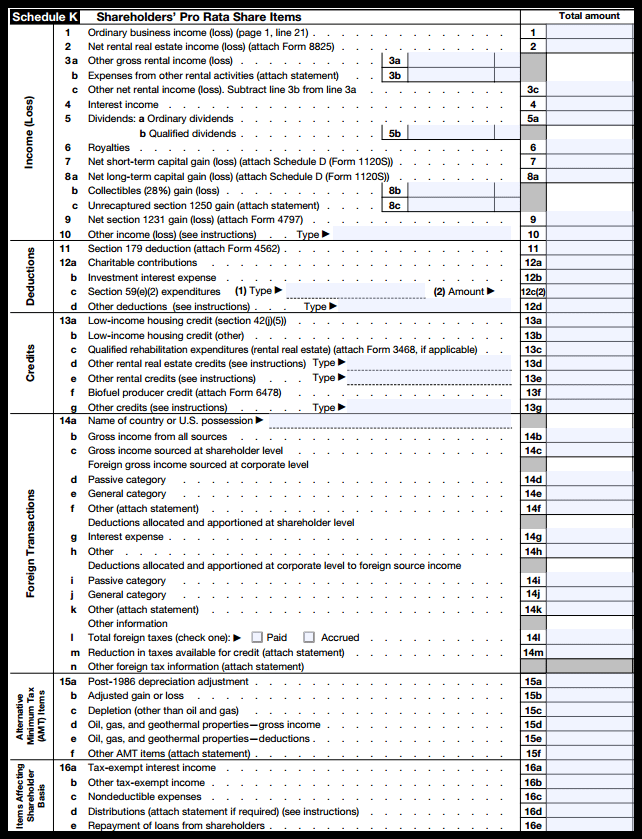

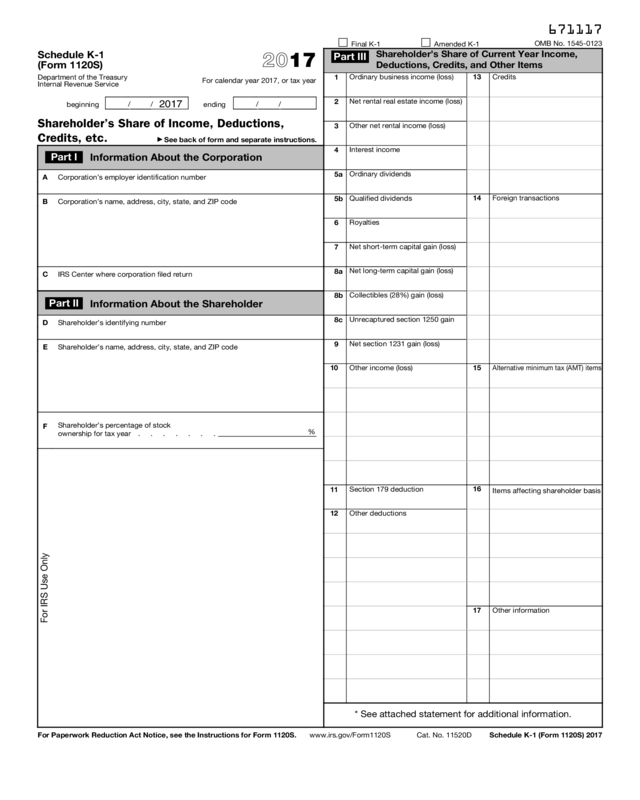

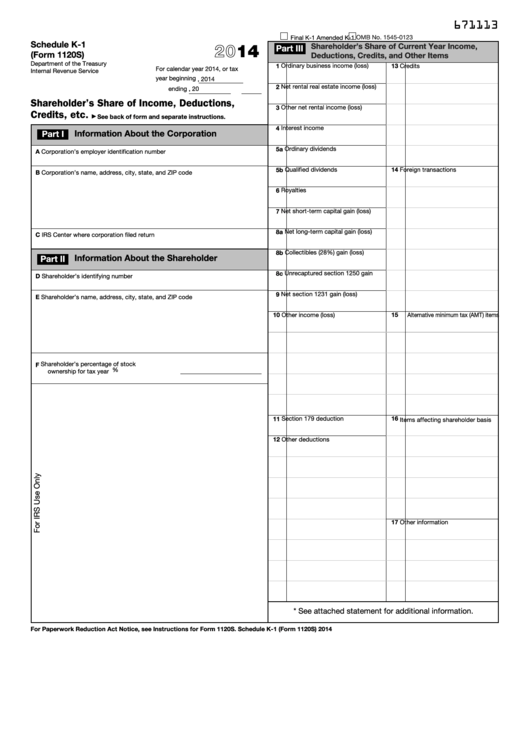

Form 1120-S Schedule K-1

Form 1120-S Schedule K-1 - Go to the input return tab. Form 8938, statement of specified foreign financial assets. Department of the treasury internal revenue service for calendar year 2022, or tax year. After filing form 1120s, each shareholder is. Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2021, or tax year. Easy guidance & tools for c corporation tax returns. For calendar year 2019, or tax year beginning. Department of the treasury internal revenue service. In addition to being the entry field for ordinary income (loss) from trade or business activities that.

Easy guidance & tools for c corporation tax returns. This schedule must be prepared for every shareholder. Form 8938, statement of specified foreign financial assets. For calendar year 2018, or tax. This code will let you know if you should. After filing form 1120s, each shareholder is. Department of the treasury internal revenue service for calendar year 2022, or tax year. Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2020, or tax year. In addition to being the entry field for ordinary income (loss) from trade or business activities that.

