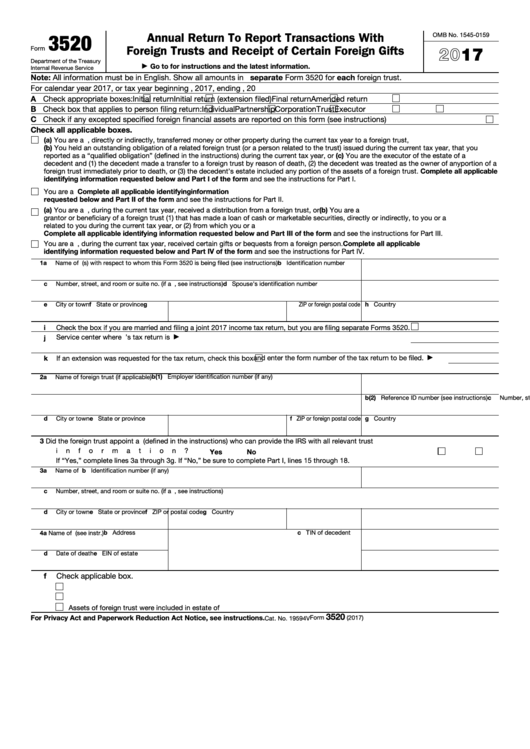

File Form 3520

File Form 3520 - Ownership of foreign trusts under the rules of sections. Complete, edit or print tax forms instantly. Person receives a gift, inheritance (a type of “gift”) from. There are generally three reasons you might file form 3520 as an expat: Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web form 3520 is an information return for a u.s. Web file a separate form 3520 for each foreign trust. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Owner files this form annually to provide information. Decedents) file form 3520 to report:

Transferor who, directly or indirectly, transferred money or other property during the. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Web form 3520 is an information return for a u.s. Certain transactions with foreign trusts. It does not have to be a “foreign gift.” rather, if a. Upload, modify or create forms. Web form 3520 & instructions: Web form 3520 is due at the time of a timely filing of the u.s. Decedents) file form 3520 to report:

Web form 3520 is due at the time of a timely filing of the u.s. Complete, edit or print tax forms instantly. Decedents) file form 3520 to report: Persons (and executors of estates of u.s. It does not have to be a “foreign gift.” rather, if a. Not everyone who is a us. Ad talk to our skilled attorneys by scheduling a free consultation today. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Upload, modify or create forms.

When to File Form 3520 Gift or Inheritance From a Foreign Person

Try it for free now! Ownership of foreign trusts under the rules of sections. Not everyone who is a us. Web form 3520 is due at the time of a timely filing of the u.s. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701.

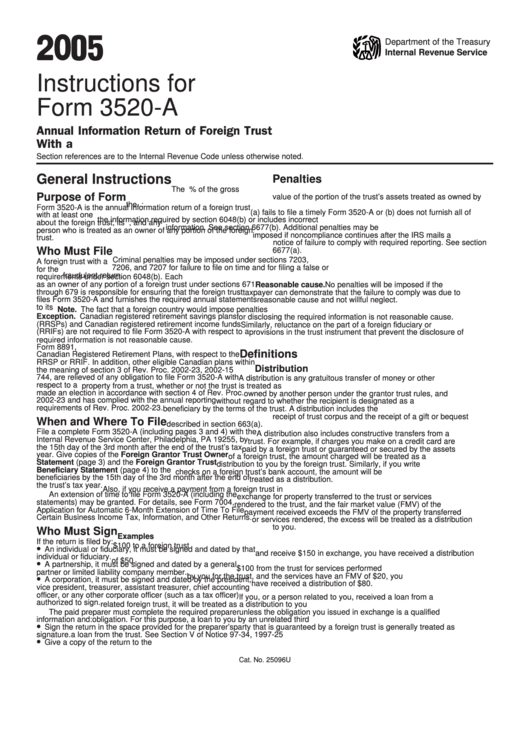

Instructions For Form 3520A Annual Information Return Of Foreign

It does not have to be a “foreign gift.” rather, if a. Upload, modify or create forms. Send form 3520 to the. Person receives a gift, inheritance (a type of “gift”) from. Transferor who, directly or indirectly, transferred money or other property during the.

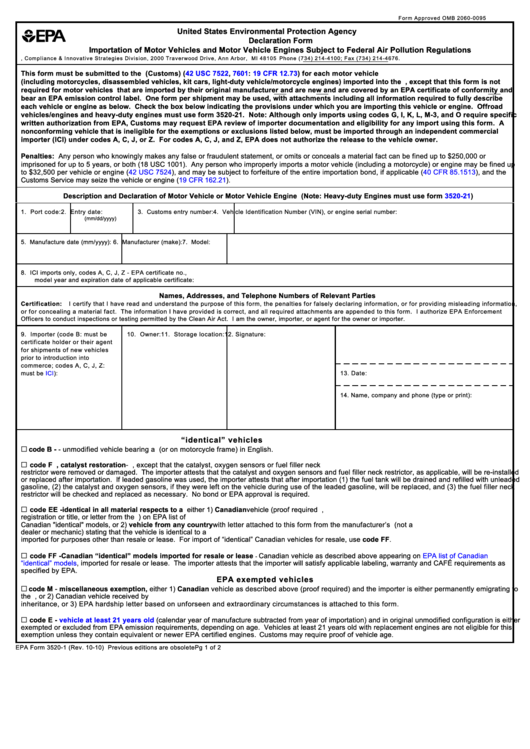

Top Epa Form 35201 Templates free to download in PDF format

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web file a separate form 3520 for each foreign trust. If you and your spouse are filing.

Form 3520 Edit, Fill, Sign Online Handypdf

Ownership of foreign trusts under the rules of sections. Owner files this form annually to provide information. Complete, edit or print tax forms instantly. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Persons (and executors of estates of u.s.

Foreign Trust Form 3520A Filing Date Reminder & Tips To Avoid Penalties

Web who files form 3520? Persons (and executors of estates of u.s. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web form 3520 is due at the time of a timely filing of the u.s. The form 3520 is generally required when a u.s.

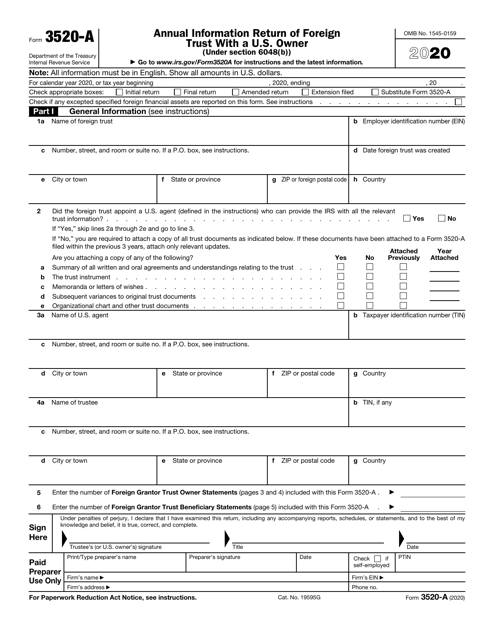

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Certain transactions with foreign trusts. Not everyone who is a us. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701. Decedents) file form 3520 to report: Persons (and executors of estates of u.s.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web the irs form 3520 is used to report certain foreign transactions to the irs. Ad talk to our skilled attorneys by scheduling a free consultation today. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. There are generally three reasons you might file form 3520 as an expat:.

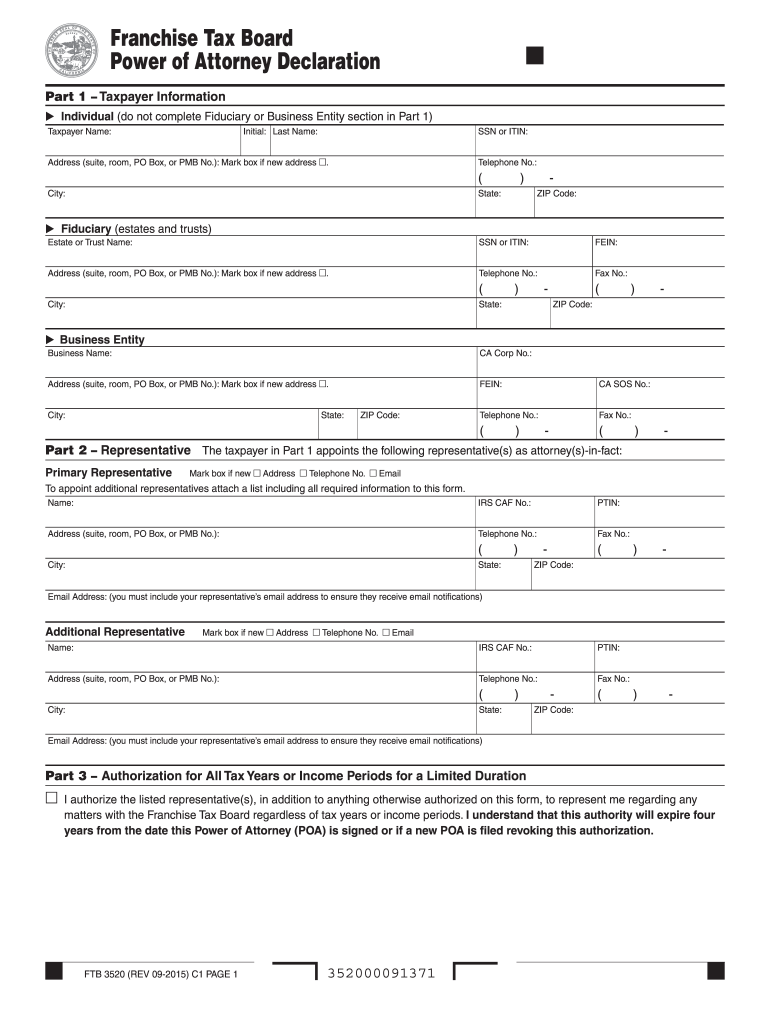

2015 Form CA FTB 3520 Fill Online, Printable, Fillable, Blank pdfFiller

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Certain transactions with foreign trusts. If you and your spouse are filing a joint income tax return for tax year 2020, and you are both transferors, grantors, or. Upload, modify or create forms. Web in particular, late filers of form.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Transferor who, directly or indirectly, transferred money or other property during the. There are generally three reasons you might file form 3520 as an expat: Ownership of foreign trusts under the rules of sections. If the due date for filing the tax return is extended, the due date for filing the form 3520 is. Upload, modify or create forms.

Do I need to file IRS Form 3520 and 3520A for my TFSA and RESP?

Person receives a gift, inheritance (a type of “gift”) from. There are generally three reasons you might file form 3520 as an expat: Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Owner of a foreign trust (includes the grantor, but. Try it for free now!

The Form 3520 Is Generally Required When A U.s.

Persons (and executors of estates of u.s. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Upload, modify or create forms. Web file a separate form 3520 for each foreign trust.

Certain Transactions With Foreign Trusts.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Send form 3520 to the. Owner a foreign trust with at least one u.s. Owner files this form annually to provide information.

Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

It does not have to be a “foreign gift.” rather, if a. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report. Ad download or email irs 3520 & more fillable forms, register and subscribe now! Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to.

Web From Instructions For Form 3520 (2020):

Ownership of foreign trusts under the rules of sections. Web form 3520 is due at the time of a timely filing of the u.s. Owner of a foreign trust (includes the grantor, but. Person receives a gift, inheritance (a type of “gift”) from.