Form 1098-C 2022

Form 1098-C 2022 - Make changes to your 2022 tax. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Type in the recipient in. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web instructions for donor caution: Donee certifies that vehicle was sold in arm's length. Web filer fields common to all form types. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Recipient fields common to all form types. Upload, modify or create forms.

To claim a deduction for donation of a motor vehicle, use screen. Upload, modify or create forms. Each contribution constitutes a new form. Make changes to your 2022 tax. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Type in the recipient in. See the current general instructions for certain. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Web filer fields common to all form types. Donee certifies that vehicle was sold in arm's length.

Upload, modify or create forms. Donee certifies that vehicle was sold in arm's length. To claim a deduction for donation of a motor vehicle, use screen. Make changes to your 2022 tax. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web filer fields common to all form types. See the current general instructions for certain. Web instructions for donor caution: Recipient copy 30 days from the date of the sale or contribution. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.

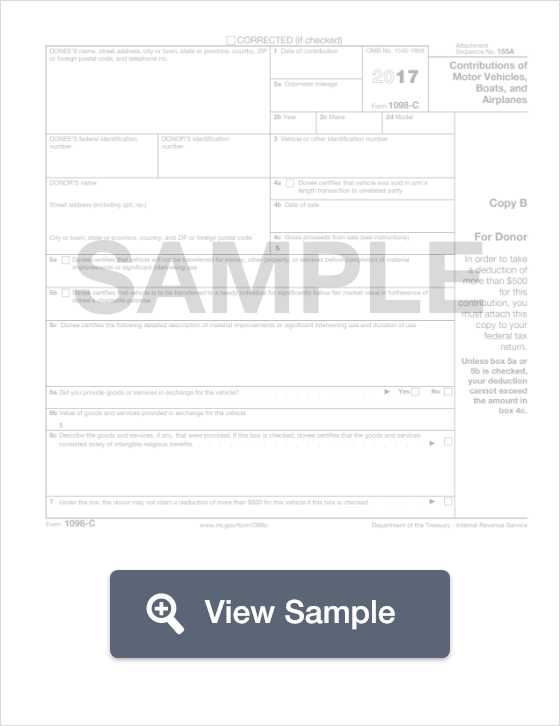

Fillable Form 1098C Vehicle Donation Deductions PDF FormSwift

Recipient copy 30 days from the date of the sale or contribution. Try it for free now! To claim a deduction for donation of a motor vehicle, use screen. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or..

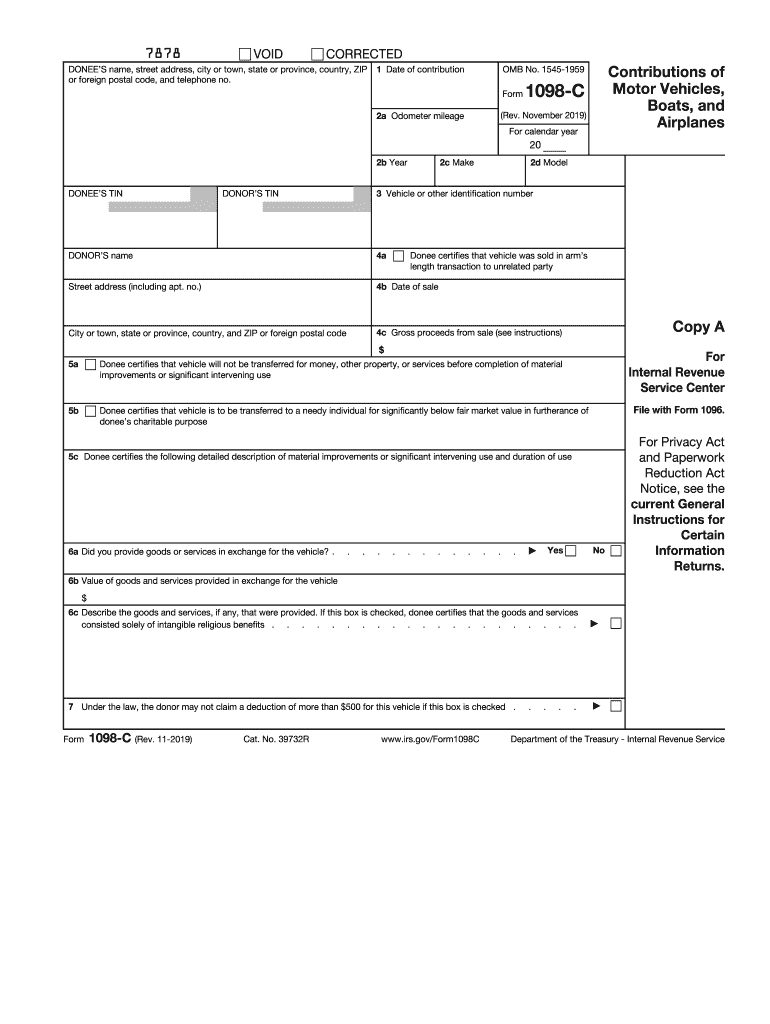

20192022 Form IRS 1098C Fill Online, Printable, Fillable, Blank

Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? To claim a deduction for donation of a motor vehicle, use screen. See the current general instructions for certain. Each contribution constitutes a new form. Recipient copy 30 days from the date of.

Form 1098CContributions of Motor Vehicles, Boats, and Airplanes

To claim a deduction for donation of a motor vehicle, use screen. See the current general instructions for certain. Web instructions for donor caution: Recipient fields common to all form types. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information.

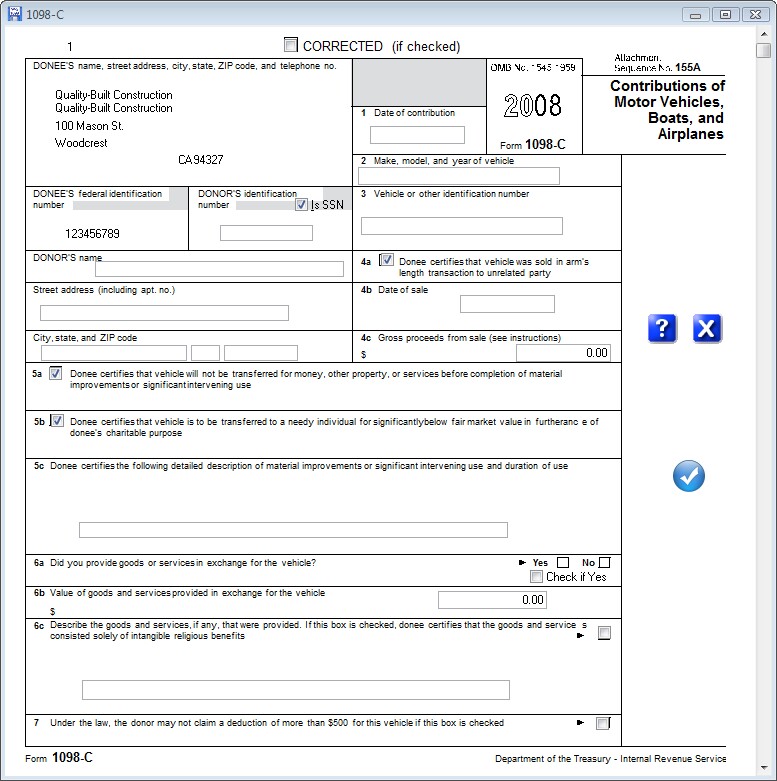

1098C Software to Print and Efile Form 1098C

Type in the recipient in. Web instructions for donor caution: See the current general instructions for certain. To claim a deduction for donation of a motor vehicle, use screen. Recipient copy 30 days from the date of the sale or contribution.

Entering & Editing Data > Form 1098C

Upload, modify or create forms. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Try it for free now! Recipient fields common to all form types. Make changes to your 2022 tax.