Department of the treasury internal revenue service for calendar year 2022, or tax year. This schedule must be prepared for every shareholder. Department of the treasury internal revenue service. Form 8938, statement of specified foreign financial assets. The s corporation files a copy of this schedule with the irs to report your share of the. Easy guidance & tools for c corporation tax returns. Department of the treasury internal revenue service for calendar year 2021, or tax year. To enter information for one shareholder: This code will let you know if you should. For calendar year 2019, or tax year beginning.

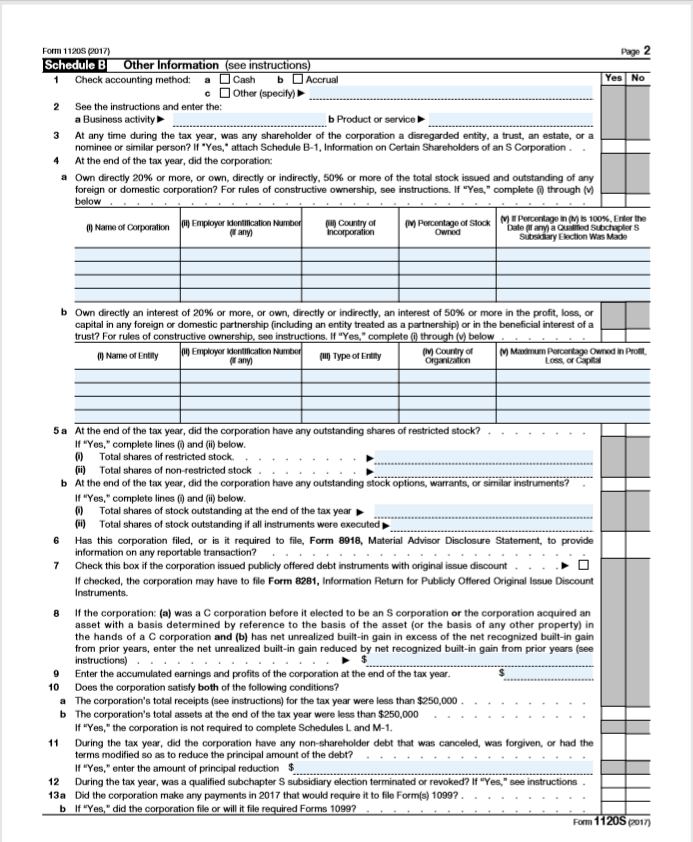

How to Complete Form 1120S Tax Return for an S Corp

To enter information for one shareholder: Web if the loss is allowed, it will then flow through to schedule e (form 1040). After filing form 1120s, each shareholder is. Form 8938, statement of specified foreign financial assets. The basis of your stock (generally, its cost) is adjusted annually as.

