Form 2848 Instructions 2023

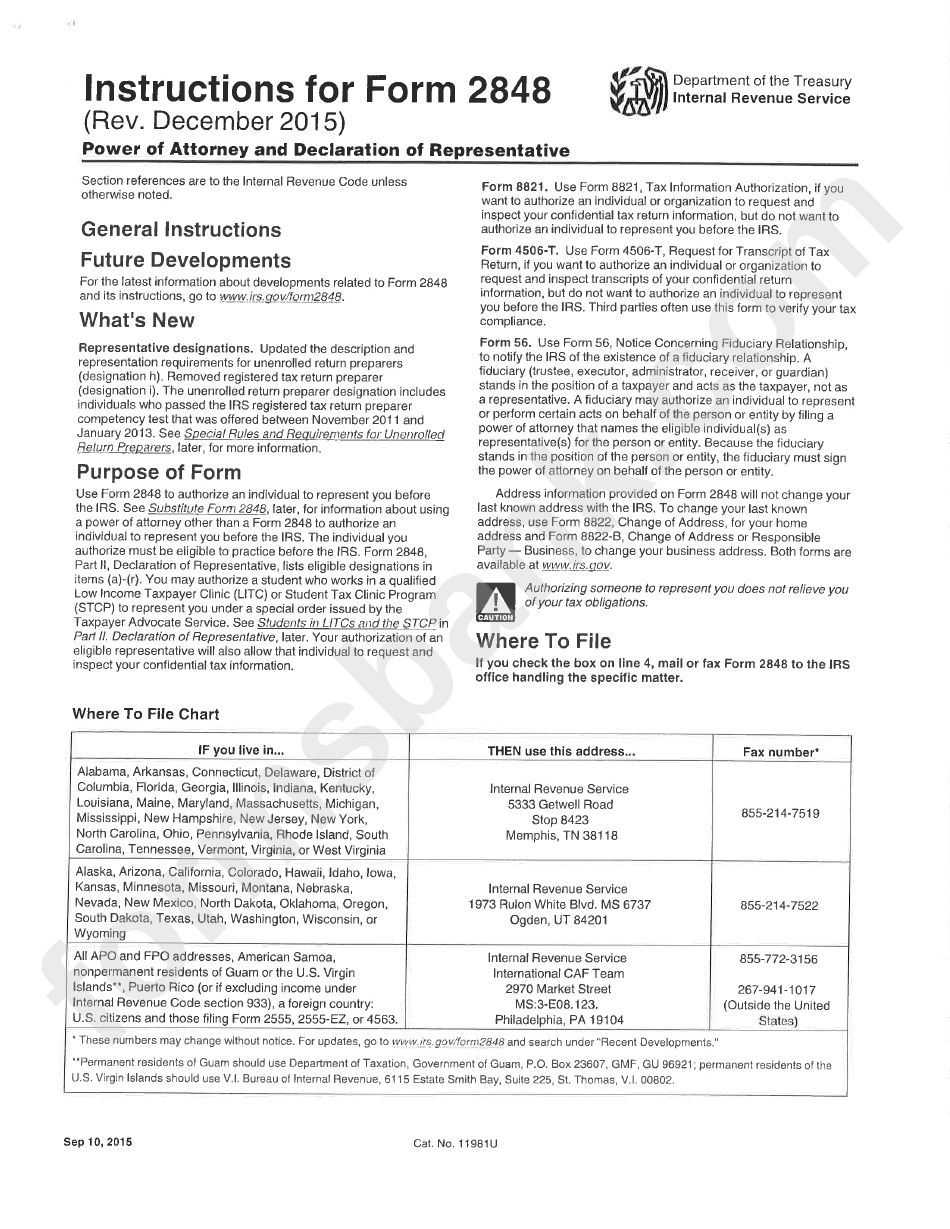

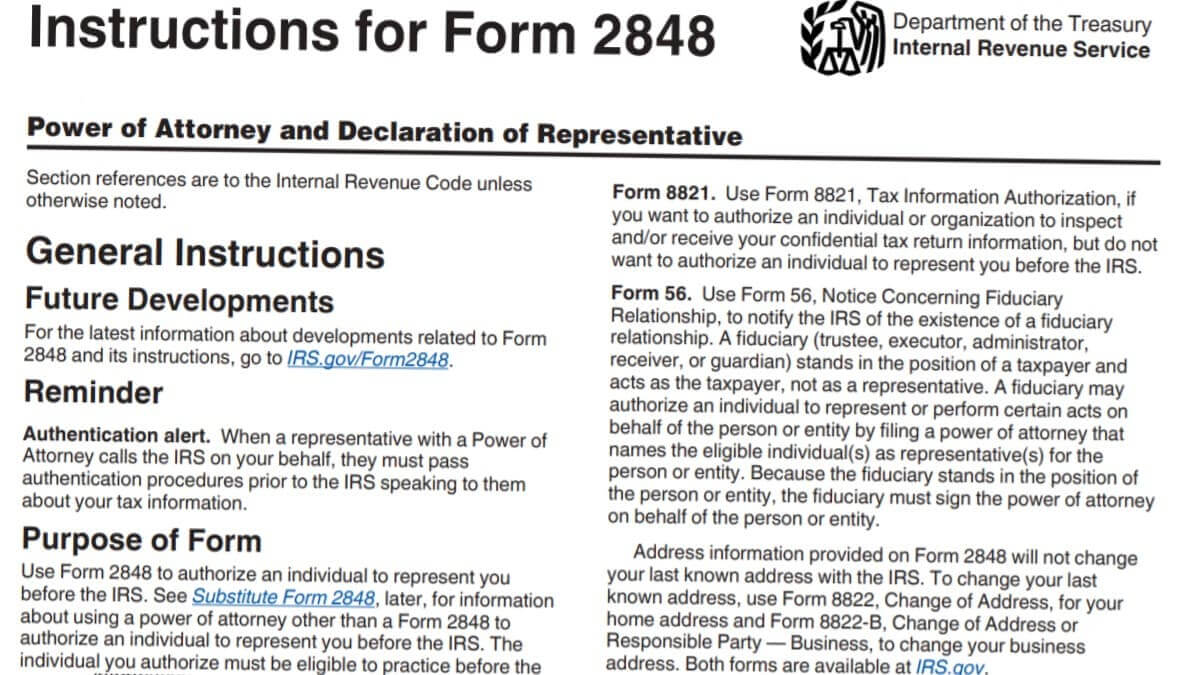

Form 2848 Instructions 2023 - For instructions and the latest information. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. Web this article aims to provide a comprehensive guideline on irs form 2848, ensuring that you have all the necessary information to use the document correctly. The individual you authorize must be eligible to practice before the irs. January 2021) department of the treasury internal revenue service. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. Form 2848, part ii, declaration of representative, lists eligible designations in items (a. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently.

