File Form 1065 Extension

File Form 1065 Extension - Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. Ad filing your taxes just became easier. Or getting income from u.s. For filing deadlines and other information. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Read this article to learn more. Web a commonly asked question is where to file a 1065 form. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. A 1065 extension must be filed by midnight local time on the normal due date of the return.

Return of partnership income and extensions need more information on filing a form 1065? In the case of a 1065, this is by the 15th day of the. Form 7004 now consists of two parts. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Taxpayers in certain disaster areas do not need to submit an extension. Web a commonly asked question is where to file a 1065 form. Web this topic provides electronic filing opening day information and information about relevant due dates for 1065 returns. A 1065 extension must be filed by midnight local time on the normal due date of the return. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Web find irs mailing addresses by state to file form 1065.

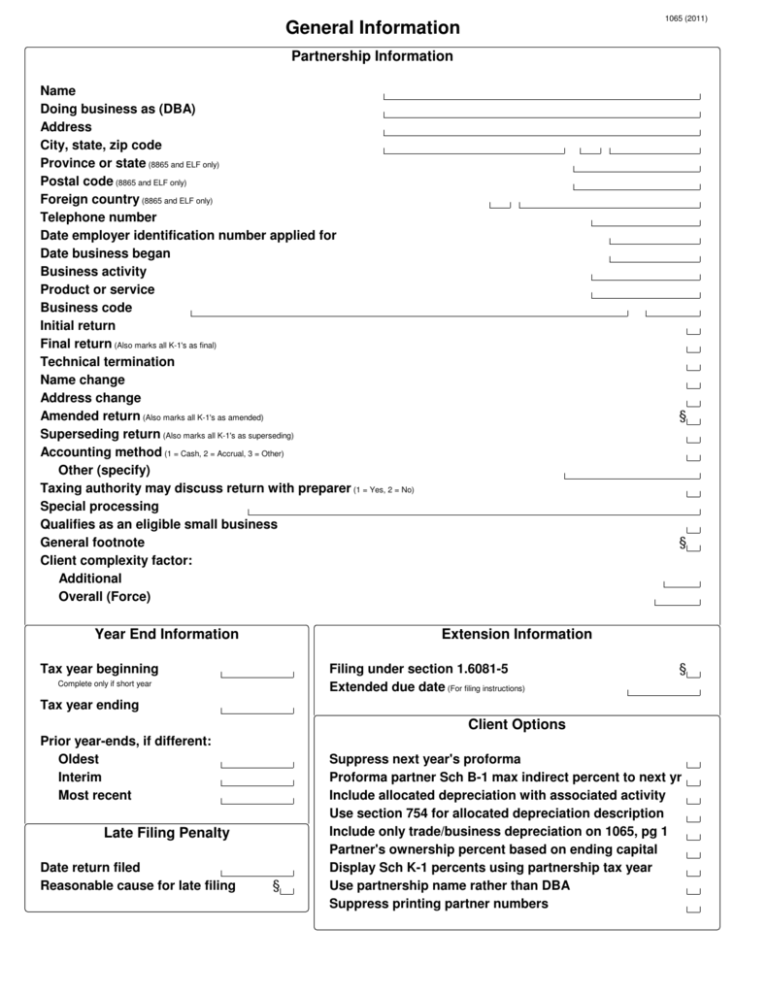

Web this topic provides electronic filing opening day information and information about relevant due dates for 1065 returns. Web there are several ways to submit form 4868. Form 7004 now consists of two parts. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. In the case of a 1065, this is by the 15th day of the. Web find irs mailing addresses by state to file form 1065. Return of partnership income and extensions need more information on filing a form 1065? Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. Read this article to learn more. And the total assets at the end of the.