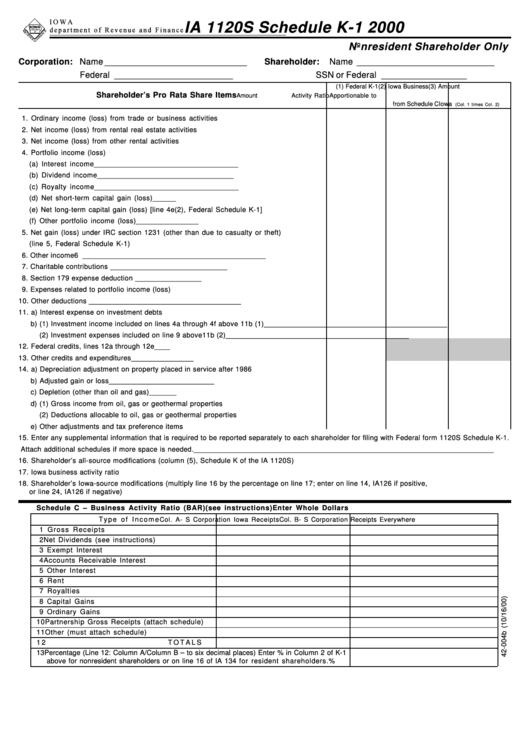

Form Ia 1120s Schedule K1 Nonresident Shareholder Only 2000

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. To enter information for one shareholder: (for shareholder's use only) department of the treasury internal revenue service. Easy guidance & tools for c corporation tax returns. In addition to being the entry field for ordinary income.

