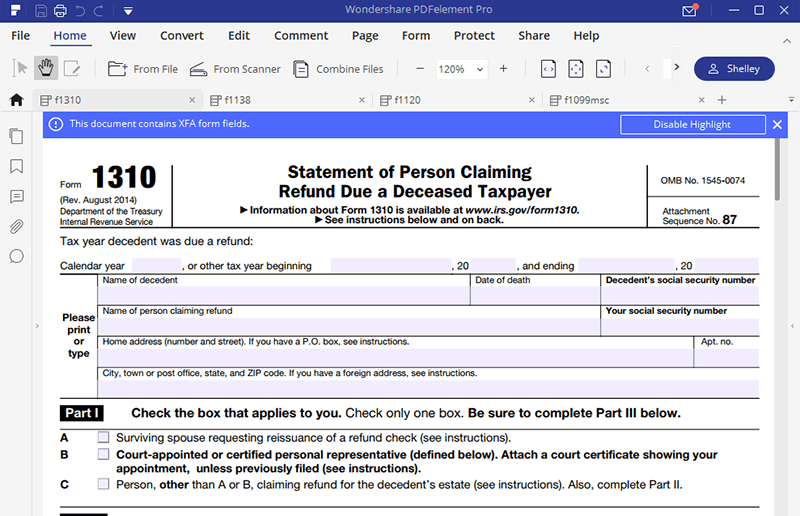

Form 1310 2022

Form 1310 2022 - Complete, edit or print tax forms instantly. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. Web claim a refund. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web comply with our simple actions to have your irs 1310 well prepared rapidly: Get ready for tax season deadlines by completing any required tax forms today. Web for form 2210, part iii, section b—figure the penalty), later. Web you should also complete and file with the final return a copy of form 1310, statement of person claiming refund due a deceased taxpayer. Ad fill, sign, email irs 1310 & more fillable forms, try for free now! Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022.

Web file only page 1 of form 2210. Complete, edit or print tax forms instantly. Applies, you must figure your penalty and file form 2210. Waiver (see instructions) of your entire. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. Web claim a refund. Go to screen 63, deceased taxpayer (1310). Web to access form 1310 in the taxact program: Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web in addition to completing this screen, the return must have the following in order to calculate form 1310:

Web for form 2210, part iii, section b—figure the penalty), later. Web file only page 1 of form 2210. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Attach to the tax return certified copies of the: Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Complete all necessary information in the necessary fillable. For a death that occurred. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web you should also complete and file with the final return a copy of form 1310, statement of person claiming refund due a deceased taxpayer.

Form 3911 Printable

Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Web you filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. Choose the web sample in the library. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty”.

