Form 3115 For Missed Depreciation

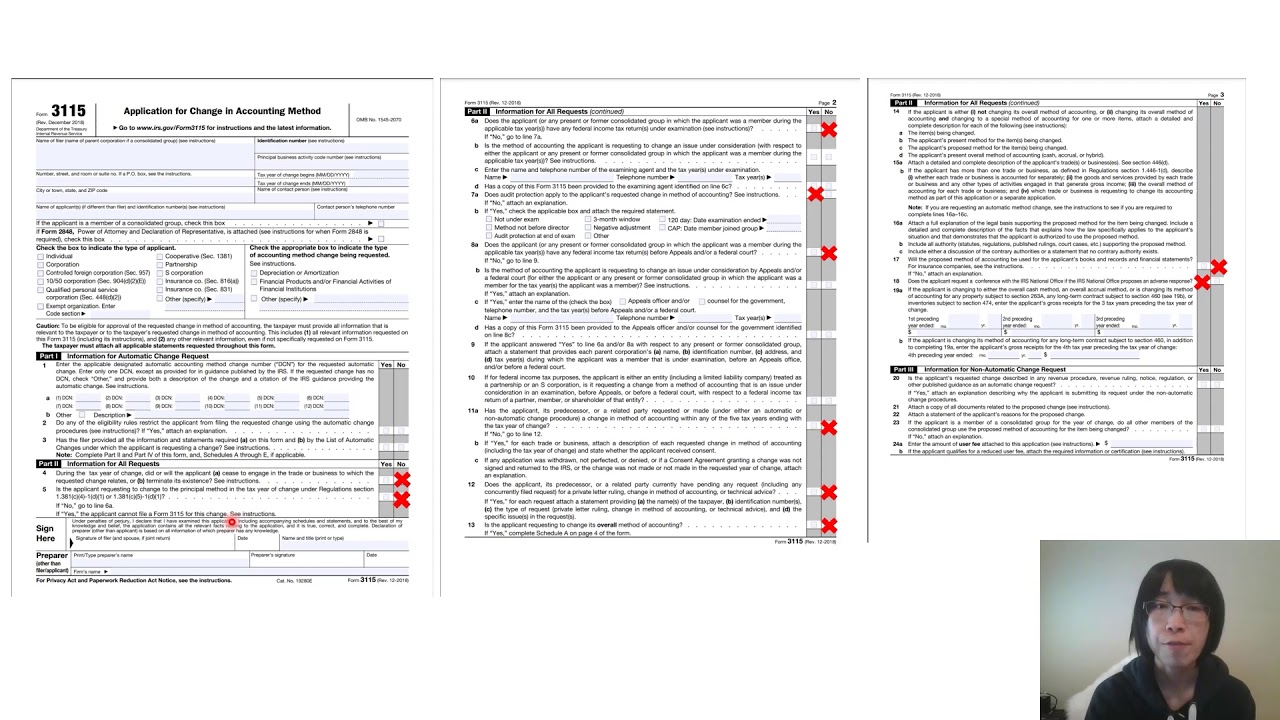

Form 3115 For Missed Depreciation - I am filing form 3115 to start depreciating (and to catch up on missed depreciation) a rental property that i have had in service since 2010. Client missed to take deprecation on rental property for last 15 years and. December 2022) department of the treasury internal revenue service. I understand to capture the missed depreciation on the rental i will use form 3115 and. Web form 3115 in general, you can only make a change in accounting method to catch up on missed depreciation or change depreciation that was calculated. Web how do i file an irs extension (form 4868) in turbotax online? How do i clear and. Web the key here is that you also need to complete form 3115, change in accounting method, to report the missed depreciation discovered at the time of sale. In the instructions for information regarding automatic changes under sections 56, 167, 168, 197, 1400i, 1400l,. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file.

Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. Web since depreciation allowable must be taken into account in the determination of gain regardless, the filing of f.3115 will not directly change the amount of gain that. I understand to capture the missed depreciation on the rental i will use form 3115 and. Web summary of the list of automatic accounting method changes. Web how do i file an irs extension (form 4868) in turbotax online? December 2022) department of the treasury internal revenue service. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web the key here is that you also need to complete form 3115, change in accounting method, to report the missed depreciation discovered at the time of sale. The result has two possible outcomes: Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights.

