Form 4506-F

Form 4506-F - Web department of the treasury or illegible. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago. Web follow the simple instructions below: Request a copy of your tax return, or designate a third party to. Get ready for tax season deadlines by completing any required tax forms today. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Request may be rejected if the form is. You can also download it, export it or print it out. A copy of an exempt organization’s exemption application or letter. Get ready for tax season deadlines by completing any required tax forms today.

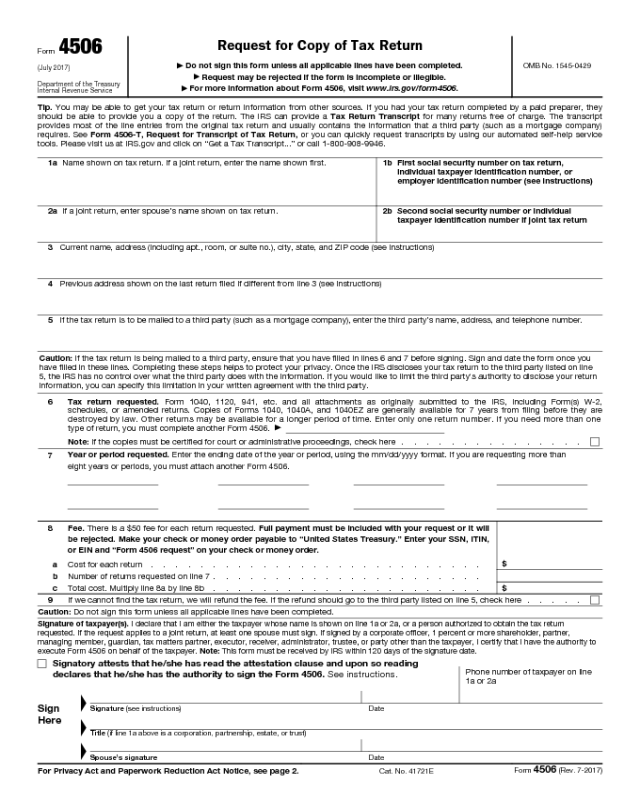

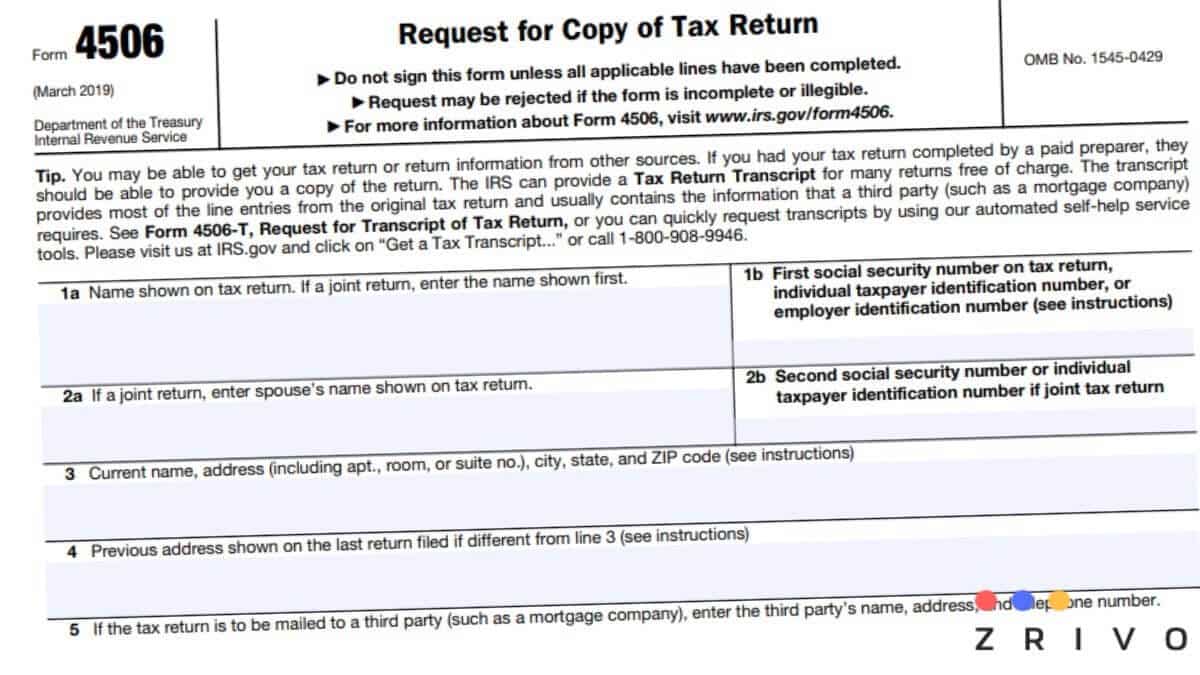

Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. A copy of an exempt organization’s exemption application or letter. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties. Request a copy of your tax return, or designate a third party to. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago. Web follow the simple instructions below: Ives request for transcript of tax return. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Get ready for tax season deadlines by completing any required tax forms today.

