Form 1118 Schedule H

Form 1118 Schedule H - Go to www.irs.gov/form1118 for instructions and the latest information. Web foreign tax credit form 1118 (final rev. Schedule h, part ii is now used to report deductions allocated and apportioned based on assets, and the title of schedule h, part ii has been revised accordingly. For instructions and the latest information. See categories of income, later. Web this article is designed to supplement the instructions for the form 1118 promulgated by the irs. • use schedule a to compute the corporation's income or loss before On page 11 of form 1118, schedule h, part ii, has been extensively revised. Schedule b, parts i & ii; And schedule j only once.

For instructions and the latest information. Complete a separate schedule a; 118 name of corporation employer identification number See categories of income, later. Go to www.irs.gov/form1118 for instructions and the latest information. Web schedule h, part ii. Web attach to the corporation’s tax return. And schedule k for each applicable separate category of income. Schedule b, parts i & ii; And schedule j only once.

Web foreign tax credit form 1118 (final rev. Schedule h, part ii is now used to report deductions allocated and apportioned based on assets, and the title of schedule h, part ii has been revised accordingly. Web department of the treasury internal revenue service attach to the corporation’s tax return. On page 11 of form 1118, schedule h, part ii, has been extensively revised. The preparer must complete a separate form 1118 for each separate category of. And schedule j only once. • use schedule a to compute the corporation's income or loss before Web schedule h, part ii. Go to www.irs.gov/form1118 for instructions and the latest information. Web attach to the corporation’s tax return.

Forms 1118 And 5471

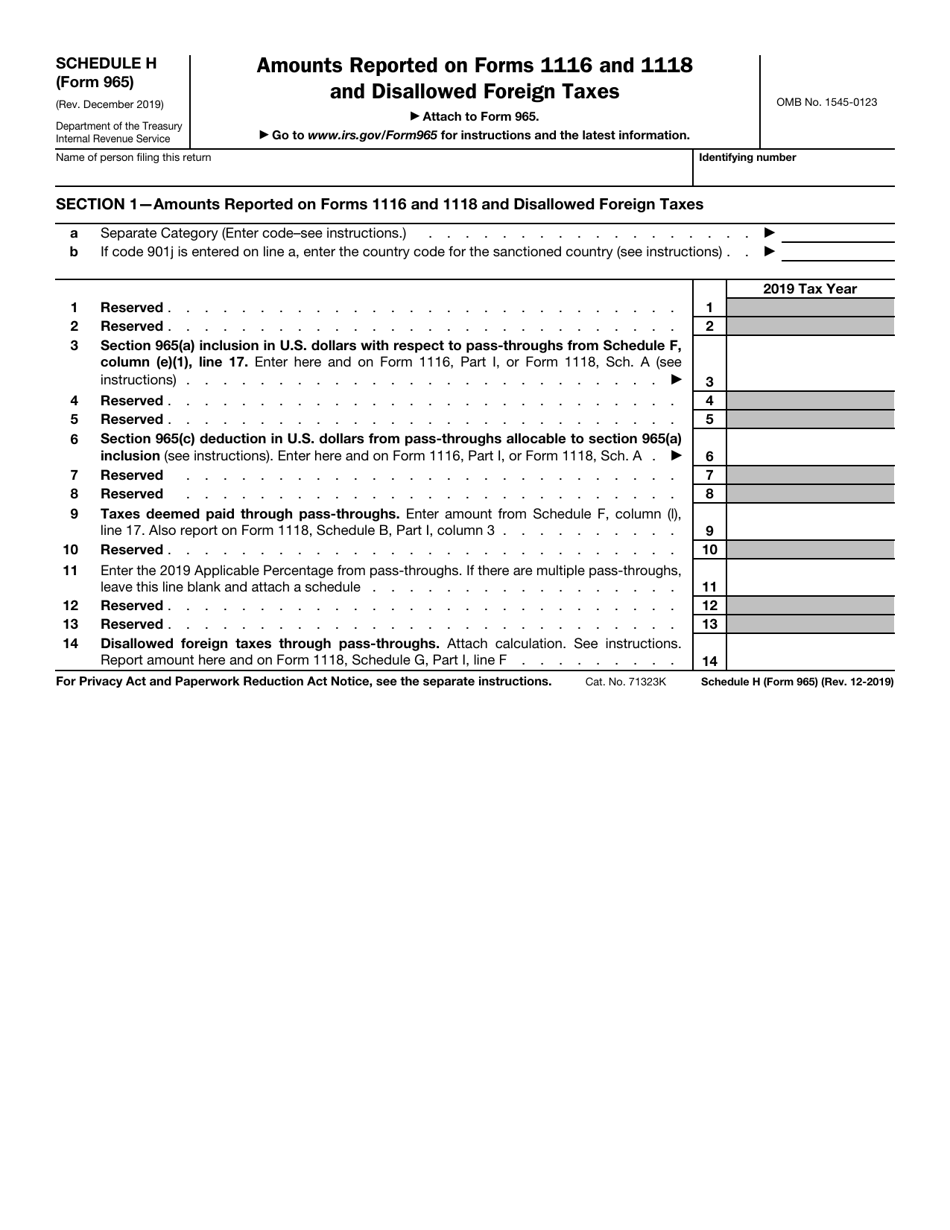

Name of person filing this return. Web schedule h (form 965) (rev. The preparer must complete a separate form 1118 for each separate category of. Go to www.irs.gov/form1118 for instructions and the latest information. Income classification lines a, b, and c the form 1118 begins by asking the preparer to compute a separate foreign tax credit for each category of.

Specific Power Of Attorney Form Pdf

And schedule k for each applicable separate category of income. See categories of income, later. For instructions and the latest information. Web schedule h (form 965) (rev. Web department of the treasury internal revenue service attach to the corporation’s tax return.