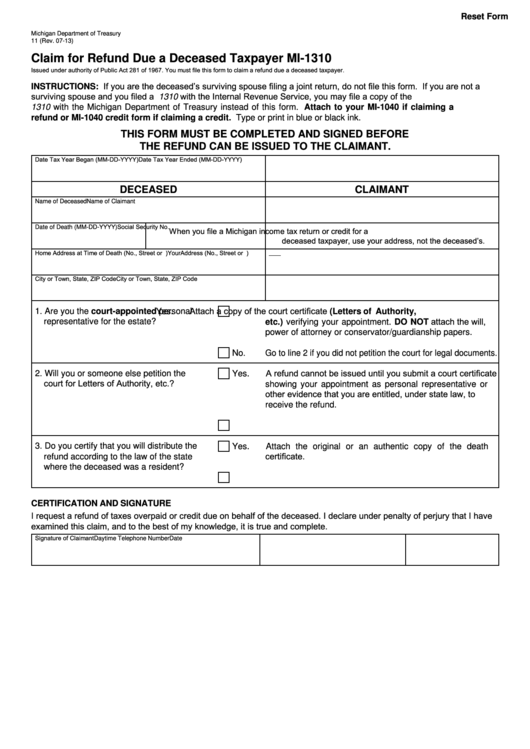

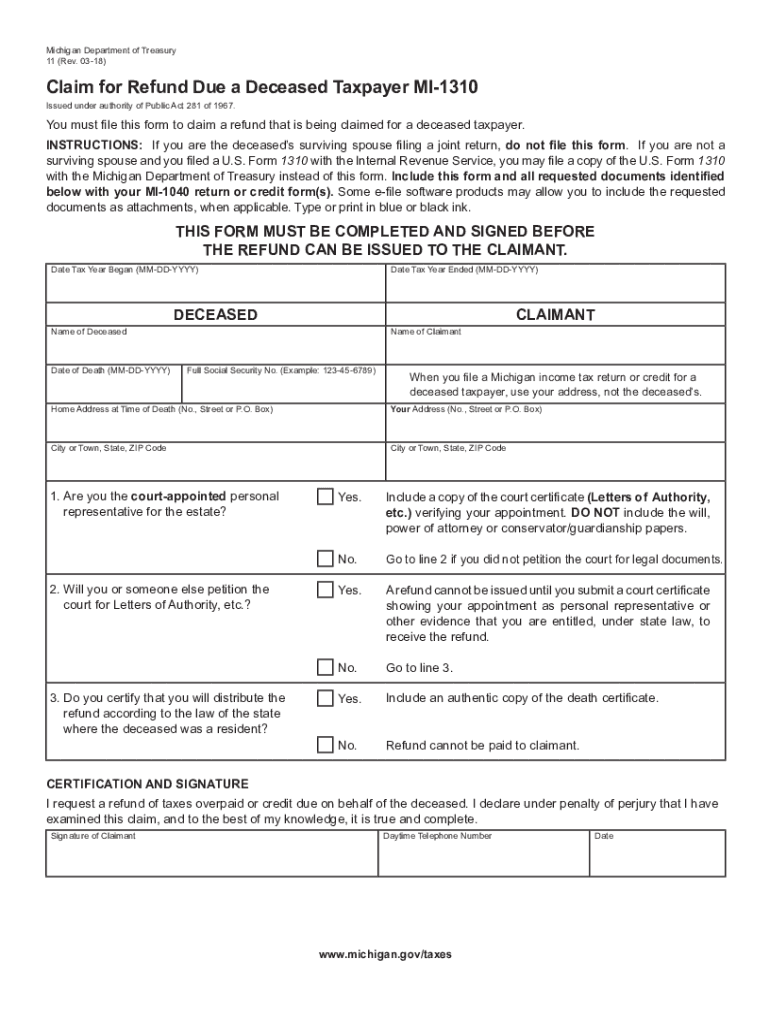

Fillable Form Mi1310 Claim For Refund Due A Deceased Taxpayer

Complete, edit or print tax forms instantly. Web follow these steps to generate form 1310: You must file page 1 of form 2210, but you. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this.

