Form 3520 Extension 2022

Form 3520 Extension 2022 - Web 1 best answer. Individual income tax return go to. If you and your spouse are filing a joint form. Web form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. Web 2022 annual information return of foreign trust with a u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web home how do i produce a form 3520 in individual tax using interview forms? Dryland cash rent averaged $200 per acre, with low third quality at.

If you and your spouse are filing a joint form. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Ad talk to our skilled attorneys by scheduling a free consultation today. Web if you properly filed for an extension of the time to file an income tax return using form 4868 pdf before the due date of your income tax return, you will also be automatically. Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. For example, a foreign trust with a tax year ending december 31,. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web tax year 2022, and you are both transferors, grantors, or beneficiaries of the same foreign trust, then you may file a joint form 3520. Web form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. Web you can file form 4868 by mailing the paper extension, requiring you to cover the postage cost.

Web if you properly filed for an extension of the time to file an income tax return using form 4868 pdf before the due date of your income tax return, you will also be automatically. Once you filed the 3520 that would be the end of that portion of the process. Ad talk to our skilled attorneys by scheduling a free consultation today. Web 2022 annual information return of foreign trust with a u.s. The deadline is the same (april 15, 2022 for gifts made in. If you and your spouse are filing a joint form. Web 1 best answer. Individual income tax return go to. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the.