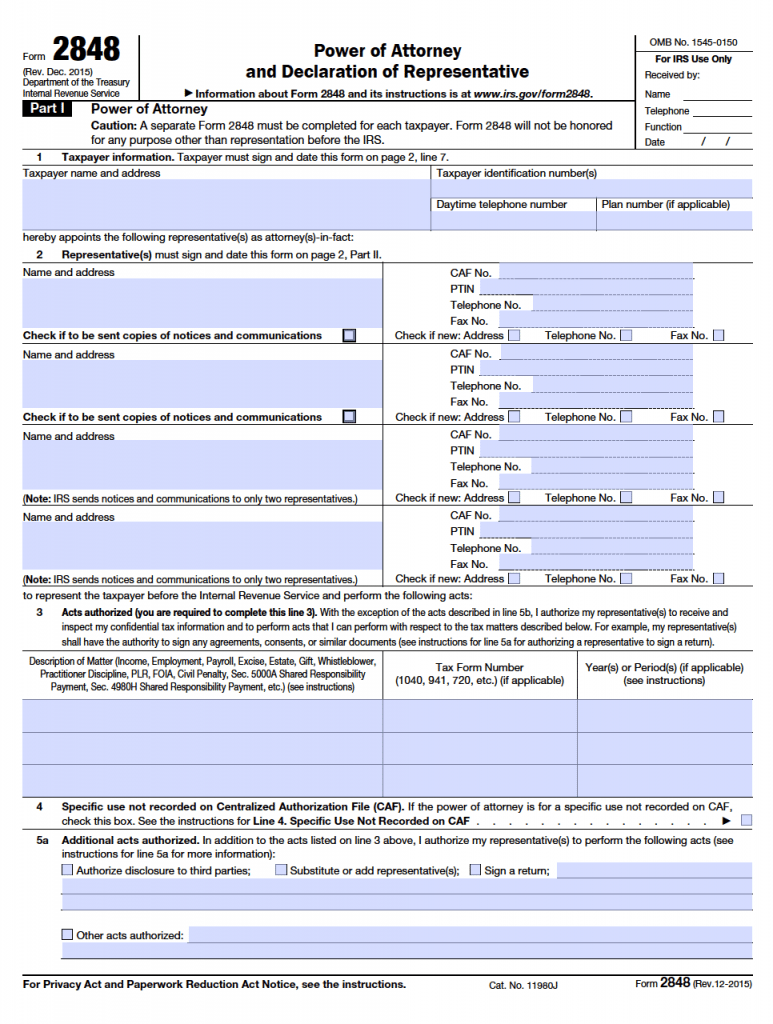

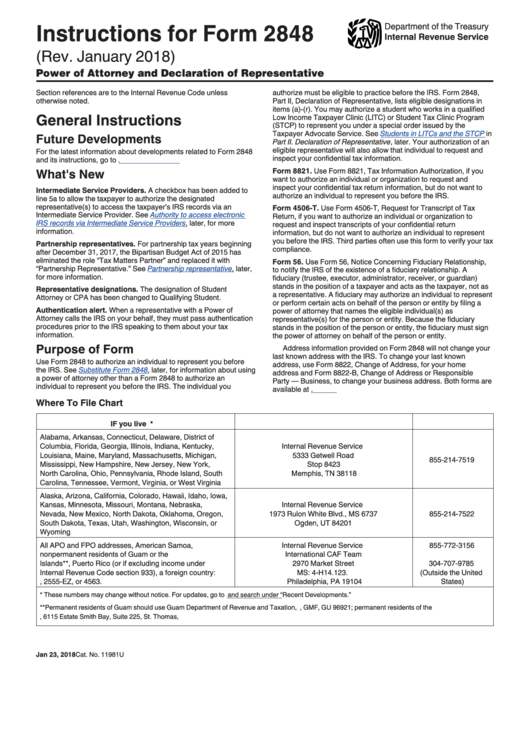

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Power of attorney and declaration of representative. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Date / / part i power of attorney. Form 2848 allows taxpayers to name someone to represent them before the irs. Form 2848 is used to authorize an eligible individual to. Web what is a form 2848? Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. You can download a form 2848 from irs.gov or access the file in the image below.

Date / / part i power of attorney. Make sure the form is signed by all parties either electronically or with an ink signature. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. The individual you authorize must be eligible to practice before the irs. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Web washington — victims of severe storms, tornadoes and flooding in florida from april 12 to april 14, 2023, now have until august 15, 2023, to file various individual and business tax returns and make tax payments, the. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. For instructions and the latest information.

Form 2848 IRS Power of Attorney (2023)

You can download a form 2848 from irs.gov or access the file in the image below. Web what is a form 2848? Date / / part i power of attorney. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. January 2021) department.

Instructions For Form 2848 Power Of Attorney And Declaration Of

For instructions and the latest information. Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. Form 2848 allows taxpayers to name someone to represent them before the irs. Web washington — victims of severe storms,.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Form 2848 allows taxpayers to name someone to represent them before the irs. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill.

Form 2848 YouTube

See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. You can download a form 2848 from irs.gov or access the file in the image below. Form 2848 allows taxpayers to name someone to represent them before the irs. The individual you.

[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022

This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. January 2021) department of.

IRS Power of Attorney Form 2848 Year 2016 Power of Attorney

Form 2848 allows taxpayers to name someone to represent them before the irs. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Power of attorney and declaration of representative. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and.