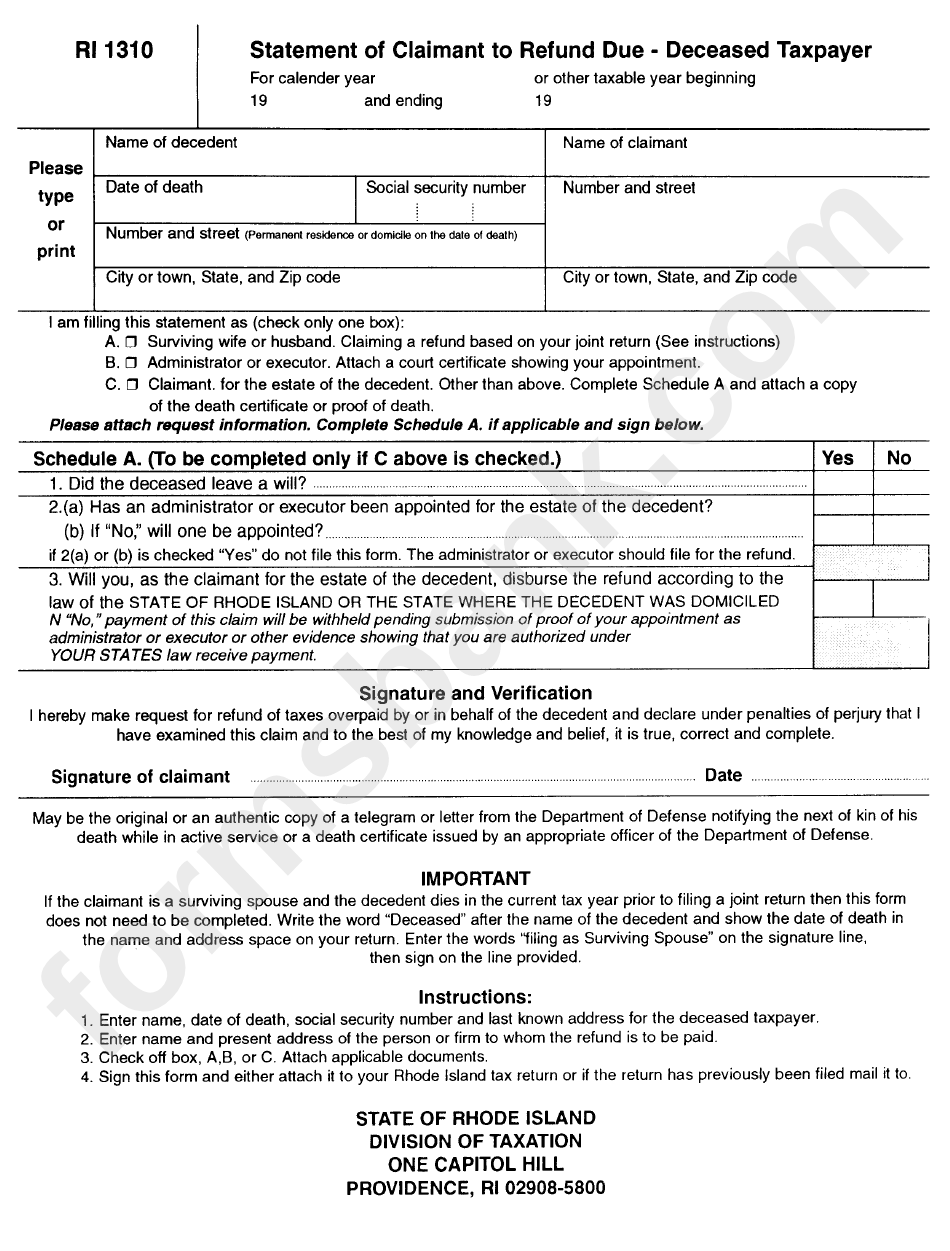

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

A date of death on the 1040 screen in the general folder. Waiver (see instructions) of your entire. Get ready for tax season deadlines by completing any required tax forms today. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. If you are.

Form 1065 Instructions 2020 2021 IRS Forms Zrivo

Web in addition to completing this screen, the return must have the following in order to calculate form 1310: Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Get ready for tax season deadlines by completing any required tax forms today. Web file only page 1 of form 2210..