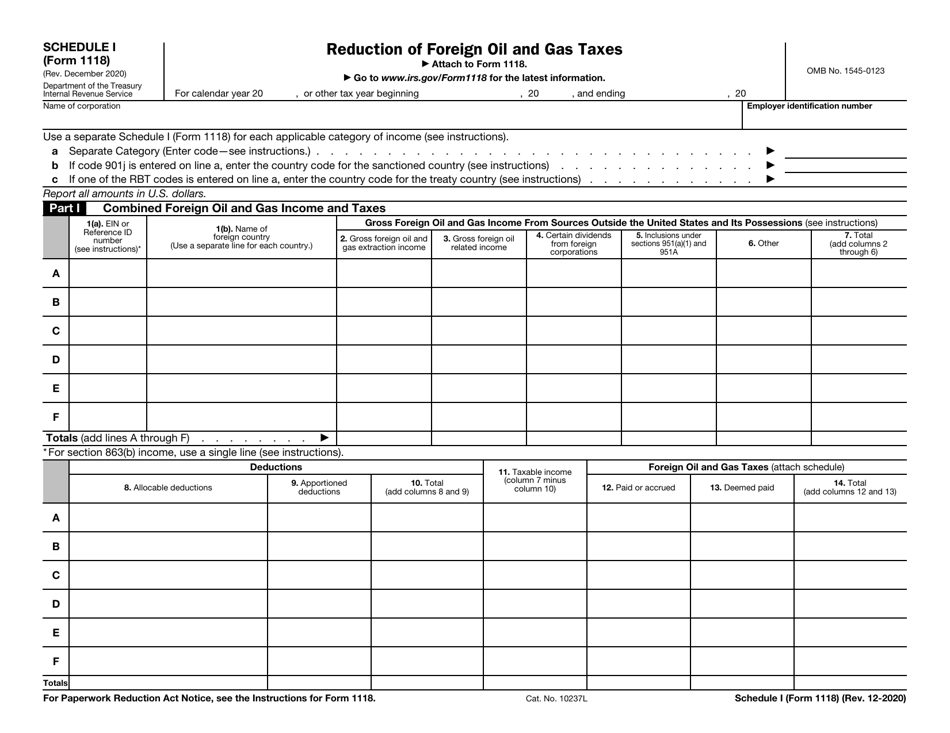

IRS Form 1118 Schedule I Download Fillable PDF or Fill Online Reduction

• use schedule a to compute the corporation's income or loss before Name of person filing this return. Web attach to the corporation’s tax return. Income classification lines a, b, and c the form 1118 begins by asking the preparer to compute a separate foreign tax credit for each category of foreign source income. Go to www.irs.gov/form1118 for instructions and.

Demystifying the Form 1118 Foreign Tax Credit Corporations Part 2

Complete a separate schedule a; Web schedule h, part ii. Go to www.irs.gov/form1118 for instructions and the latest information. On page 11 of form 1118, schedule h, part ii, has been extensively revised. Web foreign tax credit form 1118 (final rev.

Demystifying the Form 1118 Part 6. Schedule F1 Determining the Tax

For calendar year 20 , or other tax year beginning , 20 , and ending , 20 omb no. Web this article is designed to supplement the instructions for the form 1118 promulgated by the irs. Go to www.irs.gov/form1118 for instructions and the latest information. And schedule k for each applicable separate category of income. Income classification lines a, b,.

