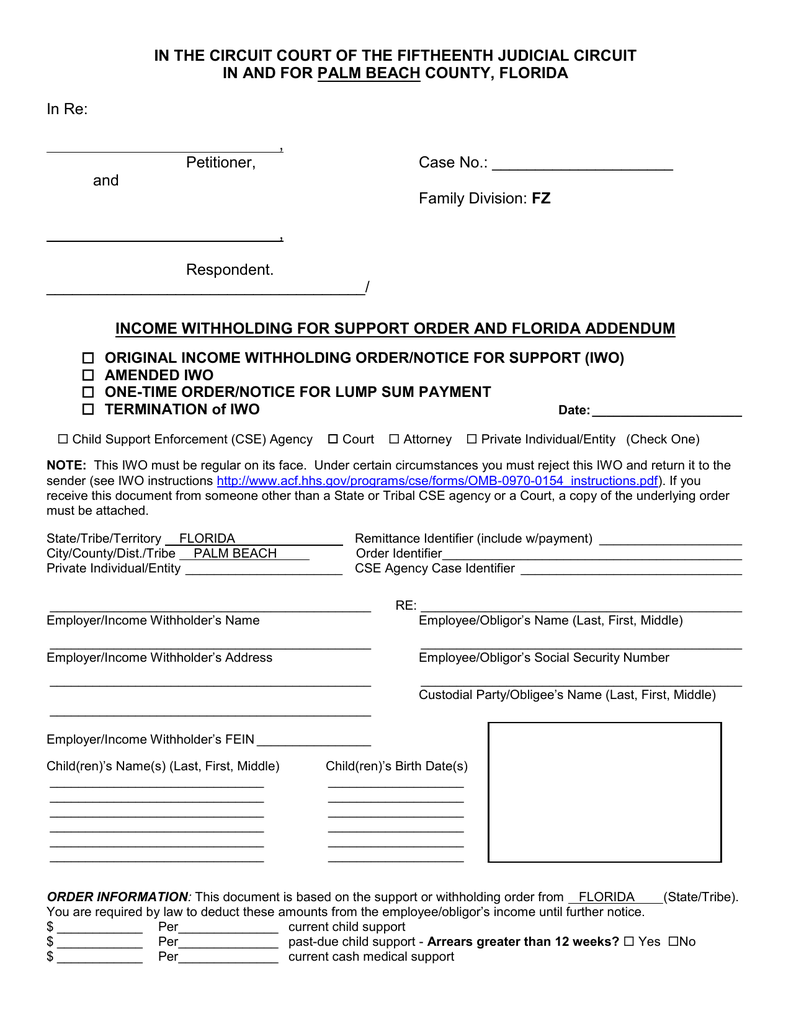

Florida Withholding Form

Florida Withholding Form - Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Web get access to the florida tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Arrasmith founder and chief legal counsel of the law offices. Web eligible taxpayers that file florida corporate income/franchise tax returns with original or extended due dates falling on or after april 12, 2023, and before august 30, 2023, will. There is also an annual payment schedule that applies to employers. Web instructions to federal income withholding order (iwo) download: Web family court in florida; Otherwise, skip to step 5. Web (2) l3 (2).00 exemption from withholding may be claimed only if: Web landlord tenant lawyer.

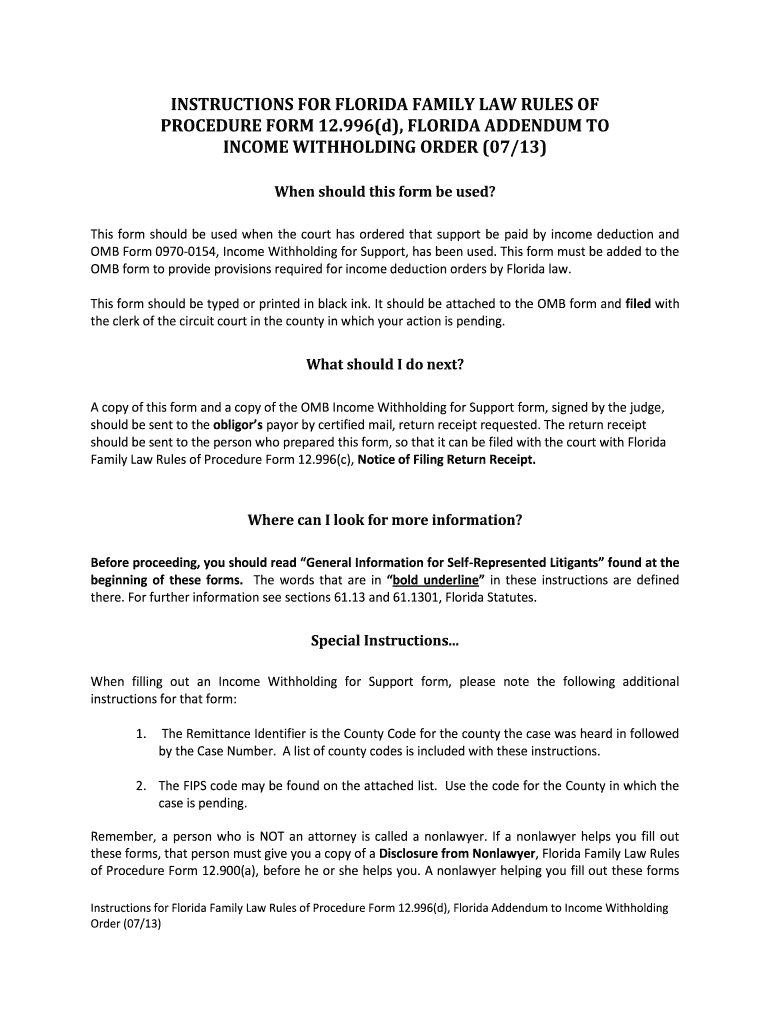

Web the child support program automatically sends income withholding for support notices to a parent's employer when the employer is known. Web july 20, 2023. Web instructions to federal income withholding order (iwo) download: The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web eligible taxpayers that file florida corporate income/franchise tax returns with original or extended due dates falling on or after april 12, 2023, and before august 30, 2023, will. This form is used to report annual income as well as fica taxes deducted from paychecks. Snohomish county tax preparer pleads guilty to assisting in the. There is also an annual payment schedule that applies to employers. See page 2 for more information on each step, who can claim. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.

The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web july 20, 2023. Web claiming an exemption from withholding which, per irs guidelines, expires each year. Web up to 25% cash back the irs has two primary payment schedules for withholding taxes: Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. There is also an annual payment schedule that applies to employers. Arrasmith founder and chief legal counsel of the law offices. Web family court in florida; Web (2) l3 (2).00 exemption from withholding may be claimed only if: The employer withholds child support.

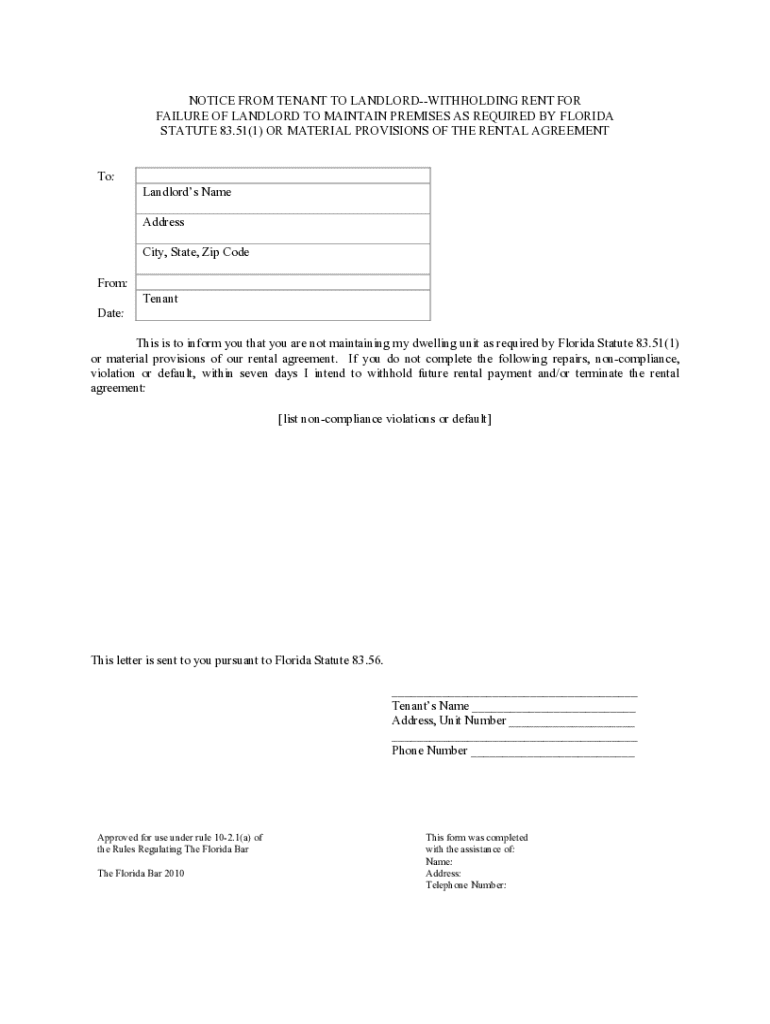

Rent Withholding Letter Florida Fill Out and Sign Printable PDF

Arrasmith founder and chief legal counsel of the law offices. Federal income withholding order (iwo) fillable form This form is used to report annual income as well as fica taxes deducted from paychecks. Otherwise, skip to step 5. Web instructions to federal income withholding order (iwo) download:

Withholding For Support Form Florida

The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web up to 25% cash back the irs has two primary payment schedules for withholding taxes: Web the child support program automatically sends income withholding for support notices to a parent's employer when the employer is known. See page 2.

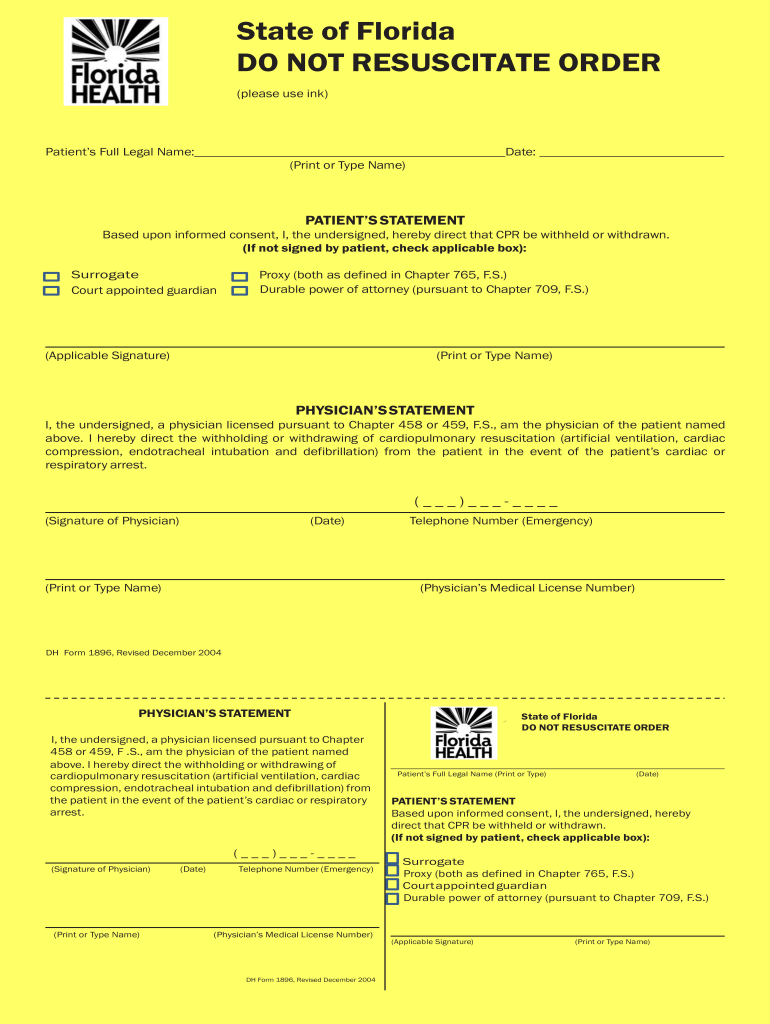

Florida Dnr Fill Out and Sign Printable PDF Template signNow

The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web get access to the florida tax withholding forms in order to determine how much income tax should be withheld from employee's salary. Federal income withholding order (iwo) fillable form Web eligible taxpayers that file florida corporate income/franchise tax returns.

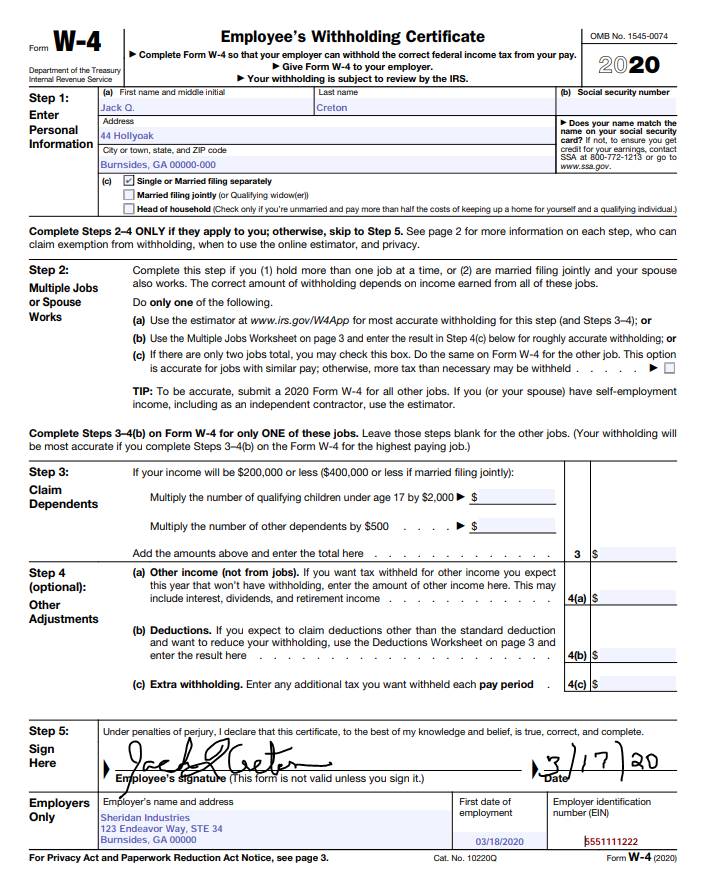

W4 Form 2023 Withholding Adjustment W4 Forms TaxUni

The employer withholds child support. The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web claiming an exemption from withholding which, per irs guidelines, expires each year. This form is used to report annual income as well as fica taxes deducted from paychecks. Web eligible taxpayers that file florida.

What Is a W4 Form and How Does it Work? Form W4 for Employers

Web claiming an exemption from withholding which, per irs guidelines, expires each year. Employee's withholding certificate form 941; Arrasmith founder and chief legal counsel of the law offices. Web family court in florida; For more information, see registering your business ( form.

Withholding Form For Employee 2023

See page 2 for more information on each step, who can claim. Web up to 25% cash back the irs has two primary payment schedules for withholding taxes: The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for. Web get access to the florida tax withholding forms in order to.

Florida Withholding Fill Out and Sign Printable PDF Template signNow

Otherwise, skip to step 5. Employers engaged in a trade or business who pay. Web claiming an exemption from withholding which, per irs guidelines, expires each year. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Arrasmith founder and chief legal counsel of the law offices.

Withholding Order/FL Addendum

For more information, see registering your business ( form. After your de 4 takes effect, compare the state income tax withheld with your estimated. Employee's withholding certificate form 941; Web instructions to federal income withholding order (iwo) download: This form is used to report annual income as well as fica taxes deducted from paychecks.

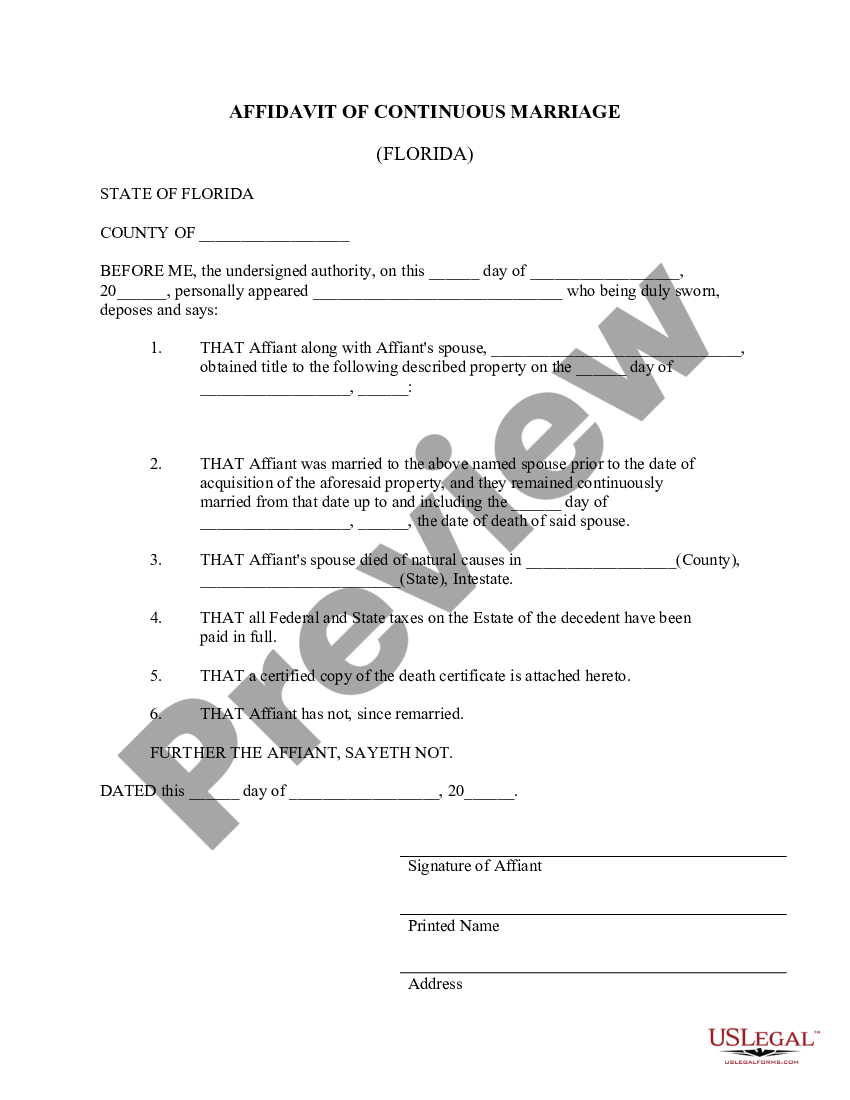

Affidavit Of Continuous Marriage Florida Withholding Tax US Legal Forms

Arrasmith founder and chief legal counsel of the law offices. Employee's withholding certificate form 941; Employers engaged in a trade or business who pay. Web family court in florida; Snohomish county tax preparer pleads guilty to assisting in the.

Florida Retirement System (FRS) pension tax withholding form (Form W4P

Web july 20, 2023. There is also an annual payment schedule that applies to employers. Web up to 25% cash back the irs has two primary payment schedules for withholding taxes: Web instructions to federal income withholding order (iwo) download: Web family court in florida;

The Employer Withholds Child Support.

Web eligible taxpayers that file florida corporate income/franchise tax returns with original or extended due dates falling on or after april 12, 2023, and before august 30, 2023, will. These changes are required to be implemented on or. There is also an annual payment schedule that applies to employers. Employers engaged in a trade or business who pay.

Web Claiming An Exemption From Withholding Which, Per Irs Guidelines, Expires Each Year.

Web july 20, 2023. Federal income withholding order (iwo) fillable form Web get access to the florida tax withholding forms in order to determine how much income tax should be withheld from employee's salary. The federal tax withholding module on frs online allows users to view, estimate, or change the federal tax withholding for.

Employee's Withholding Certificate Form 941;

Snohomish county tax preparer pleads guilty to assisting in the. For more information, see registering your business ( form. Web the child support program automatically sends income withholding for support notices to a parent's employer when the employer is known. After your de 4 takes effect, compare the state income tax withheld with your estimated.

See Page 2 For More Information On Each Step, Who Can Claim.

Web up to 25% cash back the irs has two primary payment schedules for withholding taxes: Web (2) l3 (2).00 exemption from withholding may be claimed only if: Web instructions to federal income withholding order (iwo) download: Otherwise, skip to step 5.