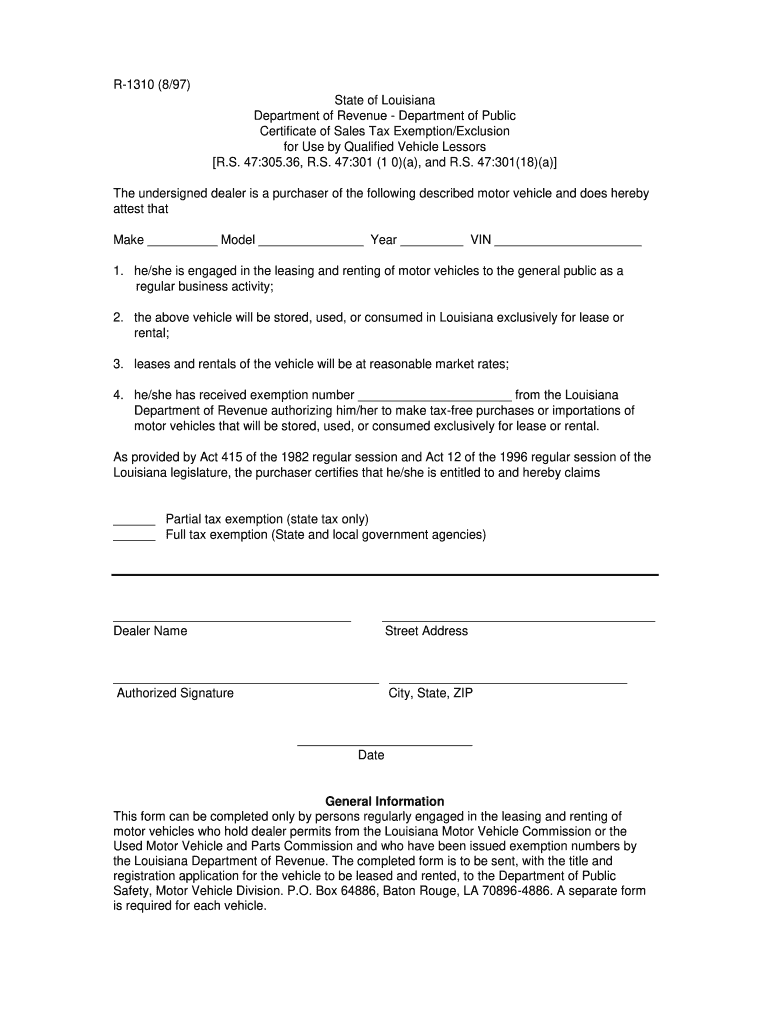

Louisiana She Revenue Fill Out and Sign Printable PDF Template signNow

Part ii reasons for filing. Enter a 1, 2, or 3 in 1=surviving spouse (married filing joint), 2=personal. Web comply with our simple actions to have your irs 1310 well prepared rapidly: Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Web claim a refund.

Form 1310 Instructions Claiming a Refund on Behalf of a Deceased

Web to access form 1310 in the taxact program: Web file form 2210 unless one or more boxes in part ii below applies. Complete, edit or print tax forms instantly. If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming. I’ll answer some common.

Form 1310 Major Errors Intuit Accountants Community

Web for form 2210, part iii, section b—figure the penalty), later. Web claim a refund. Ad download or email irs 1310 & more fillable forms, register and subscribe now! Go to screen 63, deceased taxpayer (1310). If a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a.

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

Applies, you must figure your penalty and file form 2210. Web in addition to completing this screen, the return must have the following in order to calculate form 1310: I’ll answer some common questions about requesting a tax refund due to a deceased. Web in order to claim a federal tax refund for a deceased person, you may need to.

1019 Fill Out and Sign Printable PDF Template signNow

I’ll answer some common questions about requesting a tax refund due to a deceased. Web we last updated federal form 1310 in january 2023 from the federal internal revenue service. Web you filed or are filing a joint return for either 2021 2022, but not both years, and line 8 above is smaller than 5 above. Web if a tax.

Edit Document IRS Form 1310 According To Your Needs

Web we last updated federal form 1310 in january 2023 from the federal internal revenue service. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. For a death that occurred. Waiver (see instructions) of your entire. Enter the penalty on form 2210, line 19, and on the “estimated tax.

If A Refund Is Due On The Individual Income Tax Return Of The Deceased, Claim The Refund By Submitting Form 1310, Statement Of A Person Claiming.

For a death that occurred. Web you should also complete and file with the final return a copy of form 1310, statement of person claiming refund due a deceased taxpayer. Web claim a refund. Web statement of person claiming refund due a deceased taxpayer (irs form 1310) legal representatives.

Web In Addition To Completing This Screen, The Return Must Have The Following In Order To Calculate Form 1310:

Web to access form 1310 in the taxact program: You must file page 1 of form 2210, but you. Web we last updated federal form 1310 in january 2023 from the federal internal revenue service. Complete all necessary information in the necessary fillable.

Enter The Penalty On Form 2210, Line 19, And On The “Estimated Tax Penalty” Line On Your Tax Return.

Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual. Web file only page 1 of form 2210. Waiver (see instructions) of your entire. Complete, edit or print tax forms instantly.

A Date Of Death On The 1040 Screen In The General Folder.

Web follow these steps to generate form 1310: Web file form 2210 unless one or more boxes in part ii below applies. Ad access irs tax forms. Choose the web sample in the library.