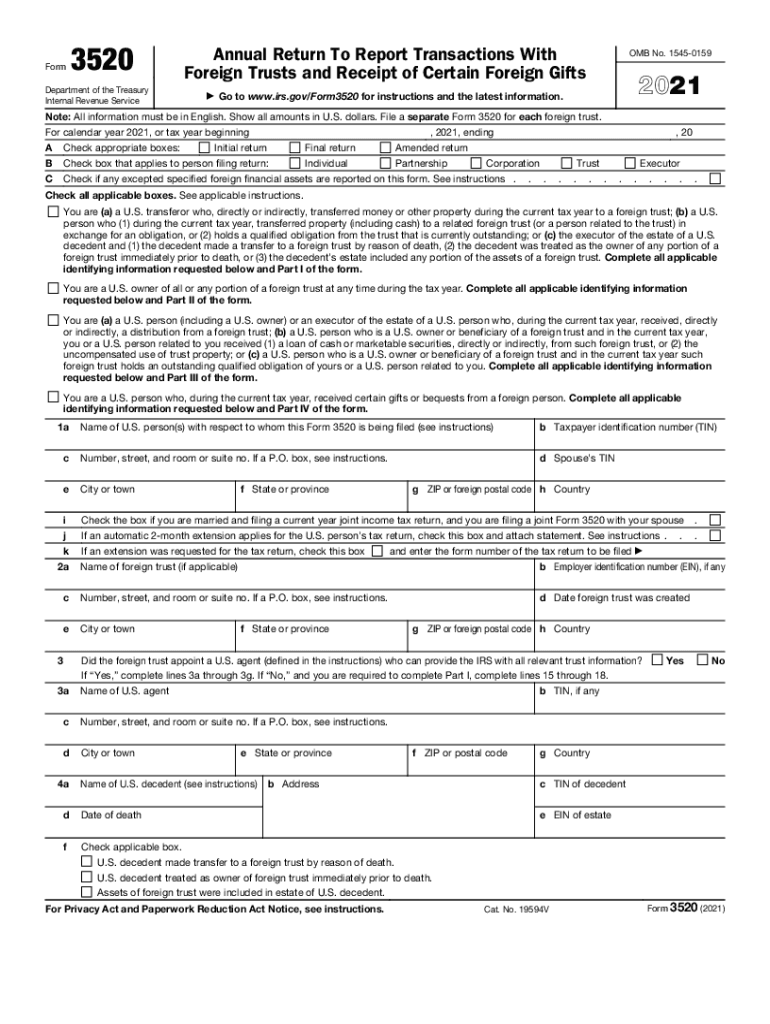

US Taxes and Offshore Trusts Understanding Form 3520

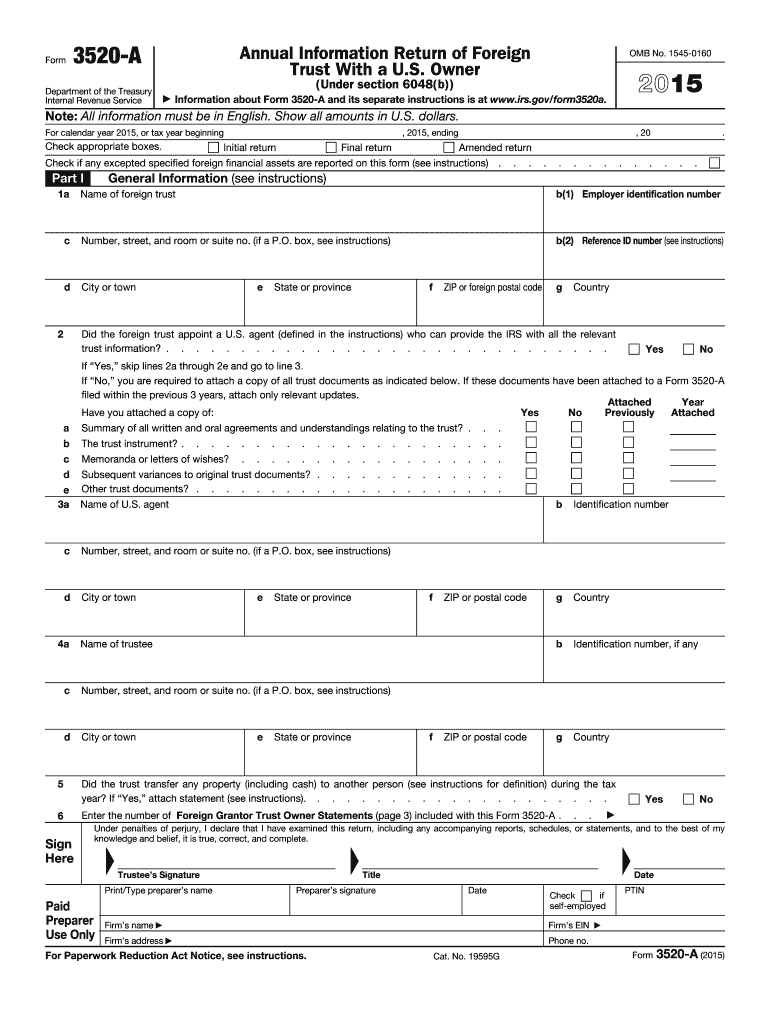

The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue. Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Person is granted an extension.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Owner, including recent updates, related forms and instructions on how to file. Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october.

3520 1 form Fill out & sign online DocHub

Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. Owner, including recent updates, related forms and instructions on how to file. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web 1 best answer. The irs form annual return to report transactions with foreign trusts.

