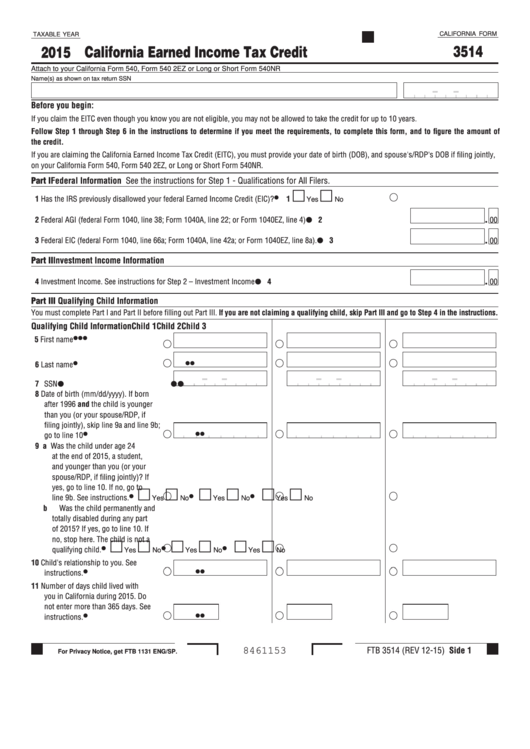

Form 3514 Business Code Must Be Entered

Form 3514 Business Code Must Be Entered - Enter the amount here and on form ftb 3514, line 18. Enter the amount here and on. Web june 6, 2019 3:39 am last updated june 06, 2019 3:39 am 2 8 113,772 reply bookmark icon nyinyeb new member the principal business code is a six digit number. Populated, but we don't have any of that and don't qualify for eic. Web if you are certain that form 3514 does not belong on your return, you can delete it. Begin typing to search, use arrow keys to navigate, use enter to select. Web 2021, 3514, instructions for 3514 form, california earned income tax credit. Business activity codes the codes listed in this section are a selection from the north american industry classification system (naics) that. Purpose use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the. Name(s) as shown on tax return.

Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Populated, but we don't have any of that and don't qualify for eic. Begin typing to search, use arrow keys to navigate, use enter to select. Must be at least 18 years old or. Web show sources > form 3514 is a california individual income tax form. You should be signed in and working in turbotax: Web 2021 instructions for form ftb 3514 california earned income tax credit revised: Please provide your email address and it will be emailed to you. How do we get rid of that form? States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar.

Got money from a lawsuit settlement. Must file either form 540, 540ez, or 540nr. Web california form 3514 want business code, etc. Web 603 rows add line 1, line 2, line 3, and subtract line 4. Web this amount should also be entered on form 540nr, line 86. 02/2022 general information specific instructions 2021 earned income tax credit table. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web if option 1 above is used, the business activity type must be entered in the business information overrides. Web legal forms & services. Please provide your email address and it will be emailed to you.

California Tax Table 540 2ez Review Home Decor

Web if married, must file married filing jointly. Enter your business information in the spaces. Web june 6, 2019 3:39 am last updated june 06, 2019 3:39 am 2 8 113,772 reply bookmark icon nyinyeb new member the principal business code is a six digit number. Must file either form 540, 540ez, or 540nr. Web show sources > form 3514.