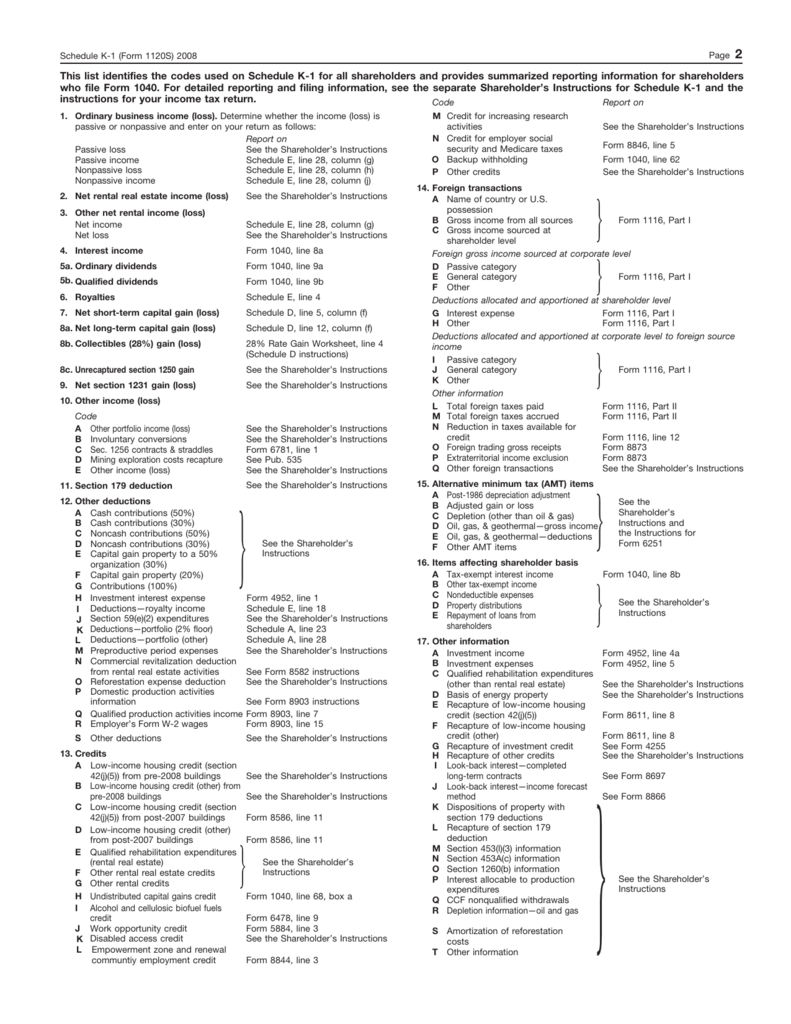

1120S K1 codes

Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2020, or tax year. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Easy guidance & tools for c corporation tax returns. For calendar year 2019, or tax.

