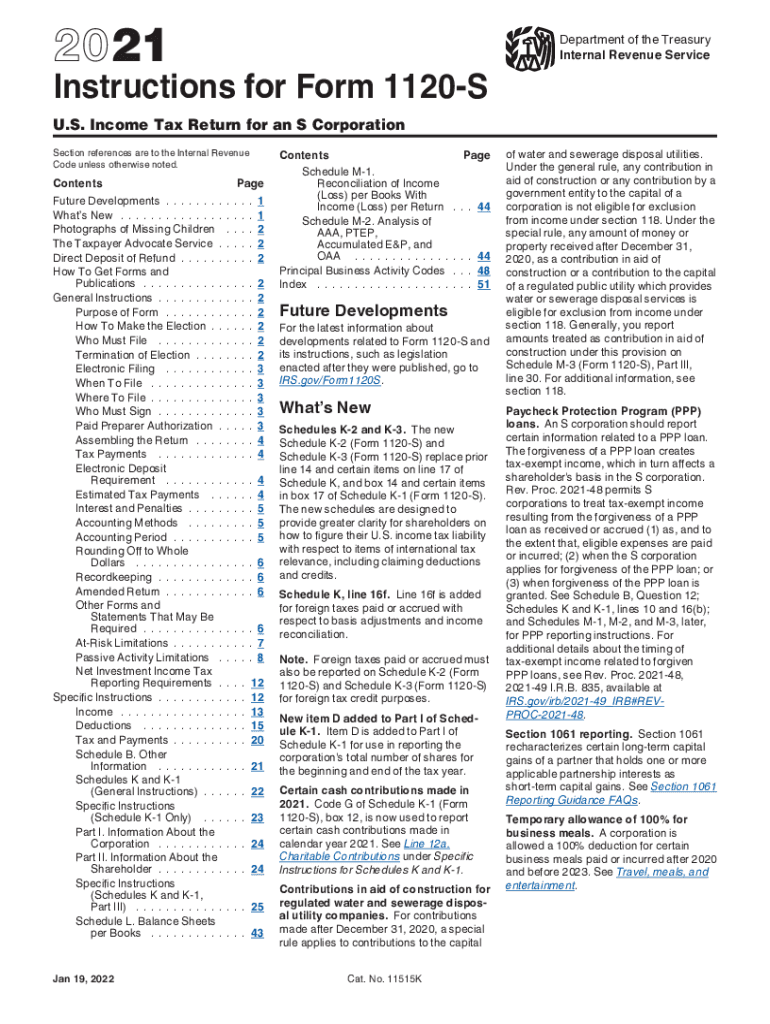

Form 1120-S Instructions

Form 1120-S Instructions - Sale of s corporation stock; See faq #17 for a link to the instructions. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Agriculture, forestry, fishing and hunting. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web a complete list of business activity codes is found in irs’s instructions for form 1120s.

Web instructions for form 1120s userid: Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Web a complete list of business activity codes is found in irs’s instructions for form 1120s. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Support activities for agriculture and forestry. Go to www.irs.gov/form1120s for instructions and the latest information.

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Agriculture, forestry, fishing and hunting. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Support activities for agriculture and forestry. See faq #17 for a link to the instructions. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Web instructions for form 1120s userid: Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Web thomson reuters tax & accounting. Sale of s corporation stock;

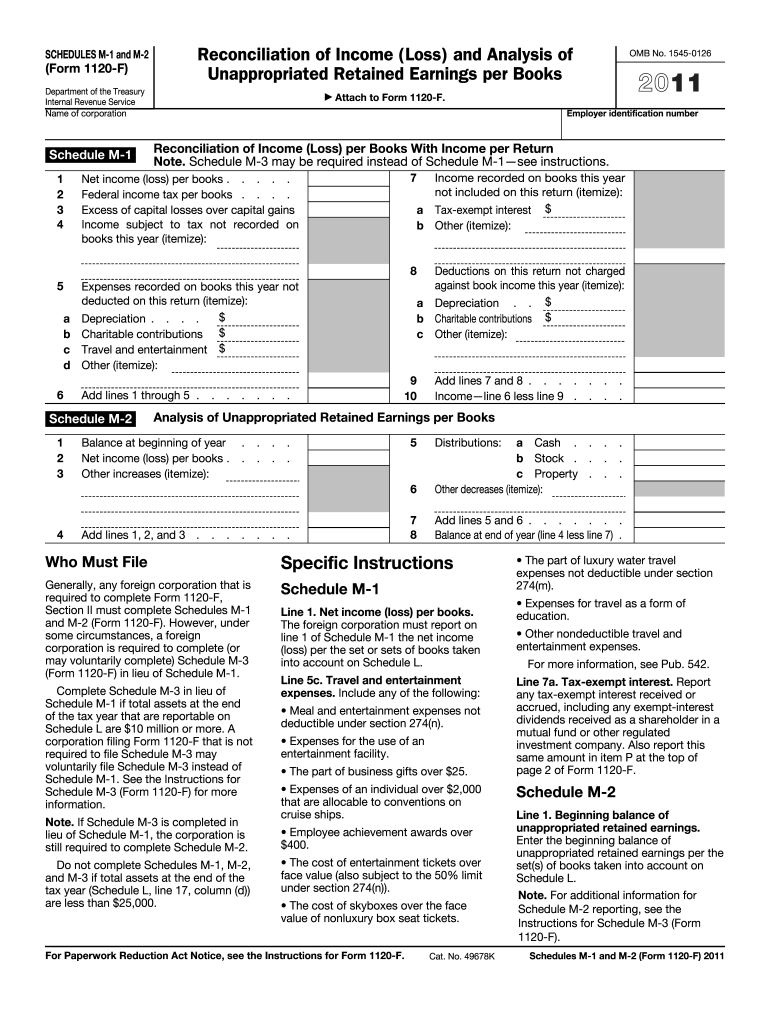

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

See faq #17 for a link to the instructions. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Web instructions for form 1120s userid: Web thomson reuters tax & accounting. Agriculture, forestry, fishing and hunting.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

See faq #17 for a link to the instructions. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Sale of s corporation stock; Support activities for agriculture and forestry. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect.

Instructions for Form 1120 REIT, U.S. Tax Return for Real Esta…

When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation..

2014 Form 1120s Instructions Form Resume Examples 023dOakKN5

Agriculture, forestry, fishing and hunting. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web thomson reuters tax.

IRS 1120S 2022 Form Printable Blank PDF Online

Web a complete list of business activity codes is found in irs’s instructions for form 1120s. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax return for an s corporation,.

What is Form 1120S and How Do I File It? Ask Gusto

Go to www.irs.gov/form1120s for instructions and the latest information. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Web thomson reuters tax & accounting. Sale of s corporation stock;

3.12.217 Error Resolution Instructions for Form 1120S Internal

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Go to www.irs.gov/form1120s for instructions and the latest information. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web instructions for form 1120s userid: Web a complete list of business activity codes is found in irs’s.

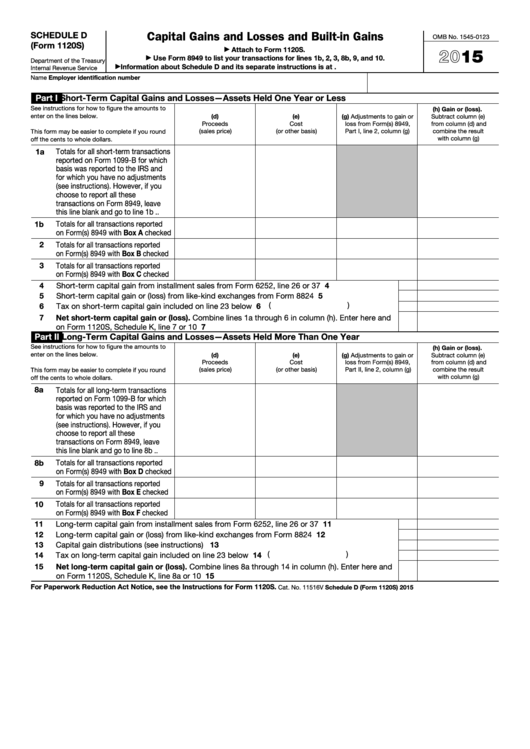

Fillable Schedule D (Form 1120s) Capital Gains And Losses And Built

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Agriculture, forestry, fishing and hunting. Support activities for agriculture and forestry. See faq #17 for a link to the instructions. Sale of s corporation stock;

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Support activities for agriculture and forestry. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. See faq #17 for a link to the instructions. Web thomson reuters tax & accounting. Income tax return for an s corporation do not file this form unless the corporation has filed.

