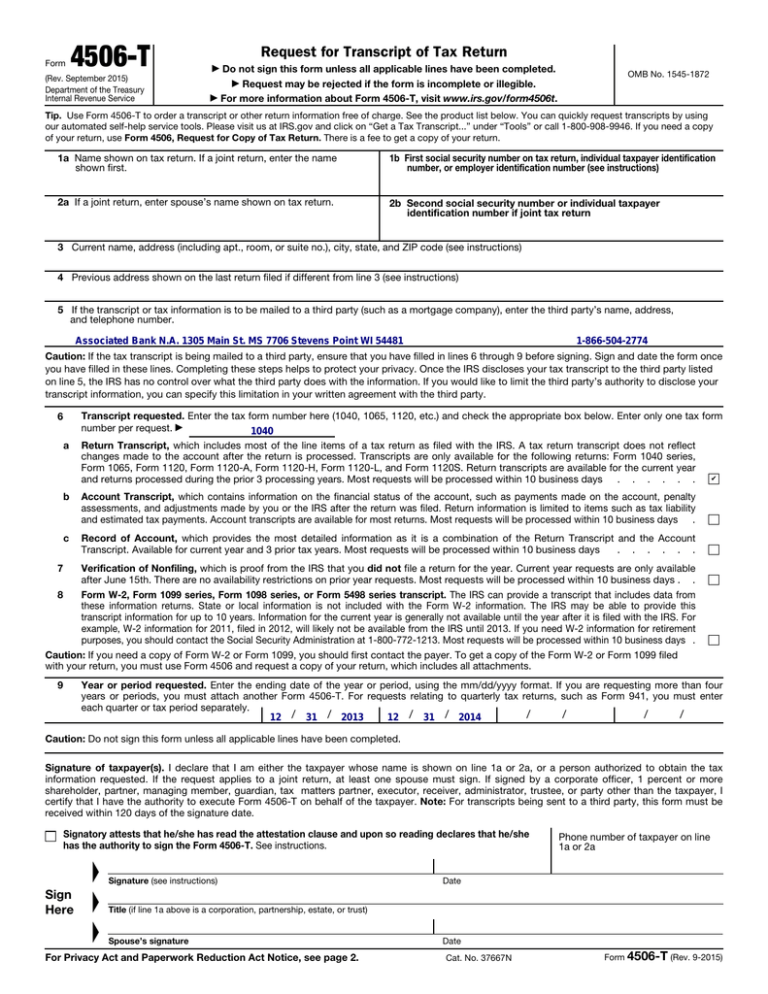

Form 4506T Request for Transcript of Tax Return (2015) Free Download

Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). You can also designate (on line 5) a third party to receive the information. Web information about form 4506,.

DISCOVER FORM 4506T??? myFICO® Forums 5645421

Taxpayers using a tax year. Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information. The secondary spouse on a joint return must use get. See the product list below. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions.

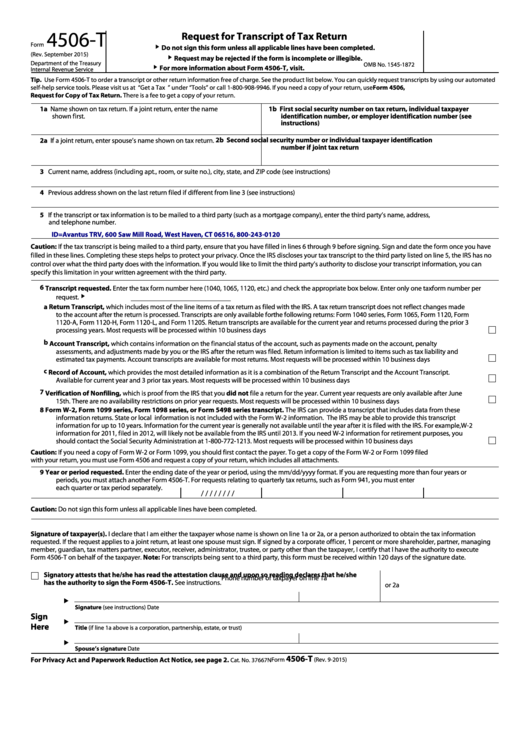

Fillable Form 4506T Request For Transcript Of Tax Return printable

You can also designate (on line 5) a third party to receive the information. See the product list below. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. 7 for situations not requiring an exact copy of. Taxpayers using a tax year.

IRS Form 4506TFilling Forms Made Easy by PDFelement

You can also designate (on line 5a) a third party to receive the information. Form 4506 is used by. Taxpayers using a tax year. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. Taxpayers using a tax year beginning in one.

4506 t Fill Online, Printable, Fillable Blank

You can also designate (on line 5a) a third party to receive the information. This form gives permission for the irs to provide sba your tax return information when applying for. The secondary spouse on a joint return must use get. 7 for situations not requiring an exact copy of. Web information about form 4506, request for copy of tax.

Form 4506T Request for Transcript of Tax Return (2015) Free Download

Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a tax year. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Web irs form 4506 can be filed by taxpayers to request an exact copy.

Fillable Form 4506T Request For Transcript Of Tax Return printable

Form 4506 is used by. Web covid eidl disaster request for transcript of tax return. The secondary spouse on a joint return must use get. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Taxpayers using a tax year.

Form 4506T YouTube

Taxpayers using a tax year. You can also designate (on line 5) a third party to receive the information. Taxpayers using a tax year. See the product list below. Form 4506 is used by.

Web Information About Form 4506, Request For Copy Of Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

7 for situations not requiring an exact copy of. Taxpayers using a tax year. See the product list below. Taxpayers using a tax year beginning in one.

You Can Also Designate (On Line 5) A Third Party To Receive The Information.

Taxpayers using a tax year. Web this transcript will often be accepted by lending institutions for student loan or mortgage purposes. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year). Web irs form 4506 can be filed by taxpayers to request an exact copy of a previously filed return and tax information.

This Form Gives Permission For The Irs To Provide Sba Your Tax Return Information When Applying For.

Web covid eidl disaster request for transcript of tax return. You can also designate (on line 5) a third party to receive the information. The secondary spouse on a joint return must use get. Form 4506 is used by.

See The Product List Below.

You can also designate (on line 5a) a third party to receive the information.