Demystifying the Form 1118 Foreign Tax Credit Corporations Part 3

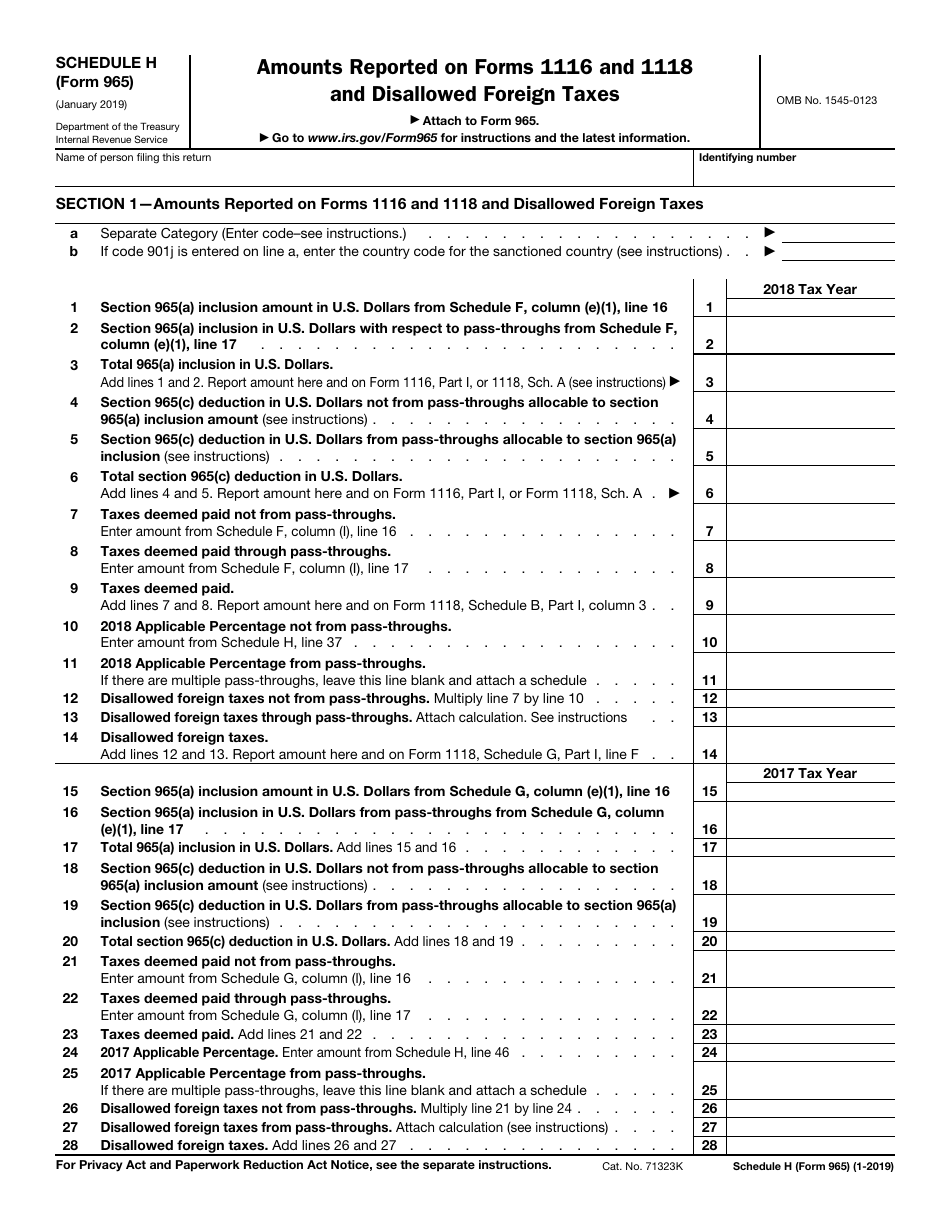

December 2020) amounts reported on forms 1116 and 1118 and disallowed foreign taxes department of the treasury internal revenue service attach to form 965. 118 name of corporation employer identification number Name of person filing this return. • use schedule a to compute the corporation's income or loss before Schedule b, parts i & ii;

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

And schedule k for each applicable separate category of income. Web foreign tax credit form 1118 (final rev. Complete a separate schedule a; Web schedule h (form 965) (rev. And schedule j only once.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Web department of the treasury internal revenue service attach to the corporation’s tax return. On page 11 of form 1118, schedule h, part ii, has been extensively revised. • use schedule a to compute the corporation's income or loss before For calendar year 20 , or other tax year beginning , 20 , and ending , 20 omb no. See.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

Name of person filing this return. • use schedule a to compute the corporation's income or loss before Web schedule h (form 965) (rev. Web schedule h, part ii. Go to www.irs.gov/form1118 for instructions and the latest information.

IRS Form 965 Schedule H Download Fillable PDF or Fill Online Amounts

For calendar year 20 , or other tax year beginning , 20 , and ending , 20 omb no. And schedule j only once. Web attach to the corporation’s tax return. Web foreign tax credit form 1118 (final rev. Go to www.irs.gov/form1118 for instructions and the latest information.

Web This Article Is Designed To Supplement The Instructions For The Form 1118 Promulgated By The Irs.

The preparer must complete a separate form 1118 for each separate category of. Schedule b, parts i & ii; For instructions and the latest information. Schedule h, part ii is now used to report deductions allocated and apportioned based on assets, and the title of schedule h, part ii has been revised accordingly.

Go To Www.irs.gov/Form1118 For Instructions And The Latest Information.

And schedule j only once. On page 11 of form 1118, schedule h, part ii, has been extensively revised. Web foreign tax credit form 1118 (final rev. Go to www.irs.gov/form1118 for instructions and the latest information.

Income Classification Lines A, B, And C The Form 1118 Begins By Asking The Preparer To Compute A Separate Foreign Tax Credit For Each Category Of Foreign Source Income.

Corporations use this form to compute their foreign tax credit for certain taxes paid or. • use schedule a to compute the corporation's income or loss before Complete a separate schedule a; 118 name of corporation employer identification number

Web Attach To The Corporation’s Tax Return.

December 2020) amounts reported on forms 1116 and 1118 and disallowed foreign taxes department of the treasury internal revenue service attach to form 965. Web schedule h (form 965) (rev. 118 name of corporation employer identification number Name of person filing this return.