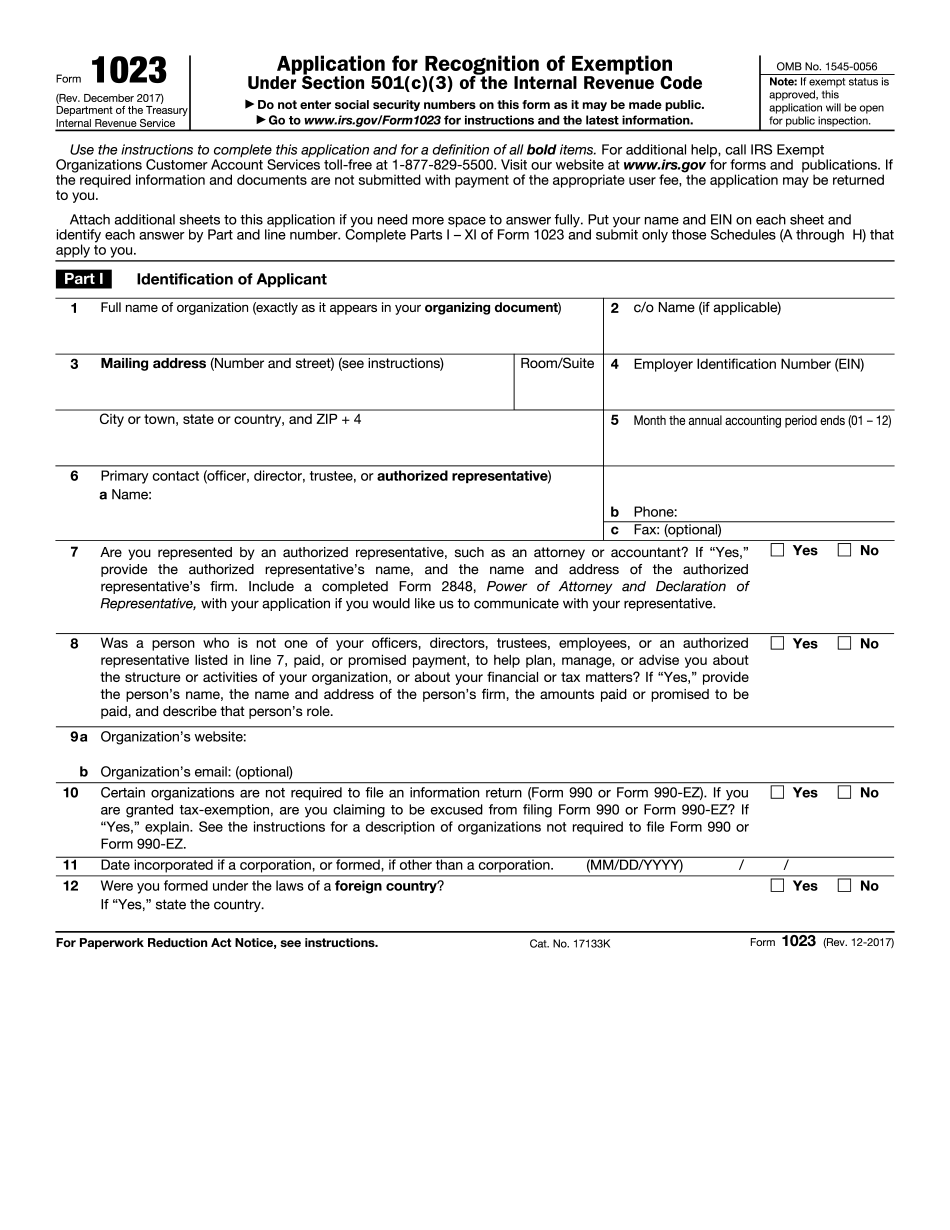

File Form 1023

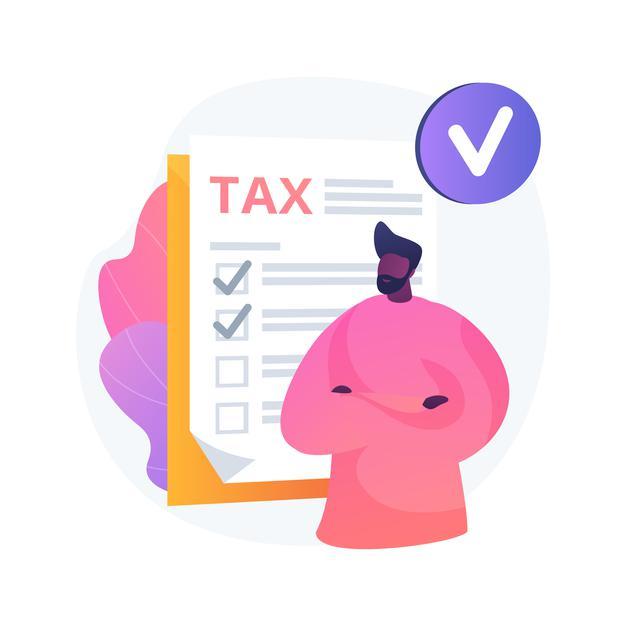

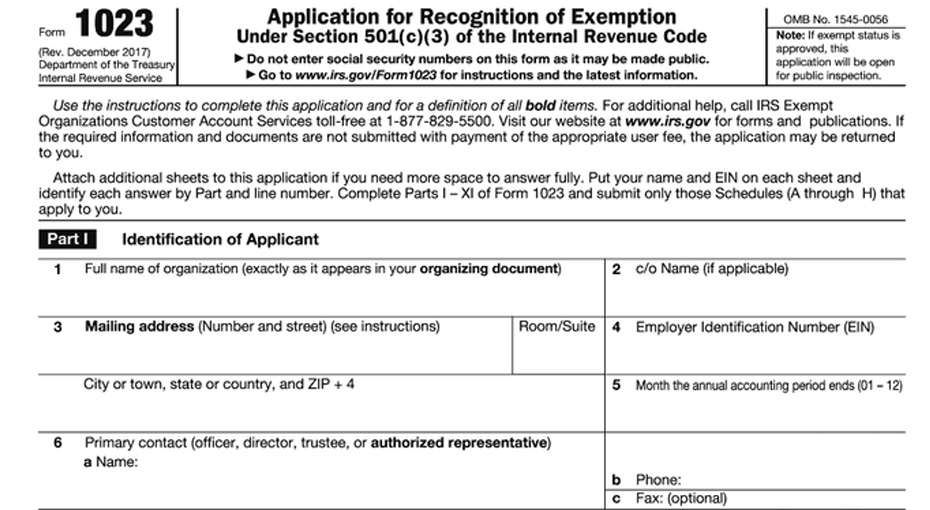

File Form 1023 - Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Go to www.irs.gov/form1023 for additional filing information. December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Republicans, though, have seized on the unverified material as part of their. Web form 1023 is used to apply for recognition as a tax exempt organization. Web how can i get a copy of form 1023? Expediting the irs form 1023 application; About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code Web form 1023 is filed electronically only on pay.gov.

Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. Irs form 1023 application review; Go to www.irs.gov/form1023 for additional filing information. How you can make a difference Expediting the irs form 1023 application; Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Reinstatement of 501c3 exemption status; Republicans, though, have seized on the unverified material as part of their. Web what kinds of organizations can file form 1023? Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form.

Expediting the irs form 1023 application; Web what kinds of organizations can file form 1023? Republicans, though, have seized on the unverified material as part of their. December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Irs form 1023 application review; Form 1023 part x, signature and upload; Web form 1023 part ix, 990 filing requirements; Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form.

