Form 3115 Instructions

Form 3115 Instructions - Even when the irs's consent is not required, taxpayers must file form 3115. Web general instructions purpose of form file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. File a copy of the signed form 3115 to the address provided. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or ogden, ut, office and, in some cases, to an additional irs office. (including extensions) federal income tax return for the year of. Name of filer (name of parent corporation if a consolidated group) (see instructions) The original form 3115 attachment does not need to be signed. Automatic consent is granted for changes that have an assigned designated change number (dcn). The original form 3115 attachment does not need to be. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method.

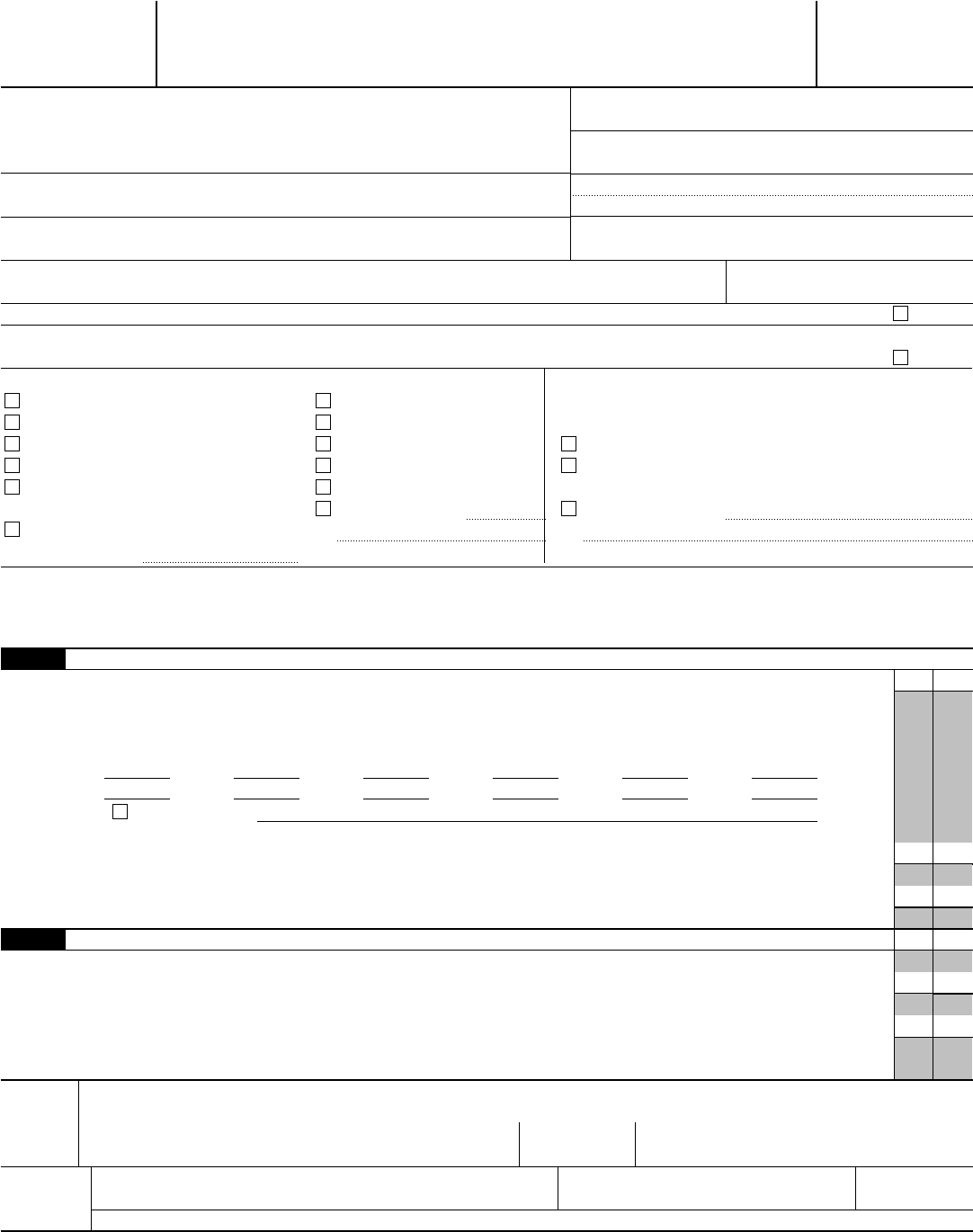

• attach the original form 3115 to the filer's timely filed (including extensions) federal income tax return for the year of change. For instructions and the latest information. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, File this form to request a change in either: For each of these copies, submit either the copy with an original signature or a photocopy of the original signed. The original form 3115 attachment does not need to be signed. Even when the irs's consent is not required, taxpayers must file form 3115. Web general instructions purpose of form file form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request as described under rev. Attach the original form 3115 to the filer's timely filed.