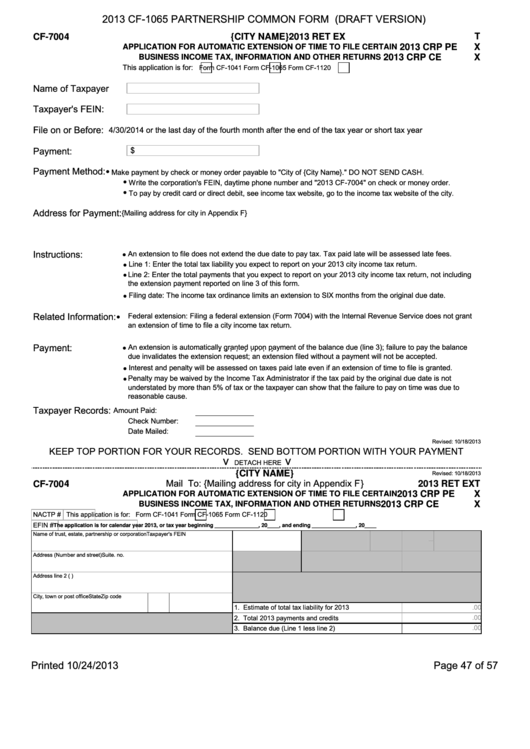

Form Cf1065 Draft Partnership Common Form 2013 printable pdf

Web there are several ways to submit form 4868. How to file an extension:. A 1065 extension must be filed by midnight local time on the normal due date of the return. If the partnership's principal business, office, or agency is located in: Or getting income from u.s.

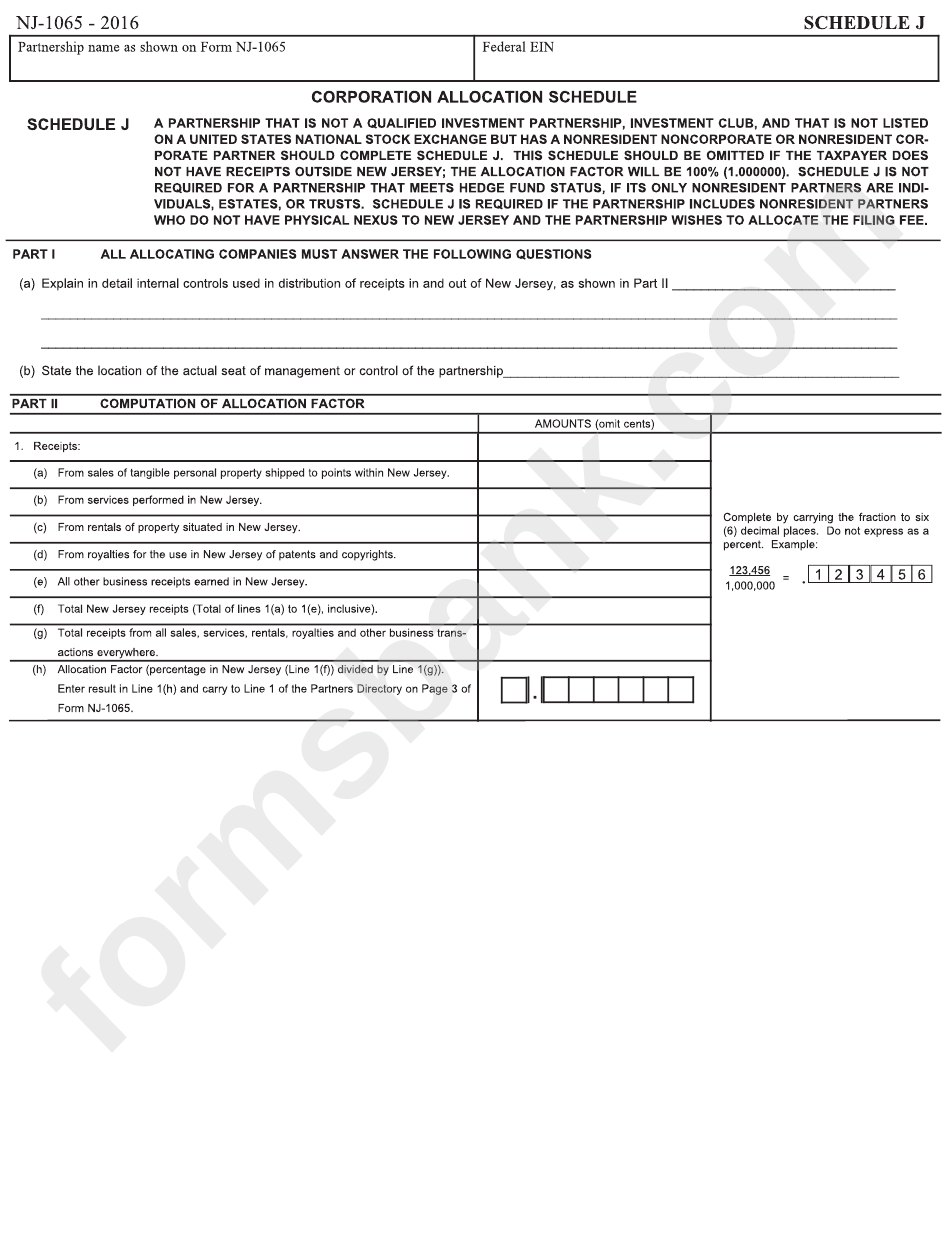

Fillable Form Nj1065 Corporation Allocation Schedule 2016

Read this article to learn more. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. A 1065 extension must be filed by midnight local time on the normal due date of the return. Taxpayers can file form 4868 by mail, but.