Our platform offers you an extensive. Ad download or email irs 4506 & more fillable forms, register and subscribe now! Edit your 4506 f online. Request a copy of your tax return, or designate a third party to. A copy of an exempt or political organization’s return, report, notice, or exemption application. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Get ready for tax season deadlines by completing any required tax forms today. Web send irs form 4506 f via email, link, or fax.

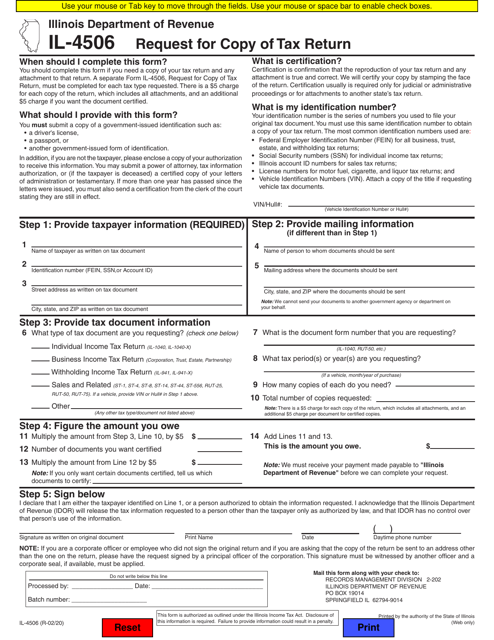

Form IL4506 Download Fillable PDF or Fill Online Request for Copy of

Web follow the simple instructions below: Include a copy of a government issued id (driver’s license or passport) to. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago. Web form 4506 must be signed.

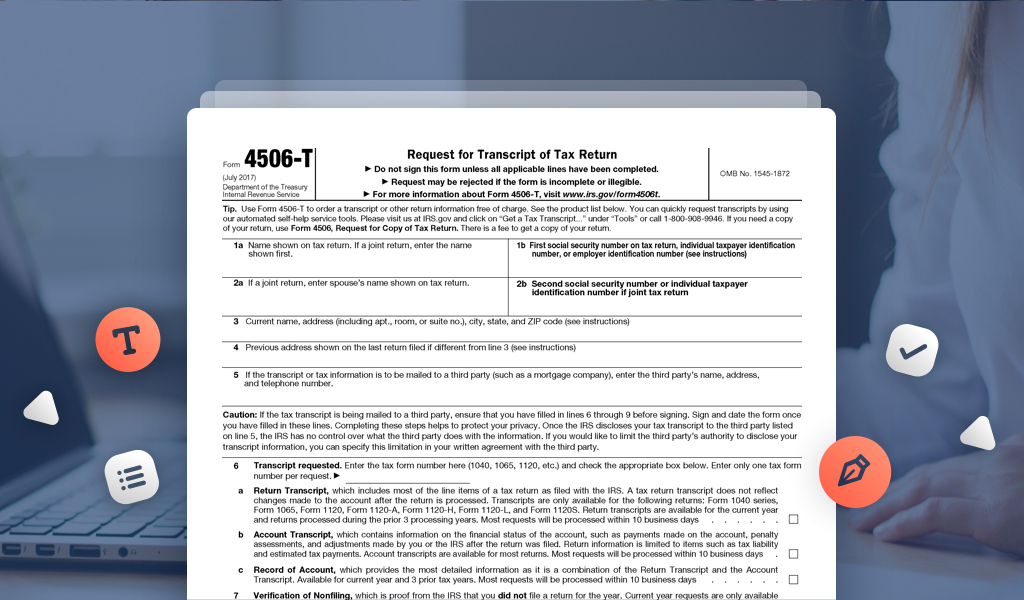

IRS releases new form 4506C

A copy of an exempt or political organization’s return, report, notice, or exemption application. Request a copy of your tax return, or designate a third party to. Get ready for tax season deadlines by completing any required tax forms today. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be..

Form 4506 Edit, Fill, Sign Online Handypdf

Web send irs form 4506 f via email, link, or fax. Request a copy of your tax return, or designate a third party to. You can also download it, export it or print it out. Type text, add images, blackout confidential details, add. Our platform offers you an extensive.

4506 Form 2021

Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Edit your 4506 f online. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Our platform offers you an extensive. Include a copy of a government issued id (driver’s license or passport).