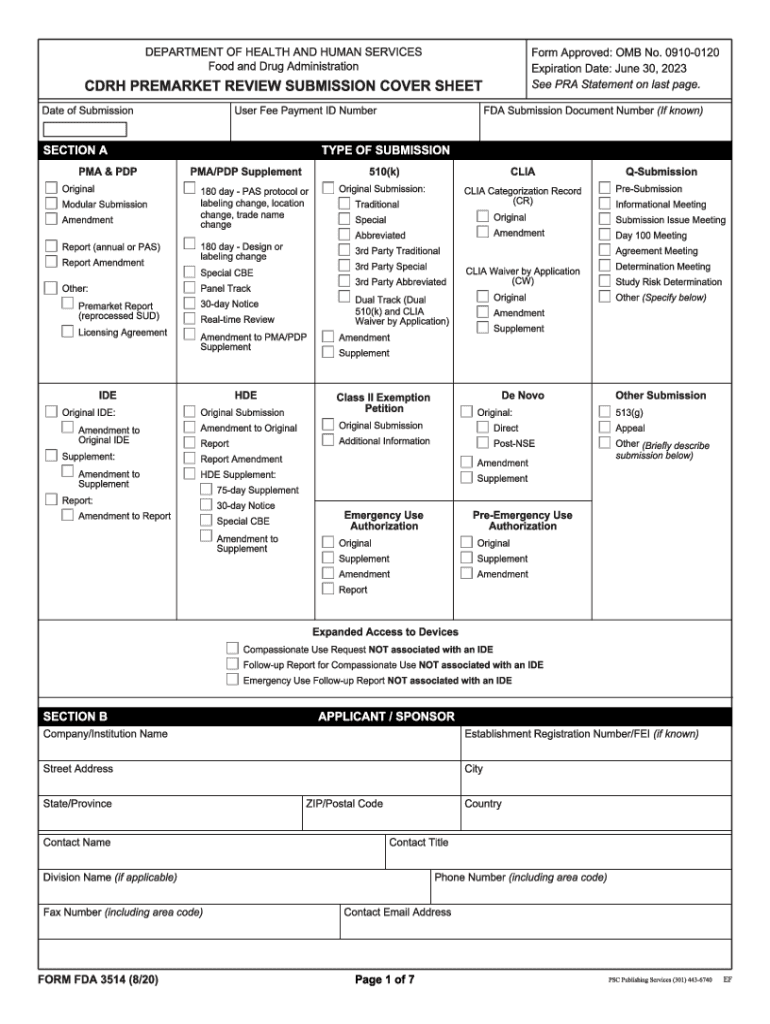

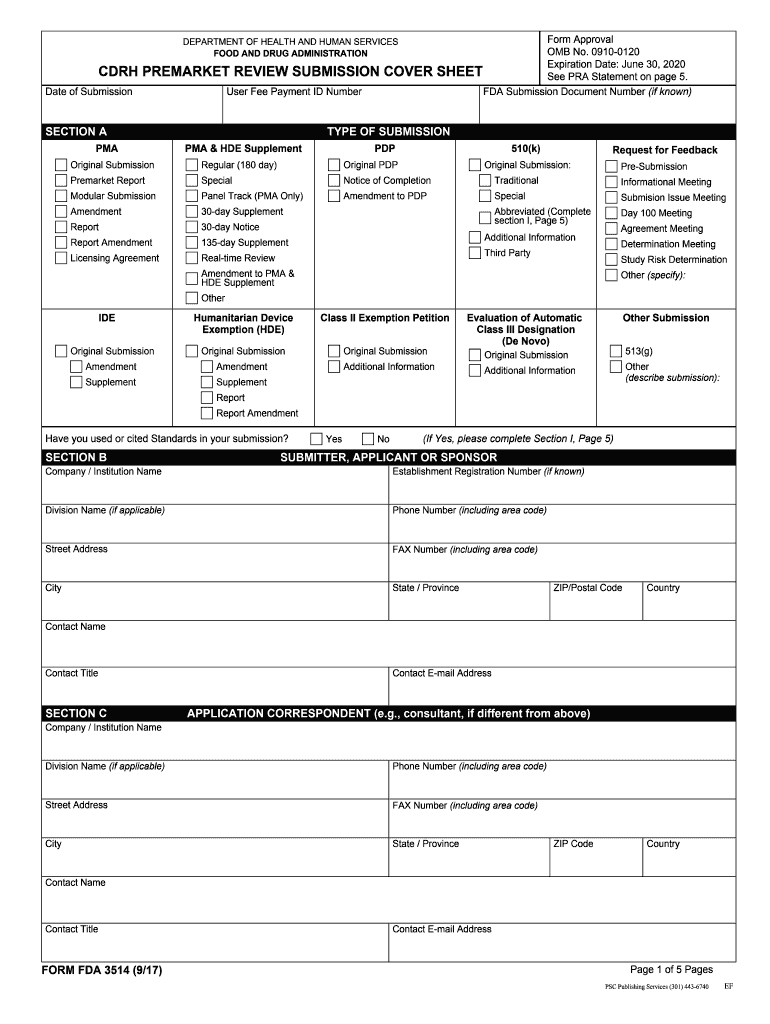

Fda form 3514 Fill out & sign online DocHub

Web june 6, 2019 3:39 am last updated june 06, 2019 3:39 am 2 8 113,772 reply bookmark icon nyinyeb new member the principal business code is a six digit number. Enter the amount here and on form ftb 3514, line 18. Enter your business information in the spaces. Name(s) as shown on tax return. Must have lived in california.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

Enter the amount here and on. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. You should be signed in and working in turbotax: Must be at least 18 years old or. Web if you are certain that form 3514 does not belong on your return, you can delete it.

FDA Form 3514 PDF Food And Drug Administration Federal Food

Web if you are certain that form 3514 does not belong on your return, you can delete it. Ask questions, get answers, and join our large community of tax professionals. Web legal forms & services. Web add line 1, line 2, line 3, and subtract line 4. How do we get rid of that form?