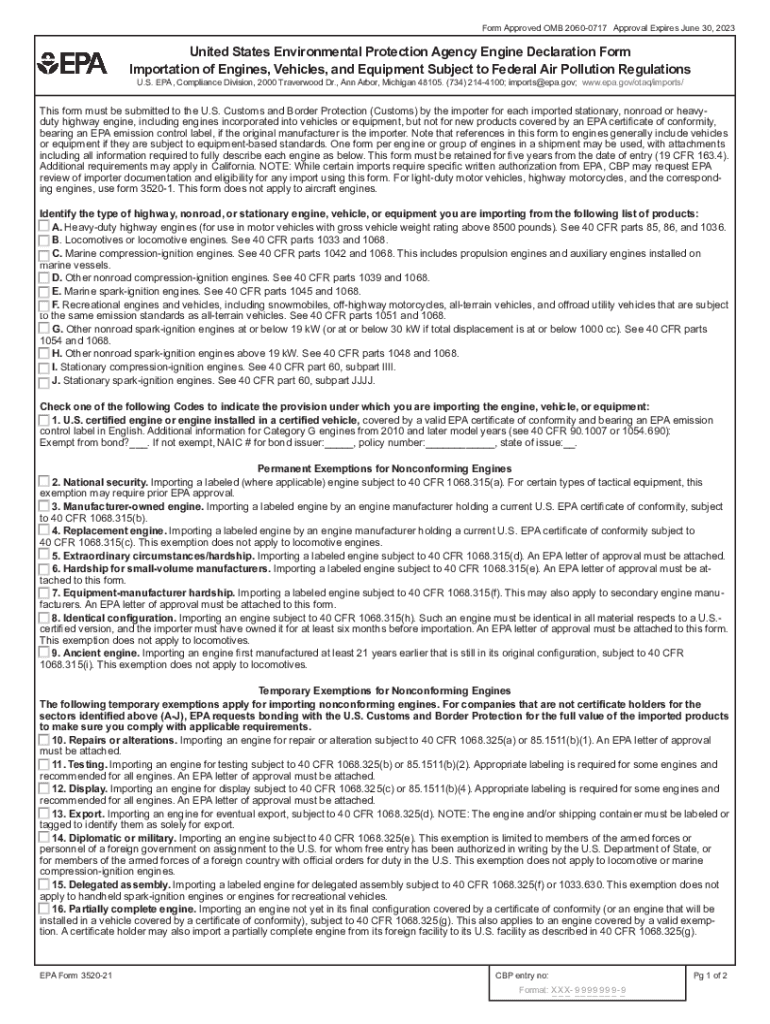

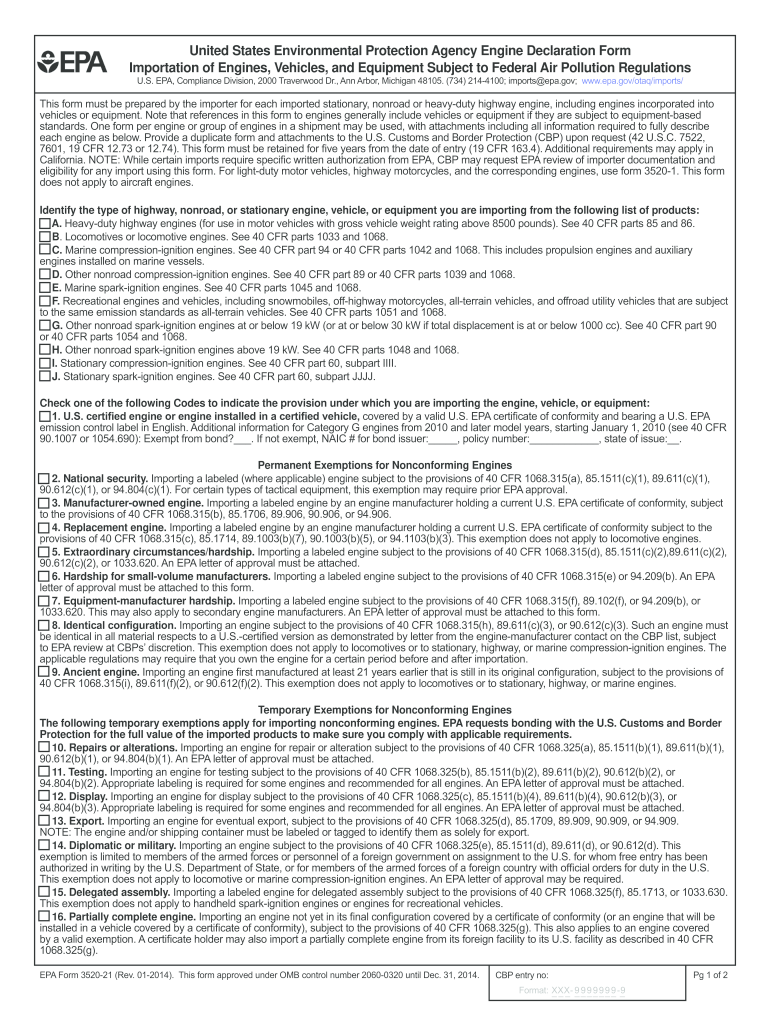

Epa 3520 21 Fill Out and Sign Printable PDF Template signNow

Individual income tax return go to. Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. Owner, including recent updates, related forms and instructions on how to file. If you and your spouse are filing a joint form. Web home how do i produce a form 3520 in individual tax using.

20142020 Form EPA 352021 Fill Online, Printable, Fillable, Blank

Individual income tax return go to. For example, a foreign trust with a tax year ending december 31,. If a timely extension is filed then the due date of these forms is. Web if you properly filed for an extension of the time to file an income tax return using form 4868 pdf before the due date of your income.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Form 5471 due date and extension form 5471. The deadline is the same (april 15, 2022 for gifts made in. Web form 4868 department of the treasury internal revenue service application for automatic extension of time to file u.s. If you and your spouse are filing a joint form. The irs form annual return to report transactions with foreign trusts.

Form 3520 Fill Out and Sign Printable PDF Template signNow

The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue. Owner, including recent updates, related forms and instructions on how to file. For example, a foreign trust with a tax year ending december 31,. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Person.

Forex trading irs

You inherited the money, so there would be no income tax on it. Web 2022 annual information return of foreign trust with a u.s. Ad talk to our skilled attorneys by scheduling a free consultation today. Owner, including recent updates, related forms and instructions on how to file. Form 5471 due date and extension form 5471.

Form 3520 Fill out & sign online DocHub

Web 2022 annual information return of foreign trust with a u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Once you filed the 3520 that would be the end of that portion of.

Irs Form 3520 Fill Out and Sign Printable PDF Template signNow

Ad talk to our skilled attorneys by scheduling a free consultation today. Web you can file form 4868 by mailing the paper extension, requiring you to cover the postage cost. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Web form 3520 is not included.

Web Form 4868 Department Of The Treasury Internal Revenue Service Application For Automatic Extension Of Time To File U.s.

Form 5471 due date and extension form 5471. Individual income tax return go to. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. The deadline is the same (april 15, 2022 for gifts made in.

Web 2022 Annual Information Return Of Foreign Trust With A U.s.

Web if you properly filed for an extension of the time to file an income tax return using form 4868 pdf before the due date of your income tax return, you will also be automatically. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms,. Web form 3520 is not included with your tax return, it is mailed separately to the address in the instructions.

Dryland Cash Rent Averaged $200 Per Acre, With Low Third Quality At.

Web you can file form 4868 by mailing the paper extension, requiring you to cover the postage cost. Web 1 best answer. If you and your spouse are filing a joint form. For example, a foreign trust with a tax year ending december 31,.

If A Timely Extension Is Filed Then The Due Date Of These Forms Is.

Once you filed the 3520 that would be the end of that portion of the process. Owner, including recent updates, related forms and instructions on how to file. You can also file the form for free using irs free fillable forms. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue.