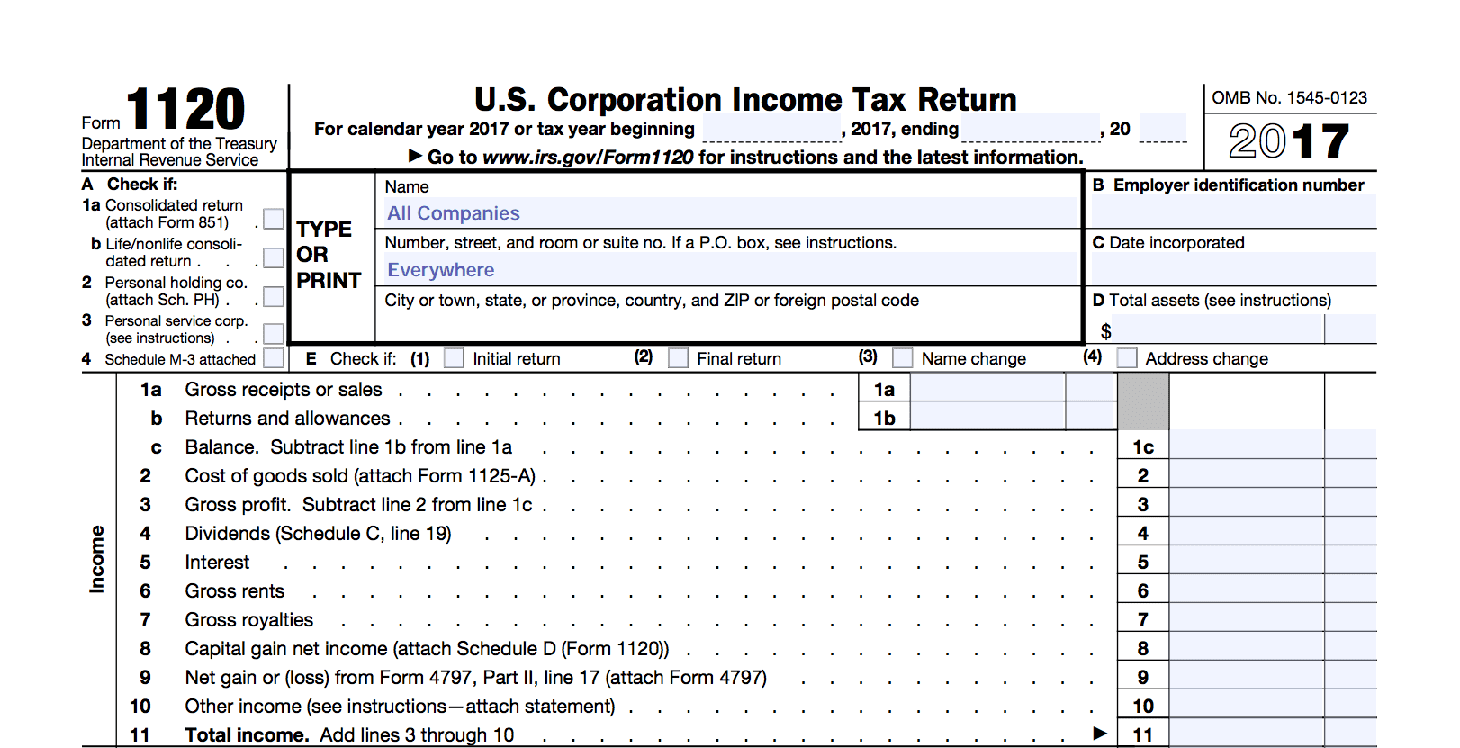

Form 1120 No Business Activity

Form 1120 No Business Activity - Corporation income tax return, including recent updates, related forms and instructions on how to file. Sales & use tax rates; Web must be removed before printing. A corporation must file a tax return for every year of its existence. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Business names, create an llc, business registration & company registration numbers. Web section 199a is a qualified business income (qbi) deduction. Complete, edit or print tax forms instantly. Web information about form 1120, u.s. Web principal business activity codes.

Form 1120 no business activity. Web section 199a is a qualified business income (qbi) deduction. Or • the corporation has tried repeatedly to contact the irs but no one has responded, or the irs. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web business activity code number (see instructions) type or print number, street, and room or suite no. See special returns for certain organizations, below. may 31,. Web information about form 1120, u.s. City or town, state or province, country,. Complete, edit or print tax forms instantly. Sales & use tax rates;

Sales & use tax rates; Web employers engaged in a trade or business who pay compensation form 9465; Knott 12.8k subscribers join subscribe 35 share 1.8k views 1 year ago #irs #taxes. Web principal business activity codes. Web 0:00 / 6:22 does my corporation need a form 1120 tax return with no activity? Web domestic corporations must file form 1120, unless they are required, or elect to file a special return. See special returns for certain organizations, below. may 31,. Web principal business activity codes. See principal business activity codes. The irs requires the filing even if the common had no activity or even lost.

Form 1120L U.S. Life Insurance Company Tax Return (2015) Free

See special returns for certain organizations, below. may 31,. Web copyrit 2023 omson reuters quickfinder® handbooks | form 1120 principal business activity codes—2022 returns 1 quick nder® table continued on the next page form. City or town, state or province, country,. Knott 12.8k subscribers join subscribe 35 share 1.8k views 1 year ago #irs #taxes. Installment agreement request popular for.

Learn How to Fill the Form 1120 U.S. Corporation Tax Return

See principal business activity codes. Web the quick answer is yes. The irs requires the filing even if the common had no activity or even lost. Web employers engaged in a trade or business who pay compensation form 9465; Ad easy guidance & tools for c corporation tax returns.

Form 1120RIC U.S. Tax Return for Regulated Investment Compan…

Web business activity code number (see instructions) type or print number, street, and room or suite no. Or • the corporation has tried repeatedly to contact the irs but no one has responded, or the irs. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. We revised the list of principal.

IRS Form 1120

Form 1120 no business activity. Complete, edit or print tax forms instantly. Sales & use tax rates; Web information about form 1120, u.s. City or town, state or province, country,.

Form 1120 Corporate Tax Return (2014) Free Download

You’ll need to investigate the particular demands for your area to guarantee you have all the needed documentation and also documents. See principal business activity codes. Web copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder® the type and rule above prints on all proofs. Business activity codes the codes listed in this.

Does My Corporation Need a Form 1120 Tax Return with No Activity? YouTube

Web principal business activity codes. City or town, state or province, country,. Knott 12.8k subscribers join subscribe 35 share 1.8k views 1 year ago #irs #taxes. Web section 199a is a qualified business income (qbi) deduction. Business names, create an llc, business registration & company registration numbers.

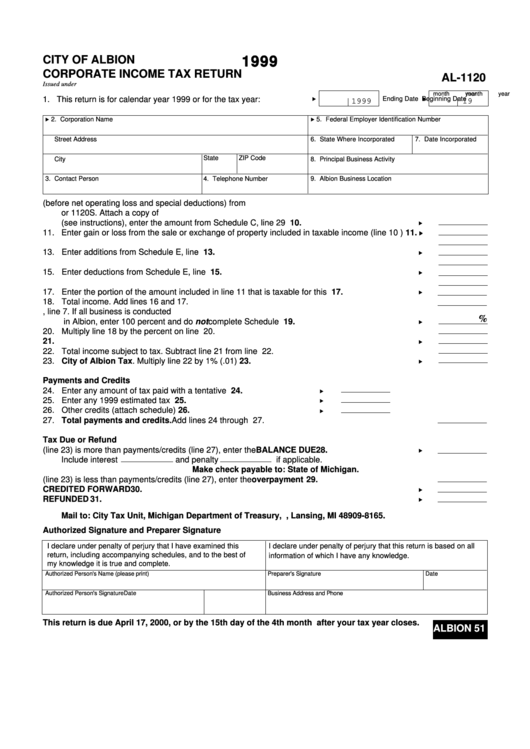

Form Al1120 Corporate Tax Return City Of Albion 1999

Corporation income tax return, including recent updates, related forms and instructions on how to file. Web business activity code number (see instructions) type or print number, street, and room or suite no. Ad easy guidance & tools for c corporation tax returns. See principal business activity codes. City or town, state or province, country,.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

Installment agreement request popular for tax pros. • the business is facing an immediate threat of adverse action; Web copyrit 2020 omson reuters quickfinder® handbooks | form 1120s principal business activity codes—2019 returns quick nder® the type and rule above prints on all proofs. Web employers engaged in a trade or business who pay compensation form 9465; Web domestic corporations.

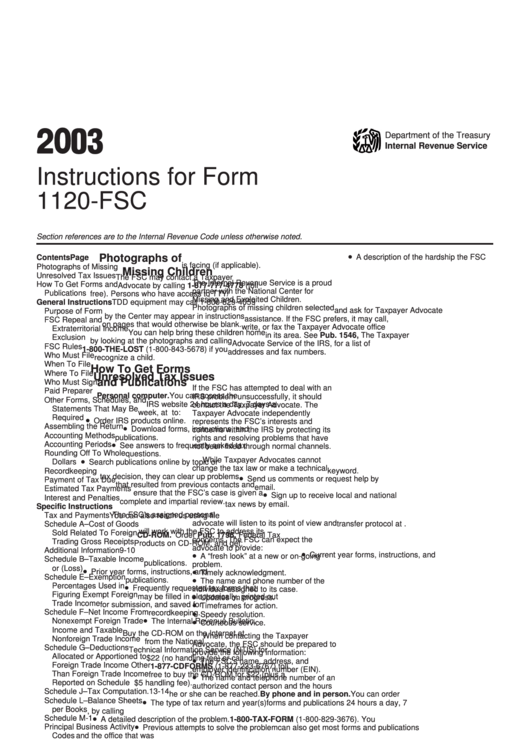

Instructions For Form 1120Fsc U.s. Tax Return Of A Foreign

Web if there are no transactions to include on the return, the form 1120 just contains zeros and the identifying information of the business, including the name and employer. Installment agreement request popular for tax pros. The irs requires the filing even if the common had no activity or even lost. Web watch newsmax live for the latest news and.

U.S Corporation Tax Return, Form 1120 Meru Accounting

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web information about form 1120, u.s. Web must be removed before printing. Web the quick answer is yes. Or • the corporation has tried repeatedly to contact the irs but no one has responded, or the irs.

Web Principal Business Activity Codes.

Knott 12.8k subscribers join subscribe 35 share 1.8k views 1 year ago #irs #taxes. Web section 199a is a qualified business income (qbi) deduction. Web employers engaged in a trade or business who pay compensation form 9465; Web business activity code number (see instructions) type or print number, street, and room or suite no.

City Or Town, State Or Province, Country,.

We revised the list of principal business activity codes. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Corporation income tax return, including recent updates, related forms and instructions on how to file. Use this form to report the.

Web Copyrit 2020 Omson Reuters Quickfinder® Handbooks | Form 1120S Principal Business Activity Codes—2019 Returns Quick Nder® The Type And Rule Above Prints On All Proofs.

Installment agreement request popular for tax pros. Form 1120 no business activity. See special returns for certain organizations, below. may 31,. Download or email inst 1120 & more fillable forms, try for free now!

You’ll Need To Investigate The Particular Demands For Your Area To Guarantee You Have All The Needed Documentation And Also Documents.

Sales & use tax rates; Business activity codes the codes listed in this section are a selection from the north code for the activity you are trying to categorize,. Web form 1120 no business activity. Complete, edit or print tax forms instantly.