Form 3520 How To File

Form 3520 How To File - Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web anyone in the u.s. Web you must separately identify each gift and the identity of the donor. The form provides information about the foreign trust, its u.s. Owner a foreign trust with at least one u.s. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Try it for free now! Send form 3520 to the.

Decedents) file form 3520 to report: Owner files this form annually to provide information. Send form 3520 to the. Web form 3520 filing requirements. Taxpayers may attach a reasonable cause. Owner a foreign trust with at least one u.s. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Complete, edit or print tax forms instantly. Who has had a facebook account at any time between may 24, 2007, and dec. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web anyone in the u.s. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Web requested below and part iii of the form. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Send form 3520 to the. Completing this form requires the. Persons (and executors of estates of u.s. Ad complete irs tax forms online or print government tax documents. Get ready for tax season deadlines by completing any required tax forms today.

Form 3520 Reporting Foreign Gifts and Distributions From a Foreign Trust

The form provides information about the foreign trust, its u.s. Get ready for tax season deadlines by completing any required tax forms today. Ad complete irs tax forms online or print government tax documents. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return.

Form 3520 Edit, Fill, Sign Online Handypdf

The due date for filing form 3520 is april and the due. Ad complete irs tax forms online or print government tax documents. Web the penalty for filing a delinquent form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. Web the 1040 form is the official tax return that.

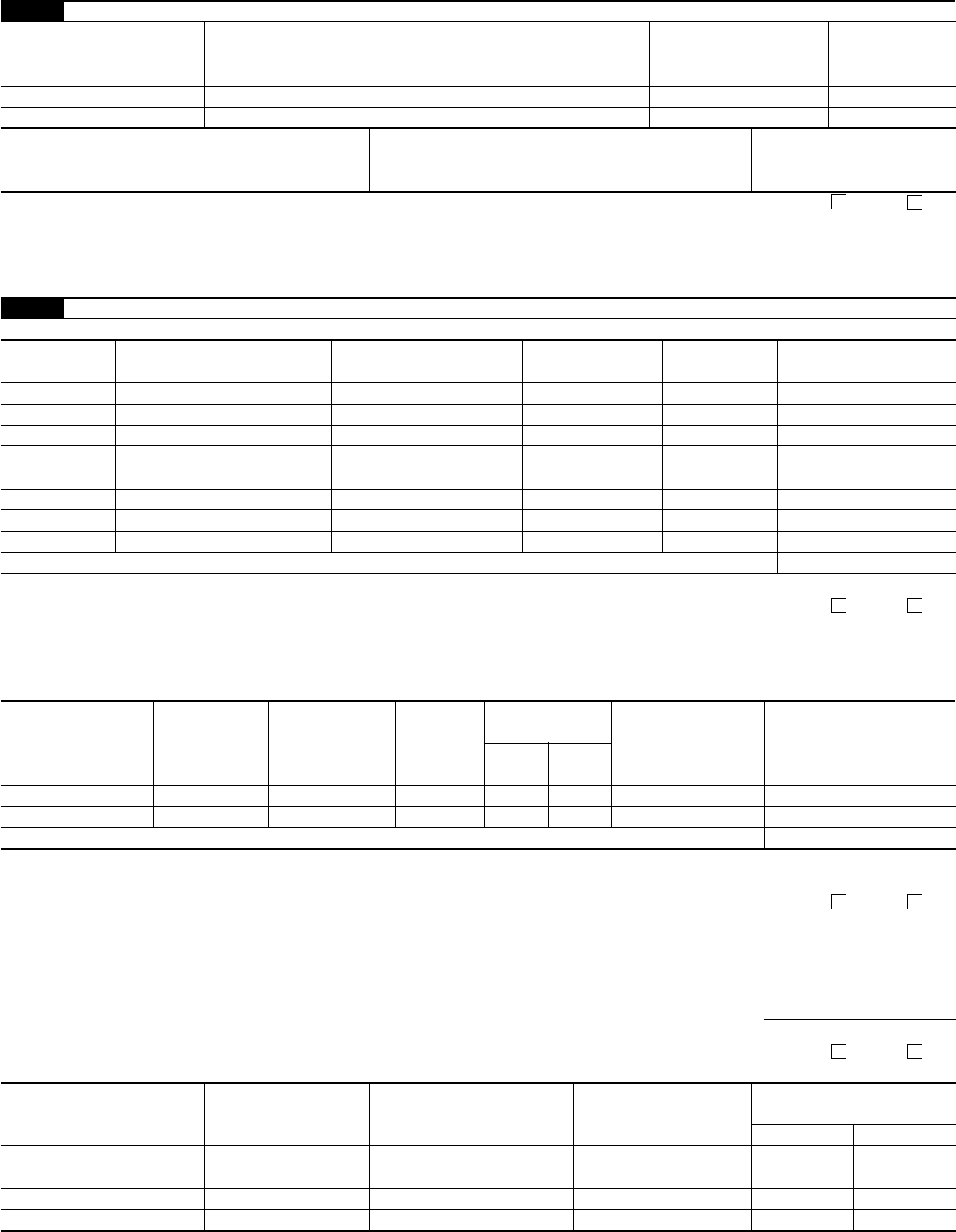

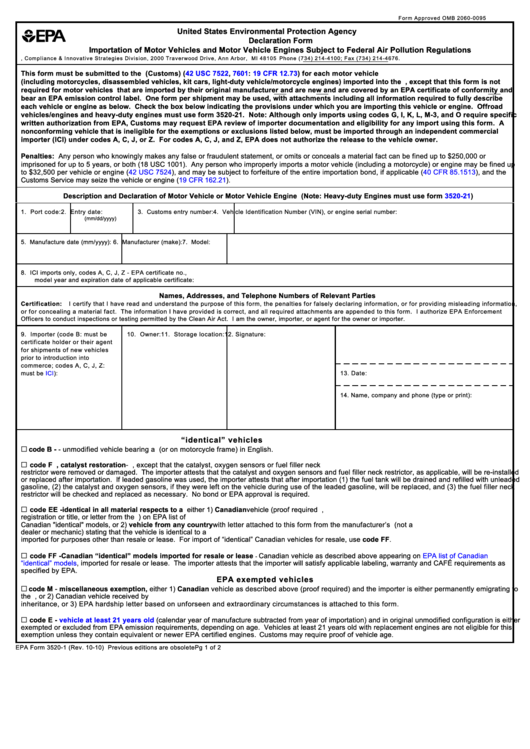

Top Epa Form 35201 Templates free to download in PDF format

Web anyone in the u.s. Owner files this form annually to provide information. Web american citizens and resident aliens who receive a foreign inheritance valued at over $100,000 must report it using irs form 3520. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships. Ownership of foreign trusts under the.

Form 3520 2013 Edit, Fill, Sign Online Handypdf

Completing this form requires the. Owner files this form annually to provide information. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Ad complete irs tax forms online or print government tax documents. Web an income tax return, the due.