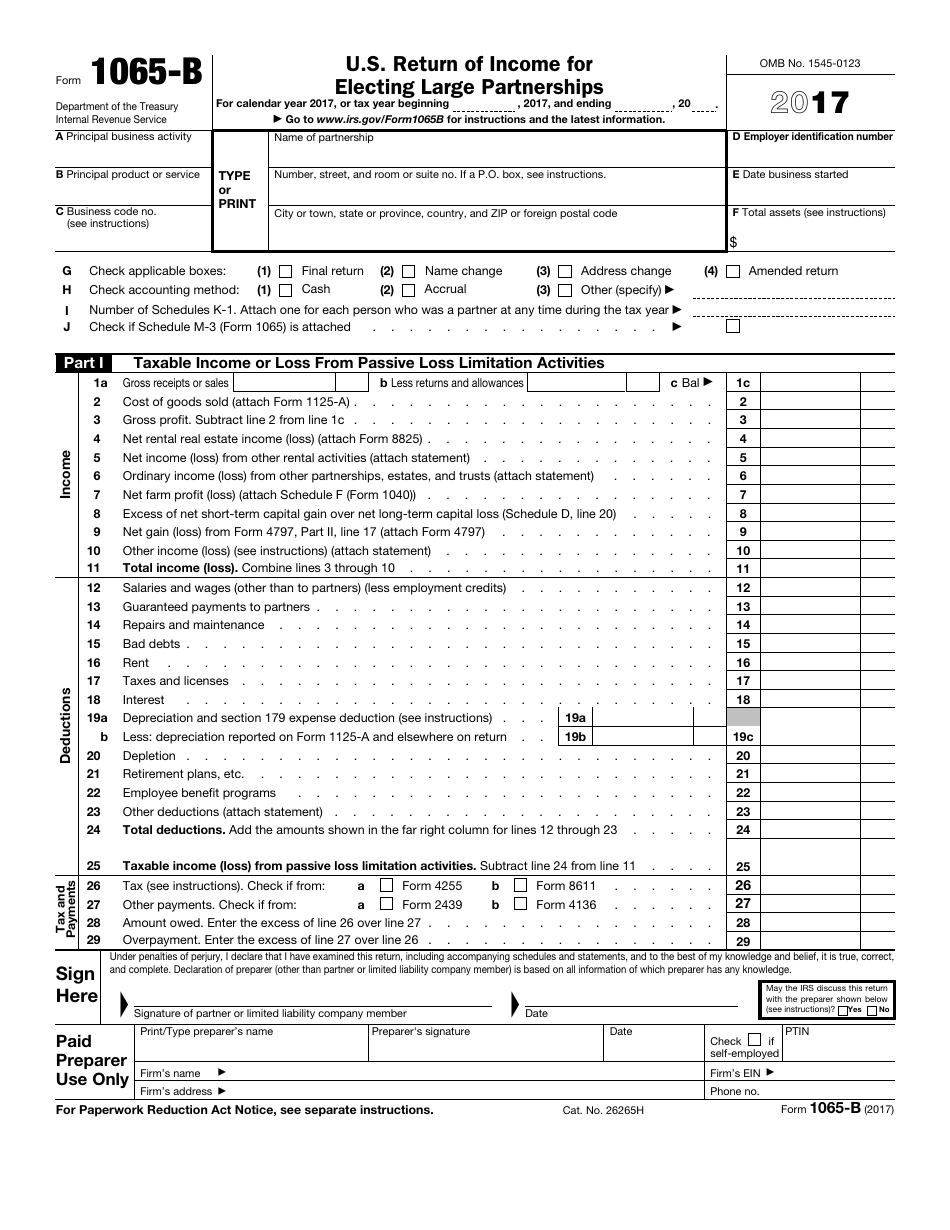

IRS Form 1065B Download Fillable PDF or Fill Online U.S. Return of

Web this topic provides electronic filing opening day information and information about relevant due dates for 1065 returns. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065) electronic filing leave. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day..

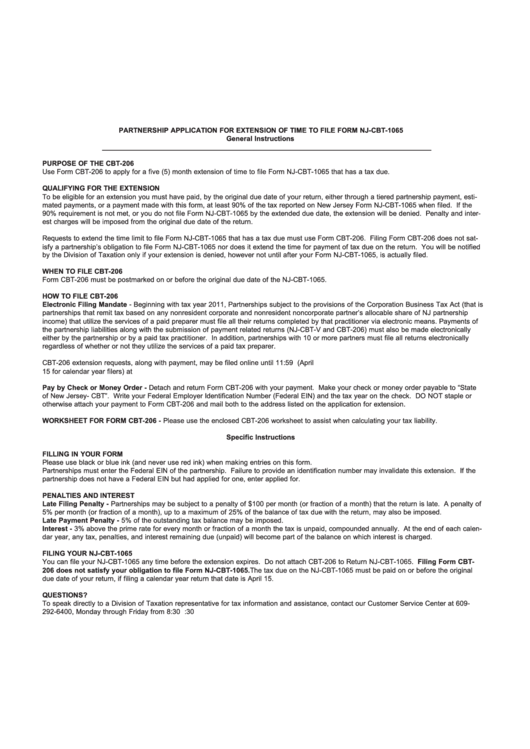

Form NjCbt1065 Partnership Application For Extension Of Time To

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. Or getting income from u.s. Generally, a domestic partnership.