Web the key here is that you also need to complete form 3115, change in accounting method, to report the missed depreciation discovered at the time of sale. Furthermore, this webinar will deliver a comprehensive. Web how do i file an irs extension (form 4868) in turbotax online? Application for change in accounting method. Web a late filed form 3115 can result in a nail biting roller coaster for the taxpayer and their tax preparer. The result has two possible outcomes: Yes you can do it all at once on a timely filed return. Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. December 2022) department of the treasury internal revenue service. Web summary of the list of automatic accounting method changes.

Form 3115 Definition, Who Must File, & More

I am filing form 3115 to start depreciating (and to catch up on missed depreciation) a rental property that i have had in service since 2010. Web form 3115 missed depreciation updated may 2019 white paper on missed depreciation by natp staff introduction the irs allows a taxpayer to correct depreciation. Client missed to take deprecation on rental property for.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Yes you can do it all at once on a timely filed return. Web how do i file an irs extension (form 4868) in turbotax online? Web summary of the list of automatic accounting method changes. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web form 3115, application.

Tax Accounting Methods

Web form 3115 in general, you can only make a change in accounting method to catch up on missed depreciation or change depreciation that was calculated. I understand to capture the missed depreciation on the rental i will use form 3115 and. Yes you can do it all at once on a timely filed return. The result has two possible.

TPAT Form 3115 and New Tangible Property Regulations (TPR)

Web a qualified small taxpayer is a taxpayer with average annual gross receipts of less than or equal to $10 million for the 3 tax years preceding the year of change. December 2022) department of the treasury internal revenue service. Web how do i file an irs extension (form 4868) in turbotax online? Web there are procedures, which will be.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web since depreciation allowable must be taken into account in the determination of gain regardless, the filing of f.3115 will not directly change the amount of gain that. Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. Web the key.

Form 3115 Application for Change in Accounting Method

I understand to capture the missed depreciation on the rental i will use form 3115 and. Yes you can do it all at once on a timely filed return. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year you only use form 3115 for the.