Instructions for Form 2848 IRS Tax Lawyer

We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. Web this article aims to provide a comprehensive guideline.

Instructions For Form 2848 Power Of Attorney And Declaration Of

Web what is a form 2848? January 2021) department of the treasury internal revenue service. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Make sure the form is signed by all parties either electronically or with an ink signature. Form 2848 is.

Breanna Form 2848 Instructions

This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. Form 2848 allows taxpayers.

Form 2848 Instructions

Power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. The individual you authorize must be eligible to practice before the irs. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Form 2848 is used to authorize an eligible individual.

Web Information About Form 2848, Power Of Attorney And Declaration Of Representative, Including Recent Updates, Related Forms, And Instructions On How To File.

Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Web this article aims to provide a comprehensive guideline on irs form 2848, ensuring that you have all the necessary information to use the document correctly. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Form 2848 is used to authorize an eligible individual to.

You Can Download A Form 2848 From Irs.gov Or Access The File In The Image Below.

See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. Web what is a form 2848? January 2021) department of the treasury internal revenue service. Power of attorney and declaration of representative.

Web Washington — Victims Of Severe Storms, Tornadoes And Flooding In Florida From April 12 To April 14, 2023, Now Have Until August 15, 2023, To File Various Individual And Business Tax Returns And Make Tax Payments, The.

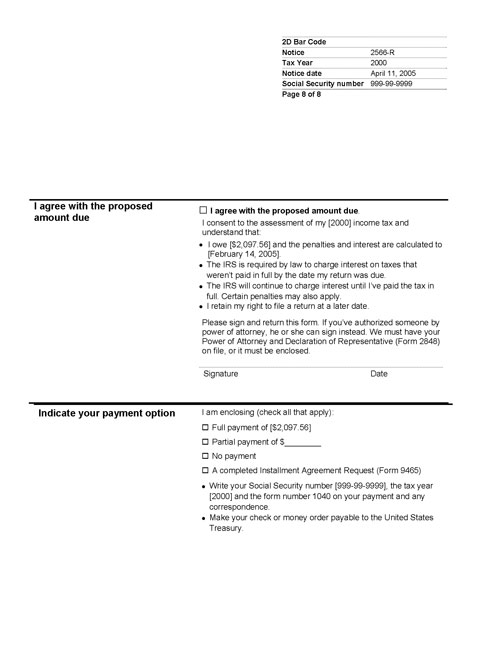

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. Make sure the form is signed by all parties either electronically or with an ink signature.

This Form Grants A Designated Individual The Authority To Represent You Before The Irs, So It's Essential To Fill It Out Correctly.

We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. Form 2848, part ii, declaration of representative, lists eligible designations in items (a. Date / / part i power of attorney. Form 2848 allows taxpayers to name someone to represent them before the irs.

![[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022](https://i.pinimg.com/originals/5d/2e/e7/5d2ee7f7d89068e86f739e40ac8cd1e8.png)