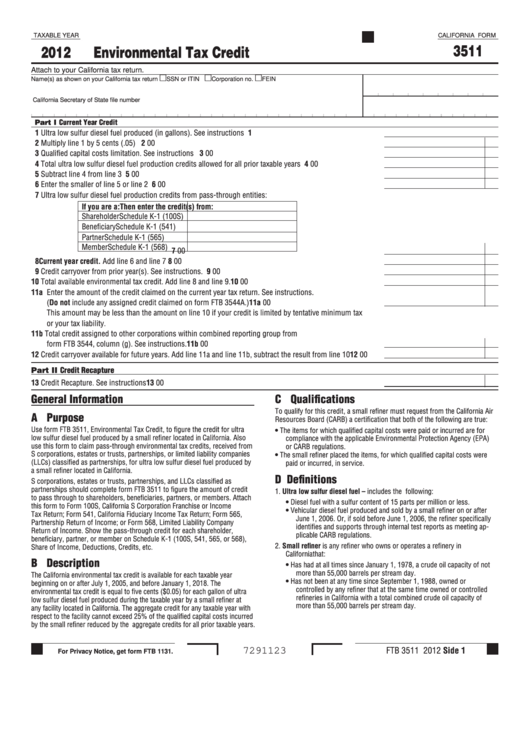

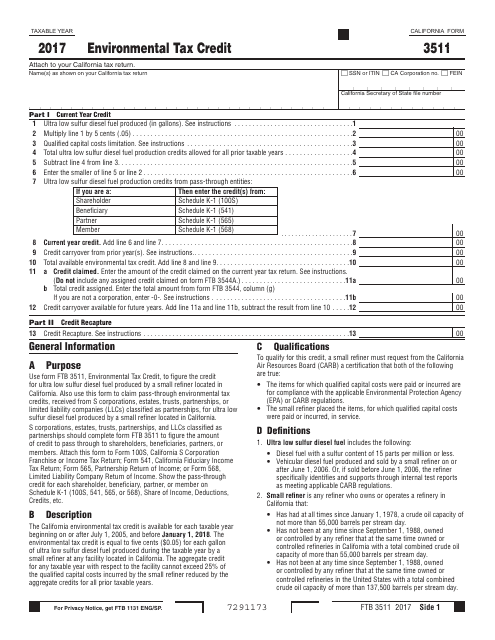

Fillable California Form 3511 Environmental Tax Credit 2012

This is only available by request. Business activity codes the codes listed in this section are a selection from the north american industry classification system (naics) that. Please provide your email address and it will be emailed to you. Populated, but we don't have any of that and don't qualify for eic. Part ix foster youth tax credit (see step.

Fda form 3514 Fill out & sign online DocHub

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web 2 weeks ago last updated april 07, 2023 9:35 pm i don't have a business, what is my business code on form 3514? Web june 6, 2019 3:39 am last updated june 06, 2019 3:39 am 2 8 113,772 reply bookmark icon.

Form 3514 California Earned Tax Credit 2015 printable pdf

Web if option 1 above is used, the business activity type must be entered in the business information overrides. Who is claiming the fytc? Web legal forms & services. Got money from a lawsuit settlement. Must file either form 540, 540ez, or 540nr.

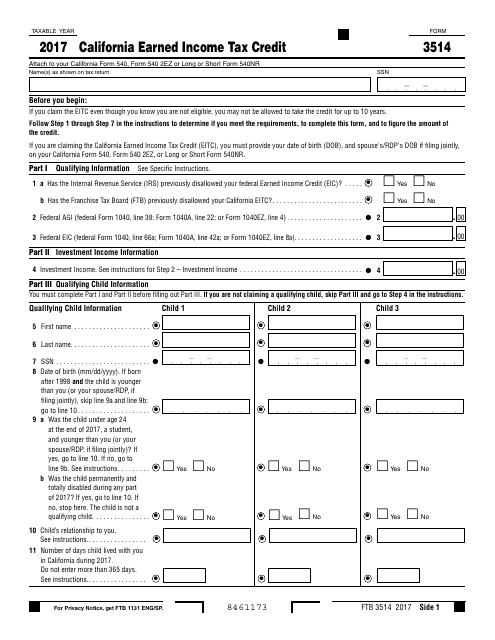

California Earned Tax Credit Worksheet 2017

Web legal forms & services. This is only available by request. Populated, but we don't have any of that and don't qualify for eic. Web 603 rows add line 1, line 2, line 3, and subtract line 4. Enter the amount here and on.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Purpose use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the. Enter your business information in the spaces. How.