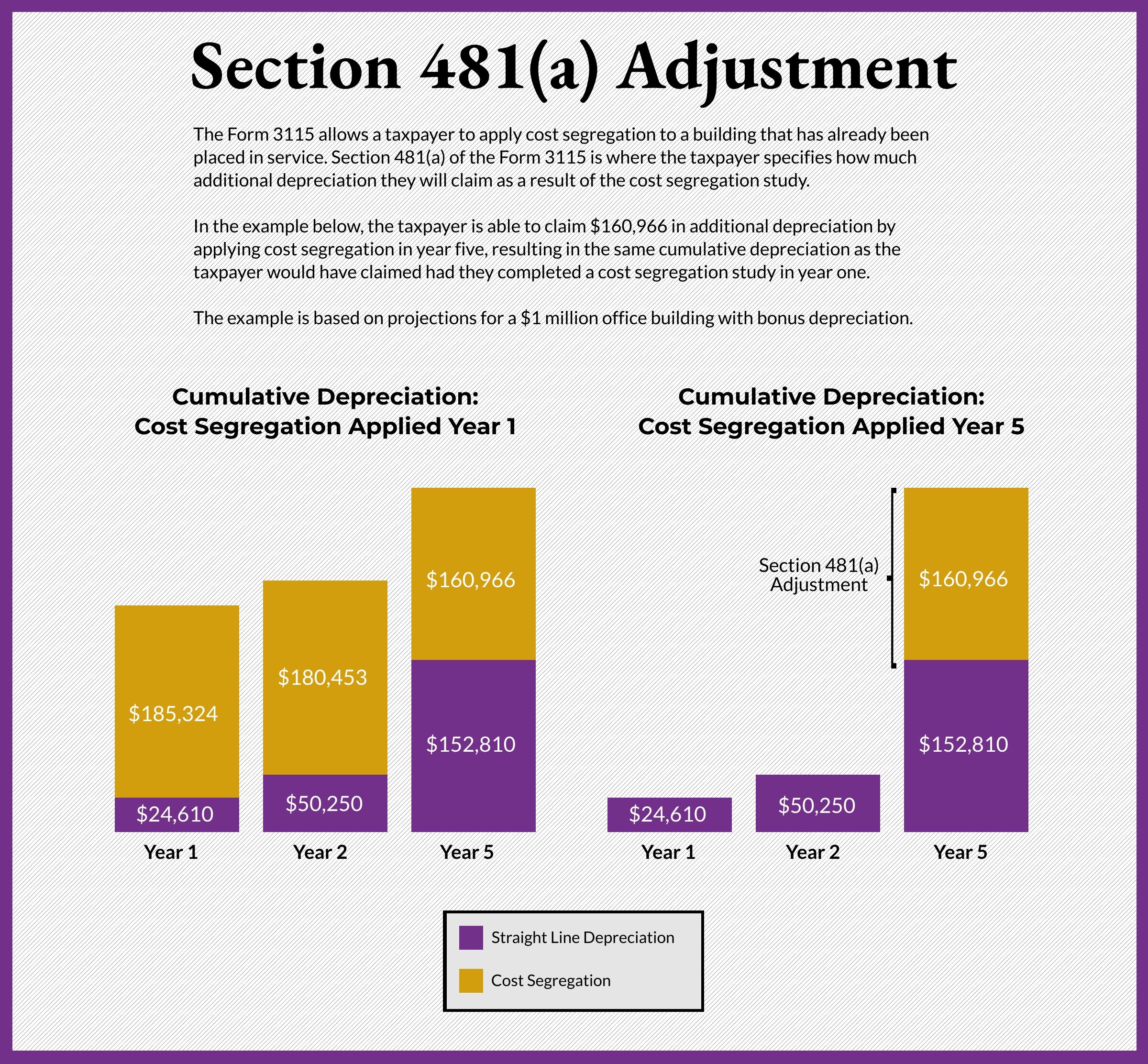

IRS Form 3115 How to Apply Cost Segregation to Existing Property

File an extension in turbotax online before the deadline to avoid a late filing penalty. I understand to capture the missed depreciation on the rental i will use form 3115 and. Web a qualified small taxpayer is a taxpayer with average annual gross receipts of less than or equal to $10 million for the 3 tax years preceding the year.

Form 3115 Depreciation Guru

I understand to capture the missed depreciation on the rental i will use form 3115 and. Web since depreciation allowable must be taken into account in the determination of gain regardless, the filing of f.3115 will not directly change the amount of gain that. Yes you can do it all at once on a timely filed return. Web today i.

Form 3115 Missed Depreciation printable pdf download

How do i clear and. Web form 3115 in general, you can only make a change in accounting method to catch up on missed depreciation or change depreciation that was calculated. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year you only use form 3115.

How to catch up missed depreciation on rental property (part I) filing

In the instructions for information regarding automatic changes under sections 56, 167, 168, 197, 1400i, 1400l,. Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year you only use form 3115 for the year you are. Web form 3115, change in accounting method, is used to.

Web Form 3115, Change In Accounting Method, Is Used To Correct Most Other Depreciation Errors, Including The Omission Of Depreciation.

Furthermore, this webinar will deliver a comprehensive. Web form 3115 in general, you can only make a change in accounting method to catch up on missed depreciation or change depreciation that was calculated. Web i am back, i filed the extension for the client whom i will be assisting. Web summary of the list of automatic accounting method changes.

Web The Key Here Is That You Also Need To Complete Form 3115, Change In Accounting Method, To Report The Missed Depreciation Discovered At The Time Of Sale.

Web there are procedures, which will be explained, that will allow us to fix these depreciation omission and or oversights. Client missed to take deprecation on rental property for last 15 years and. In the instructions for information regarding automatic changes under sections 56, 167, 168, 197, 1400i, 1400l,. Web a late filed form 3115 can result in a nail biting roller coaster for the taxpayer and their tax preparer.

File An Extension In Turbotax Online Before The Deadline To Avoid A Late Filing Penalty.

Web can form 3115 be filed for missed depreciation on rental property in the year of sale. Web a qualified small taxpayer is a taxpayer with average annual gross receipts of less than or equal to $10 million for the 3 tax years preceding the year of change. Web today i mailed a 3115 claiming a ~$2.1 million 481a adjustment for missed depreciation between 2006 and 2016. The result has two possible outcomes:

I Understand To Capture The Missed Depreciation On The Rental I Will Use Form 3115 And.

Web form 3115, application for change in accounting method, is an application to the irs to change either an entity’s overall accounting method or the accounting treatment of any. How do i clear and. Web form 3115 missed depreciation updated may 2019 white paper on missed depreciation by natp staff introduction the irs allows a taxpayer to correct depreciation. Web how do i file an irs extension (form 4868) in turbotax online?