Automatic consent is granted for changes that have an assigned designated change number (dcn). The original form 3115 attachment does not need to be signed. For instructions and the latest information. File this form to request a change in either: Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, However, to allow for a reasonable period for taxpayers to transition to the december 2022 form 3115, the irs will accept either the december 2022 form 3115 or the december 2018 form 3115 if filed by a taxpayer on or before april 18, 2023, unless the December 2022) department of the treasury internal revenue service. Name of filer (name of parent corporation if a consolidated group) (see instructions) (including extensions) federal income tax return for the year of. The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request as described under rev.

Nys 2016 tax extension paper form psadovendor

Attach the original form 3115 to the filer's timely filed. The original form 3115 attachment does not need to be. The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request as described under rev. Method change procedures when filing form 3115, you must determine if the.

Form 3115 Instructions (Application for Change in Accounting Method)

For instructions and the latest information. For each of these copies, submit either the copy with an original signature or a photocopy of the original signed. (including extensions) federal income tax return for the year of. The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request.

Form 3115 Application for Change in Accounting Method(2015) Free Download

However, to allow for a reasonable period for taxpayers to transition to the december 2022 form 3115, the irs will accept either the december 2022 form 3115 or the december 2018 form 3115 if filed by a taxpayer on or before april 18, 2023, unless the Attach the original form 3115 to the filer's timely filed. Web to obtain the.

3115 Purpose of Form and Filing

Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or ogden, ut, office and, in some cases, to an additional irs office. Application for change in accounting method. For instructions and the latest information. About form 3115, application for change in.

Form 3115 Application for Change in Accounting Method(2015) Free Download

However, to allow for a reasonable period for taxpayers to transition to the december 2022 form 3115, the irs will accept either the december 2022 form 3115 or the december 2018 form 3115 if filed by a taxpayer on or before april 18, 2023, unless the The form instructions provides a list of possible dcns. Attach the original form 3115.

Form 3115 Instructions (Application for Change in Accounting Method)

Automatic consent is granted for changes that have an assigned designated change number (dcn). Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or ogden,.

Form 24 Change To Section We've chosen to wrap it inside a tag in

Web you must file form 3115 under the automatic change procedures in duplicate as follows. • attach the original form 3115 to the filer's timely filed (including extensions) federal income tax return for the year of change. About form 3115, application for change in accounting method | internal revenue service Web per the form 3115 instructions,for an automatic change request,.

Form 3115 Edit, Fill, Sign Online Handypdf

(including extensions) federal income tax return for the year of. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Web form 3115 is used to request this.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Attach the original form 3115 to the filer's timely filed. Web you must file form 3115 under the automatic change procedures in duplicate as follows. The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request as described under rev. File a copy of the signed form.

Abortion Instructions and Informed Consent Form Free Download

The taxpayer may convert any form 3115 filed under nonautomatic change procedures before may 11, 2021, that is still pending to an automatic request as described under rev. Attach the original form 3115 to the filer's timely filed. December 2022) department of the treasury internal revenue service. File this form to request a change in either: Method change procedures when.

The Taxpayer May Convert Any Form 3115 Filed Under Nonautomatic Change Procedures Before May 11, 2021, That Is Still Pending To An Automatic Request As Described Under Rev.

The form instructions provides a list of possible dcns. File this form to request a change in either: Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. However, to allow for a reasonable period for taxpayers to transition to the december 2022 form 3115, the irs will accept either the december 2022 form 3115 or the december 2018 form 3115 if filed by a taxpayer on or before april 18, 2023, unless the

Attach The Original Form 3115 To The Filer's Timely Filed.

Web form 3115 is used to request this consent. Web you must file form 3115 under the automatic change procedures in duplicate as follows. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or ogden, ut, office and, in some cases, to an additional irs office. For instructions and the latest information.

Name Of Filer (Name Of Parent Corporation If A Consolidated Group) (See Instructions)

Automatic consent is granted for changes that have an assigned designated change number (dcn). December 2022) department of the treasury internal revenue service. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. The original form 3115 attachment does not need to be.

The Original Form 3115 Attachment Does Not Need To Be Signed.

Method change procedures when filing form 3115, you must determine if the irs has issued any new published guidance which includes revenue procedures, revenue rulings, notices, Even when the irs's consent is not required, taxpayers must file form 3115. Web the irs encourages all taxpayers to use the december 2022 form 3115. • attach the original form 3115 to the filer's timely filed (including extensions) federal income tax return for the year of change.