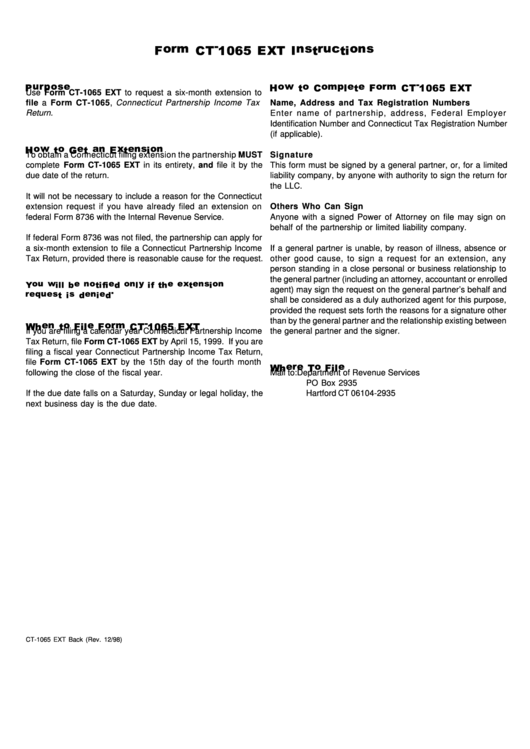

Form Ct1065 Ext Instructions printable pdf download

And the total assets at the end of the. Form 7004 now consists of two parts. Read this article to learn more. A 1065 extension must be filed by midnight local time on the normal due date of the return. Extension overview alerts and notices trending ultratax cs topics section 163 (j) and form 8990 (1065) types of allocations (1065).

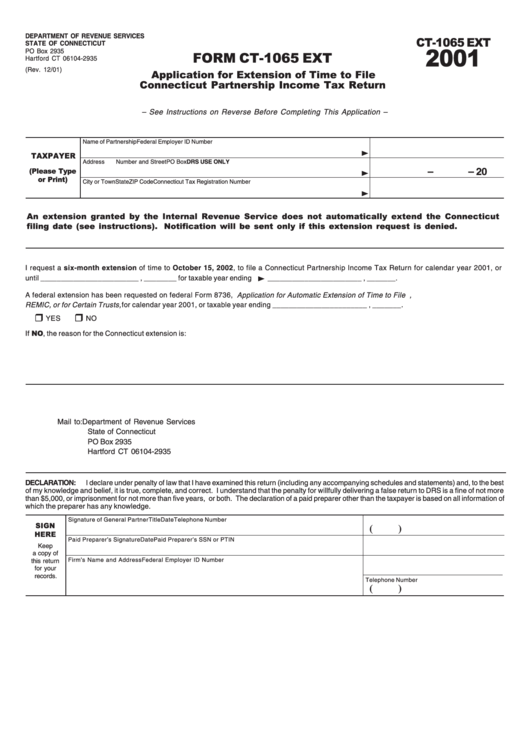

Form Ct1065 Ext Application For Extension Of Time To File

Web find irs mailing addresses by state to file form 1065. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain. Taxpayers in certain disaster areas do not need to submit an extension. Ad filing your taxes just became easier. How to.

File Form 1065 Extension Online Partnership Tax Extension

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Return of partnership income and extensions need more information on filing a form 1065? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web a commonly asked.

Irs Form 1065 K 1 Instructions Universal Network

In the case of a 1065, this is by the 15th day of the. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax.

Extension to file 1065 tax form asrposii

Taxpayers in certain disaster areas do not need to submit an extension. Web find irs mailing addresses by state to file form 1065. Web there are several ways to submit form 4868. Web if you need more time to file form 1065, you may request an extension through filing form 7004, application for automatic extension of time to file certain..

Form 1065 E File Requirements Universal Network

Taxact helps you maximize your deductions with easy to use tax filing software. Taxpayers in certain disaster areas do not need to submit an extension. And the total assets at the end of the. In the case of a 1065, this is by the 15th day of the. Taxpayers can file form 4868 by mail, but remember to get your.

In The Case Of A 1065, This Is By The 15Th Day Of The.

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from the operation of a partnership. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. How you file the 1065 form will vary based on how you file your tax return.

Form 7004 Now Consists Of Two Parts.

Web when must the 7004 be filed? Web find irs mailing addresses by state to file form 1065. Web a commonly asked question is where to file a 1065 form. Web if the business is a c corporation then the extension is due by the 15th day of the 4th month after the end of your tax year.

How To File An Extension:.

Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of. Web form 1065 extensionis generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. Read this article to learn more. Taxact helps you maximize your deductions with easy to use tax filing software.

Return Of Partnership Income And Extensions Need More Information On Filing A Form 1065?

Web this topic provides electronic filing opening day information and information about relevant due dates for 1065 returns. Web you must file your extension request no later than the regular due date of your return. Ad filing your taxes just became easier. For example, if your c corporation is a.