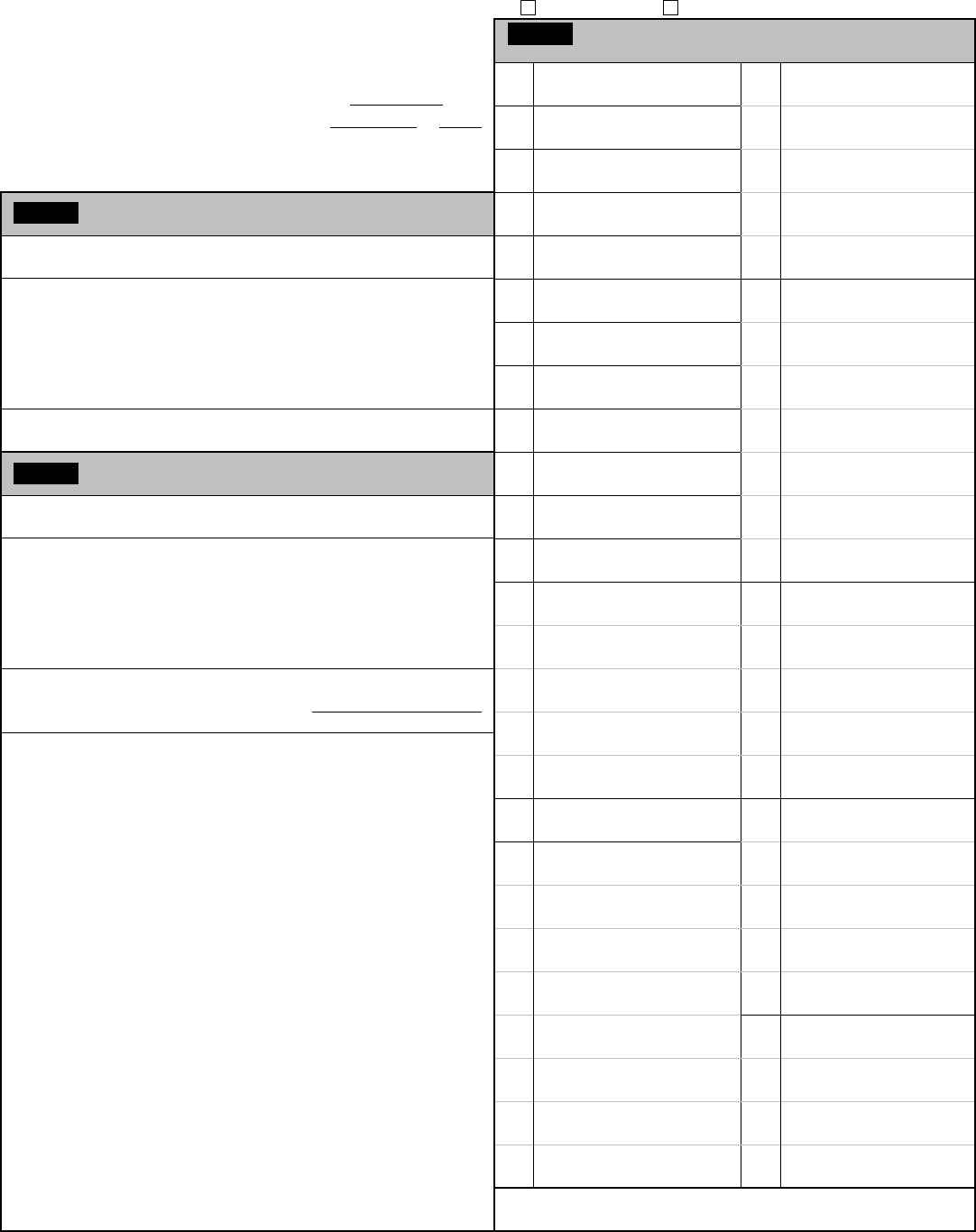

Form 1120 S Schedule K1 Edit, Fill, Sign Online Handypdf

For calendar year 2019, or tax year beginning. Department of the treasury internal revenue service for calendar year 2020, or tax year. This code will let you know if you should. Go to the input return tab. Web similar to a partnership, s corporations file an annual tax return using form 1120s.

Fill out the 1120S Form including the M1 & M2

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. The basis of your stock (generally, its cost) is adjusted annually as. The s corporation files a copy of this schedule with the irs to report your share of the. This code will let you know.

What is Form 1120S and How Do I File It? Ask Gusto

This schedule must be prepared for every shareholder. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Form 8938, statement of specified foreign financial assets. After filing form 1120s, each shareholder is. The s corporation files a copy of this schedule with the irs to.

2016 Form 1120 S (Schedule K1) Edit, Fill, Sign Online Handypdf

Go to the input return tab. To enter information for one shareholder: Department of the treasury internal revenue service. Department of the treasury internal revenue service for calendar year 2022, or tax year. Easy guidance & tools for c corporation tax returns.

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

The basis of your stock (generally, its cost) is adjusted annually as. Go to the input return tab. In addition to being the entry field for ordinary income (loss) from trade or business activities that. For calendar year 2018, or tax. After filing form 1120s, each shareholder is.

Fillable Schedule K1 (Form 1120s) Shareholder'S Share Of

For calendar year 2018, or tax. The basis of your stock (generally, its cost) is adjusted annually as. Department of the treasury internal revenue service for calendar year 2020, or tax year. This schedule must be prepared for every shareholder. For calendar year 2019, or tax year beginning.

What is Form 1120S and How Do I File It? Ask Gusto

(for shareholder's use only) department of the treasury internal revenue service. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. In addition to being the entry field for ordinary income (loss) from trade or business activities that. Department of the treasury internal revenue service for.

In Addition To Being The Entry Field For Ordinary Income (Loss) From Trade Or Business Activities That.

This schedule must be prepared for every shareholder. Department of the treasury internal revenue service for calendar year 2020, or tax year. Web similar to a partnership, s corporations file an annual tax return using form 1120s. Department of the treasury internal revenue service.

Web The Partnership Should Use This Code To Report Your Share Of Income/Gain That Comes From Your Total Net Section 743 (B) Basis Adjustments.

After filing form 1120s, each shareholder is. For calendar year 2018, or tax. For calendar year 2019, or tax year beginning. Department of the treasury internal revenue service.

Department Of The Treasury Internal Revenue Service For Calendar Year 2021, Or Tax Year.

Form 8938, statement of specified foreign financial assets. The s corporation files a copy of this schedule with the irs to report your share of the. To enter information for one shareholder: Easy guidance & tools for c corporation tax returns.

(For Shareholder's Use Only) Department Of The Treasury Internal Revenue Service.

Web if the loss is allowed, it will then flow through to schedule e (form 1040). This code will let you know if you should. Department of the treasury internal revenue service for calendar year 2022, or tax year. The basis of your stock (generally, its cost) is adjusted annually as.