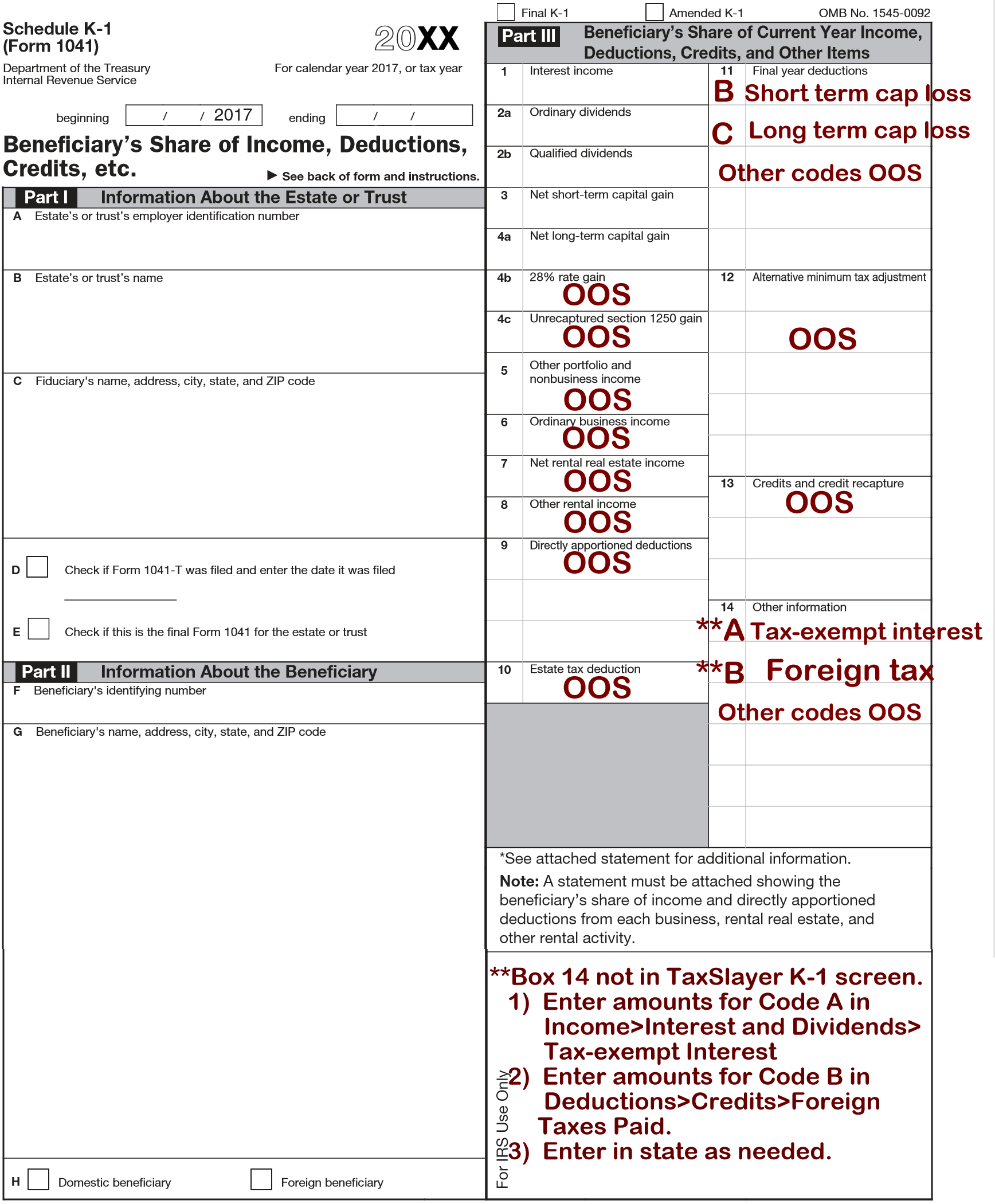

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Sale of s corporation stock; Agriculture, forestry, fishing and hunting. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Web instructions for form 1120s userid: Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s.

Corporation Income Tax Return, To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income Tax Liability Of A Corporation.

Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Web instructions for form 1120s userid: When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended.

Web Thomson Reuters Tax & Accounting.

Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Sale of s corporation stock; Agriculture, forestry, fishing and hunting. See faq #17 for a link to the instructions.

Income Tax Return For An S Corporation Do Not File This Form Unless The Corporation Has Filed Or Is Attaching Form 2553 To Elect To Be An S Corporation.

Support activities for agriculture and forestry. Go to www.irs.gov/form1120s for instructions and the latest information. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder.