Florida Notice Of Trust Form

Florida Notice Of Trust Form - Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice of trust will never include any of the private details set out in the trust. Web a notice of trust in florida must include the following information: While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). Web florida statute relating to a florida notice of trust: (2) the notice of trust must contain the name. Web what information needs to be included in a notice of trust? 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. Web updated june 01, 2022 a florida living trust allows a person (the grantor) to legally define the recipient (s) of their assets after they die. Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.”

736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice of trust will never include any of the private details set out in the trust. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. See also the florida probate code statute 733.707. Web this notice of trust is found in florida trust code 736.05055. (2) the notice of trust must contain the name. 733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate.

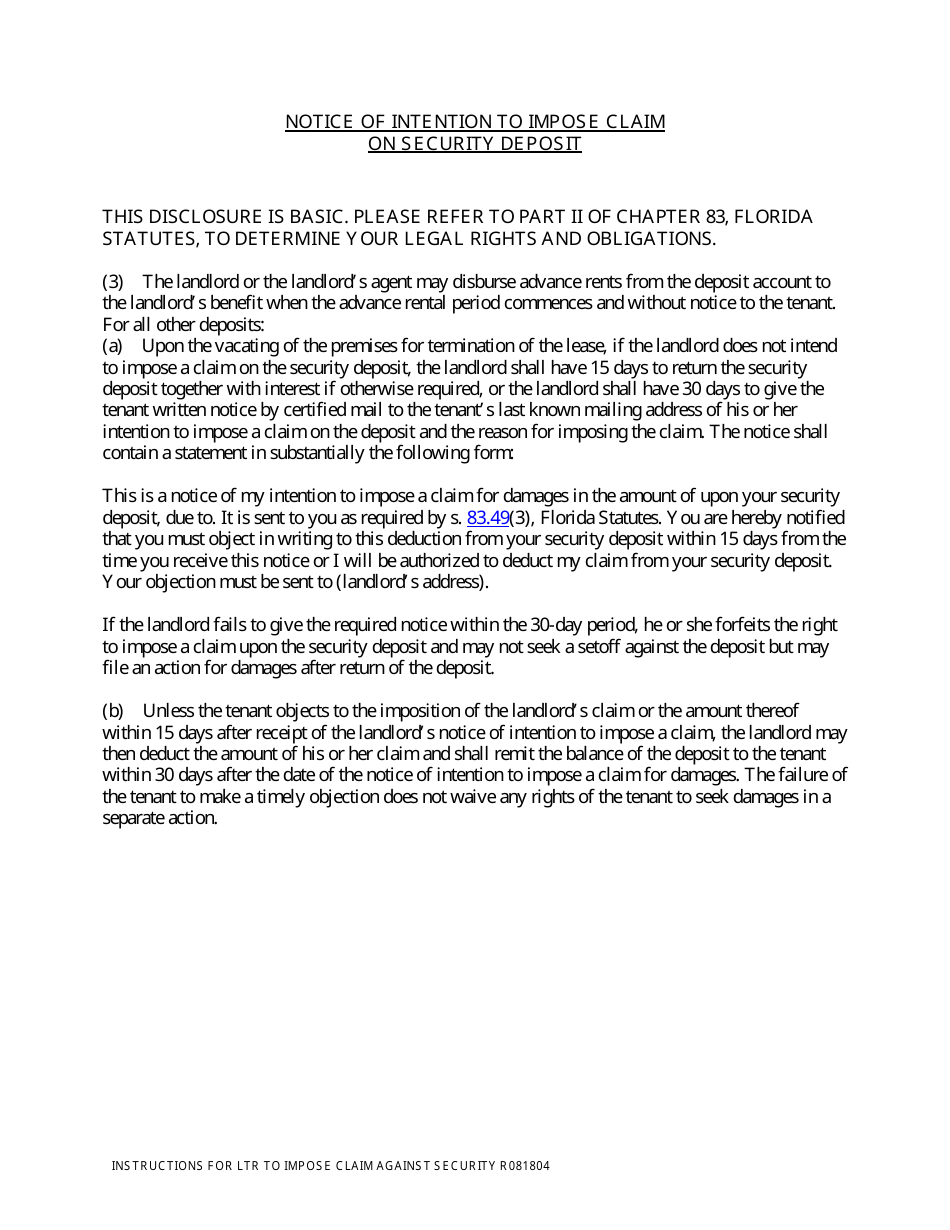

Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. The grantor appoints a trustee to manage the trust in the event they become mentally incapacitated. See also the florida probate code statute 733.707. (1) upon the death of a settlor of a trust described in s. The florida revocable living trust is a legal form created by a person (a grantor) into which assets are placed with instructions on who will benefit from them. Web in florida, a notice of trust is the formal notice that a trustee provides to the public that the trustmaker has deceased. Web florida statute relating to a florida notice of trust: Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.”

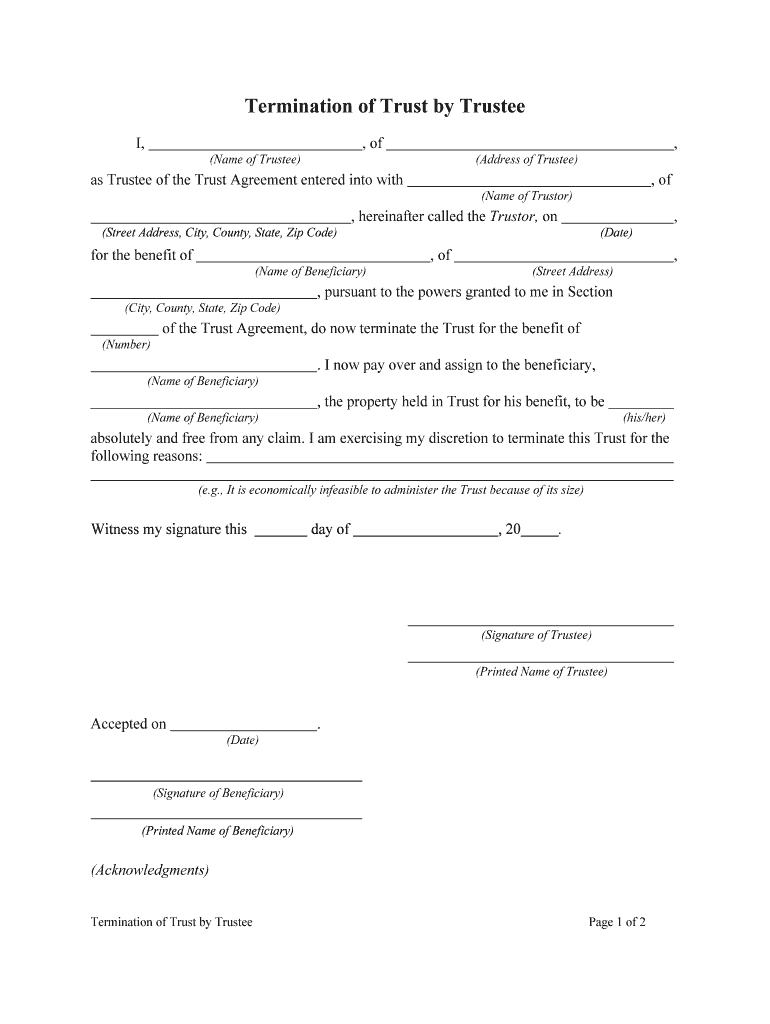

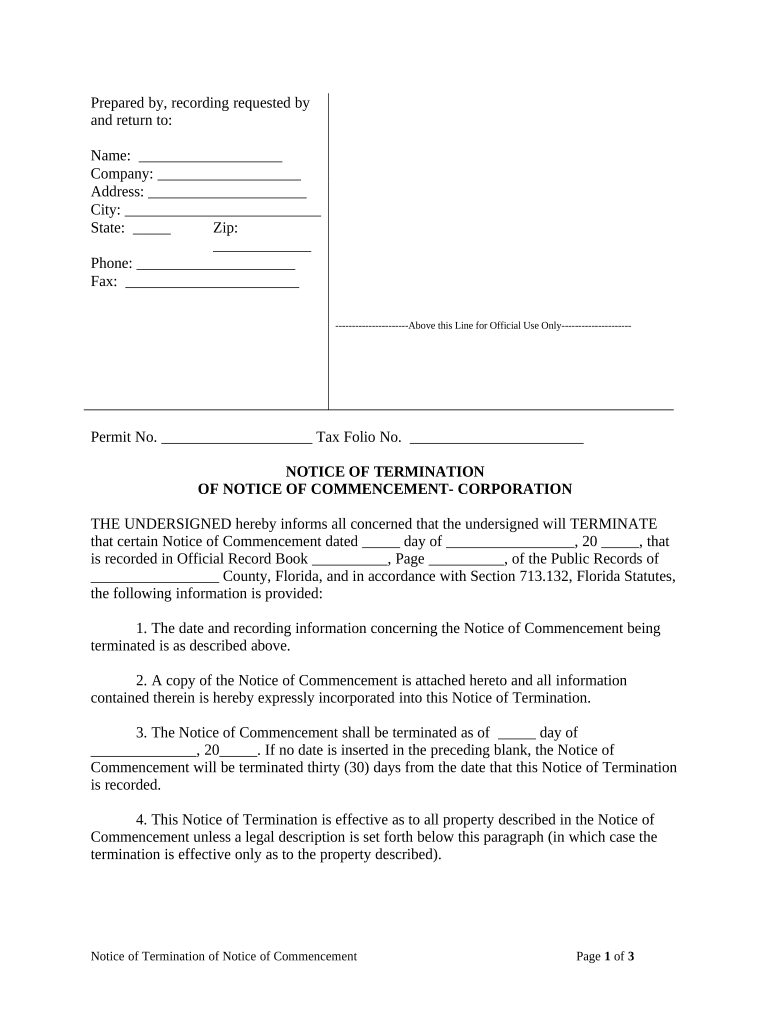

Termination Trustee Fill Online, Printable, Fillable, Blank pdfFiller

Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. While operating similarly to a will, a living trust differs in that.

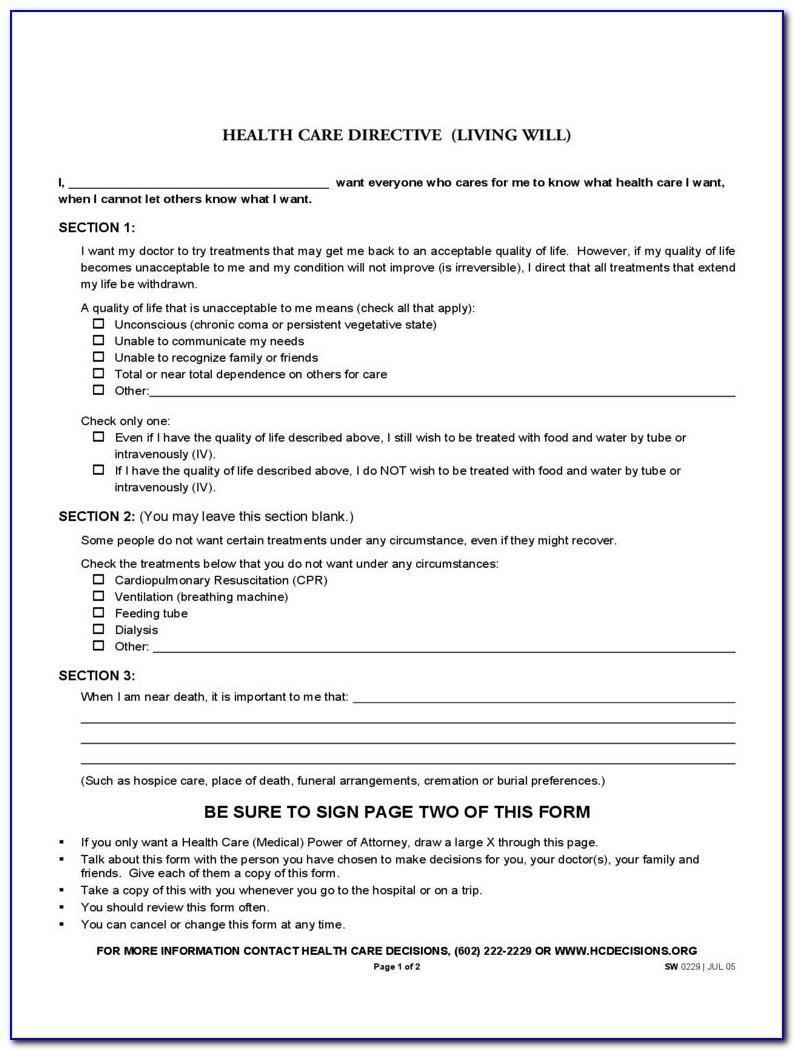

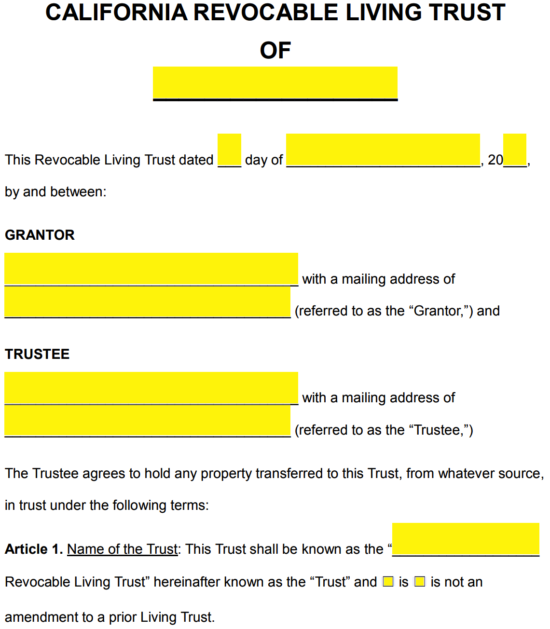

Florida Revocable Living Trust Form Free

Web this notice of trust is found in florida trust code 736.05055. A) expenses of administration and b) the decedent’s debts (creditor claims). (2) the notice of trust must contain the name. While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased.

Florida Revocable Living Trust Form Free Printable Legal Forms

Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. Web in florida, a notice of trust is the formal notice that.

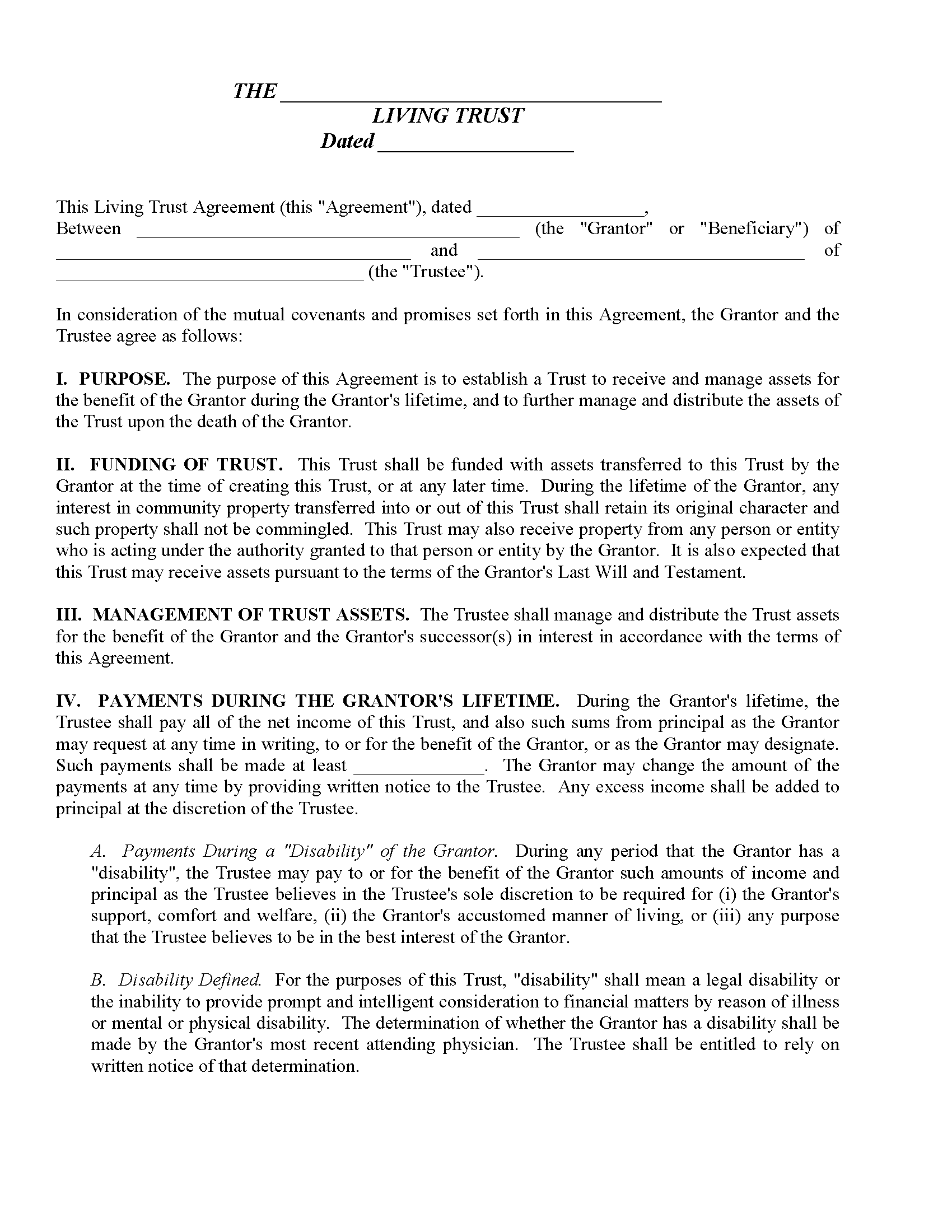

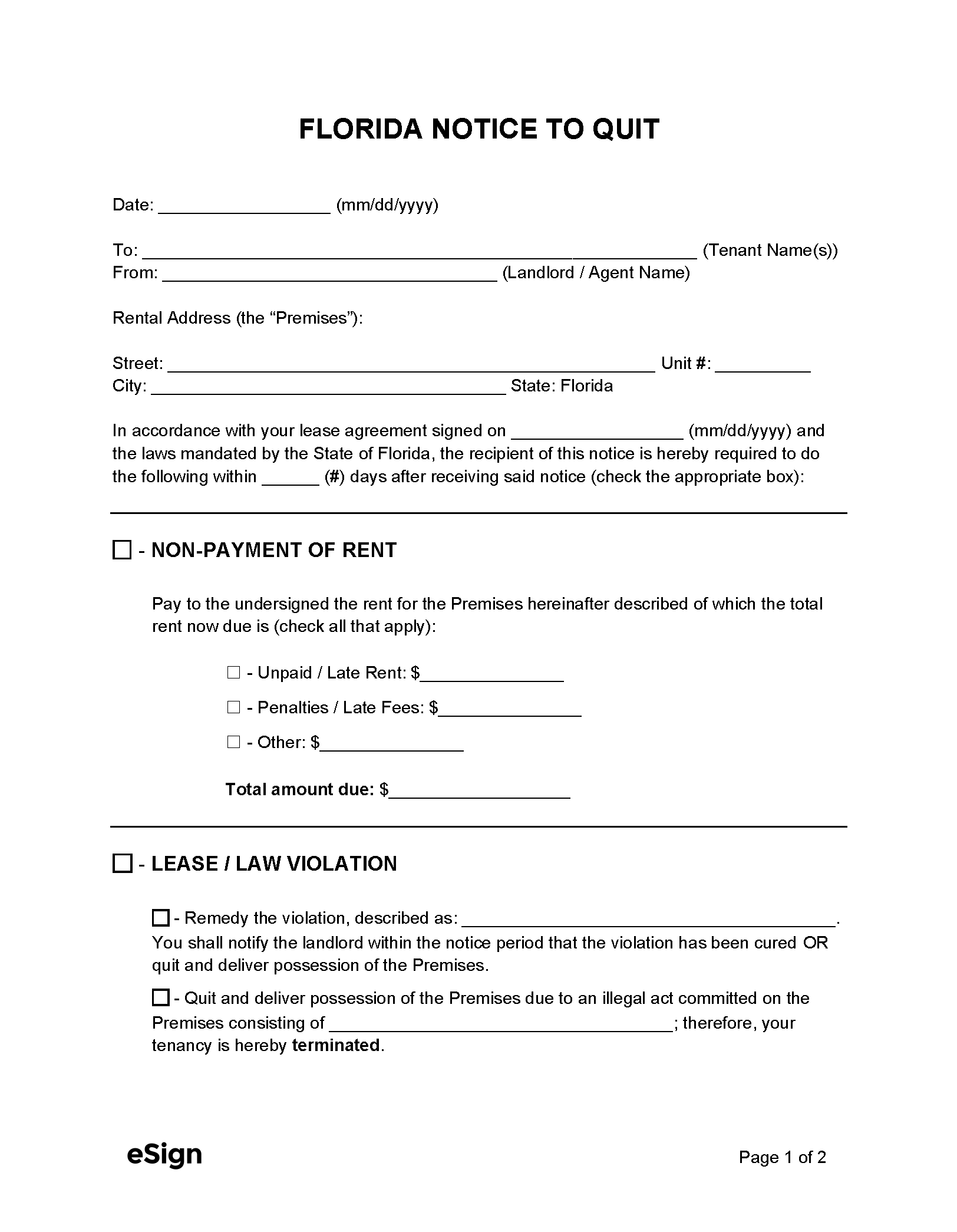

Florida Notice of Intention to Impose Claim on Security Deposit

Web florida statute relating to a florida notice of trust: The trustee is the person who holds nominal ownership of the assets held in trust. 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. You see, when one has a revocable trust, and they die, that revocable trust may have to pay:.

notice commencement Doc Template pdfFiller

733.707 (3), the trustee must file a notice of trust with the court of the county of the settlor’s domicile and the court having jurisdiction of the settlor’s estate. See also the florida probate code statute 733.707. Web florida statute relating to a florida notice of trust: Web what information needs to be included in a notice of trust? 733.707.

Free California Revocable Living Trust Form PDF Word eForms

(2) the notice of trust must contain the name. Web this notice of trust is found in florida trust code 736.05055. To read statutes on rev trusts, click here. Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of.

Free Florida Eviction Notice Templates Laws PDF Word

Web this notice of trust is found in florida trust code 736.05055. Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a..

Florida Nfa Gun Trust Form Universal Network

Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. See also the florida probate code statute 733.707. Web florida statute relating.

Certificate of Trust Form Fill Out and Sign Printable PDF Template

Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice.

Notice of Trustee's Sale

Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. (1) upon the death of a settlor of a trust described in s. The florida revocable living trust is a legal form created by a person (a grantor) into which assets are placed.

Web A Notice Of Trust In Florida Must Include The Following Information:

To read statutes on rev trusts, click here. Web the clerk shall file and index this notice of trust in the same manner as a caveat, unless there exists a probate proceeding for the grantor's estate in which case this notice of trust must be filed in the probate proceeding and the clerk shall send a. The name of the settlor the settlor’s date of death the title of the trust (if there is one) the date of the trust the name and address of the trustee a notice of trust will never include any of the private details set out in the trust. Web in florida, a notice of trust is the formal notice that a trustee provides to the public that the trustmaker has deceased.

Web Updated June 01, 2022 A Florida Living Trust Allows A Person (The Grantor) To Legally Define The Recipient (S) Of Their Assets After They Die.

Upon the trustmaker’s death, florida statute 736.05055 requires that the successor trustee file a “notice of trust” with the court of the county of the trustmaker’s domicile. 736.05055 notice of trust.— (1) upon the death of a settlor of a trust described in s. (2) the notice of trust must contain the name. A notice of trust is a legal record used to alert the court that the trustor’s of a florida trust has passed away, also providing the contact information of the person designated as the trust’s trustee.

733.707 (3), The Trustee Must File A Notice Of Trust With The Court Of The County Of The Settlor’s Domicile And The Court Having Jurisdiction Of The Settlor’s Estate.

While operating similarly to a will, a living trust differs in that the assets placed within the trust are not subject to probate (court processing of a deceased person’s real estate and property). You see, when one has a revocable trust, and they die, that revocable trust may have to pay: Web florida statute relating to a florida notice of trust: A) expenses of administration and b) the decedent’s debts (creditor claims).

733.707 (3), The Trustee Must File A Notice Of Trust With The Court Of The County Of The Settlor’s Domicile And The Court Having Jurisdiction Of The Settlor’s Estate.

Web what information needs to be included in a notice of trust? Under section 736.05055(2), florida statutes, a notice of trust must contain “the name of the settlor, the settlor’s date of death, the title of the trust, if any, the date of the trust, and the name and address of the trustee.” (1) upon the death of a settlor of a trust described in s. See also the florida probate code statute 733.707.