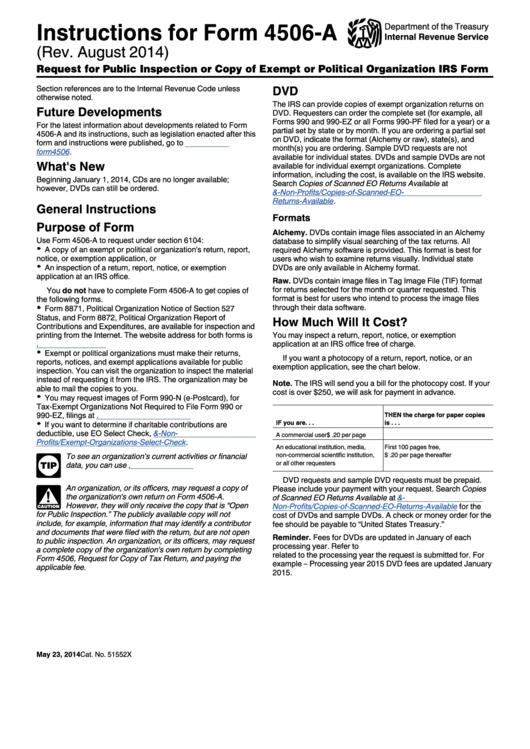

Instructions For Form 4506A (Rev. August 2014) printable pdf download

Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Web department of the treasury or illegible. Ives request for transcript of tax return. Web form 4506 must be signed and dated by the taxpayer listed on line 1a or 2a. Get ready for tax season deadlines by completing any required tax forms.

Information of form 4506 T YouTube

Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Web follow the simple instructions below: Web send irs form 4506 f via email, link, or fax..

Request Previous Tax Returns with Form 4506T pdfFiller Blog

Ives request for transcript of tax return. Web form 4506 is used by taxpayers to request copies of their tax returns for a fee. Type text, add images, blackout confidential details, add. Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed. Web follow.

2021 Form IRS 4506F Fill Online, Printable, Fillable, Blank pdfFiller

A copy of an exempt or political organization’s return, report, notice, or exemption application. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties. Ives request for transcript of tax return. Ad download or email irs 4506 & more fillable forms, register and subscribe.

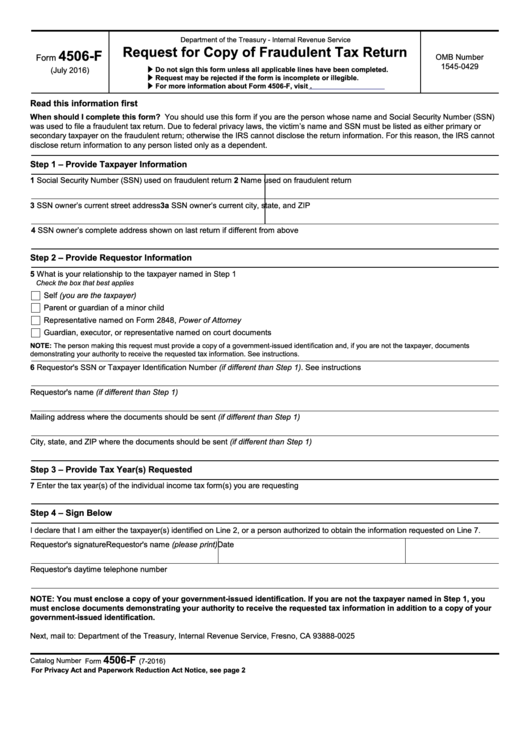

Fillable Form 4506F Request For Copy Of Fraudulent Tax Return 2016

Web send irs form 4506 f via email, link, or fax. Our platform offers you an extensive. Provide taxpayer information if you are authorized to request tax information for the person whose name and ssn was used to file the fraudulent return, you must submit a. A copy of an exempt organization’s exemption application or letter. Get ready for tax.

Form 4506F Identity Theft Victim’s Request for Copy of Fraudulent Tax

The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Are you seeking a quick and practical solution to complete form 4506 f at an affordable price? Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient.

Request A Copy Of Your Tax Return, Or Designate A Third Party To.

Ives request for transcript of tax return. A copy of an exempt or political organization’s return, report, notice, or exemption application. Provide taxpayer information if you are authorized to request tax information for the person whose name and ssn was used to file the fraudulent return, you must submit a. Get ready for tax season deadlines by completing any required tax forms today.

Edit Your 4506 F Online.

Request may be rejected if the form is. Web department of the treasury or illegible. Web internal revenue code, section 6103(c), limits disclosure and use of return information received pursuant to the taxpayer’s consent and holds the recipient subject to penalties. Web form 4506, request for copy of tax return, takes longer and costs $50 per return form 4506 is useful if you need a copy of your tax return from more than three years ago.

Web Form 4506 Must Be Signed And Dated By The Taxpayer Listed On Line 1A Or 2A.

A copy of an exempt organization’s exemption application or letter. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Web follow the simple instructions below: Get ready for tax season deadlines by completing any required tax forms today.

Web Form 4506 Must Be Signed And Dated By The Taxpayer Listed On Line 1A Or 2A.

Type text, add images, blackout confidential details, add. The irs must receive form 4506 within 120 days of the date signed by the taxpayer or it will be. Our platform offers you an extensive. Web department of the treasury internal revenue service request for copy of tax return do not sign this form unless all applicable lines have been completed.