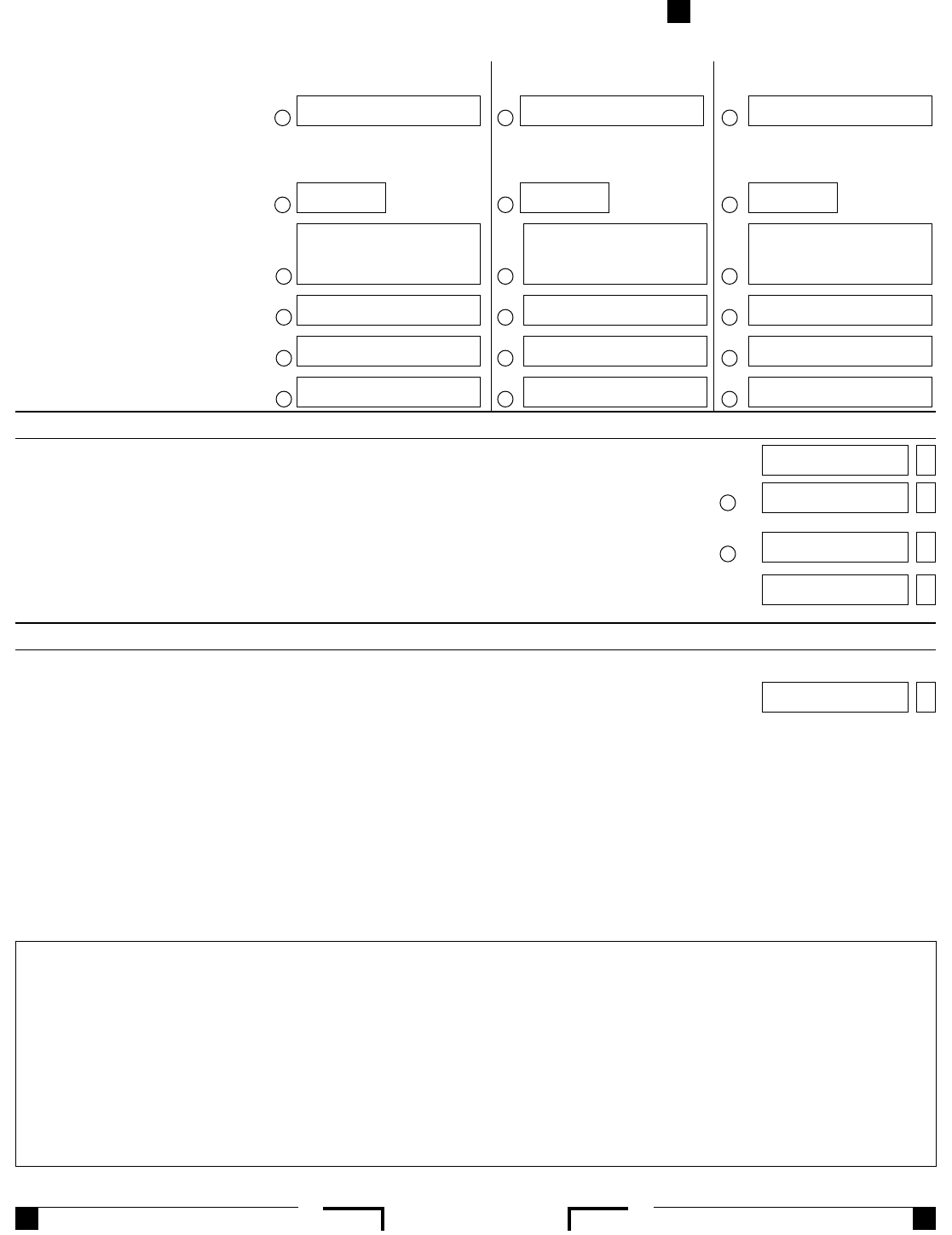

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Web california form 3514 want business code, etc. Populated, but we don't have any of that and don't qualify for eic. Business activity codes the codes listed in this section are a selection from the north american industry classification system (naics) that. Web 2021, 3514, instructions for 3514 form, california earned income tax credit. Web this amount should also be.

Enter The Amount Here And On Form Ftb 3514, Line 18.

Enter the amount here and on. Part ix foster youth tax credit (see step 10 in the instructions.) 31. Name(s) as shown on tax return. Who is claiming the fytc?

Ask Questions, Get Answers, And Join Our Large Community Of Tax Professionals.

Web if you are certain that form 3514 does not belong on your return, you can delete it. Purpose use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the. Web add line 1, line 2, line 3, and subtract line 4. Web june 6, 2019 3:39 am last updated june 06, 2019 3:39 am 2 8 113,772 reply bookmark icon nyinyeb new member the principal business code is a six digit number.

Web Legal Forms & Services.

Must have lived in california for more than half the year. Web if married, must file married filing jointly. This is only available by request. Got money from a lawsuit settlement.

Must Be At Least 18 Years Old Or.

02/2022 general information specific instructions 2021 earned income tax credit table. Web if you are claiming the california eitc, you must provide your date of birth (dob), and spouse’s/ registered domestic partner’s (rdp’s) dob if filing jointly, on your california. Web 8461213 ftb 3514 2021 side 1 california earned income tax credit attach to your california form 540, form 540 2ez or form 540nr. Enter your business information in the spaces.