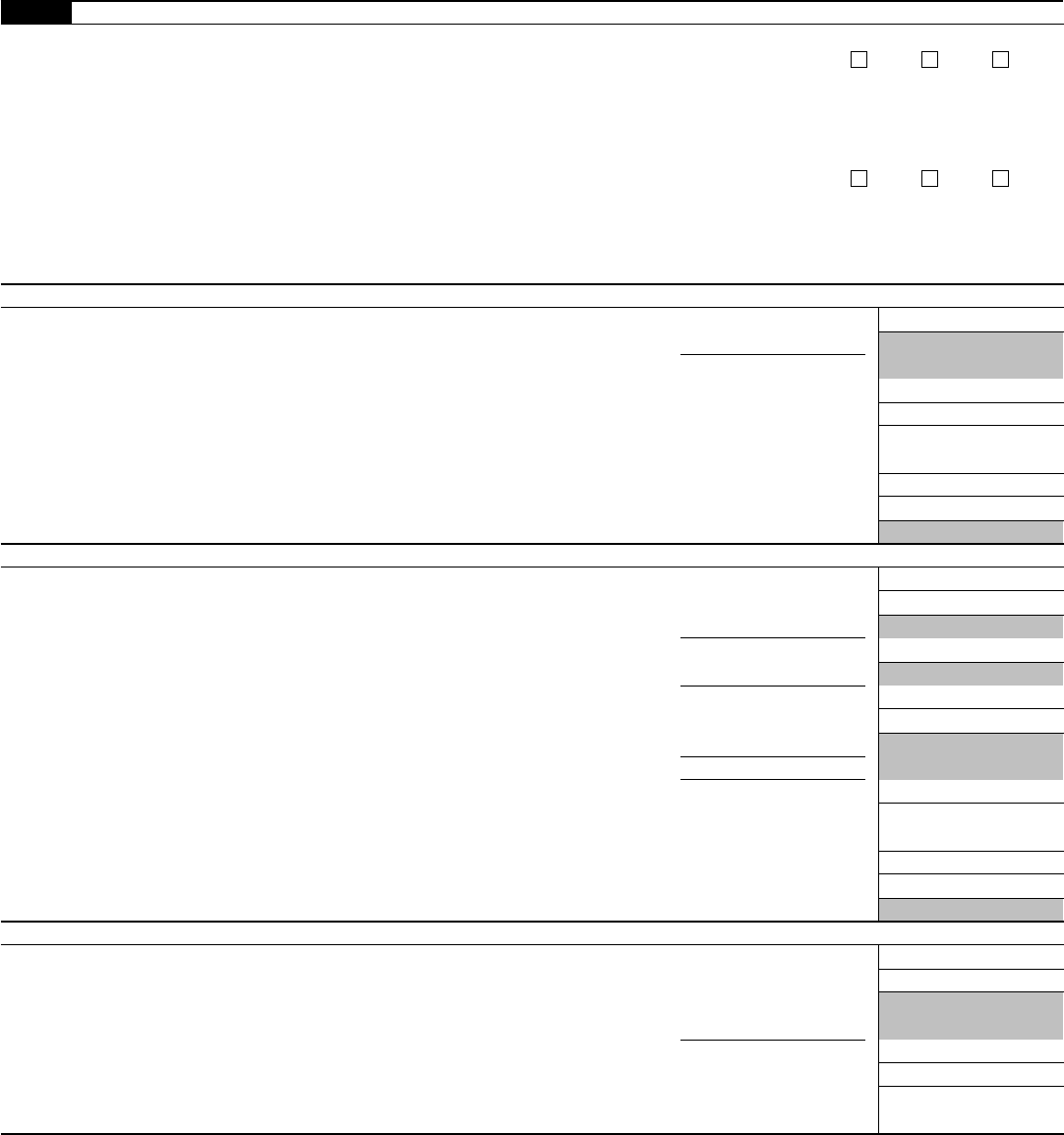

Fillable Form 3520A Foreign Grantor Trust Beneficiary Statement

Get ready for tax season deadlines by completing any required tax forms today. Web form 3520 does not have to be filed to report the following transactions. Web one example of a situation in which a taxpayer fails to file a form 3520 and probably should have a solid reasonable cause argument is this: Send form 3520 to the. Form.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Send form 3520 to the. Web anyone in the u.s. Who has had a facebook account at any time between may 24, 2007, and dec. Note that the irs may recharacterize purported.