Irs Form 1098 Instructions Universal Network

Recipient fields common to all form types. Type in the recipient in. See the current general instructions for certain. To claim a deduction for donation of a motor vehicle, use screen. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified.

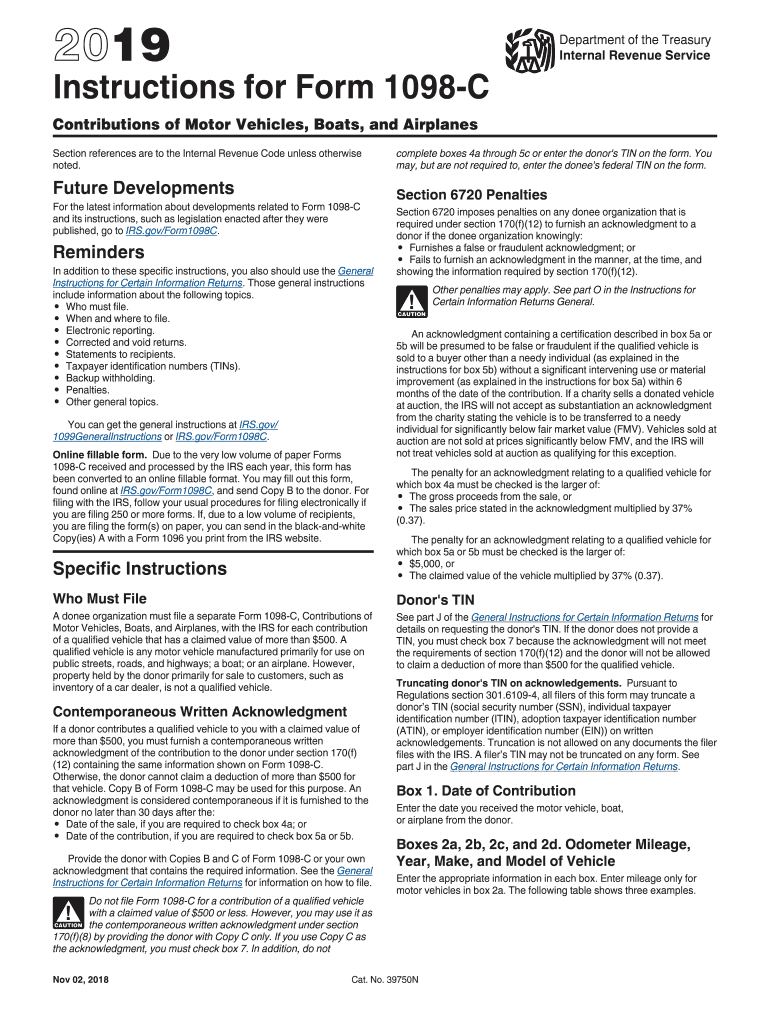

20192022 Form IRS Instruction 1098C Fill Online, Printable Fill

Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Try it for free now! See the current general instructions for certain. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and.

How to Print and File Tax Form 1098C, Contributions of Motor Vehicles

Donee certifies that vehicle was sold in arm's length. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Make changes to your 2022 tax. Recipient fields common to all form types. To claim a deduction for donation of a motor vehicle, use.

IRS Instruction 1098C 20192022 Fill out Tax Template Online US

Upload, modify or create forms. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your.

See The Current General Instructions For Certain.

Recipient copy 30 days from the date of the sale or contribution. Upload, modify or create forms. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. To claim a deduction for donation of a motor vehicle, use screen.

Each Contribution Constitutes A New Form.

Recipient fields common to all form types. Donee certifies that vehicle was sold in arm's length. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Web filer fields common to all form types.

Web Instructions For Donor Caution:

Web answer yes when asked if you made any donations to charity in 2022 answer yes when asked do you want to enter your donations for 2022? Make changes to your 2022 tax. Type in the recipient in. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or.

Try It For Free Now!

Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information.