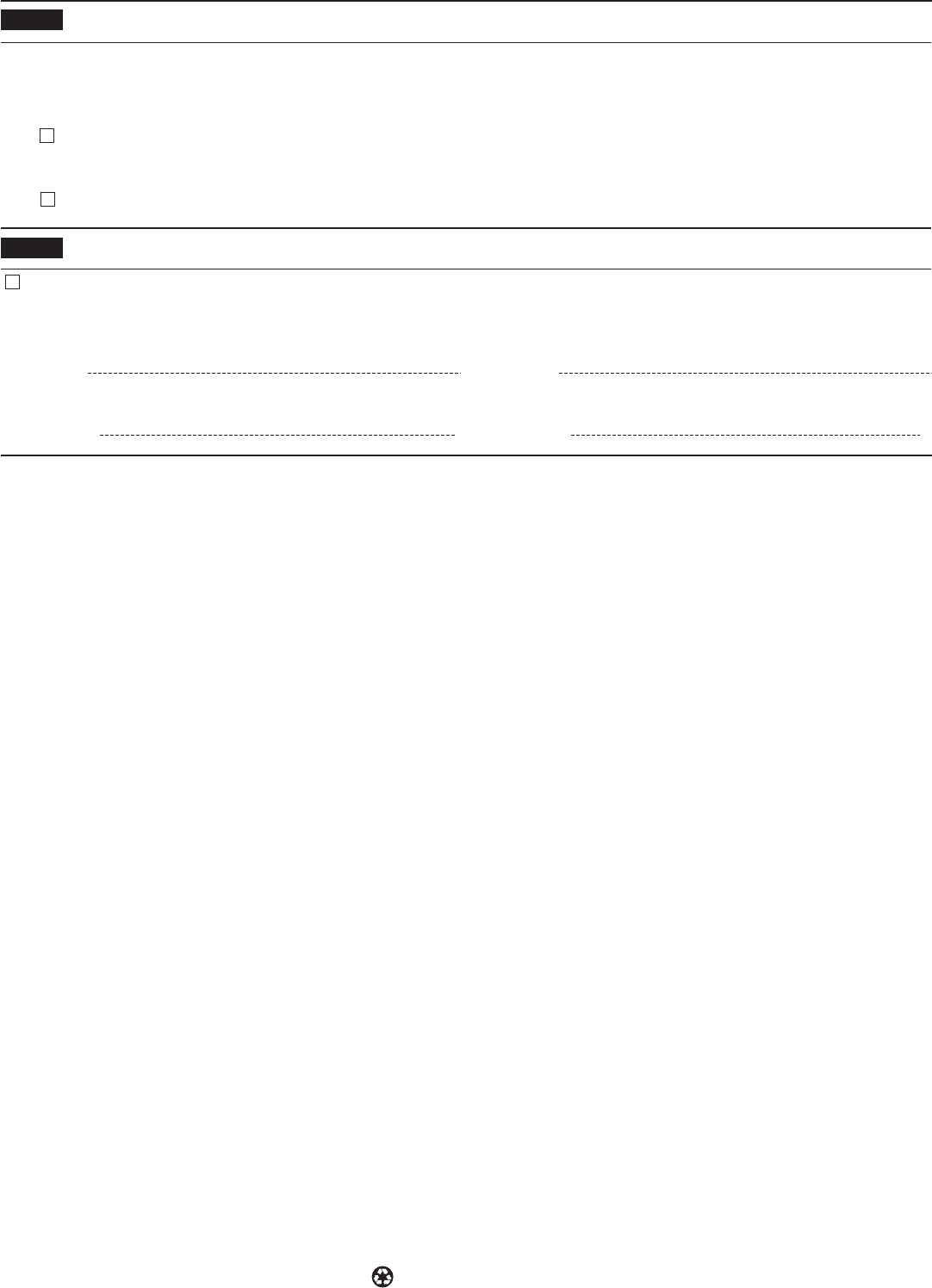

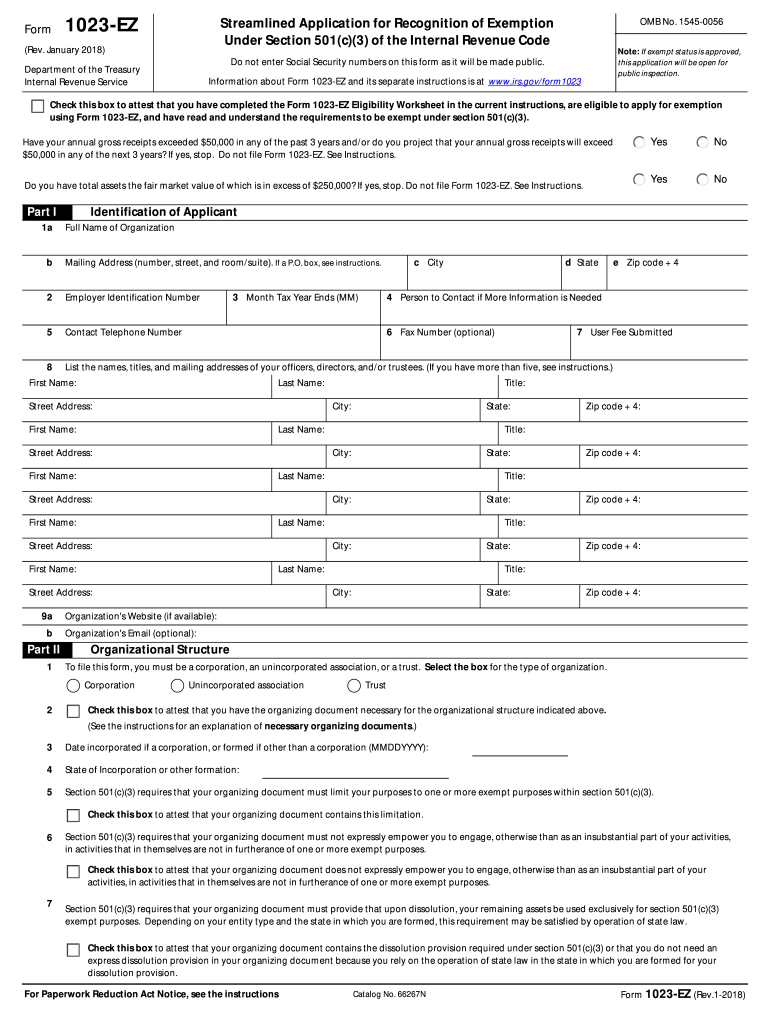

Form 1023EZ Edit, Fill, Sign Online Handypdf

December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Web what kinds of organizations can file form 1023? How you can make a difference Reinstatement of 501c3 exemption status; Web form 1023 is filed electronically only on pay.gov.

What Is Form 1023EZ? Foundation Group®

Reinstatement of 501c3 exemption status; Web how can i get a copy of form 1023? December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Irs form 1023 application review; Web form 1023 part ix, 990 filing requirements;

How to File Form 1023EZ 501c3 Application TRUiC

Form 1023 part x, signature and upload; Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. Reinstatement of 501c3 exemption status; How you can make a difference

How to Fill Out Form 1023 & Form 1023EZ for Nonprofits Step by Step

Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Web form 1023 is filed electronically only on pay.gov. Web form 1023 is used to apply for recognition as a tax exempt.

Form 1023 Tax Exempt Form 1023

December 2017) department of the treasury internal revenue service application for recognition of exemption under section 501(c)(3) of the internal revenue code Irs form 1023 application review; Expediting the irs form 1023 application; Go to www.irs.gov/form1023 for additional filing information. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true.

ICANN Application for Tax Exemption (U.S.) Page 1

Web form 1023 part ix, 990 filing requirements; Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts. You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application. Organizations must electronically file this form to apply for recognition of exemption.

2017 2019 IRS Form 1023 Fill Out Online PDF Template

How you can make a difference Irs form 1023 application review; Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Web form 1023 is used to apply for recognition as a tax exempt organization. Expediting the irs form 1023 application;

Form 1023 and Form 1023EZ FAQs Wegner CPAs

Web form 1023 part ix, 990 filing requirements; Web how can i get a copy of form 1023? Form 1023 part x, signature and upload; Republicans, though, have seized on the unverified material as part of their. How you can make a difference

1023 ez form Fill out & sign online DocHub

Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Form 1023 part x, signature and upload; How you can make a difference Web form 1023 is used to apply for recognition as a tax exempt organization. Irs form 1023 application review;

Tips on filing the IRS Form 1023

Form 1023 part x, signature and upload; Expediting the irs form 1023 application; Web form 1023 is used to apply for recognition as a tax exempt organization. Web form 1023 is filed electronically only on pay.gov. Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts.

Web How Can I Get A Copy Of Form 1023?

Irs form 1023 application review; Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Web form 1023 is used to apply for recognition as a tax exempt organization. Go to www.irs.gov/form1023 for additional filing information.

Expediting The Irs Form 1023 Application;

Reinstatement of 501c3 exemption status; Web form 1023 is filed electronically only on pay.gov. About form 1023, application for recognition of exemption under section 501(c)(3) of the internal revenue code Organizations that may qualify for exemption under section 501(c)(3) include corporations, limited liability companies (llcs), unincorporated associations and trusts.

Web Form 1023 Part Ix, 990 Filing Requirements;

Republicans, though, have seized on the unverified material as part of their. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. How you can make a difference Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true.

December 2017) Department Of The Treasury Internal Revenue Service Application For Recognition Of Exemption Under Section 501(C)(3) Of The Internal Revenue Code

Form 1023 part x, signature and upload; Web what kinds of organizations can file form 1023? You'll have to create a single pdf file (not exceeding 15mb) that you will upload at the end of the application.