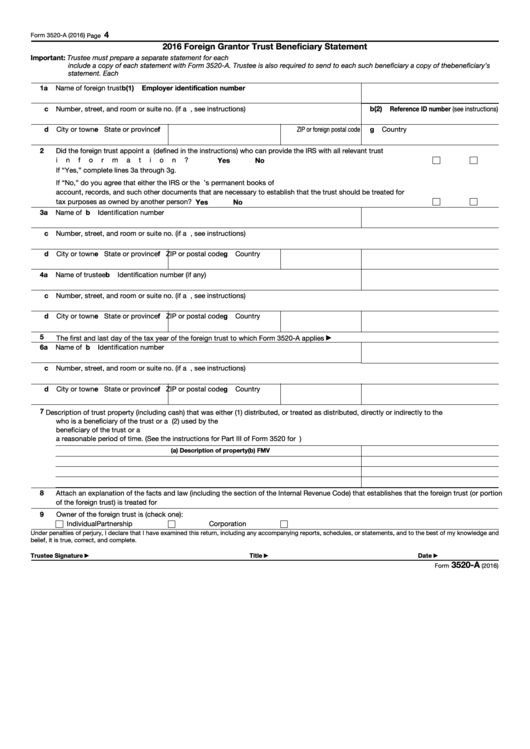

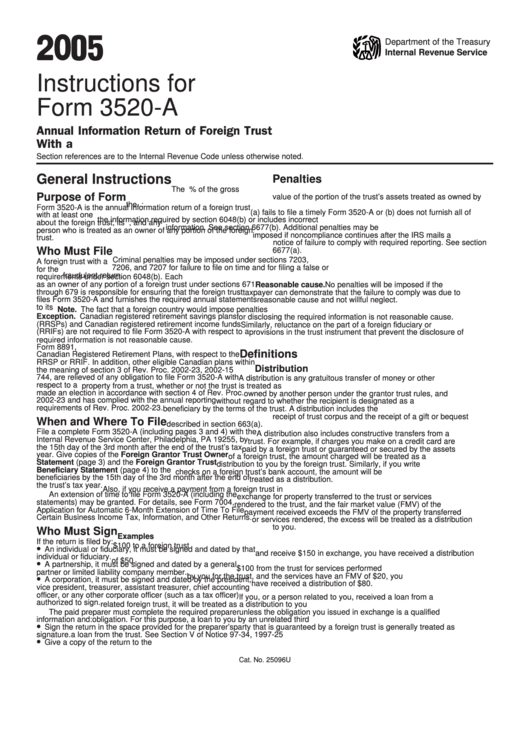

Instructions For Form 3520A Annual Information Return Of Foreign

The form provides information about the foreign trust, its u.s. Web anyone in the u.s. Ownership of foreign trusts under the. Who has had a facebook account at any time between may 24, 2007, and dec. Web you must separately identify each gift and the identity of the donor.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Taxpayers may attach a reasonable cause. The due date for filing form 3520 is april and the due. Web you must separately identify each gift and the identity of the donor. Most fair market value (fmv). Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a.

question about form 3520 TurboTax Support

Send form 3520 to the. Web anyone in the u.s. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Owner a foreign trust with at least one u.s. Ad complete irs tax forms online or print government tax documents.

Owner Files This Form Annually To Provide Information.

Taxpayers may attach a reasonable cause. Web requested below and part iii of the form. Owner a foreign trust with at least one u.s. Note that the irs may recharacterize purported gifts from foreign corporations or foreign partnerships.

Certain Transactions With Foreign Trusts.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Upload, modify or create forms. Most fair market value (fmv). Person who, during the current tax year, received certain gifts or bequests from a foreign person.

Web American Citizens And Resident Aliens Who Receive A Foreign Inheritance Valued At Over $100,000 Must Report It Using Irs Form 3520.

The form provides information about the foreign trust, its u.s. Completing this form requires the. Web form 3520 does not have to be filed to report the following transactions. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a.

Web Anyone In The U.s.

Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Decedents) file form 3520 to report: Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Complete, edit or print tax forms instantly.